The only way is down for the Chinese share market…?

As the US share market hits all-time highs, we are often asked why the Chinese share market, as measured by the Shanghai Composite Index, is 64 per cent below its October 2007 peak.

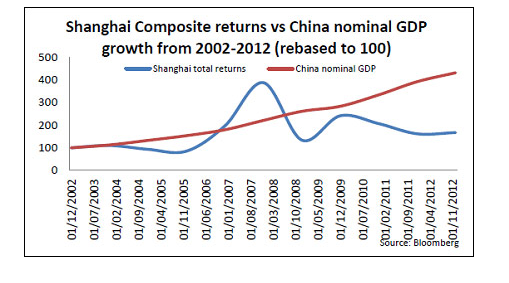

The graph below, courtesy of Bloomberg, shows the return of the Shanghai Composite Index over the past decade and compares it with China’s nominal GDP growth (based to 100).

It seems to us that the Chinese government’s spending, more often than not, focuses on low return investments, including fixed asset investment and infrastructure (and since nine of China’s top ten companies in the Index are State owned, they will take the time to remove the shackles of government policy).

While this has been like winning lotto for the resource and energy sectors, readers should be mindful of the following:

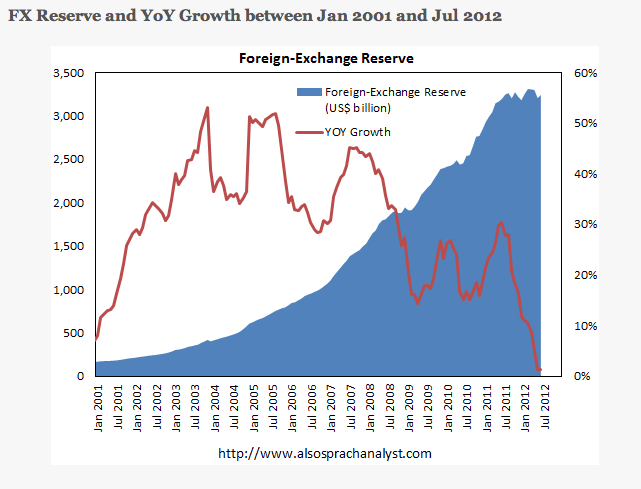

Year on year growth in Chinese foreign exchange reserves, after exceeding 30 per cent for the 2002-2008 period, is now nearing nil.

Some commentators, including CLSA’s Strategist, Russell Napier, claims: “The growth in Chinese reserves has determined all the key developments in

financial markets in the last two decades”.

Meanwhile, China’s balance of trade (value of Exports exceeding value of Imports) surprised analysts with a rare deficit at $0.9b for the month of March 2013.

This is precisely the problem with Australia. It should be investing more on harnessing entrepreneurial talent eg: tech start-ups via provision of policies that enable people with smart ideas to grow their businesses. Wayne Swan pegging the economy to China is a dangerous game, only if it is not offset with Smart investment spending in new age Australian Industries, of which many have been snapped up in Mountain View. – A great loss to Australia.