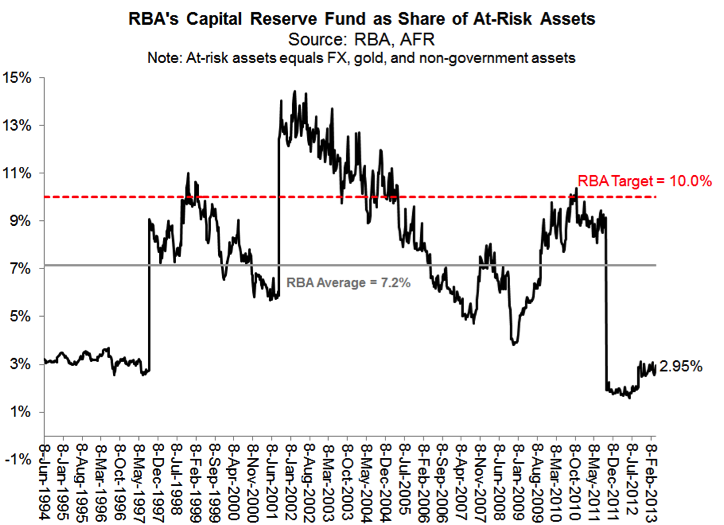

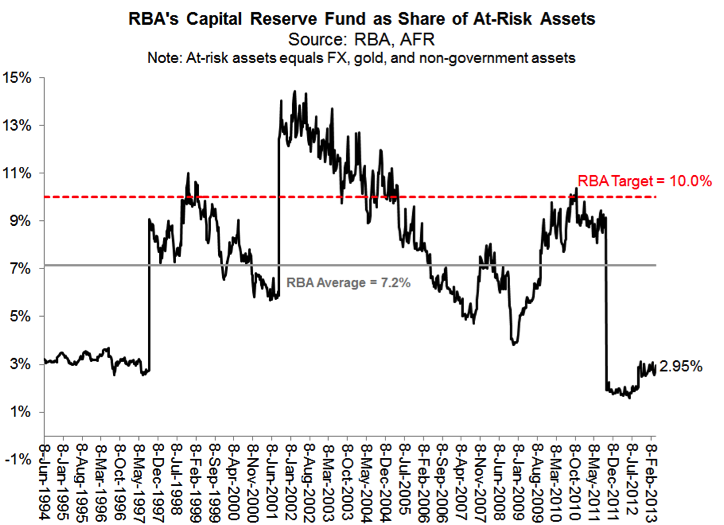

The dwindling RBA reserve

My fellow guest on Your Money Your Call, Christopher Joye, shot an email around that I thought you might be interested in…

While his article discusses the impact of a 5% devaluation of FX and gold reserves, history shows that a 5% positive revaluation is also a possibility that cannot be ruled out.

Nevertheless, the column does quite rightly raise awareness of the issue and queries how the RBA got to this point.

“In the Financial Review Jacob Greber and I have an exclusive news story revealing that a Coalition government would inject up to $4 billion of emergency cash into the RBA’s capital base to ensure it does not fall into reputationally damaging ‘negative equity’ (where its liabilities are worth more than its assets). A 5% decline in the value of the RBA’s FX and gold reserves would wipe out its capital buffer.

‘I am not aware of the government having to put any capital into the RBA since the early days of it being established,’ said the RBA’s official historian, Selwyn Cornish.”

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

John Trudgian

:

Another reason to look for a weaker AUD!