Three reasons we continue to like Woolworths

In recent months, The Montgomery Fund has accumulated a significant position in Woolworths – it’s now one of our largest positions. And we remain positive on the outlook for the company over the medium term, even after the recent rally in its share price.

Our original investment thesis was predicated on the following:

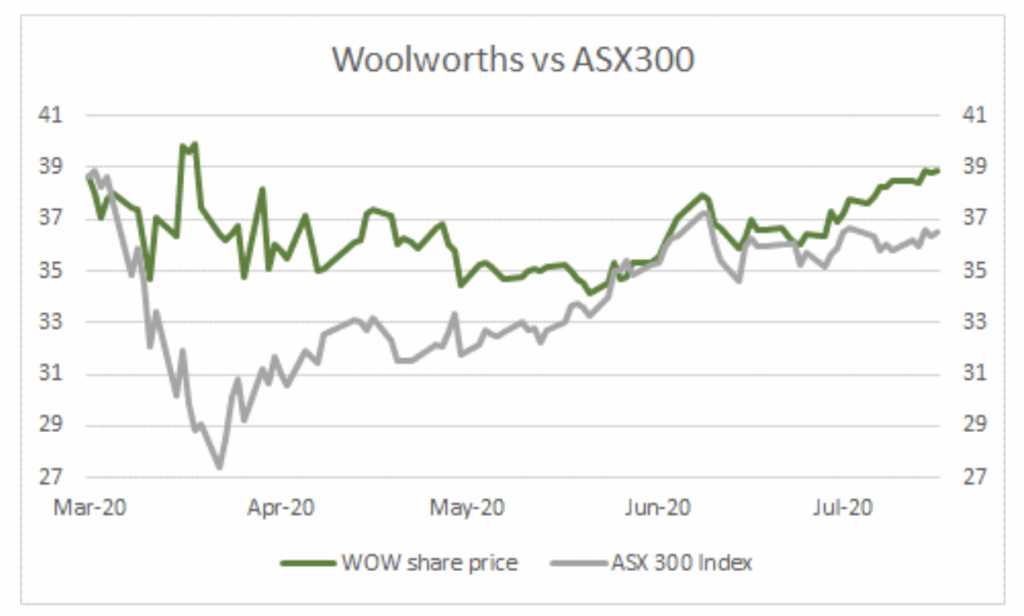

The share price had come under pressure due to rotation into re-opening trade and disclosure of COVID-related costs.

Over March, the Woolworths share price was very resilient to the sell-off seen in other parts of the market as investors flocked to the relative safety of supermarkets amidst scenes of panic buying and hoarding in a world of uncertainty.

However, as the market recovery took hold over April and May, the shares underperformed significantly as the price fell around 15 per cent even as the broader market rallied by more than 15 per cent over the same time frame as investors chased the “reopening trade.”

Source: Bloomberg

During this time, the stock was further penalised due to the disclosure of significant COVID-19 related costs, which eroded any positive earnings leverage from the spike up in sales.

Potential beneficiary of re-rotation trade

While the investment market largely shrugged off the implications of a second wave over these months, we felt the Woolworths share price had reached a level where the stock was attractive – both in terms of its defensive but growing yield, but also relative to the broader market.

There was the additional potential tailwind of being the beneficiary of a rotation trade back into defensive consumer staples businesses should rolling lock-downs recommence (impacting both market sentiment and supporting WOW’s earnings), or any uncertainty in the shape of the economic recovery – especially in terms of the uncertain outlook for corporate profitability.

Looking ahead, we remain positive on the outlook for Woolworths for three reasons:

1). Defensive but growing yield

Woolworths has a defensive but growing yield as the business is leveraged to population growth, while also being a beneficiary of any food inflation should this materialise as a result of supply chain disruption and / or as an unwanted by-product of unprecedented fiscal and monetary support.

