Part 2: Are Negative Interest Rates Having Unintended Consequences?

The record low interest rate environment is seeing investors buying speculative grade corporate debt and extending maturities to generate positive yields. The rewards are becoming increasingly unsustainable given the level of risks.

Following on from my recent blog, credit quality has been deteriorating in recent years with 40 per cent of Standard and Poor’s sample of 14,400 non-financial companies categorised as highly leveraged.

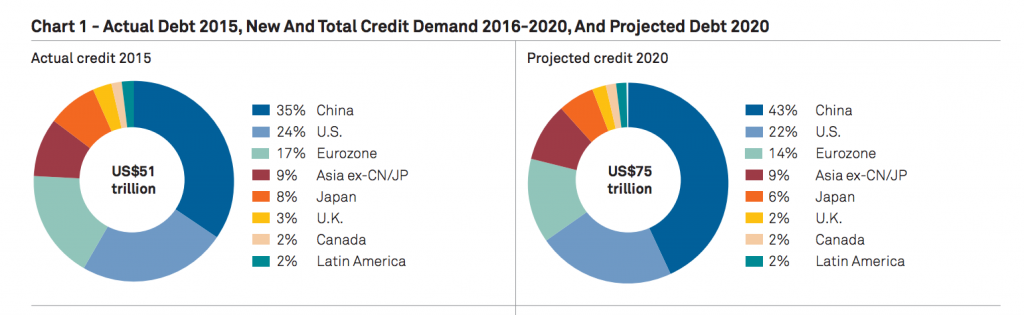

In the recent Standard & Poor’s Report, global corporate debt is expected to soar from US$51 trillion to US$75 trillion over the five years to 2020, a compound annual growth rate of 8 per cent. China’s share of this corporate debt is expected to jump from US$18 trillion (or 35 per cent) to US$32 trillion (or 43 per cent), a compound annual growth rate of 12 per cent.

Standard and Poor’s believes “China’s opaque and ballooning corporate debt and the rapid rise of US leveraged finance have developed as key credit risks.

Francis Cheung, Head of China – Hong Kong Strategy at CLSA claims China’s bad debts are reaching “crisis level” with non-performing loans representing 19 per cent of Chinese bank assets, well above the official figure of 1.6 per cent and the global average of 4.5 per cent.

And according to prominent Chinese Economist, Ma Guangyuan, “the proportion of China’s non financial debt to GDP has risen from 100 per cent before 2008 to 250 per cent today – and that threatens to trigger a systemic problem for the economy.

If the authorities lose their grip on rebalancing the Chinese economy, the downside risks appear material!

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Hi David,

Thanks for the great article. I’ve been reading a lot about China’s issues with a debt bubble, and the high level of non-performing loans coming through the system.

I can’t help but thing, however, whats to stop China’s central bank from simply propping up failing commercial banks with printed money?

Joe

Thanks Joe, I think it is inevitable the Chinese government will force Industry rationalisation (a takes over b, thus concentrating the number of companies) as well as propping up selected companies via the printing press. Other companies will default on their bond payments and assuming this becomes extensive, foreign bond holders will be less likely to invest. A declining Chinese currency would then see a lot of political grandstanding! Watch this space.

G’day David,

Given the downside risks, I was interested to see something new when I stopped by Fundhost today…

Thank you Greg. All will be revealed on the new Montgomery Alpha Plus Fund, a domestic market neutral offering, in August.