To Vaccinate your portfolio or not?

How to position portfolios for a potential (but not certain) vaccine is currently front of mind here at Montgomery. A vaccine feeds into the ‘reopening’ theme as well as the narrative about a broader economic recovery and companies that are leveraged to it – the ‘economic sensitives’.

At Montgomery we have always considered three characteristics as being necessary, if not central, to supporting a sound investment and they are Quality, Value and Prospects. For clarity, ‘Prospects’ can refer to a number of scenarios but more often than not refers to growth.

Within that broad framework, and cognizant of the current pandemic, government fiscal response and central bank monetary policies, there are perhaps three major themes that we are most interested in today.

The first is the Reopening/Vaccine theme. The second is the Structural Growth theme. And the third are income opportunities that could re-rate – amid ultra-low interest rates – when their prospects become clearer and more certain. A lot of money has already been made investing in a fourth theme. These were the companies that benefitted – and continue to do so – during the COVID-inspired lockdowns and from the trends associated with spending more time at home. Consumer discretionary companies with an excellent e-commerce solution have done well for our investors including companies like Adairs, RedBubble, Kogan, Marley Spoon and Super Retail Group. Also performing brilliantly were shares in companies offering the technology and platforms that formed the backbone of, and facilitated, all of the activities conducted while at home. In this group our investors have benefitted from NextDC, Macquarie Telecom and Megaport.

In this blog post however we touch on the reopening theme and include recent analysis by Keith Parker, Head of US and Global Equity Strategy, and his team at UBS, in a presentation entitled Retreat, rotate or risk up?

Amid lockdowns, border closures and social distancing there are companies whose prospects the market has hitherto understandably questioned. Conversely, these same companies may be best leveraged to the development and distribution of a vaccine (assuming wide adoption), or even a treatment or an accurate test with rapid results.

Earlier this year we also insured portfolios for this possibility buying Sydney Airports, Transurban, IDP Education and Atlas Arteria among others in The Montgomery Fund, and in the Montgomery Small Companies Fund added companies including Webjet, Corporate Travel Management and Tyro.

In a world that has experienced four decades of declining interest rates it might be a surprise to believe that value might still exist. It is among these previously downtrodden but potentially under-appreciated companies where at least ‘relative’ value may still exist.

We mention relative value because after four decades of declining interest rates ‘absolute’ value may be tough to find.

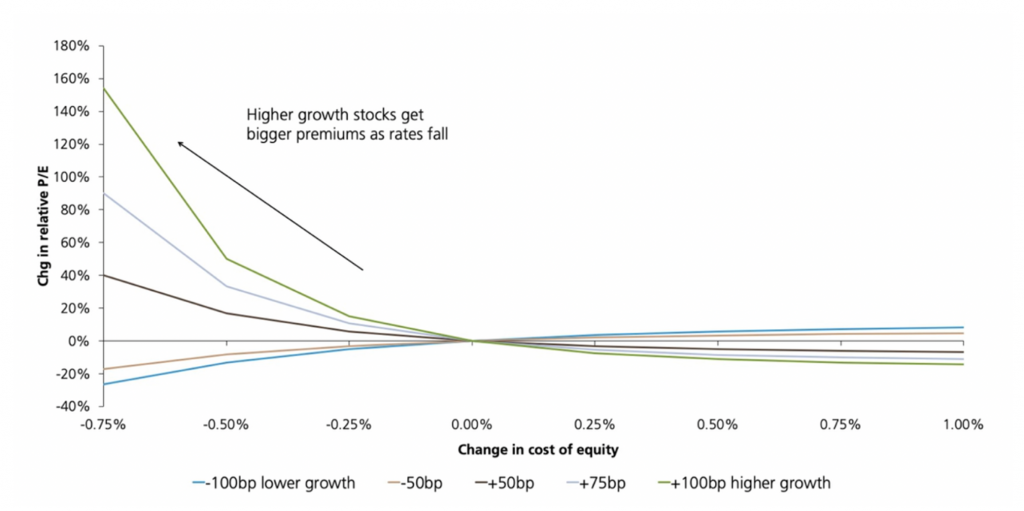

Figure 1. Companies with the brightest perceived prospects become most expensive

Each band in Figure 1. represents a cohort of companies with a similar growth rate. What the chart shows is something we have discussed here before; that companies with the highest growth rates respond most aggressively to cuts in interest rates and the associated fall in the cost of equity (COE). As the cost of equity declines it is the companies with the fastest growth that have become the most expensive through a change in their Price to Earnings ratio (PE).