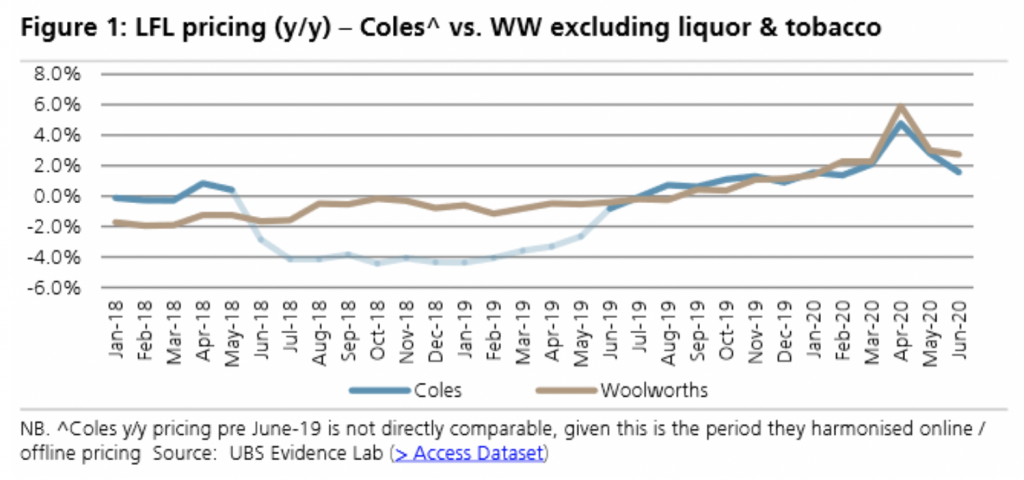

For example, the chart below from UBS shows a strong period of average inflation of around 3.5 per cent in JunQ20, after posting 1.8 per cent in MarQ20 due to removal / reduction of promotions during April and May – largely driven by inflation in fresh products.

Source: UBS

While supplier expectations are for inflation to slow, this is coming off a period of strong growth. We expect the industry to remain rational – especially with most recent threat Kaufland announcing its exit before commencing in January, and COVID-19 providing challenges to the operating environment.

2). Winning market share from loyalty program

Industry feedback suggests Woolworths remains well placed to win market share in the supermarket space – with superior service and loyalty programs often cited as key reasons of the driver.

Targeted marketing should help the company to continue building on its lead in the medium term, even as growth in 2021 slows as a result of the spike experienced in FY20.

Finally, Big W stands to be a direct beneficiary of a reduction in the Target footprint as announced by Wesfarmers in June.

3). Earnings recovery from Hotels as economy emerges from COVID-19 restrictions

One business often overlooked in the broader Woolworths Group is the Hotels division. The division – which is currently loss making given COVID-19 restrictions – should return to profitability over time, driving an uplift of approximately 5 per cent in medium term earnings for the Group. This helps to offset any slowdown in grocery spend resulting from a return to restaurants over time.

The Montgomery Funds own shares in Woolworths. This article was prepared 20 July with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Woolworths you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Karin Hefftner

:

Funny how things change. I recall your negative sentiment on WOW a few years back with the arrival in Australia of the likes of ALDI etc.

Luke

:

I recall some great pieces you wrote on Aldi a few years ago and how it strategically enters new markets and grows its share but more importantly chips away at the incumbent market leader/s margins. Is this still playing out in the Australian market? And as we head further into a recession will loyalty and superior service be enough to continue to drive growth in WOW market share?

Stuart Jackson

:

Hi Luke, Aldi has continued to grow but given the nature of its differentiated offer, it has predominantly won over the value focused shopper that historically shopped at Franklins. If you look at Aldi’s share of the grocery market today, it isn’t dissimilar to where Franklins was at prior to it losing its way and broadening its offer and losing sight of its core consumer proposition. Hence the vast majority of Aldi’s share grow came from Metcash supplied independent retailers. Aldi’s market share growth continues but the rate of growth is slowing post the expansion into WA and SA in 2016. A few years ago, we posited that Woolworths and Coles would see an erosion in their share, returns and margins if they didn’t take steps to cut costs in order to be more competitive on price. What wee saw was a material reinvestment in price by Woolworths and Coles in 2016 that closed the gap to Aldi. This of course came at the expense of margins. More recently we have seen both Coles and Woolworths announce major investments ion new automated distribution centres which will reduce supply chain costs. While I do not see these investments improving margins, they are necessary to maintain the price competitiveness of the retailers, with most of the cost savings likely top be reinvested in prices over time. The ability to makes these sorts of investments is a material competitive advantage for the major supermarket retailers as compared to the dis-aggregated supply chain of the independent sector. The majors also benefit from an incumbent portfolio of locations in highly trafficked areas. Given the number one determinant of which supermarket a consumer primarily shops at is convenience, this is a material competitive advantage.

In the current environment, Aldi is not performing as well as Coles and Woolworths in the current environment as Aldi is more exposed shopping malls. Additionally, consumers are more hesitant to go to the supermarket with the same frequency due to COVID-19. So the shops are getting bigger and requiring a full service offer.

Tim

:

Dishonest and resilient. And they no longer want the hotels. Severly disoriented management team

John

:

I rang woollies wyndhamvale and asked if everybody has to wear a mask doing there shopping they will still let you shop. Without a mask

Woollies thinks more of making money than saving peoples lives

Roger Montgomery

:

Thats now changing but probably too late John. I was at a shopping strip this morning early and even after the NSW Premier recommended everyone wear masks, I was the only one. Cafe lines were full and everyone chatting without a care in the world. The only way to get this under control is to go early and hard.