The good, the bad, and the shorted

Last month Roger shared a wrap-up blog from the most recent reporting season and concluded that results were generally more good than bad for the majority of ASX companies that reported. This led to many companies’ share prices surprising on the upside.

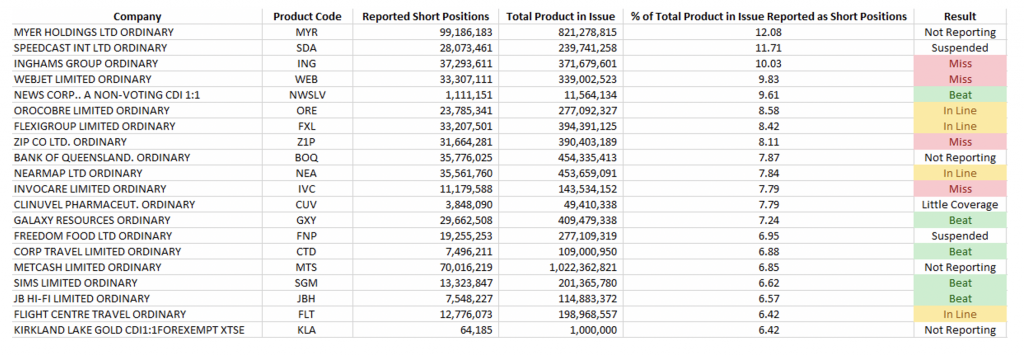

I thought it would be interesting to take this analysis a step further and look at the reporting season for the top 20 most shorted stocks on the ASX as at the beginning of August, as below:

Source: ASIC/Montgomery

Of those companies that reported their year-end earnings throughout August, four missed consensus forecasts, four were roughly in line and moreover five beat consensus forecasts. How does this run rate compare to the broader market? Overall, roughly 40 per cent of firms missed earnings estimates through reporting season, so a run rate of just 31 per cent of misses amongst the most shorted companies that reported is surprising, and further in line with the historic average of 30 per cent. How can this be? The Montgomery research team narrow it down to a number of factors, including evidence of extensive balance sheet repair, strong cost management and the strength of the consumer backed by ongoing government stimulus. The team also point to the fact that most companies provided trading updates throughout the COVID-19 Pandemic and so the market was pretty well informed as to the impact on individual companies. Whilst many may have underestimated some of these businesses and their operational leverage, not all beats demonstrated strong earnings quality, and moreover future earnings quality. There is a mounting debate on whether the demand we have seen in the COVID-19 winners will continue in the same categories going forward, and the lack of guidance companies provided won’t help answer this question anytime soon.

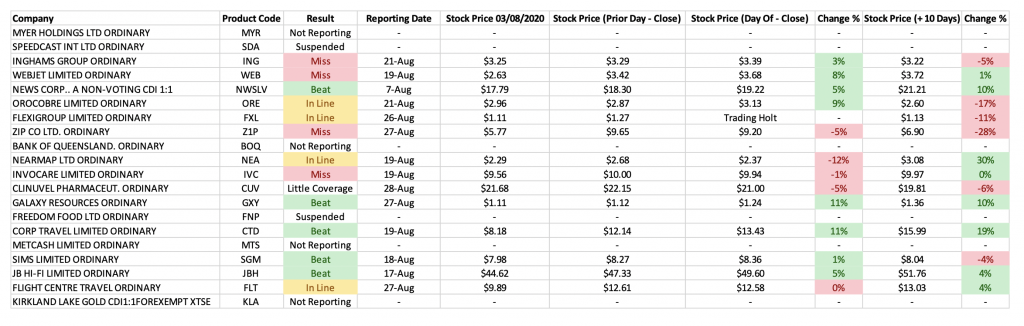

Another conclusion drawn from the August reporting season was that companies that beat expectations were on average rewarded from a price appreciation perspective, however those that missed weren’t punished as much as thought coming into the result on price performance basis. The below table looks at the same companies and their stock price movements both on the day of their result and ten days post this. Such an observation seems largely consistent with the most shorted stocks that reported, where the average price movement on the day of the result was +2 per cent to the upside. Some of this of course would have been short covering on the day, where the average movement on the upside was +6 per cent. However, there was some stronger price movements once the dust had started to settle with notable extremities in either direction, being +10 per cent on the upside and -12 per cent on the downside. Those that beat (with the exception of ASX: SGM) had positive price appreciations both on the day and ten days post their earnings result.

Source: ASIC/Montgomery

Does this mean the short sellers got it completely wrong? Not necessarily. As noted prior, many companies have provided trading updates throughout the Pandemic so the heavy price moves could have been done, in some cases, prior to the reporting season. As such, it may appear they may have lost this round but as we know at Montgomery it is all about forward-looking expectations and what is priced in and the future for many of these companies and the tailwinds they have experienced to date are by no means guaranteed. You can access the short-selling registry via the ASIC website here.

Please click here to read Roger’s wrap up

Looking at the reporting season for the top 20 most shorted stocks on the ASX we can see that only four missed consensus forecasts. Does this mean the short sellers got it completely wrong? Share on X