US inflation and the pressure on asset valuations

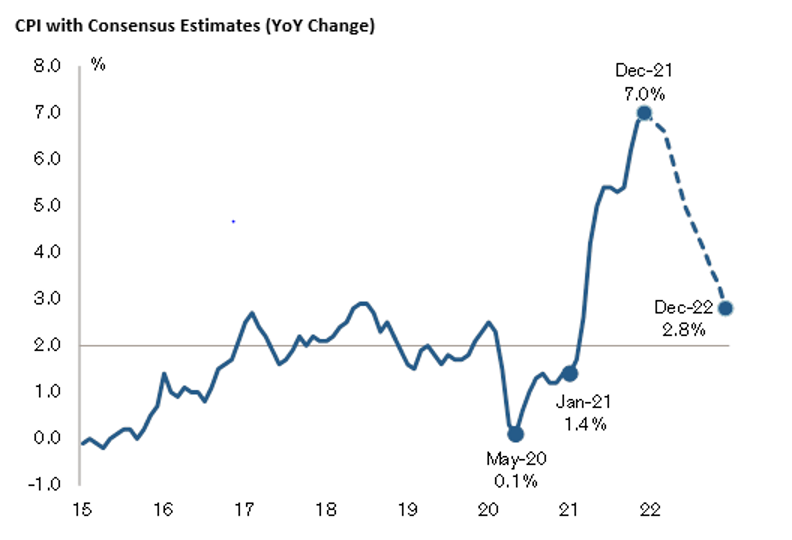

Over calendar 2021, US inflation jumped from a very tame 1.4 per cent to a worrying 7.0 per cent, the highest level recorded in four decades. The last time US inflation was at this level, the yield on the US ten-year Government Bonds was 13.5 per cent.

Over the next few months, supply bottle necks – often caused by Omicron – will likely see US inflationary expectations remain stubbornly high. Year-on-year numbers could escalate further, as weaker inflation readings from early-2021 roll off. That said, the consensus among US economists is for the US Consumer Price Index to decline to 2.8 per cent by the end of calendar 2022.

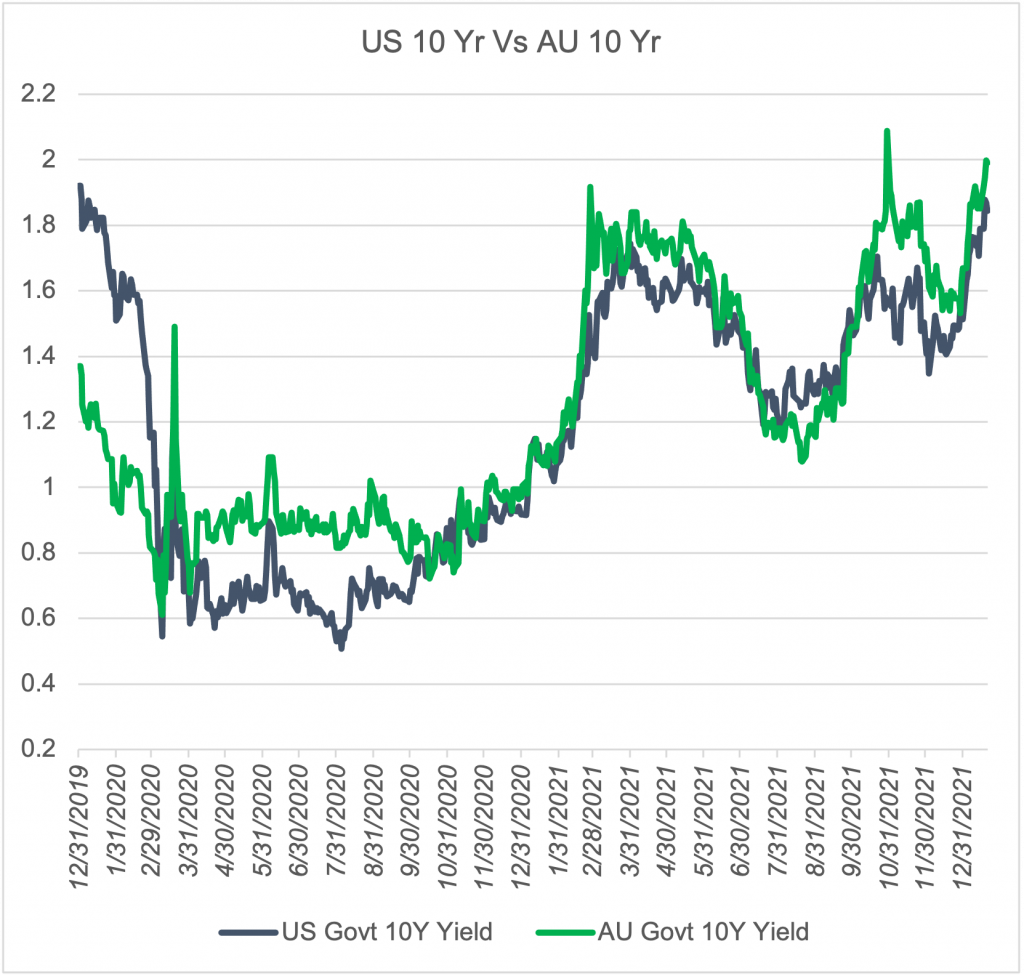

After troughing at 0.5 per cent in August 2020, US ten- year bonds have risen to around 1.9 per cent today. After troughing at 0.6 per in March 2020, Aussie ten-year bonds have risen to around 2.0 per cent today. From an historical perspective both countries’ bond yields are still exceptionally low and let’s not forget they have declined from around the 16 per cent level recorded in the early 1980s.

The reason I am focusing on inflationary expectations and long bond yields is that both often play a significant role in asset valuations, particularly those asset classes which are “long dated.” That is where their earnings stream is very much “back-ended” – typical of a relatively immature growth company whose earnings stream is less visible in the near term, but where expectations are meaningful over the longer-term.

It is those companies’ share prices which are typically more vulnerable in an environment of rising long-bond yields, as their earnings streams today remain somewhat immature and unreliable. During this transition phase toward more reliable earnings streams, a fickle market often uses the excuse of a higher long-bond yield to quickly and aggressively recategorise an exciting “growth stock” into a “concept stock”– and often that means a severe de-rating to the share price.

Examples include Afterpay Limited and the ARK Innovation ETF (ARKK), down 59 per cent and 53 per cent, respectively, from their 52-week highs.

With reasonably full employment, solid GDP growth, and hopefully a subsiding influence from COVID-19 in the Western World, it will certainly be interesting to see how 2022 plays out for investors.

As articulated in his latest newsletter entitled “Selling Out” Howard Marks concludes “Superior investing consists largely of taking advantage of mistakes made by others. Clearly, selling things because their down is a mistake that can give the buyers great opportunities.”