Reporting Season – Emerging Conclusions

Reporting season is a busy time for us at Montgomery Investment Management. Studying results announcements is one of the ways we try keep on top of what is happening in the market and identify economic trends and investment opportunities.

We do this in a fairly systematic way. Every day we review, evaluate and catalogue every last results announcement made that day. As I write, we have reviewed several hundred sets of financial statements and the accompanying commentary, representing around $700B of aggregate market capitalisation, with many more still to come.

This analysis draws our attention to individual companies that are performing well, and complements the automated stock screening tools we use, including Skaffold. It also gives us a sense of broader economic trends and the relative health of different parts of the economy.

In the charts below, we have summarized some of the high-level findings emerging from the analysis we have completed so far.

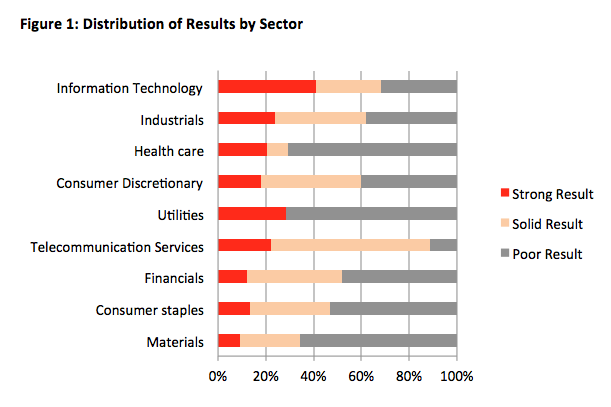

Figure 1 shows a breakdown of results by sector. The different coloured bars indicate the proportion of companies within each sector that we feel have delivered a strong, solid or poor result. Note that the proportions are based on numbers of companies, and are not weighted by market capitalization.

Some of the conclusions that emerge from this analysis include:

A significant number of information technology companies (this includes software companies and IT service providers) have reported good results for FY12. This may be a reflection of the structural changes being imposed by online commerce, and the increasing volumes of data that businesses need to gather, store and manage. Similarly, the telecommunications sector seems to be one in which solid performances are being reported.

Industrials is another category where a significant number of good results have been reported. Some of these results are from mining services companies which have clearly benefited from the resources boom, and whose prospects may dim with falling commodity prices. However, a number of other industrial companies, including MacMillan Shakespeare and Seek Limited, which feature in our investment portfolios, are also performing well.

Perhaps counter-intuitively, the materials sector is one that has underwhelmed us this year. This may reflect a large number of small, unprofitable, explorers and developers, as well as large numbers of producers with high costs of production (remember that these charts reflect numbers of individual companies, and are not weighted by market capitalisation).

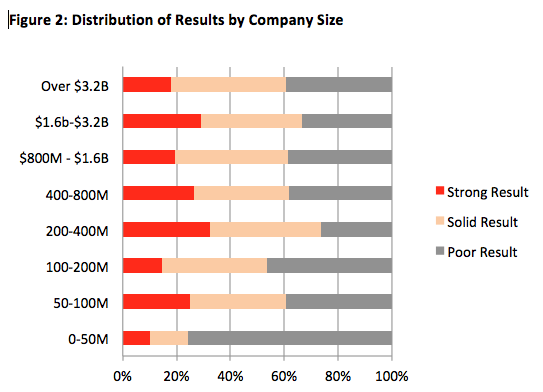

Figure 2 shows a breakdown of results by company size. Some of the conclusions that emerge from this analysis include:

The micro end of the market (<$50m market cap) is a perilous place. Most of the results reported in this size bracket left us unimpressed. Having said that, some of the best of these small companies may have very strong growth potential and investment prospects.

A significant proportion of small-cap companies ($200m-$800m market cap) are performing well. This is an interesting area for us, as companies of this size may have established a solid performance track record over a number of years, but still be some way from reaching maturity.

Good results have also been reported in the $1.6-$3.2b size bracket. Included in this category are some of the leading internet businesses such as SEK, REA and CRZ. We think some of these are high quality businesses with very significant growth ahead of them, although this is now generally recognized by the market and being reflected in their share prices.

Over the coming weeks we will be studying in more detail the interesting businesses that have been identified, and will report back with some of the highlights.

Have any emerging trends caught your attention this reporting season ?

Hi Tim, Roger et al,

Some great observations here! Thanks.

I wonder if you have had opportunity to look into Newsat, NWT. It seems to have great prospects, an enormous moat, and in the right space (pardon the pun) of telecommunications/IT. I would appreciate your comments.

Cheers

Thanks Tim, really great graphs. IT and Telecommunications the standouts. A reflection of societies focus, innovation and business use; I wonder if that’s it? Industrials; need productivity gains? Materials, ordinary yet some of the service providers have had terrifc results and end of cycle companies may have a few good years left. Healthcare; gotta love them but making money is tortuous -with expections like CSL! Comsumer staples; deflation but will still keep my WOW!

Ash, (apart from mining)I think this has been the space to be in for the last few years but if the macro economic woes continue – and it’s survival of the fittest – do you think it will be in the next 3 -5 years?

The Small cap index will get slaughtered Liz but I wont be invested in the index

Cheers

Thanks Ash, it’s a good distinction.

Under $50M market cap is the place to be I think.

You just need to be fussy.

This is my pond and there lots of opportunities.

Cheers