Don’t yield to income!

In recent times the market has been captivated by the ‘chase for yield.’ This phrase simply represents the symptom of the repressive money printing acting on interest rates globally. As a result of these low interest rates, funds are being ripped out of the safety of cash and poured into riskier assets in the pursuit of higher returns.

As more money leaves the safety of cash amid the search for a more prosperous home, it produces higher asset prices.

There has been a lot of talk about the impact of lower interest rates on asset prices, but precious little quantification of the impact to simply explain it. We have taken up the challenge.

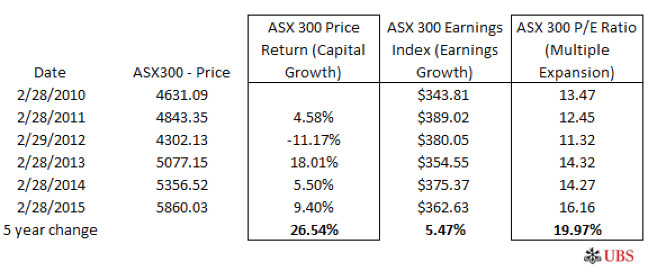

We recently asked one of the leading investment banks in the Australian market for some quantitative data on the S&P ASX 300 (ASX: XKO). A summary of this data is shown below:

The table above reveals the split between the two main drivers of aggregate stock market returns for the S&P ASX300 over a five-year period. When we look at the 26.54 per cent capital growth return, over five years to February 2015, we ask, what proportion of this is due to earnings growth and what is due simply to multiple expansion? That latter could be attributed to the willingness to pay more for yield, itself a function of declining interest rates.

Earnings growth most recently, particularly over the first half of the 2015 financial year has, at best, been anaemic. The same can be said of the period illustrated by the table above; The earnings index for the S&P ASX300 was 343.81 in 2010 versus 362.63 today, just 5.47 per cent higher than that of five years ago. On this basis, earnings growth for companies representing 81 per cent of the Australian equity market by capitalisation, is responsible for just a fifth of the S&P ASX300’s performance. That’s a poor showing in our view.

In order to invest successfully in such a market fund managers have had to focus on quality and invest in those businesses able to grow earnings much faster than the average. But given what we are about to reveal, much of the returns for many fund managers can only be attributed to sentiment. A changes in sentiment is notoriously difficult to predict so managers that have built their returns only on P/E expansion may be in for a rude awakening at some point in the future.

This is because the other four fifths of the market’s capital return, or 19.97 per cent nominally, has been generated by price/earnings multiple expansion. This number is much higher than we originally expected!

In essence the market’s expansion over five years to its current level can only be described as poor quality. of course there is the possibility that the period prior saw the market expand less than earnings growth, which would mean the recent acceleration is simply an example of investors playing catch up, but this theory is not borne out by the p/E expansion from a rational starting point.

Over extended periods of time share prices simply follow the earnings power of the business upon which they are based. This suggests something will come along to cause P/E ratios to mean revert.

In saying this, despite the poor showing from corporate Australia’s earnings growth, and the fact that share prices have detached from the core concept, what these numbers also show is that in a rate-cut environment stocks could continue their march upwards on nothing more than investors chasing income.

Of course there is no such thing as a free lunch, investing in shares is not risk free and fads in the market are common. Yielding to income and swapping low returns for more risk, is just another fad. This is why, one day, when interest rates invariably rise again (or even well before), so too will the end of the market’s obsession for yield.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Team,

The findings are certainly interesting. Eventually the outcome is binary, prices fall or earnings gather pace to justify the expansion in PE’s. Whilst the market will no doubt move through periods of sentiment, as you highlight in the long run share prices will reflect corporate earnings.

Its easy to paint a dire picture and develop a thought process that see’s prices collapse. However, what I would like to know is if there are scenarios that you see for corporate australia that enable a justification for the current high PE’s. ie – bullish cases for increasing earnings?

For me, I would like to see a sector breakdown of where the expansion has come from within the market. Maybe where PE expansion has been greater for some sectors it can be justified? Are we in the midst of a technology boom that greatly reduces captial requirements for investment within businesses and thus turns them into highly efficient, high ROE businesses that can command an above average PE?

Its pretty simple to see the market on aggregate is somewhat expensive and the case for a correction in the yield trade may generate a black swan event. But I would challange the other side and determine if we can see possible scenarios for the bullish case from here – it appears to be more difficult to do.

You are right Richard. A sector breakdown makes sense. We can do that here. As you say it is easy. before even looking at the results we can include banking/financial services, infrastructure and healthcare.