Too Much Bull?

Last week several media outlets reported that Merrill Lynch had released a prediction that the market may correct. Without giving you the entire report – you need to become a client of Bank of America Merrill Lynch for that (To enquire about becoming a client contact: Bank of Amercia Merrill Lynch: Lvl38/ 1 Farrer Pl, Governor Phillip Tower, Sydney NSW 2000 (02) 9225 6500) – we thought you should be aware of the interesting work they are doing.

In the seemingly constantly rising tide of enthusiasm that has gripped our peers, other market participants, commentators and share prices, its useful to hear from someone who has the opposite view and to examine why….Please direct all questions about curve fitting, degrees of freedom and false positives to BofAML:-

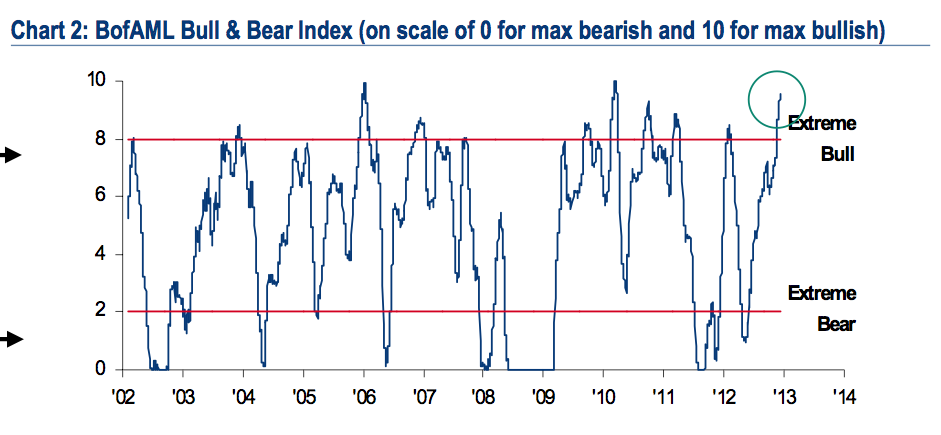

“The current B&B reading is 9.6 (on a scale of 0 for max bearish and 10 for max bullish). It suggests investor sentiment is currently more bullish than 99% of all readings since 2002….

Note: Sentiment reached >2 stdev bearish during 2008-9 financial crisis. We view that as a unique event & have not presented the readings on chart. Source: BofA Merrill Lynch Global Investment Strategy, Bloomberg, EPFR Global, Lipper FMI, Global FMS, CFTC, MSCI

Note: Sentiment reached >2 stdev bearish during 2008-9 financial crisis. We view that as a unique event & have not presented the readings on chart. Source: BofA Merrill Lynch Global Investment Strategy, Bloomberg, EPFR Global, Lipper FMI, Global FMS, CFTC, MSCI

In our view, the relative risk-reward of owning equities is unfavorable at this juncture. Our backtesting shows that since 2002 a “sell” signal of 8.0+ would on avg have been followed by a 12% peak-to-trough correction in global equities within three months. While a number of factors could reduce the probability of this outcome this time around…Longer-term investors should wait for a 5- 7% correction before adding to positions, in our view.”

Forgot to mention this important factor:

The Wile E. Coyote sell off awaits as SP500 daily & weekly uptrends simultaneously undergo a protracted topping process.

So it’s taking longer to roll over because daily AND weekly trends are terminating together.

Roger – many thanks for uploading my comment.

Bruce – unfortunately I missed that excellent TLS uptrend : (

I would not be long Telstra now.

[Disclosure: no position held]

Simon.

Back on the 14th I wrote:

Despite recurring short covering spikes [which contribute to market instability] the inevitable Wile E. Coyote crash awaits and unfortunately many investors will get badly burnt.

Ongoing USD suppression and central bank intervention has influenced markets for longer than I anticipated and the bungee cord is now VERY overstretched.

Guess what happens next ?

Extend & Pretend – with central banks attempting to forestall natural market forces and preventing much needed market corrections for years – ensures the next crash will be even worse. Delaying the inevitable just exacerbates the problem.

Government intervention has only postponed the next Great Depression – it can not be prevented.

Be careful folks.

P.S. Telstra [TLS] weekly chart is parabolic with high risk of significant reversal.

I wouldn’t have thought that a “5 – 7% correction” would make much difference to LONGTERM investors….

Plus it’s awfully difficult to time the peaks and troughs…

Indeed. Thats why I was fairly dismissive about it.

Simon Says “P.S. Telstra weekly chart is parabolic with high risk of a nasty reversal.”

I agree TLS is overbought, but Simon it worries me that RM says you are a great chartist …. when you call a clear linear TLS price chart parabolic. Have another peak.

B

Hi Bruce,

I just checked for you. You’re right if looking at a log scale. However there’s a distinct curve there on the linear axis. But either way it clearly worries me a lot less than it seems to worry you. Perhaps you’d be worried less if you realised we don’t look at charts.

