Stock Bubble? Lessons from Dalio, Buffett and History

As we are all well aware, central banks have been, through quantitative easing, suppressing interest rates since the GFC. Consequently, monetary policy has fueled unprecedented flows of institutional and private capital into real estate, private equity and stocks.

History holds some valuable lessons. The consequences of last time this was attempted is explained in the classic book, Lords of Finance: The Bankers Who Broke the World. Its author Liaquat Ahamed offers us the following reminder:

“The quartet of central bankers did in fact succeed in keeping the world economy going but they were only able to do so by holding U.S. interest rates down and by keeping Germany afloat on borrowed money. It was a system that was bound to come to a crashing end. Indeed, it held the seeds of its own destruction. Eventually the policy of keeping U.S. interest rates low to shore up the international exchanges precipitated a bubble in the U.S. stock market. By 1927, the Fed was thus torn between two conflicting objectives: to keep propping up Europe or to control speculation on Wall Street. It tried to do both and achieved neither. Its attempts to curb speculation were too halfhearted to bring stocks back to earth but powerful enough to cause a collapse in lending to Germany, driving most of central Europe into depression setting in train deflationary forces throughout the rest of the world. Eventually in the last week of October 1929, the bubble burst, plunging the United States into its own recession. The U.S. stock market bubble thus had a double effect. On the way up, it created a squeeze in international credit that drove Germany and other parts of the world into recession. And on the way down, it shook the U.S. economy.”

Elsewhere, and the world’s largest hedge fund Bridgewater Associates, with US$160 billion under management, said: “We are bearish on financial assets as the U.S. economy progresses toward the late cycle, liquidity has been removed, and the markets are pricing in a continuation of recent conditions despite the changing backdrop.”

We have previously reported that the majority of the debt accumulated since 2010 by US non-financial corporates has been used for unproductive purposes, specifically financial engineering such as earnings-per-share-boosting stock buybacks[1], special dividends and mergers and acquisitions (at inflated prices). Swapping equity for debt through buybacks has, almost without doubt, inflated the equity market while simultaneously misdirecting capital away from productive purposes. By way of example, U.S. banks collectively returned 99 per cent of net earnings to shareholders via buybacks and dividends. In other words, the jaws between prices and reality have widened.

Bridgewater again; “2019 is setting up to be a dangerous year, as the fiscal stimulus rolls off while the impact of the Fed’s tightening will be peaking,” and “…since asset markets lead the economy, for investors the danger is already here.”

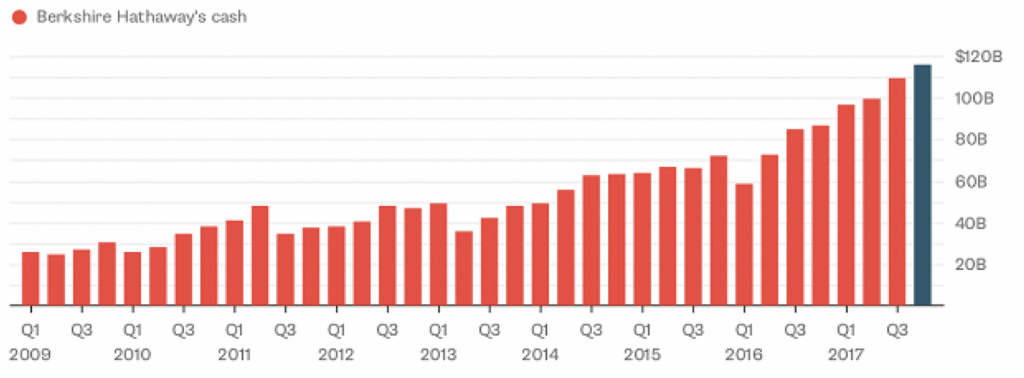

Finally, Warren Buffett’s Berkshire Hathaway is now holding US$116 billion in cash, which is a quarter of the company’s market capitalisation. Why? In the latest annual report Buffett wrote that an attractive price is “a requirement that proved to be a barrier to virtually all deals we reviewed in 2017.”

Figure 1. Buffett’s Cash

Source: Bloomberg

This is an important observation because, as one commentator noted Buffett has enough cash on hand to acquire 450 of the S&P 500 companies outright. Yet he did not buy any of them. Nor did he reduce the cash position to expose himself to more shares of any S&P 500 components. He has chosen cash in the form of short-term Treasuries.

History, the world’s biggest hedge fund and the portfolio of the world’s most successful investor are all telling us something.

At Montgomery, we’re listening and our mandates allow us to do something about it.

In our long-only funds, which include The Montgomery Fund, The Montgomery Global Fund, Montgomery Global Equities Fund (ASX:MOGL) and The Montgomery [Private] Fund, we have the ability to hold cash. Across our domestic and global funds cash weightings remain at relatively high levels.

