REA, you’ve done it again

For background information about this A1-quality company, I previewed REA Group’s (ASX:REA) latest results here, wrote about why I believe REA Group is one of Australia’s highest-quality businesses here, and I also wrote about why REA Group will keep delivering for investors here.

Figure 1. REA Group (ASX:REA) has been a favourite here since 6 July 2010

REA Group recently reported its full-year results for 2024, delivering a solid financial performance albeit largely in line with expectations. Net profit came in just under market expectations due to higher costs that are expected to remain elevated in 2025.

REA Group recently reported its full-year results for 2024, delivering a solid financial performance albeit largely in line with expectations. Net profit came in just under market expectations due to higher costs that are expected to remain elevated in 2025.

In its full-year results to 30 June 2024, REA Group reported a 23 per cent increase in revenue growth to $1.453 billion, a 27 per cent leap in earnings before interest, tax, depreciation and amortization (EBITDA) to $825 million, and a 24 per cent rise in net profit to $461 million. Operating expenses were up 18 per cent to $628 million.

In FY24, REA Group’s India operations revenue rose $24 million, and EBITDA improved $3 million. For FY25, a similar EBITDA improvement of around $4 million is expected.

Australian residential revenue increased 24 per cent to $996 million. ‘Revenue growth in the ‘buy’ division of the business was driven largely by a 19 per cent increase in ‘buy yield’ (REA Group raised prices on existing tiers and pushed sellers into more expensive tiers), an increase in national listings and a three per cent positive impact from geographical mix due to the outperformance of the higher-yielding Sydney and Melbourne markets.

‘Rent’ revenue increased thanks to an eight per cent average price rise and growth in depth penetration, partly offset by a one per cent decline in listings.

With the exception of Perth, where the market is so strong, listings are tight because vendors are not confident they can find another property to buy after selling, REA Group’s CEO has reportedly described Australia’s property market is being in ‘goldilocks’ conditions for REA Group.

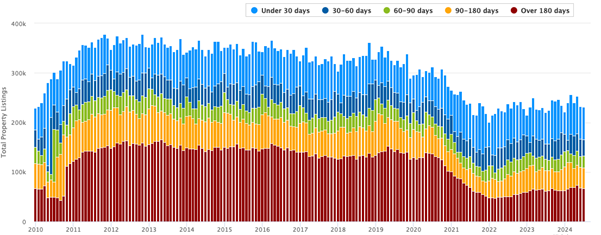

Demand for property in Australia remains strong despite the higher interest rates. This is thanks to solid population growth from immigration especially from China. Importantly, turnover remains elevated with the number of days that properties remain listed well below five-year averages.

And with listings having recently experienced some reversal from a decade-long decline, buyers have plenty of choice, while the declining days on market is increasing turnover.

Keeping in mind, REA Group’s revenue is directly related to listings volume (not real estate prices), REA Group’s trading update revealed national residential listings rose 12 per cent year-on-year, with Sydney up 12 per cent and Melbourne up 15 per cent.

Whilst July listings were up circa 12 per cent year on year, they were up closer to two per cent year-on-year without the benefit of two extra working days in July this year. As some analysts have noted, when adjusted for the two extra working days in July, realestate.com.au buy listings were roughly in-line with FY18.

As Figure 2 reveals, however, national listings in FY24 are well below FY18, meaning REA Group has taken significant market share from its main rival Domain Holdings (ASX:DHG) since 2018 (the last year without being impacted by elections or Covid-19).

That’s why I remain an avowed fan of this A1 company. Within it is the most valuable competitive advantage of all: the ability to raise prices without a detrimental impact on unit sales volume. REA Group has been raising its prices for many years, and customers are still crossing the road to buy its products rather than its competitors’.

As I have noted for many years, REA Group will grow its revenue by raising prices for residential buy listings under existing tiers and indirectly by continuing to introduce new premium pricing tiers. The history of new tiers includes Feature, Premiere, Premier All, Premiere +, and the latest, which is Luxe. These premium tiers attract eyeballs from existing tiers, encouraging property vendors to upgrade to these new tiers.

Figure 2. Total Australian property listings

Source: SQM Research, Highcharts

Source: SQM Research, Highcharts

REA Group reported an additional 127.2 million average monthly visits, 4.1 times more monthly visits in the second half than the nearest competitor on average. The company also reported 3.8 million unique properties tracked by their owner on realestate.com.au, which was up 37 per cent year on year.

REA Group remains an outstanding business and is expected to deliver approximately 15 per cent growth in EBITDA and net profit after tax (NPAT) for FY25, even accounting for geographical mix challenges and ongoing investments. The company’s ongoing product enhancements and diversifications – such as Ignite, Luxe, seller leads, and REAx/Green – will continue to drive long-term growth. The Luxe tier carries a 90 per cent premium over the standard offering, which should provide additional upside in FY25 and beyond.

FY25 residential buy yield growth is forecast to be slightly lower than FY24’s 19 per cent, at 10-12 per cent, with price increases again being the primary driver. REA Group continues to demonstrate its strength as the leading digital property advertising company in Australia and one of the best in the world. While there are some headwinds, particularly related to geographical mix and investment costs, the company’s strategic initiatives and product improvements are expected to sustain growth. Investors and analysts alike should keep a close eye on potential consensus adjustments in the near term, as well as the impact of REA Group’s ongoing innovations on its long-term performance.