US Government Shutdown And Defaults In Perspective…

When the Republicans in The House of Representatives and the Democrats in the Senate couldn’t agree on the terms of refinancing legislation, and particularly whether Obamacare measures should be included (Republicans insisted on delaying Obamacare while Democrats held firm), the US government shut down. It has been 17 years since the last shutdown, in which all non-essential governmental operations cease receiving payments. According to reports, almost 800,000 federal government employees are on furlough with no assurance they’ll be paid retrospectively.

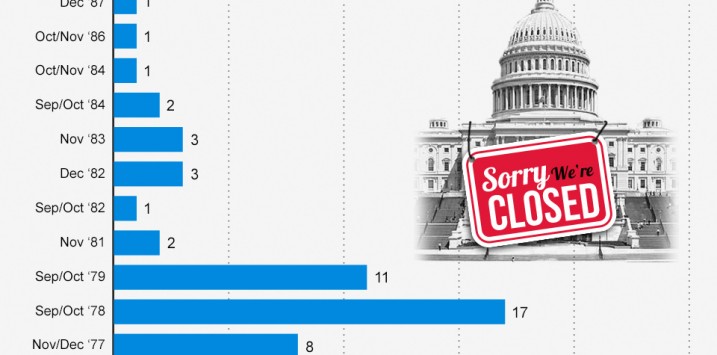

Statista reports that this is the 18th time a shutdown has occurred (see graphic). The last time this happened was in December 1995 under President Bill Clinton.

For Australian investors, the situation could get serious if an agreement is not reached in raising the country’s US$16.7 trillion dollar debt ceiling by October 17. Any failure by the US to pay interest on its debt obligations would be nothing less than a default, however before everyone gets excited about another Lehman Brothers moment, keep in mind that the US has defaulted three times before – and on each occasion the political impasse was resolved. As my friend Ashley Owen over at Philo Capital (and a fellow Cuffelinks contributor) points out, the US government defaulted last not in 1801, as has been reported elsewhere, but as recently as 1979 – on April 26, May 3 and May 10. On each occasion the payments were made late. In other words, if your definition of default is a failure to pay, then what transpired in 1979 is not a default. If your definition is failure to pay on time, then the US did default in our lifetimes.

On one assessment, investors expect the markets will fear the unknown (concerns surrounding an impending default) and sell off, before rallying on its confirmation (certainty) – with commentators noting that the default is not due to insufficient funding or an inability to pay but a temporary and political issue.

Nevertheless, for lenders to the US the securities they receive cannot be regarded as risk free, and the financial market’s interest rate setting systems which includes repurchase agreements may see US treasuries as insufficiently suitable collateral for ‘repos’. At a minimum, one should expect volatility and the repricing of risk. The alternative is hastily drafted legislation that somehow circumvents the market’s concerns.

Great read Roger.

To me all this US govt shut down is just ‘shuffling the deck chairs on the Titanic’.

They just can’t keep borrowing more and more to pay off larger and larger debts. I know ‘experts’ tell us that ‘once things get back to normal they will be able to pay off their debts’.

I on the other hand say, ‘this IS the new normal’, the US economy can’t go back to the hey day before the GFC, because that was based on loose loaning practices that are not going to happen again.

Just like a rubber band that gets pulled too far, the US economy is going to ‘snap in half’. If they pass this bill this time or not, somewhere down the road they will ask for a higher debt figure again and again. And somewhere either they wont be able to pass the law or the financiers will not be willing to loan them more money. Snap.

It seems to me like it might be a good opportunity to pick up some good performing businesses at a discounted price…

“Perhaps the biggest of the big lies is that the government will not be able to pay what it owes on the national debt, creating a danger of default. Tax money keeps coming into the Treasury during the shutdown, and it vastly exceeds the interest that has to be paid on the national debt.

Even if the debt ceiling is not lifted, that only means that government is not allowed to run up new debt. But that does not mean that it is unable to pay the interest on existing debt.” Thomas Sowell.