Even though we’d prefer not to hold cash for long periods of time, it does provide us with an option over lower prices should they transpire. Indeed, higher cash levels have, thus far, enabled the funds to capture more of the upside in rising markets, than the downside during declining markets.

In our Global Long/Short fund, The Montaka Global Fund, the ‘net’ market exposure is just 35 per cent.

Our desire to preserve capital remains a priority with the aim to take advantage of value as and when it presents.

[1]As an aside it is interesting to note that buybacks were illegal in the US prior to 1982 because the Securities and Exchange Commission regarded them as manipulation.

Warren Buffett’s Berkshire Hathaway is now holding US$116 billion in cash. Is the world’s most successful investor telling us something? Click To Tweet

Joel

:

Thanks Roger, great reading.

So Berkshire tipped $23 billion of the company cash into the mark (around 50%) over the GFC period.

With the benefit of hindsight this even appears conservative given the discounts that would have been on offer in this period.

joe

:

re: Buffet cash chart before 2008 to see what they were doing prior GFC.

If you plot the ratio of cash held to Dow Jones you almost get a 1: 1 relationship

The ave cash held hovering between 25-50 B between 2005-2014.

It then continues to rise, almost linearly, (except for March 2016)

If one assumes an average cash position of $40B (one could argue that this should be a % of NAV – i.e. should increase as NAV increases) then, as Roger points out, Buffet is indeed “telling us something”.

Christian Forsyth

:

If Buffet parks his cash in short term US treasuries, where does Montgomery park cash?

Roger Montgomery

:

TD’s, Cash and ASX:AAA

William

:

Would it make sense to keep money in bank accounts when banks can fail in a major crisis? Wouldn’t it be better to put money in 30 day US Treasuries?

Roger Montgomery

:

That’s a scenario with extremely low probability. It’s not impossible but a lot of work has been done from David Murray’s Financial System Inquiry to today, to make the banks “unquestionably strong”. My friend Chris Joye also noted recently, “While Australia’s economic growth remains very brisk—real GDP expanded at an above-trend 3.1 per cent over the year to March—national house prices have experienced a gradual 2.2 per cent correction since October 2017 as a result of APRA’s “macro-prudential” constraints. This means Australia’s house price-to-income ratio is falling rapidly back to more normal levels at a time when the economy and the labour market are thriving. Indeed, were it not for a healthy rise in Australia’s labour force participation rate to record highs, our jobless rate would have fallen to 4 per cent (it is currently 5.4 per cent).

John

:

It would be interesting to see the Buffet cash chart before 2008 to see what they were doing prior GFC.

Roger Montgomery

:

That’s easy. Here’s the data to the end of the March quarter.

March 31, 2018 108.56

Dec. 31, 2017 115.95

Sept. 30, 2017 109.3

June 30, 2017 99.75

March 31, 2017 96.46

Dec. 31, 2016 86.37

Sept. 30, 2016 84.84

June 30, 2016 72.68

March 31, 2016 58.34

Dec. 31, 2015 71.73

Sept. 30, 2015 66.26

June 30, 2015 66.59

March 31, 2015 63.71

Dec. 31, 2014 63.27

Sept. 30, 2014 62.38

June 30, 2014 55.46

March 31, 2014 48.95

Dec. 31, 2013 48.19

Sept. 30, 2013 42.08

June 30, 2013 35.7

March 31, 2013 49.09

Dec. 31, 2012 46.99

Sept. 30, 2012 47.78

June 30, 2012 40.66

March 31, 2012 37.83

Dec. 31, 2011 37.3

Sept. 30, 2011 34.78

June 30, 2011 47.89

March 31, 2011 41.18

Dec. 31, 2010 38.23

Sept. 30, 2010 34.46

June 30, 2010 27.95

March 31, 2010 25.67

Dec. 31, 2009 30.56

Sept. 30, 2009 26.92

June 30, 2009 24.51

March 31, 2009 25.55

Dec. 31, 2008 25.54

Sept. 30, 2008 33.37

June 30, 2008 31.16

March 31, 2008 35.57

Dec. 31, 2007 44.33

Sept. 30, 2007 47.08

June 30, 2007 46.95

March 31, 2007 46.03

Dec. 31, 2006 43.74

Sept. 30, 2006 42.25

June 30, 2006 42.07

March 31, 2006 42.86

Dec. 31, 2005 44.66

John

:

Thanks Roger, I looked at Joe’s comment above.

Based on those figure s- at least in relation to cash holdings- Buffet did not seem to be accumulating cash pre GFC but this time he is. I guess this means he learnt a lesson that he is not implementing?

john

:

thanks