Sirtex Update – Part 2

The last time we provided an update on Sirtex Medical Limited (ASX: SRX), we signed off our note on the release of their Preliminary SIRFLOX Study Result as follows:

“We have held the view that a clear benefit exists when SIR-Spheres Microspheres (SIRT) – Sirtex’s core medical device – is used for the treatment of inoperable liver cancers, over the current standard of care modalities (chemotherapy), and all that today’s announcement tells us is that it does.”

That was clearly a contrarian view at the time. Shares of Sirtex where facing some pretty aggressive selling from other investors, who either did not agree with us, or simply did not understand what was being presented to them and the likely impact on the businesses future prospects.

That’s fine, that’s what makes a market and creates volatility and potential opportunites. But with the price falling from $39 to an intra-day low of $14.80, and being better prepared than most, we took the opportunity to increase our position. Some months on and that appears to have been the correct decision.

Today and somewhat belated, are our thoughts following their subsequent ASCO (American Society of Clinical Oncologists) Presentation. The meet is the single most important forum for HealthCare/Medical Device companies to both present data and results from pivotal trials and to have a discussant on its clinical relevance which in turns drives its likely commercial significance.

SIRFLOX is a pivotal trial for Sirtex. Indeed it’s the largest trial ever undertaken in this modality (Oncology/Inoperable liver tumours) and hence, it’s a time Sirtex want to be seen as positive. Which is why and perhaps unsurprisingly, the presentation both to ASCO and investors was very upbeat and focused largely on the fact that the results were “well received” and could “potentially” warrant oncologists to consider the data in their own practice “hopefully” leading to higher dose sales.

As a high-level summary, these are our concluding summaries:

- We believe an incremental benefit (albeit small) will accrue in time to Sirtex from label modernisation combined with positive data from SIRFLOX.

- We estimate this benefit to be in the region of 20,000 patients globally per annum which lifts our base case patient numbers / dose sales in the order of 20 per cent over the life of our modelling.

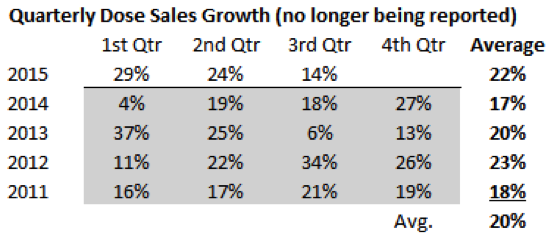

- Based on potentially adding a new sales channel (1st / 2nd / 3rd line penetration) we lift our outer year dose sales growth rates and apply a CAGR of ~20 per cent per annum in-line with recent trends.

- The overall impact being our base-case valuation increases to the high $20 range.

Label Modernisation

Perhaps the single most important outcome from a pivotal trial such as SIRFLOX is asking the simple question – does the data from the trial overwhelmingly support a recommendation that will result in the FDA/CE Mark/TGA approving the use of SIRT in the setting they want – e.g. can SIRT be upgraded as a first line Standard of Care (SOC) with a Chemo backbone in conjunction with other biologics? The answer to this we now believe is unfortunately no. The data available today simply does not support this change but with more data coming in 2017 from their ongoing FOXFIRE study, the door is not completely closed.

However, a second prize could potentially be afforded to Sirtex from the SIRFLOX data which shows the Progression Free Survival (PFS) in the liver was improved by a statistically significant 7.9 months. With this data, Sirtex can now potentially modernise the current label for SIRT from an old and disused chemotherapy label, to current systemic chemotherapy. This is important.

For if it does, this potentially opens up 3rd / 2nd / 1st line sales – but slowly. Management have articulated this by stating that sales won’t be a like a switch but will be akin to gradually turning on a tap.

We expect a likely outcome will be a gradual improvement in growth rates overtime, nothing immediate, but building momentum as oncologists become further educated on SIRTs potential earlier use. Therefore, we conclude the second prize is likely to result in a longer-term positive impact for Sirtex’s sales, revenues, margins, earnings and hence valuation.

“The feedback from key opinion leaders has been positive, and to that extent Sirtex believes sales in first-line mCRC are achievable based on the strong results demonstrated in the liver…will ultimately facilitate an increase in the utilisation of SIR-Spheres microspheres at an earlier stage of patient treatment…”

Sirtex ASCO Presentation.

We note that a small hurdle still remains in that Sirtex still require Quality of Life data which will come out later this year, probably the second quarter of FY16. So whilst it’s a possibility [for label modernisation], it’s no certainty at this stage that it will occur.

Expanded Market Indication

In our view, throughout the presentation there was a clear shift in messaging and a repositioning for SIRT as a liver-only treatment. We also note there has been no change to SIRT’s positioning within Sirtex’s core market, salvage, which is welcomed given the success they continue to experience here.

Given this repositioning, we note the potential for additional market penetration and sales and we have attempted to estimate the market size in Liver Only Disease (LOD) Metastatic Colorectal Cancer – what can Sirtex logically attack?

If Sirtex modernise the current label for SIRT to current systemic chemotherapy, our view is they could increase the number of patients they treat globally by c19,000-20,000 per annum. Liver Only Disease treatments could bring a further 4 per cent global addressable market. But this is a rough approximation given very little data exists through the industry on LOD and what would be treatable with SIRT.

Overall, we conclude that adding 20 per cent upside to our base case patient and dose sales modelling is potentially warranted over time.

Whilst not overwhelmingly positive in the scheme of what could be and what could be achieved in 2017 post FOXFIRE study, when added to the fact that the SIRFLOX data will also strengthen the case for the use of SIRT earlier and hence will likely gain reimbursement now in additional geographies opening further sales channels, it’s yet another step forward. And the business has taken numerous steps in the past 10 years.

Combining all data, our estimated addressable market size for Sirtex, potential dose sales in the years ahead which translates into a continued ~20 per cent Compound Annual Growth Rate sees our base-case valuation lifts to the high $20 range.

Source: MIM Sirtex reported quarterly growth rates over time and averages.

Both The Montgomery Fund and The Montgomery [Private] Fund remain shareholders in SRX.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Greg McLennan

:

Thanks for the update, Russ. Great information as always.

Russell Muldoon

:

No problems Greg. Will keep you updated as more information comes to hand.

Nicholas Christian

:

Peter Lynch said “Never invest in any idea you can’t illustrate with a crayon on butchers paper.” or “If you can’t explain it in simple terms a fifth grader would understand.”

I’m glad you boys are ‘all over it’ Because that fried my brain.

Russell Muldoon

:

Ive always preferred “the harder you work, the luckier you become”.