The Republic of Google

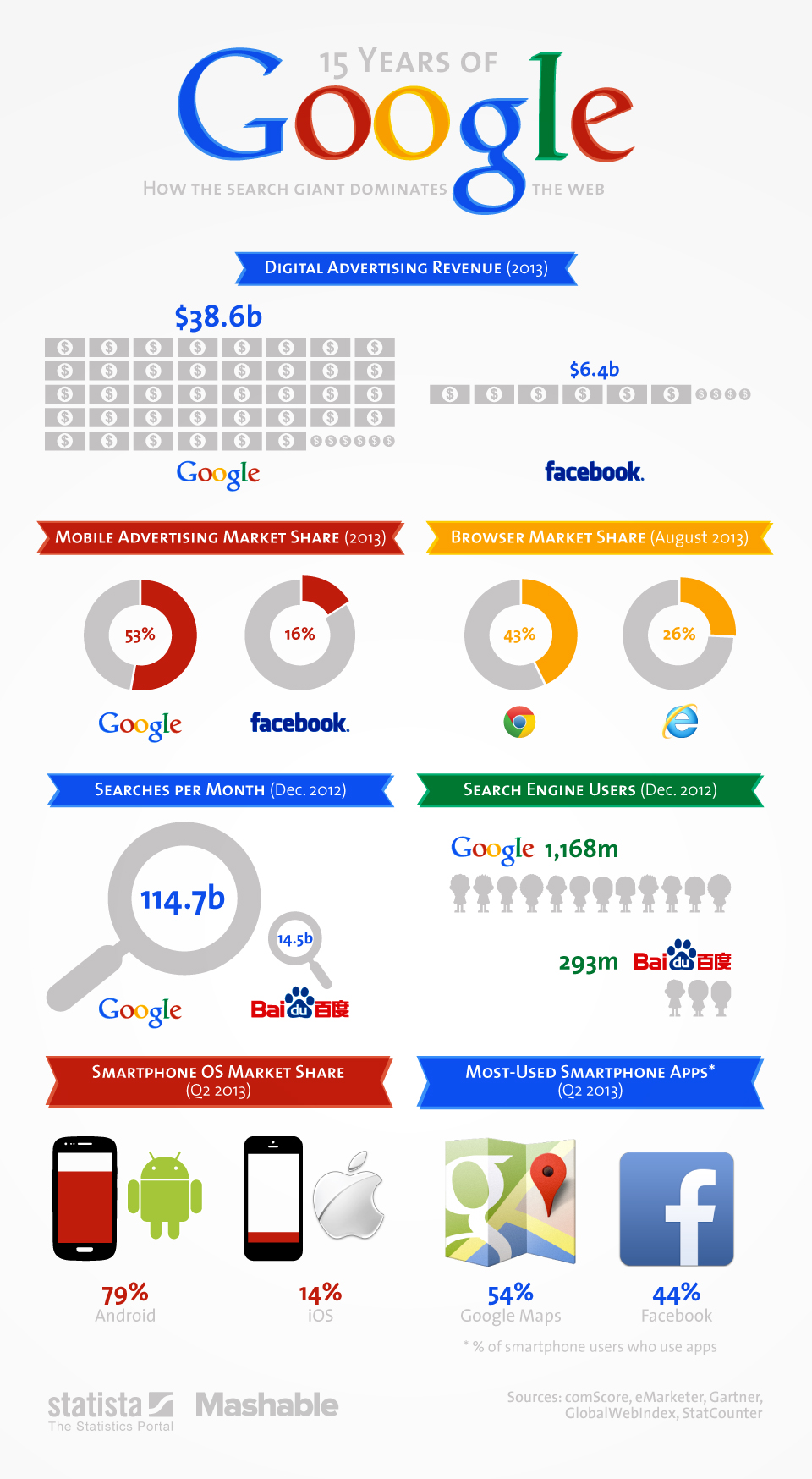

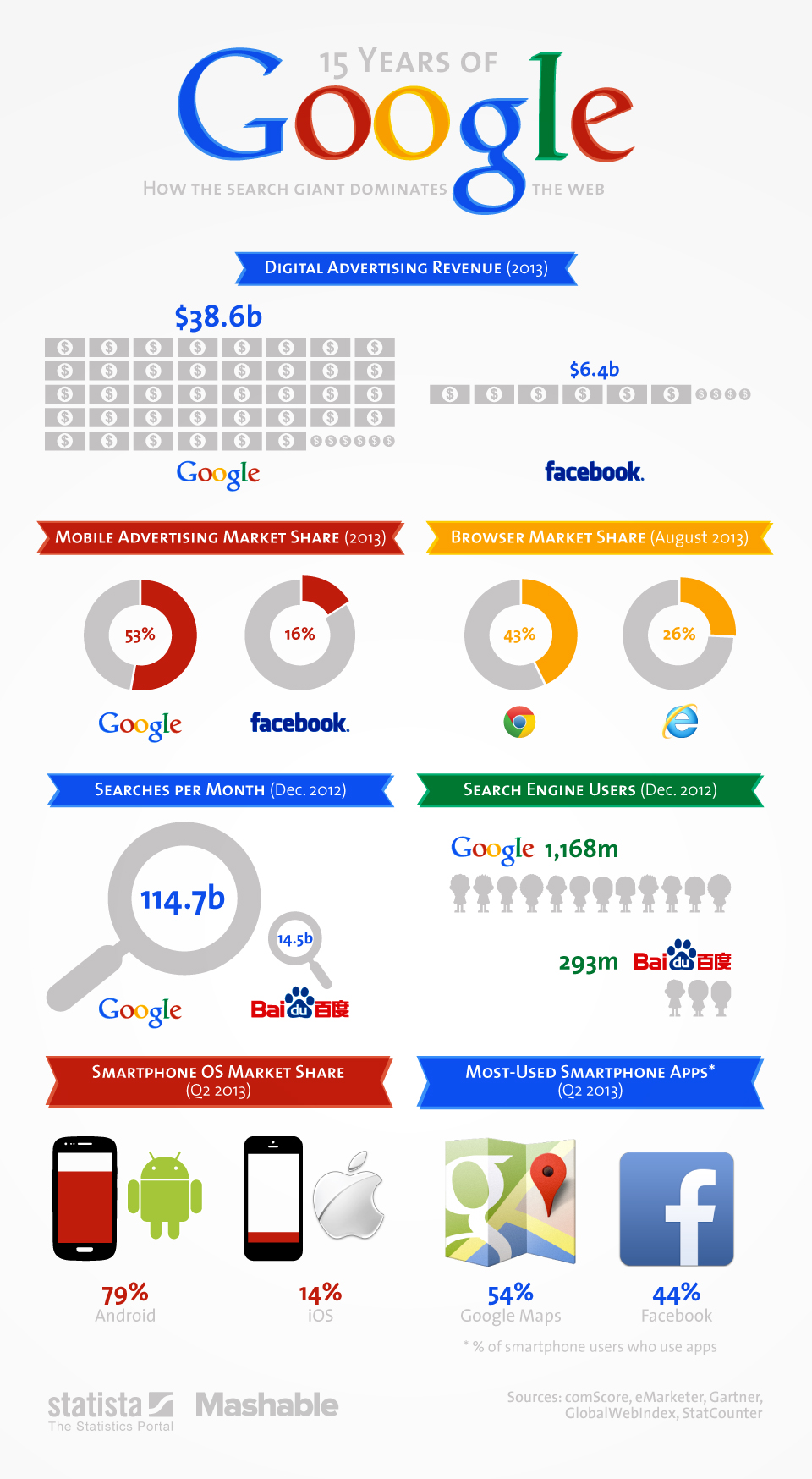

Much as we used to let our fingers do the walking through the Yellow Pages, today’s customers and students now ‘Google’ it. There are many things that don’t work perfectly, but that hasn’t inhibited Google’s growth. The following picture from Statista provides a useful snapshot of Google’s footprint.

Expect more convergence between internet and e-commerce in ways you haven’t even imagined and then expect Google to be in the driver’s seat…

As an aside, Google is listed in the US and is owned by our friends at Magellan Financial Group (minority shareholder of Montgomery Investment Management) in the Magellan Global Fund.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Chris B

:

Googles algorithms are like Coca-Cola’s secret formula. However, maybe one day someone will be able to come up with something as good. Yahoo’s results aren’t as good. So I think Coca-Cola’s secret formula is stronger. But the network effect may keep Google strong.

I tasted Inca Cola the other day, it is so nice, some say better than Coca-Cola! Coca-Cola have a stake in them so they fixed that problem.

As a computer programmer, for years I’ve been wondering if open-source could compete with company products eg OpenOffice vs Microsoft Office, Mozilla vs Internet Explorer. Linux (open source) has never really taken off commercially to a huge extent. If you look at Mozilla, it was the browser with the largest market share for a while, now Google Chrome has come from nowhere to grab top spot. The reason I think is because open source has no centralised grand plan, developers all have different ideas and Mozilla got in a mess and people got sick of it. Nothing has been able to compete with Microsoft Office especially Excel, one reason is that Microsoft is the governing body of development ideas, they have a centralised grand plan. Android which is linux based is doing well because Google is controlling it. This is where open source has a big disadvantage.

Marcus

:

You’re right Roger. It’s almost inevitable that the internet and e-commerce are going to get closer and closer.

There are a few aussie startups getting in the game too.

Take ‘the Price Geek’ for example. http://www.thepricegeek.com

or ‘Client Catalyst’ who are like the Yellow Pages for mobile.