REA-lly good prospects

Yesterday REA Group Limited (ASX: REA) released their full year results. Whilst it slightly missed expectations we were nonetheless pleased by the result.

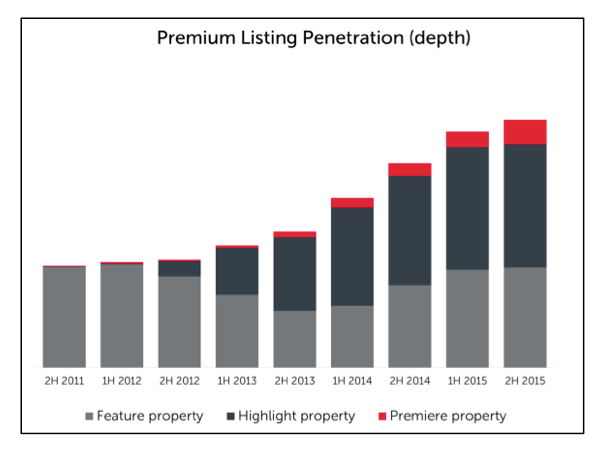

Full year revenue, EBITDA & underlying profit grew by 20 per cent, 20 per cent and 25 per cent respectively. The main growth driver was listing revenues which increased 46 per cent over the year.

To boot, REA’s incremental EBITDA margin reached over 70 per cent. This means that the firm generates more than 70c of EBITDA for every $1 of additional revenue it earns (most of which falls straight to the bottom line). Profit growth generation in this scenario is lucrative.

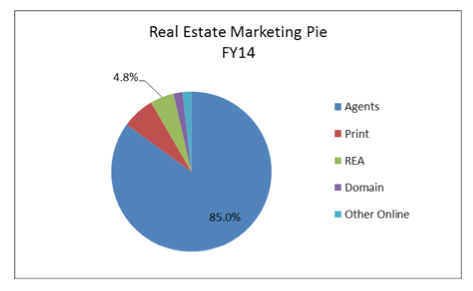

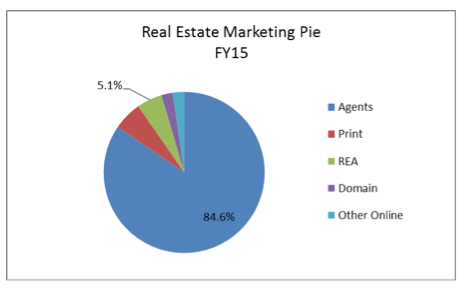

We also saw the continuance of our long term thesis playing out as per the below. For those who missed our last blog, we view REA’s growth prospects in context over Australia’s total spend in real estate marketing (real estate agent commissions, print ads, REA ads, Domain ads etc). In this context, REA’s share is very low and arguably the firm provides more value to each housing transaction than they currently are earning in revenue.

REA’s take of Australia’s circa $6-7 billion real estate marketing “pie” looks to be increasing through a combination of higher paid listing volumes on the website and ad price increases.

Some market participants appear to be concerned about how a potential pricing bubble in some of Australia’s capital cities may affect REA negatively. At Montgomery we looked into this and found that REA would benefit from any cooling of the property market. Simply put, in a hot market, property sellers find it easier to attract buyers and may not need REA’s platform whereas in a cooler market, the phenomena reverses.

Further, in cooler markets, houses tend to be ‘for-sale’ longer leading to ads bought on REA with longer lifespans (e.g. 60 days rather than 30 days). All these drive the firm’s revenues up.

REA’s prospects appear bright and we remain happy holders.

The information in this blog is general in nature and is not a recommendation or a solicitation to deal in any security. Please do your own research and consult a licensed financial advisor where appropriate.

The Montgomery Fund, The Montgomery Private Fund, The Montgomery Global Fund & The Montaka Global Fund hold positions in REA Group Limited.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

MARK

:

Yes good result ……in a universe of so many companies reporting badly at the moment.

This market is more than ever a very specific stock pickers market.

Between the property market, and some shares, people are paying extraordinary prices for overpriced assets.. shows the wisdom of intrinsic value.

Roger Montgomery

:

Indeed Mark. Thanks.