The disintermediation gathers pace

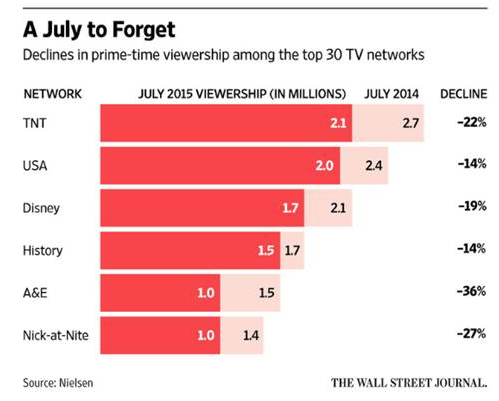

Streaming services from Netflix and Hulu have dramatically cut the viewer numbers of the top US cable companies. According to Nielsen, the aggregate audience of the top six US cable channels declined 21 per cent from 11.8 million in July 2014 to 9.3 million in July 2015. So far this summer, (free to air) broadcast and cable channels are averaging 94.7 million viewers, down 3 per cent year on year, and down 6 per cent on the 2013 numbers.

In recent years free to air broadcasters have responded to the disintermediation of the sector with more aggressive programming, and this has been reflected domestically with the jump in the broadcasting rights to the biggest winter sporting codes.

In recent years free to air broadcasters have responded to the disintermediation of the sector with more aggressive programming, and this has been reflected domestically with the jump in the broadcasting rights to the biggest winter sporting codes.

Nine Network has paid the National Rugby League (NRL) $185 million per annum for a five year package commencing in 2018 to receive exclusive live coverage of the four biggest games each week, the finals and the three annual State of Origin games.

Not to be outdone, Seven Network as part of a total $2.5 billion package will pay the Australian Football League (Aussie Rules) $140 million cash and $10 million of contra per annum to broadcast 3.5 games per week for six years commencing 2017. The balancing $1.63 billion will come from Newscorp, Foxtel and Telstra.

Both Seven Network and Nine Entertainment have recently announced reduced earnings on a softer than anticipated Free to Air advertising market combined with flat costs. This excludes the $1.9 billion impairment of Television Goodwill and Licenses announced by the Seven Network earlier today.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.