Inflation, what is happening and what conclusions can we draw

Most people are familiar with the concept of inflation. As a quick recap, it is the process whereby prices tend to increase over time. A positive, but low, level of inflation is generally seen as positive for a number of reasons and central banks tend to manage their interest rates to try to hit an inflation target of generally around 2%.

The mechanism they use for this are:

- If economic activity is high, rates are likely to increase to encourage savings and make borrowing more expensive and, in this way, suppress economic activity to avoid an overheating economy and resulting runaway inflation.

- Conversely, if economic activity is low, which tends to be associated with low inflation, central banks tend to lower interest rates to stimulate the economy by making borrowing cheaper and discourage savings and stimulate consumption.

Inflation is like almost all other economic processes caused by supply/demand balance (at least as long as you have a functioning market). Economists generally make a difference between two different processes when talking about the causes of inflation. These are:

- Demand-Pull inflation – This is when consumer demand for a large number of goods and services increase faster than the supply of said goods and services and prices rise as there is competition for the limited supply.

- Cost-Push inflation – This is when the input cost rises and prices have to rise to maintain the profit margin of the producer of goods and services.

It is quite obvious that inflation matters in different ways to different parts of the economic value chain and depending on which type of inflation we are seeing, different companies will benefit or suffer in different ways.

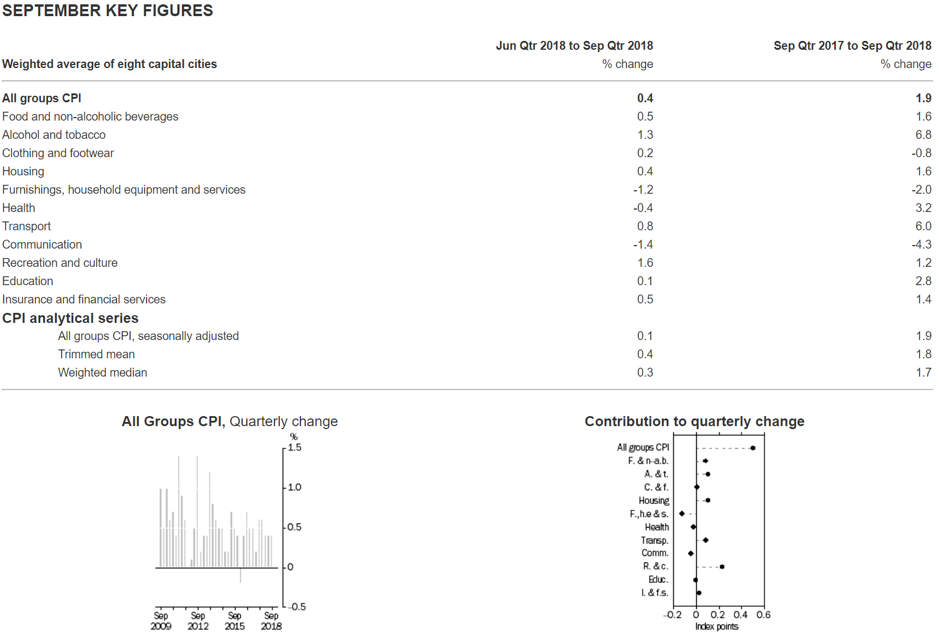

Yesterday the Australian Bureau of Statistics released their September inflation figures and I thought it would be interesting to have a look and see if we can draw any conclusions from the numbers.

You are free to draw your own conclusions but my thoughts regarding the numbers in the tables above, please keep in mind I am not an economist but an engineer by training, so my interpretations might not be the same as an economist’s are:

- Overall, inflation is trending down. As I have previously covered, even though the RBA has communicated that they see the next interest rate move up, I struggle to see this as there are no signs of inflation picking up and with the housing market rolling over, increased interest rates could have a very negative effect on economic activity.

- Given that US and many other countries have started to increase interest rates, this should lead to a weaker Australian dollar due to interest rate parity theory.

- The biggest driver of the inflation we are seeing are:

- Recreational and Culture. The biggest driver is the price of international travel and accommodation which was up 4.3 per cent. This is a clear result of the weaker Australian dollar compared to most popular foreign tourism destinations so cost-push inflation without any Australian beneficiaries.

- Alcohol and Tobacco was the second largest driver, and this is driven by increased tobacco prices due to tax increases, so this is a cost-push inflation without any real beneficiaries (apart from government and any smokers who quit as a result).

- The third largest contributor was transport costs and in this fuel costs which is both a result of the weaker Australian dollar and the higher international oil price.

- The largest price falls were seen in:

- Communications where increased competition in the mobile and broadband space with Telstra in particular rationalising their mobile plans.

- Cost of Childcare fell 11.8 per cent due to introduction of the new Child Care Subsidy on July 2. This is just a subsidy change and not indicative of any underlying supply/demand dynamics.

In general, there seems to be much more cost-push than demand-pull inflation at the moment and the cost-push is driven by a weaker Australian dollar and higher international oil prices. This suggests to me that there are very few positive conclusions to draw for any domestic exposed business but that the outlook for the Australian dollar is weaker which should benefit export-oriented companies.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

andrew ronan

:

I agree with Simon %100, we have fake data that supports fake confidence to keep the fake flatbuilding rent seeking centrally planned immigration ponzi economy afloat, that is all made possible by our fake money system and fake economic theories. It will all blow sky high as it has all ways done in the past, every fiat currency in history has always failed without exception.

inflation is not the cost of goods and services going up, it still takes the same energy and labour to produce those, it’s the buying power of your fiat currency goin down, its tax by stealth.

Fiat currency is the root of most of our economic and political problems throughout the world.

I find it hard to believe that with all the amazing technological advances we have made in every other area, we have failed so badly in economics.

simon

:

the only conclusion you can draw is that the ABS figures are biased garbage the govt/ RBA uses to make it look like inflation is tame. Ask any normal family about inflation of school fees, private insurance, petrol costs, electricity, council rates, toll road fees, movie tickets, water rates, airport parking, speeding+parking fines, car servicing, home and car insurance, rego, land tax, etc ,etc,etc……….

Ian

:

Agree Simon. My carrier just put my shipping rates up by 5% and that’s the second time within 12 months. And asset inflation? Well lets just ignore that. If Montgomery believe actual inflation is trending down they are kidding themselves.

Mike Williams

:

Thanks Andreas I agree with your conclusion and the AUD going lower ..though it seems strongly supported at the 70 US cents mark. My understanding is the Montgomery Global funds are close to hedging the Aussie, which seems somewhat contrary given your commentary. Would be interested to get comments on how Montgomery Global Funds ar intending to manage foreign exchange in the short to medium term. Cheers

Andrew Macken

:

Hi Mike, I’ll take your question.

In the Montgomery Global funds, the underlying currency exposures continue to be dominated by USD, EUR and to a lesser extent JPY. We still hold some exposure to AUD in our global funds, but the exposure is relatively small, in the order of approximately 10 percent.

Hope this helps. All the best,

-AM

Kelvin Ng

:

Hi Andrew, are there reasons why the Montgomery Global funds have not hedged out EUR? The whole Euro project is looking very shaky.

Thanks.

Kelvin