Three reasons why discretionary spending is set to fall

Many economists believe that consumer spending is the most important short-run determinant of economic performance. Which is a worry. Because it looks like discretionary spending is heading south.

Things are not looking good for discretionary spending due to:

- Lack of real wage inflation

- Limited further fall in savings ratio

- Potentially lower immigration.

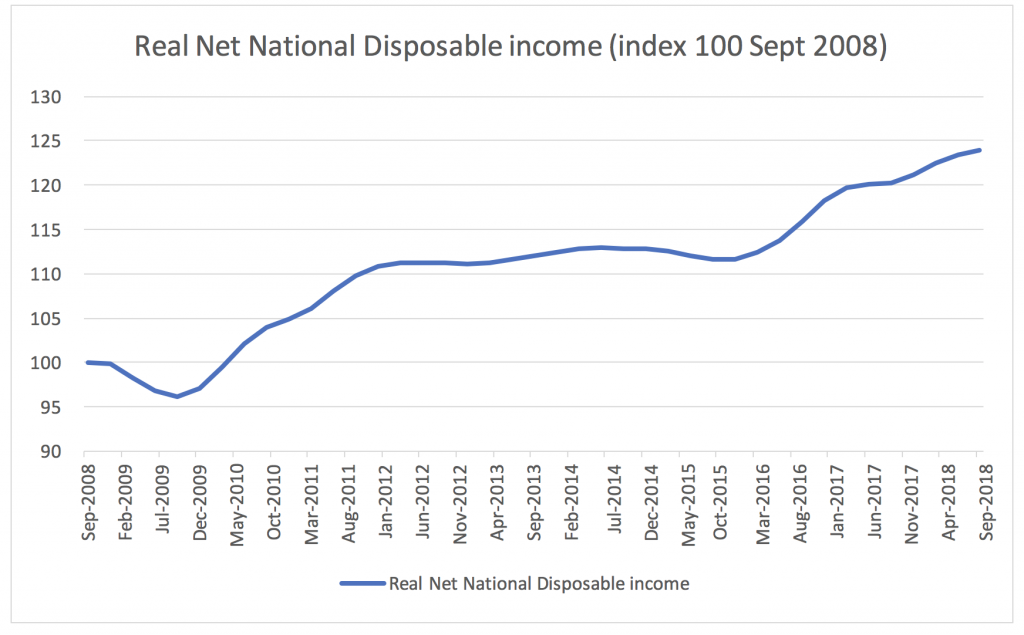

Let’s start with the Australian Bureau of Statistics national accounts for the September quarter. (I think the most interesting measurement is the real net national disposable income as this should give a picture of how much cashflow households actually have available to spend.)

If we look at the aggregate figures first, it shows a relatively steady uptrend:

Source: ABS

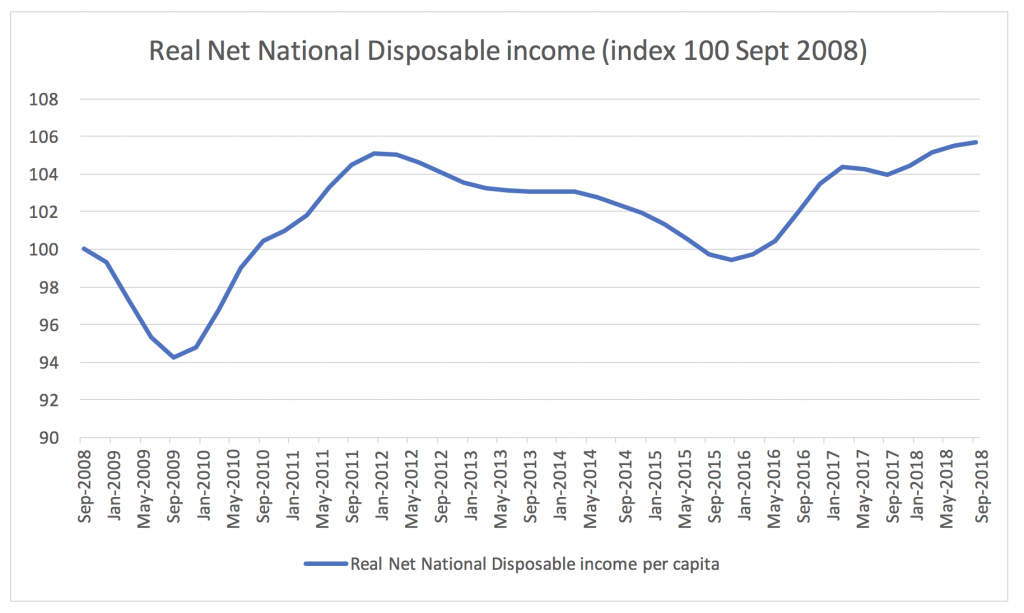

But if we look at a per capita basis which is arguably more interesting to judge the ability to absorb price increases, the picture is less positive and shows that the average household has not had a real (i.e. taking away the effects of inflation) income increase for the last 6 years:

