Lockdown, reopen, lockdown, reopen, repeat

Globally, investors have hitherto been blissfully optimistic about the end of hard lockdowns, the development of a potential vaccine and broad economic re-openings. But all that may be about to change.

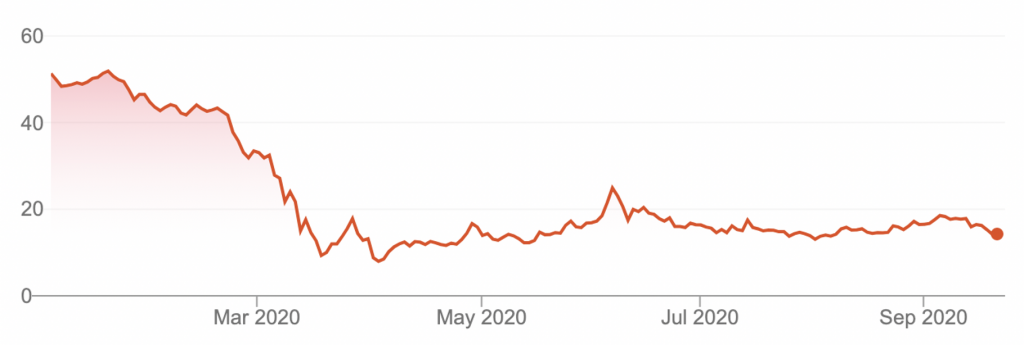

The share price of cruise line operators such as Carnival Cruises is perhaps one of the better indicators of how realistic such optimistic sentiment is.

Figure 1. Carnival Corp share price Year to Date

The recent turn down in the share price from a high of US$18.53 to $14.41 reflects waning sentiment with respect to any imminent reopening and return to ‘normal’ leisure travel.

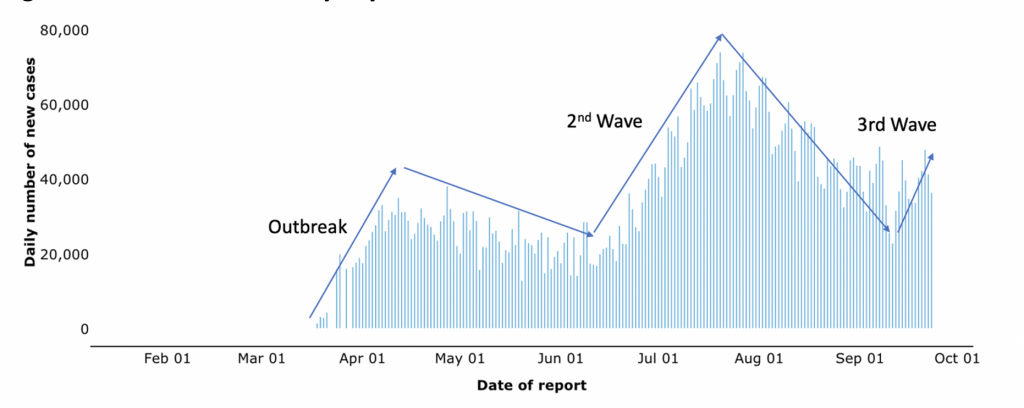

Figure 2. reveals emerging COVID-19 data from the US illustrating a troubling trend.

Figure 2. New Cases in USA by day

The first observation is that it looks like a third wave is developing in the US. According to the W.H.O., from Jan 3 to 3:13pm CEST, 22 September 2020, there have been 6,740,464 confirmed cases of COVID-19 with 198,363 deaths. Just over 41,690 new cases were reported overnight.

At the time of writing, the U.S. death toll from the coronavirus surmounted 200,000 (approximately the population of Salt Lake City or Huntsville, Alabama). This tragic toll has occurred despite the country being the world’s richest nation, replete with medical and emergency supplies, advanced laboratories and world leading scientists. Putting the death toll in perspective, the number now dead from COVID-19 in the U.S. is equivalent to a 9/11 attack every day for more than two months.

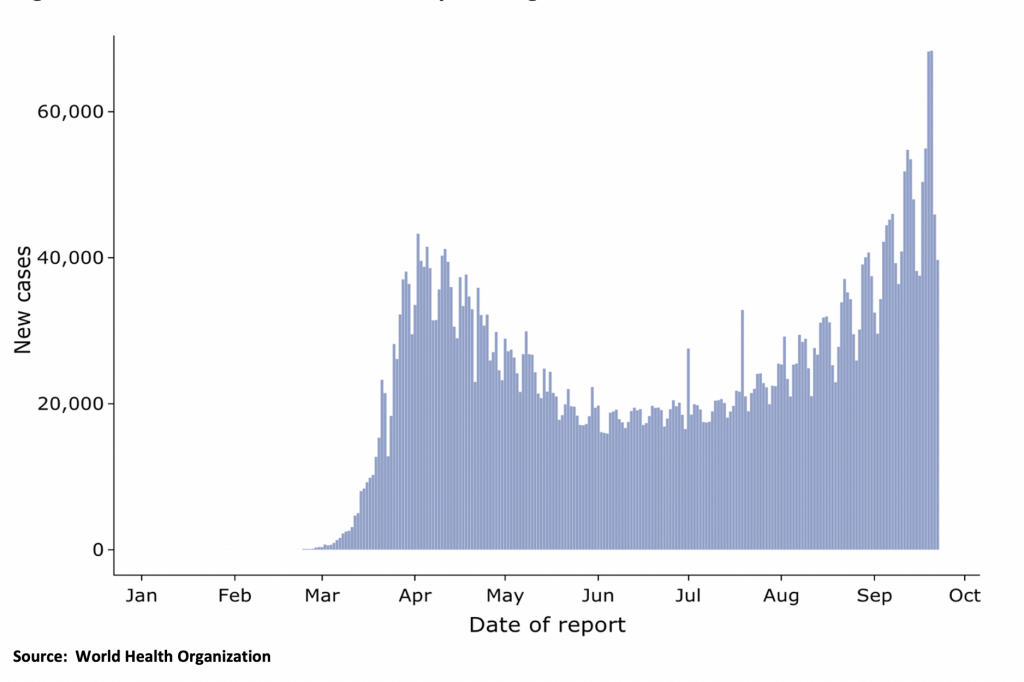

In Europe, where border restrictions are virtually non-existent, new cases of Covid-19 have increased dramatically in what appears to be a significant second wave (Figure 3.) It is now expected that the wave will accelerate as European holiday makers return home.

Figure 3. New Confirmed cases in European Region

Investors should always be assessing their portfolios for exposure to risks and in this case examine asymmetric international and domestic exposures. If in Australia we are gradually re-opening, while the rest of the world is returning to lockdowns, how does that impact your holdings?