Ready. Set. Run!

According to The Wall Street Journal: “Tight credit, restrictions on the ownership of multiple homes and an easing of prohibitions on alternative investments overseas have triggered a long-expected downturn in the Chinese residential housing market.”

We have been warning investors in Australia’s big mining services businesses that the writing’s on the wall.

The iron ore price is falling, coal has plunged, and supply of iron ore is about to ramp up during a seasonally soft period for demand.

According to The WSJ: “Prices are falling for both new and old apartments. The volume of deals is drying up. And developers are pulling back, furloughing workers and delaying new projects.”

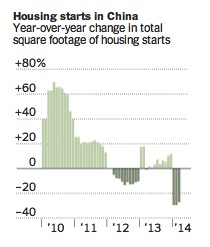

We have already reported that housing market plummeted 25 per cent in April, from a year ago. Just how much can be seen in the graph below.

Source: China’s National Bureau of Statistics, via CEIC Data

Anecdotal stories of the slowdown are evident everywhere. The WSJ reported the contrast from last year when Su Hua, a real estate broker in Shenzhen, had his highest commissions ever. Last week, the same agent was reported to be sitting in a deserted office with several silent phones on his desk and an income that has halved.

Some concerns remain also for the banking system. The bulls argue that even a steep slump in housing won’t lead to the bank failures or US-style bailouts. This is because even after a fall, house prices would still be above mortgage balances and so the pressure on foreclosures would be limited.

The issue, however, is whether slowing growth has an impact on returns for products issued through the shadow banking system. Much of the financing for the property boom has been through the shadow banking system. Investors in these ‘funds’ effectively leant money to property speculators and developers. Big losses are more than merely possible, and protests have already been reported. The concern is that amid an already slowing economy, a crisis in the banking system could be the straw that breaks the camels back.

The simple fact is that debt cannot continue to rise at rates above income growth indefinitely. In China, the two have been diverging for many, many years. Chinese leaders are reported to have “been increasingly concerned over the last several years that housing prices were rising to unaffordable levels and that the economy was becoming overly dependent on investment; residential construction accounts for one-ninth of all economic output.” As a result, they have increased short term interest rates to make cash deposits more attractive, raised interest rates on mortgages for second homes and banned the purchase of third properties.

Either way, the Chinese economy must slow. This will have an impact on Australia’s miners, Australian tourism and possibly for those sections of the property market reliant on Chinese foreign investors.