Source: ABS

Basically, the increase in disposable income over the last 6 years has come from population growth. I see this as worrying for at least two reasons:

- The lack of individual household disposable income increase means that there is less room for price increases and given that the input costs are for many companies increasing as mentioned above, there is risk that margins will come under pressure or that volumes fall away if companies decides to increase prices.

- Australia’s population growth is primarily (80+ per cent) driven by immigration and although there has been a long political consensus that high immigration is beneficial for Australia, it seems like public debate is starting to swing towards a more restrictive policy with especially the state governments (NSW and VIC in particular) feeling the effects of the population growth and the need to invest in infrastructure. Big changes to the overall immigration policy are probably unlikely but adjustment downwards is more likely than any increases. This would be negative for volume growth (but could be positive for disposable incomes if it leads to higher wage inflation).

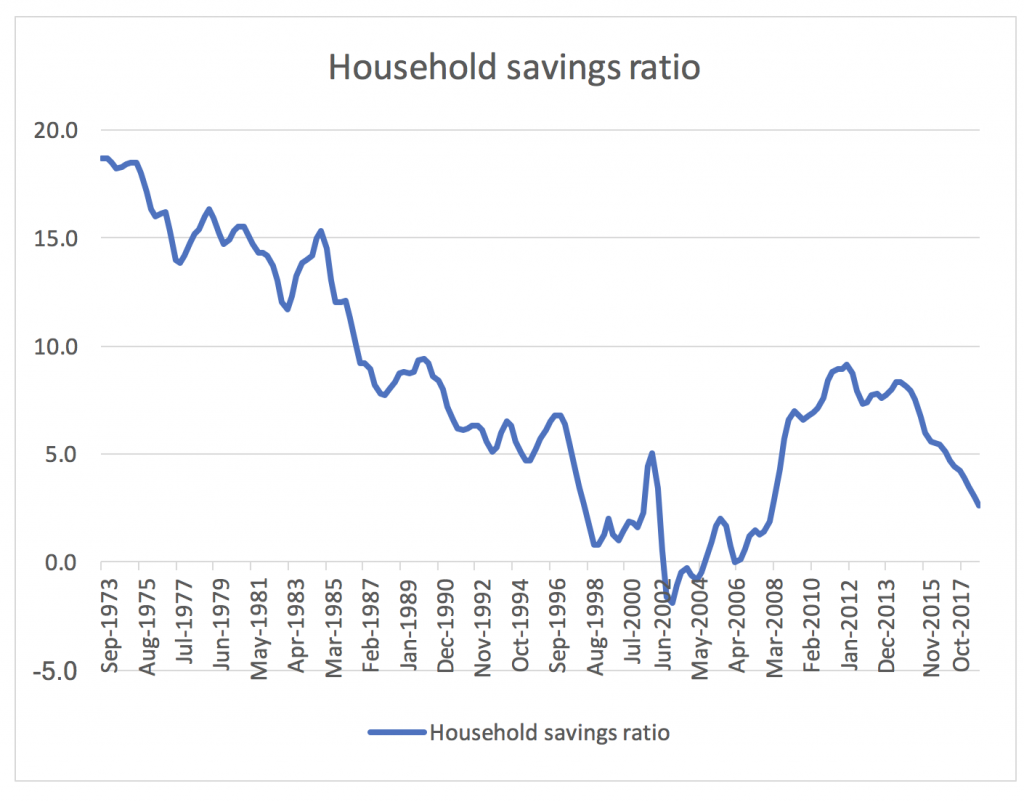

Another interesting statistic to look at when assessing households spending power is the savings ratio which basically shows the portion of income that households save for the future.

Source: ABS

As can be seen from the graph, the ratio is falling rapidly, meaning that households are currently cutting back on savings to maintain their consumption. We still do not have a negative savings ratio (i.e. households drawing down on their savings to consume) but we are not far off and I would not consider any further falls in the savings ratio as a sustainable driver of growth in consumption.

In conclusion, things are not looking good for discretionary spending.

This blog is a follow-up to a blogpost looking at recent inflation which can be viewed here

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY