The market’s “weighty” overreaction

Markets often resemble their participants, and the stock market is particularly vulnerable to the human psyche, prone to bouts of elation and despondency with each new trend. The recent euphoria surrounding a novel class of weight-loss and diabetes management drugs is a textbook example of this phenomenon.

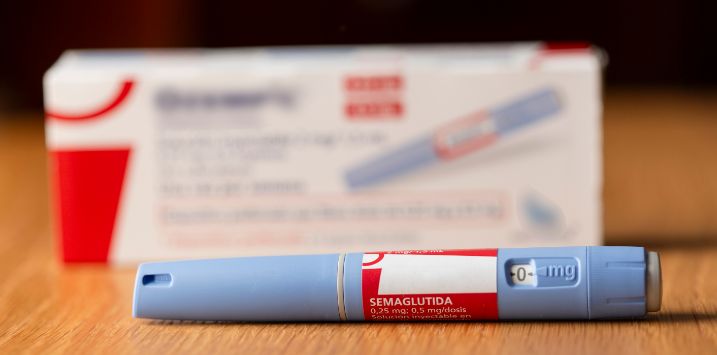

The so-called “Ozempic effect” catalyses a market reaction that warrants a closer look, suggesting the pendulum of investor sentiment may have swung too far towards pessimism for the companies thought to be negatively impacted by the advent of a new generation of glucagon-like peptide 1 (GLP-1) medications. For the discerning investor, current trends might present more bark than bite, hinting at substantial opportunities presented by the market’s enthusiasm for the disruptive effect of these healthcare innovations.

The weight of expectation

As the battle against obesity intensifies in developed nations, particularly the U.S., Wall Street’s reaction to a new generation of GLP-1 medications—including Ozempic and its ilk (Eli Lilly produces Mounjaro) —has been nothing short of exuberant. And while the clinical evidence favours rising profits for their manufacturers, the prevailing investor narrative seems to be that entire populations will be transformed, and a completely slimmer and healthier population is just over the horizon. That vision is shaping investment strategies and shaking up stock valuations in several sectors.

Over in the U.S., Eli Lilly and Novo Nordisk have seen their market caps rise by more than U.S.$340 billion year-to-date. And while one analyst noted, this is more than the market cap of the bottom 480 stocks in the S&P500, the enthusiasm for the transformative impact on their revenues may indeed be justified.

But I want to highlight the negative impact on other companies here.

In Australia, CSL (ASX:CSL) is 25 per cent lower than its February high. The Ozempic Effect has impacted sentiment towards the company’s newly integrated kidney disease business, Vifor, and its pipeline of drugs in various phases of development, wiping A$37 billion off the company’s market value. This is despite CSL estimating its profits will grow by between 15 and 17 per cent in 2024.

Vifor’s kidney disease treatments are responsible for almost 40 per cent of the division’s revenue, which in turn is responsible for 15 per cent of CSL group revenue. That’s six per cent of CSL revenue at risk from the wave of Ozempic-style drugs.

And when Novo Nordisk, the developer of Ozempic, halted a study early because the efficacy of Ozempic in treating kidney disease was instantly apparent, CSL’s share price took another hit. However, the reaction fails to account for the renal failure aspect of the Vifor business, which has little to do with weight and tends to impact the aged.

Resmed’s (ASX:RMD) business of supplying solutions for sleep apnoea – a condition more common amongst the overweight – has been hit, through its share price, even harder than CSL. From a high of $35 in May this year, Resmed’s share price is 37 per cent lower. Resmed’s market cap has declined U.S.$12.6 billion from U.S.$34.3 billion to today’s $21.7 billion.

The optimistic picture for Ozempic is having a negative impact on those companies believed to be disrupted. It will be the case that calories are cut but extrapolating that to envisage a world where nobody will ever consume high calorie foods and beverages again is an example of using a broad brush. Slimming an entire nation is a whimsical expectation by investors. Investors selling fast-food stocks, for example, predict a world where these giants transform their menus to accommodate a health-conscious clientele. The idea that will airlines save fuel and become more profitable from lighter passenger loads is fanciful.

So, if this sounds like another overreaction to another fad, you might be right.

A grounded perspective

I think a more tempered analysis is required and that encourages a more cautious approach. While the promise of GLP-1 therapies in combating weight issues is grounded in very encouraging clinical results, the broader implications for an entire nation’s waistline and, by extension, related market sectors may be overstated. For example, the GLP-1 market is a fraction of the global diabetes market size.

Several hurdles stand in the path of these drugs reshaping an entire nation’s health and, consequently, the implied economics of entire business sectors. And the current high cost of these treatments is but one.

Our channel checks have confirmed unpleasant side effects will put a cap on the number of people who will benefit from this new generation of treatments. Meanwhile, entrenched dietary habits mean the drugs may not be the final solution many investors are banking on.

I spoke recently with an Australian surgeon and an obesity specialist. He thinks the sell-off in CSL and Resmed is “stupid” because the wonder drug has natural limits. First, he notes, almost 50 per cent of candidates can’t take Ozempic for any meaningful length of time because the way it reduces their appetite is by producing nausea. He also noted, the dosage has to go up as time passes, and while this is highly lucrative for the manufacturers, its correspondingly prohibitively expensive for many patients. At the required dosage, the annual cost might be U.S.$10-$15,000 per year, which is simply too expensive for many who suffer from obesity, a disease with a socioeconomic aspect. It will certainly only be some of the more than 100 million obesity sufferers in the U.S. who can afford treatment.

More importantly, for the thesis that the market is overenthusiastic about the indirect impacts of Ozempic, weight is claimed to return as soon as a patient ceases taking GLP-1 drugs. This will incentivise many patients to stay on the drugs. Studies also show muscle is lost rather than fat, so when the patient stops taking the drug and weight returns, they have an even higher body fat percentage than before, which is a worse outcome.

These consequences will be a factor in the decision-making process for some patients.

Meanwhile, safety studies for those on Ozempic outside the diabetic setting won’t be released until next year. And finally, few, if any, studies have shown significant mortality purely from obesity. Sufferers do experience heart/organ/foot/back/ankle issues, but these are co-morbidities that cause sufferers to die earlier and not a lot earlier.

The industry’s financial health

Despite these natural limits, a seismic shift in investment portfolios has occurred, directly and adversely affecting peripheral sectors from food and beverages to medical devices.

The repercussions of this shift are evident as stock prices tumble in industries assumed to be on the losing side of the “Ozempic Effect.” Food giants and medical device manufacturers alike have seen significant declines in share prices as market sentiment turns sour on what was once considered steady terrain.

Yet, these reactions may be more reflective of an emotional market than a rational one. Hard data and corporate earnings paint a different picture, one where the immediate impact of these weight-loss drugs on consumer habits and company bottom lines is not as dramatic as the market’s response would suggest.

Weight loss and exercise go hand-in-hand as partners on the merry-go-round of fads. For example, the market’s infatuation with the Atkins low-carb diet at the turn of the century is a case in point. Between May 2002 and February 2003, McDonalds’ stock fell 55 per cent to a split-adjusted U.S.$13.50. Today MCD trades at U.S.$261.97, illustrating the cyclical nature of health trends and their influence on stock prices.

Investment opportunities can always be found in the gap between perception and reality. The current market narrative around weight-loss drugs may be overlooking the enduring complexity of dietary habits and the multifaceted nature of obesity. For the investor willing to look beyond the present zeitgeist, current pessimism towards those companies perceived to be adversely impacted may offer a chance to capitalise on the market’s potentially myopic view of the “Ozempic effect.” The pendulum of market sentiment inevitably swings back, and when it does, enormous profits may accrue to those who swim against Ozempic impact’s tide.

The Montgomery Fund and the Montgomery [Private] Fund own shares in CSL. The Polen Capital Global Growth Fund also owns shares in Novo Nordisk. This blog was prepared 6 November 2023 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade in CSL and Novo Nordisk, you should seek financial advice.