The Montgomery Fund’s key drivers of performance in 2021

In this week’s video insight Joseph discusses the key drivers of The Montgomery Fund’s performance for calendar year 2021. Overall, 2021 was a successful year for The Montgomery Fund. The total return of 25.1 per cent after fees represented an outperformance of 7.6 per cent versus the broader S&P/ASX 300 Accumulation Index, and included two distributions which collectively accounted for 4.2 per cent of the return.

The portfolio holdings of The Montgomery Fund’s differ materially to the S&P/ASX 300 Accumulation Index. This reflects not only our quality focus, but also our benchmark unaware portfolio construction. It also highlights the diverse nature of the top contributors.

Transcript

For this week’s video insight, I wanted to review The Montgomery Fund’s (The Fund) performance for 2021, but also provide some colour on a few of the key drivers that contributed to last year’s returns.

Overall, 2021 was a successful year for The Montgomery Fund. The Fund’s total return of 25.1 per cent after fees represented an outperformance of 7.6 per cent versus the broader S&P/ASX 300 Index, and included two distributions in June and December which collectively accounted for 4.2 per cent of the return.

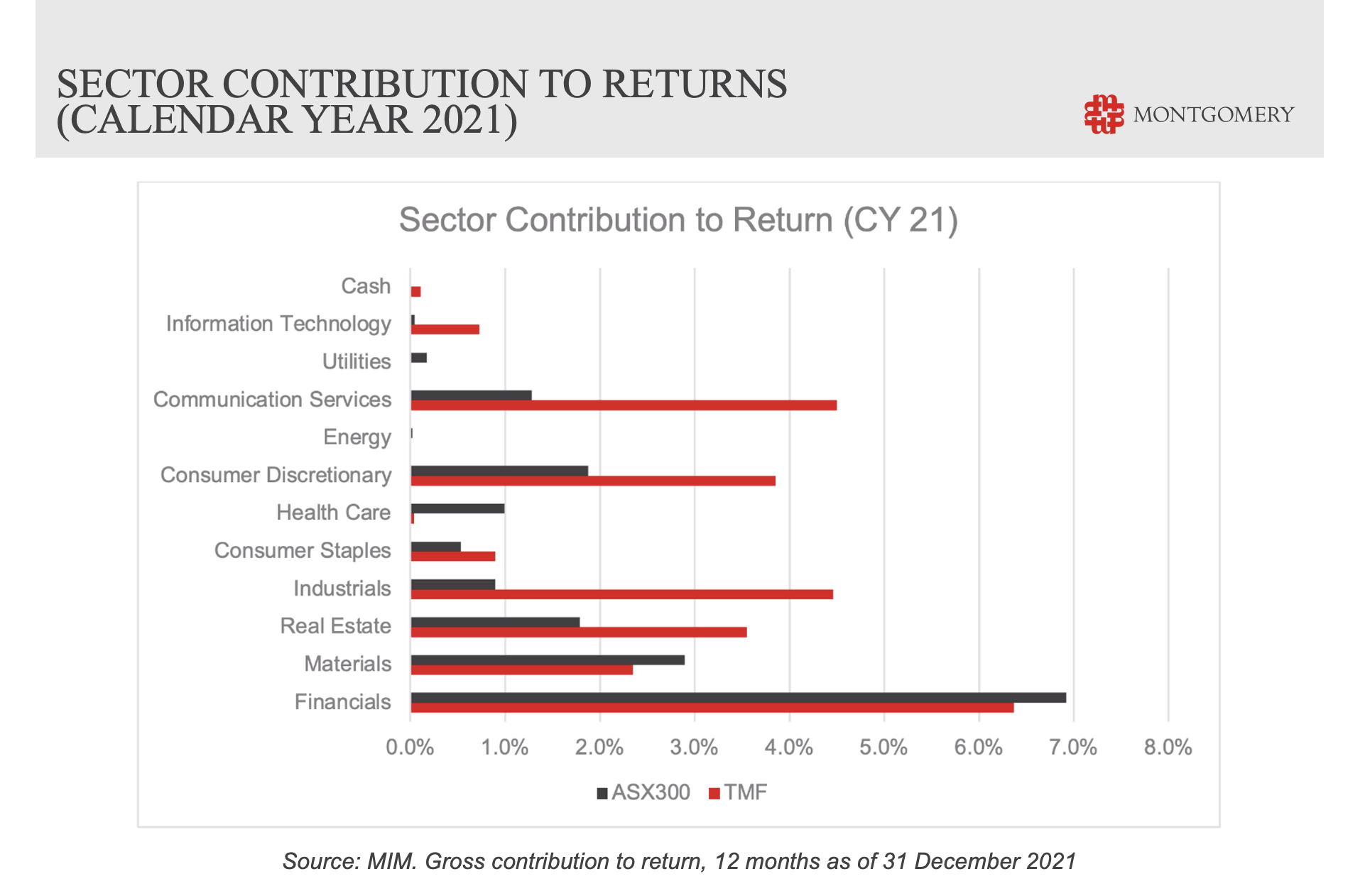

Going through the drivers of the returns – the following slide shows the sector contribution to The Montgomery Fund’s returns in 2021 versus the broader index.

As you can see from the slide, the drivers of returns differ materially to the ASX 300. This reflects not only our quality focus, but also our benchmark unaware portfolio construction. It also highlights the diverse nature of The Fund’s top contributors. For example, our top 6 contributors include two financial companies, a mining company, an industrial business, a property REIT / developer and a telco.

Like the broader ASX index, financials were the largest contributor to Fund performance last year. This reflects The Fund’s major bank positioning being at its highest level since inception, as well as the stellar outperformance of Macquarie Group.

Other notable contributors were industrials – driven by gains in portfolio stalwart Reliance as well as the takeover offer for Sydney Airport, while Communication Services also features prominently given the strong relative performance of Telstra and Uniti Group.

In terms of detractors – the notable laggard once again was Healthcare – as Avita’s share price decline offset a solid contribution from The Fund’s re-entry into Resmed.

Other detractors include PointsBet and Aristocrat Leisure. We have exited our position in the former, while the latter is relatively new re-entrant where we are positive on the medium-term outlook given its execution in large and growing addressable markets relative to its valuation.

One key callout is The Fund’s cash position, which only averaged 6 per cent over the year, well down over its historic average of 20 per cent since The Fund’s inception.

As we look ahead into 2022, we expect The Fund to remain more fully invested and back the diverse range of quality names in the portfolio. This is because despite the early turbulence, we anticipate The Fund’s investments to exceed the return on cash over the medium term.

To learn how to apply you can visit The Montgomery Fund’s web page here.

The Montgomery Fund owns shares in Macquarie Group, Reliance, Sydney Airpot, Telstra, Uniti Group, Avita Medical, Resmed, PointsBet and Aristocrat Leisure. This video was prepared 18 January 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Outstanding achievement in an uncertain world. I assume each company is assessed regularly and culled if/when circumstances change.

I wonder what the average length of time a stock remains in this Montgomery Fund?

We would love to hold them forever but when prices detach from reality or the company’s prospect deteriorate (or both) we need to separate.