Of course, in a low return world, everyone wants growth and unsurprisingly those companies with the best prospects for scarce growth are most in demand. They consequently become the most expensive because demand drives PE expansion – investors are willing to pay more for the same dollar of earnings.

Value however might still exist among those companies that have suffered during but survived hard economic lockdowns. The market remains somewhat uncertain about the prospect for a vaccine such that those with more confidence about a solution, if proved correct, could be handsomely rewarded.

If that’s you, where might you look for such companies?

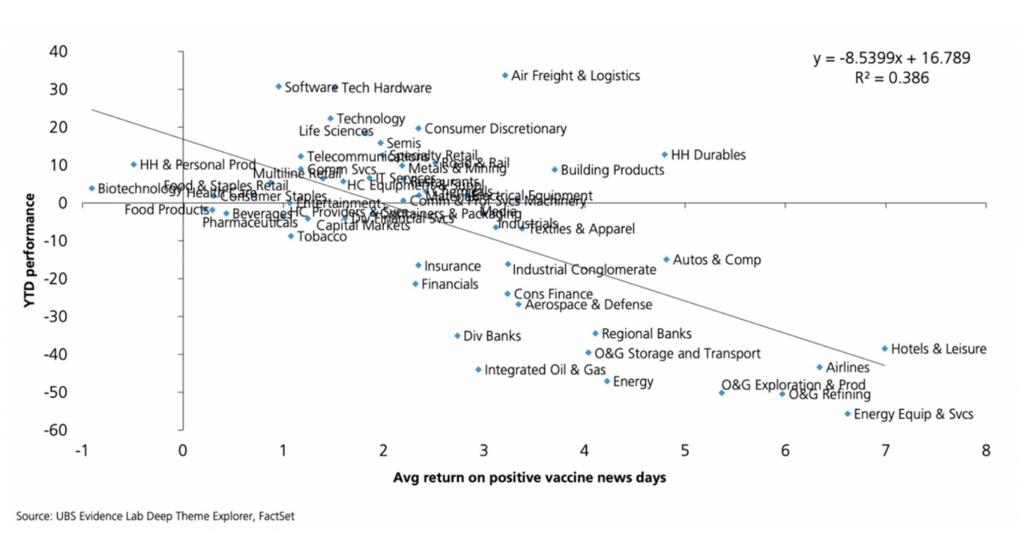

To answer that question, UBS has crunched the numbers and conducted regression analysis to divine a scatter plot (US data) that ultimately reveals those companies whose stocks have performed worst (presumably due to the impact of economic stasis) but which perform best on days that have been marked by positive news about the progress of a vaccine. The assumption is that these companies could perform well over a longer period of time if positive tidbits about a vaccine mature to become fact.

Figure 2. Year to Date sector and industry returns versus sensitivity to vaccine news

As an aside the chart also reveals those companies whose stocks have performed best (in some cases due to the stay-at-home restrictions) but which perform less well on days when positive news of a vaccine is flowing.

And investor might ‘rotate’ at least some of their portfolio from the latter category to the first category as their confidence about the release and distribution of a vaccine grows.

So which are the sectors and industries most leveraged to positive vaccine news that have hitherto been beaten down? According to UBS analysis they include Energy Equipment & Servicing companies, Hotels and Leisure operators, Airlines and Oil & Gas refiners and Producers (although there could be structural as well as cyclical issues here).

At the other end of the spectrum – companies with buoyant stock prices that react relatively less well to positive vaccine news are Food & Staples retailers, Beverage Companies, Pharma companies, software, tech hardware and technology companies.

Any analysis based on historical data cannot possibly take into account future unknowns, which mean investors can rarely invest and forget. Nevertheless trends can and do persist and so the above analysis should provide some food for thought about how you rotate, position or insure your equity portfolio.

Hi Roger

We hear much about vaccines for covid maybe soon maybe the end of 2021 maybe never and we sometimes hear of alternatives that help patients on respirators i wonder why though we don’t hear much about mesoblast which is in trials for patients on respirators and saving lives plenty of noise about American companies ,Australian companies punch above their weight but struggle to get mentioned,i also think a rapid test for covid should be a priority seems to be a no brainer.

Hi Robert, good point. According to our reading there is a huge amount of work being done on an accurate and rapid test, which of course would permit people to travel securely and safely. The ocean cruising and airline industries are the keenest to see results.