“Merrill Lynch had released a prediction that the market may correct”. I find such “predictions” pretty tiresome. Of course the market might correct… , everyone knows that! However as soon as one uses “may”, then it’s not a prediction; it’s just stating one of a number of possibilities. In fact it’s more than a possibility, it’s a foregone conclusion that the market will correct at some point. If ML had said it “will” correct and indicated when (even approximately) then that would be a prediction. Like many others, ML is covering its backside. If the market doesn’t correct, by saying “may” they avoid the embarrassment of having got it totally wrong. When it does correct, regardless of when, they can boast of their presience. Some others play a similar game by heading their articles as a question e.g. Are markets heading for a correction?

Thanks Michael. You are right. EVerything is uncertain. That’s why we are seeking higher than cash returns to compensate for that risk. You raise and excellent point.

A person who regularly writes to me is Simon. He’s a technical analyst with a little bit of a following and I am interested in watching how successful his calls will turn out to be.

He’s asked me to share his warning with you.

“Despite recurring short covering spikes [which contribute to market instability] the inevitable Wile E. Coyote crash awaits and unfortunately many investors will get badly burnt.

Ongoing USD suppression and central bank intervention has influenced markets for longer than I anticipated. The bungee cord is now VERY overstretched – guess what happens next ?

Extend & Pretend – with central banks attempting to forestall natural market forces and preventing much needed market corrections for years – ensures the next crash will be even worse.

Delaying the inevitable exacerbates the problem.

Government intervention has only postponed the next Great Depression – it can not be prevented.

P.S. Telstra weekly chart is parabolic with high risk of a nasty reversal.”

As we have had negative experiences allowing others to promote their own blogs, facebook pages etc, so as much as I would like to share your handle and url Simon, our policy is simply to say no to all comers. We will be watching with interest!

The news indicated that alot of money had matured at the end of 2012 and organisations are not so worried any more about depositing money for near zero interest rate for the benefit of safety.

That money has gone into equities, to chase value and returns.

So while nothing major has been announced, and if anything company reports do not show any leaps and bounds in improvements. Money that has matured has become available to enter the market, so we have seen equity prices rises, not on fundermentals, but on availability.

Considering broader issues, for the past three months or more, investors in general haven’t had anything specific to worry about – things have been fairly benign. There hasn’t been a whole lot of worry about debt crises in Europe and the market became comfortable that politicians in the US would kick the ‘fiscal cliff’ can down the road back in November.

I figure that in the absence of major bad news, people become a little more adventurous and more inclined to ignore the little bumps in the road that occasionally come along. Sooner or later something will happen to bring the world’s major financial problems back to the front of investors’ minds and there will be a bit of a correction but who knows when that might be. Until then, I predict relatively plain sailing – could be a week, could be a few months. Or more. Or less.

Sure, I don’t have lots of cool graphs and analysis to justify my simplistic appraisal, but I think you can overcomplicate these things. The market, after all, is just a whole lot of fallible people scratching their heads trying to work out what will happen next.

You’d enjoy Keynes and his Beauty Contest metaphor, which he introduced in Chapter 12 of his treatise, The General Theory of Employment, Interest and Money as an explanation for prices changes in the equity market. (1936)

“It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.”

Here it is again from Wikipedia:

“Keynes described the action of rational agents in a market using an analogy based on a fictional newspaper contest, in which entrants are asked to choose from a set of six photographs of women that are the “most beautiful.” Those who picked the most popular face are then eligible for a prize.

A naïve strategy would be to choose the face that, in the opinion of the entrant, is the most beautiful. A more sophisticated contest entrant, wishing to maximize the chances of winning a prize, would think about what the majority perception of beauty is, and then make a selection based on some inference from his knowledge of public perceptions. This can be carried one step further to take into account the fact that other entrants would each have their own opinion of what public perceptions are. Thus the strategy can be extended to the next order and the next and so on, at each level attempting to predict the eventual outcome of the process based on the reasoning of other rational agents.

“It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.” (Keynes, General Theory of Employment Interest and Money, 1936).

Keynes believed that similar behavior was at work within the stock market. This would have people pricing shares not based on what they think their fundamental value is, but rather on what they think everyone else thinks their value is, or what everybody else would predict the average assessment of value to be.

National Public Radio’s Planet Money tested the theory by having its listeners select the cutest of three animal videos. The listeners were broken into two groups. One selected the animal they thought was cutest, and the other selected the one they thought most participants would think was the cutest. The results showed significant differences between the groups. Fifty percent of the first group selected a video with a kitten, compared to seventy-six percent of the second selecting the same video. Individuals in the second group were generally able to disregard their own preferences and accurately make a decision based on the preferences of others. The results were considered to be consistent with Keynes’s theory.”