Stocks to watch

We’ll take a break from The Screen series for a few weeks, as our focus shifts to full-year company results and outlook statements. And while it’s still early days, a few businesses have already caught our attention. Below follow our notes on two of them.

JB Hi-Fi (ASX: JBH)

JBH’s result was largely what we expected in terms of margins, but completely missed the top line – with total sales growing less than previously forecasted. Total sales of $3.484 billion is below previous guidance for 6-8 per cent sales growth, a symptom of the poor retail trading conditions since the federal budget.

Unfortunately, this miss was compounded by the fact that JBH’s forward-looking statement suggests that management currently expect sales growth of just 3 per cent to $3.5 billion for 2015. A particularly soft trading period in July (down 5.5 per cent) means they have started this financial year well and truly on the back foot. If this guidance is accurate, this will be the lowest level of growth experienced by the company since listing.

It’s not all negative news, however, and we’ve come to expect a certain level of ‘clearing of the decks’ when new management takes the reins. Couple this with several big-product releases, such as mid-September’s iPhone 6, and an influx of computer games to support recent sales of the new Xbox and PS4, and the December quarter should be a bright spot for the business.

Another positive takeaway is the fact that there is virtually no growth being ascribed at current market pricing. But like we continuously mention, along with ‘cheap’, you also want ‘good’. Given the growth forecast for this year is well below historical trends, it would be hard to argue that there are better opportunities elsewhere.

Capitol Health Limited (ASX: CAJ)

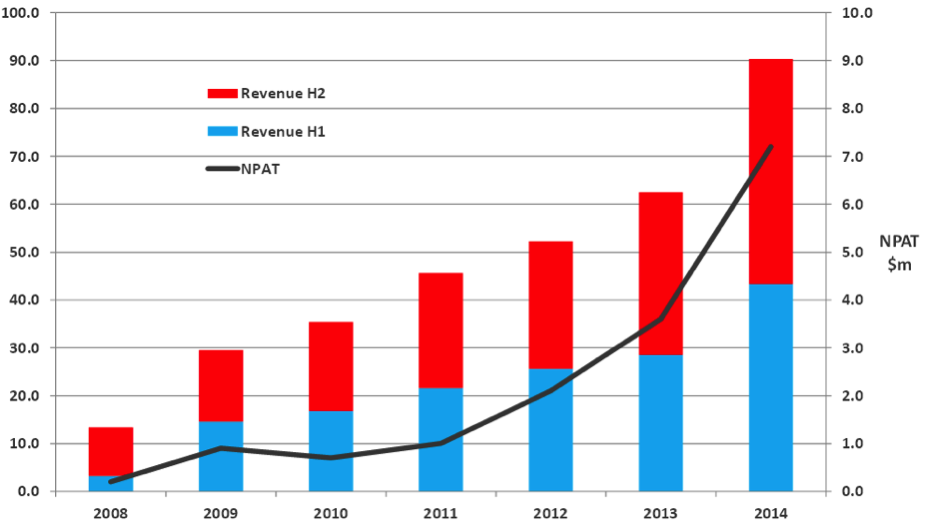

It’s a business we spoke about recently in The Screen: Part II, and the result was largely pre-released a few weeks ago. CAJ had a very strong 12 months, and looking at the chart below, it was a record period of growth for the business in dollar terms.

CAJ’s Revenue and NPAT growth

The drivers behind the business are an apparent ‘superior’ customer offering, which has resulted in market share gains across Victoria. Whilst this is extremely important, it probably comes in second place to their acquisition of MDI Group, which was completed in 2013 and thus has made a material contribution to the company’s record full-year result.

Management has noted that the group is actively seeking opportunities for further growth as the market continues to consolidate (which we read as further acquisitions), and a number of other business tailwinds will again see a strong result in FY15. Whilst the shares don’t look particularly cheap both here and on our modelling, they need to deliver approximately 30 per cent earnings CAGR for the next few years to justify their premium pricing, and the momentum behind the business will continue to see investors attracted to the business.

There are a number of other reports which we have noted are of sufficient quality to warrant further investigation by the investment team at Montgomery. As we are still digging through them, we will hold off posting on those for now.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Capitol health has been smashed over the past 12 months – some of it related to fed gov changes – but it is now a takeover target?

Hi Guys – just wondering what your current views on Capitol Health are. It has been smashed over the last 12 months in particular and off the back of some fed government announcements – to the point where it is at its intrinsic value according to skaffold. If it drops any further does it represent a takeover opportunity given that it is not one of the majors on a national basis?

Hi Bruce, we currently are not following CAJ closely however I just had a closer look. To me, it appears that they may be a little overstretched on their balance sheet (too much debt) and as you say, theyve been hit on the revenue side recently which potentially places them in a tough spot <-- from their bankers perspective. It may just be that the market has concerns here and thus is anticipating some sort of large capital raise (which it would be highly dilutive at current share prices). Id put this one in the too hard basket and seek better opportunities elsewhere. If you own it, Id be calling management and finding out how comfortable they are / others are with their financing / funding position. It may prove in time that they tried to grow way too fast.

I haven’t taken a big look into JBH yet as have had to focus on two other companies in Woolworths and Cardno for uni purposes so will need to take a closer look later.

I am a bit surprised by the commentary i have heard regarding JBH. The revenue growth was surprising, i always thought this year would be a good one or at the very least in line with previous announcements with various technology releases and major events that would drive demand for new televisions.

I also think that it might be worth investigating to see whether JBH’s pricing advantage is weakening as i have had (albiet small and very limited) experience where JBH did not really offer value for purchases.

At the right price it would make a good addition but agree, at present there a companies which are probably higher on quality chain and have a better outlook.

We believe their price promise is untenable. Many products available online cheaper.

Hi, do you have any comments on Singapore stocks

Sure, which ones?