Opposing forces currently affecting the share-market

In this week’s video insight David discusses how the current confusing market conditions have most investors sitting on their hands watching it play out, although domestic and international super-funds, infrastructure funds and private equity groups will be using this market confusion to make proposals and takeovers bids for more interesting relatively secure cashflow plays. David discusses the current take-over proposals for Uniti Group and why we see the business in a beneficial position.

Transcript

David Buckland:

The public market is currently in a fight between rising bond yields leading to pressure on valuations, in conjunction with relatively strong economic measures including a multi-year low unemployment rate and lots of potential takeovers.

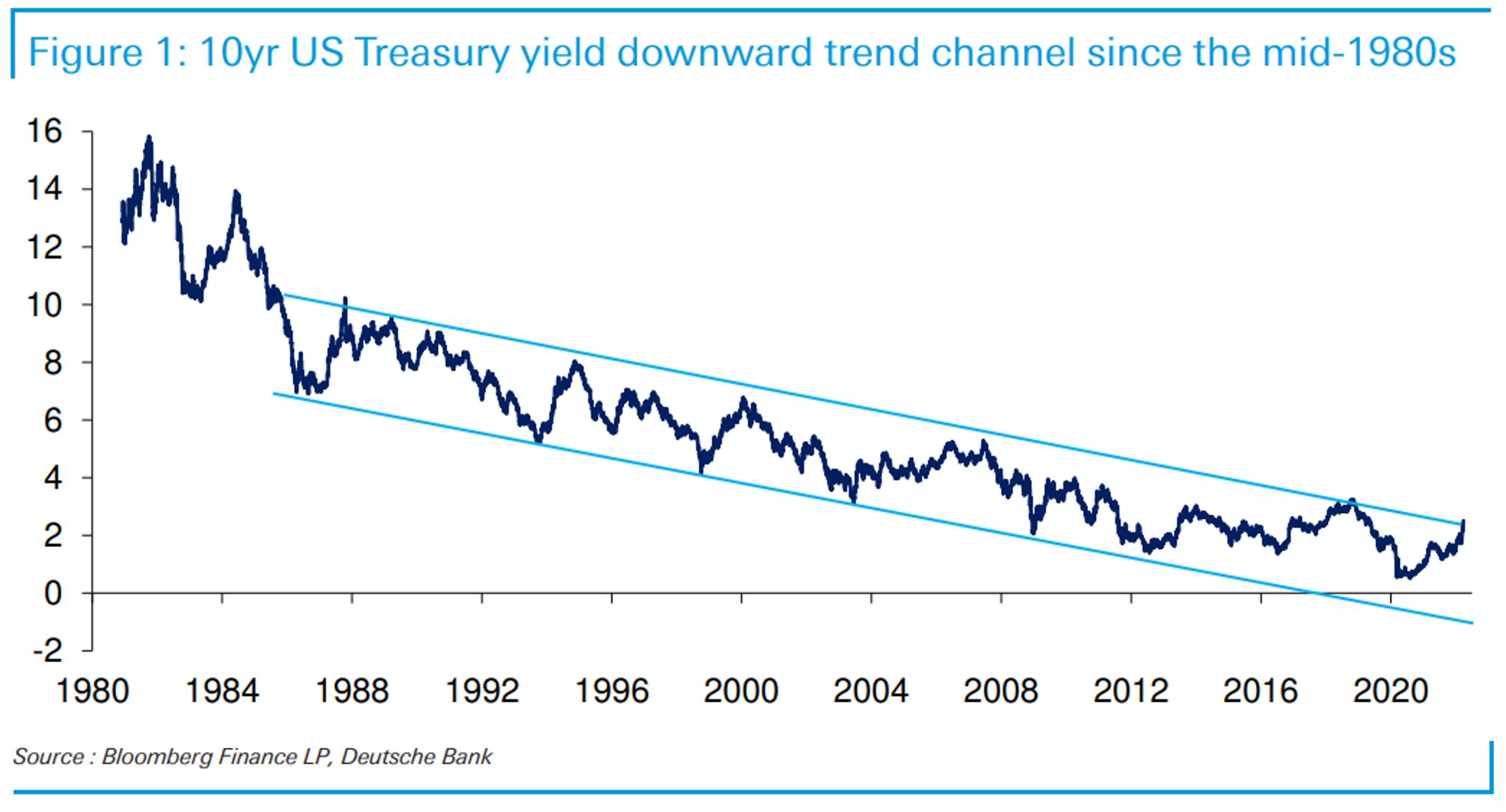

The graph below plots the US 10-year treasury bonds. With the yield coming down from a record high of 16 per cent in the early 1980s to a record low of 0.5 per cent in mid-2020, the bull market in interest rates is over with the retracement to the current 2.5 per cent.

And with US inflation running at a 40 year high – 7.9 per cent in February and likely to be higher in March due to the severe jump in energy prices – it seems the yield on US ten-year treasury bonds will sell-off further, with a 3 per cent handle likely in the foreseeable future.

Logically, most investors are sitting on their hands in the short-term, watching how this volatility plays out.

Domestic and international super-funds, infrastructure funds and private equity groups will be using this market confusion to make proposals and takeovers bids for more interesting relatively secure cashflow plays.

Uniti Group (ASX:UWL) is one company we have been actively following for the past three years, and its share price has shot up from $0.25 to the current $4.70 – $4.80 over that time, and had two competing proposals – one from Morrison & Co and Brookfield at $4.50 per share or $3.06 billion and one from MIRA and a Canadian Pension Fund at $5.00 per share or $3.4 billion. Yesterday, the Morrison/Brookfield consortium upped the ante to $5.00 per share, whilst MIRA took their bat and ball and went home.

While there is no guarantee these proposals will result in a take-over offer, our Montgomery Small Cap Team of Gary Rollo and Dominic Rose own Uniti and have closely considered the fact Uniti has a multitude of positive characteristics.

It is a scarce infrastructure asset with a high returning business, with a short payback, a 40-year long life, which is relatively inflation-proof. And there is a lot of capital – both domestic and internationally – chasing opportunities like this.

Together with the NBN, Uniti operates in an effective duopoly where scale matters and provides broadband access network infrastructure, with Uniti at around 20 per cent of the market and gaining a greater share of new connections. Fibre in the ground, with its sunk costs, offers the highest quality and fastest solution.

The pricing construct for NBN is under currently under review, and the Montgomery Small Cap team have concluded the NBN’s pricing appears inflation protected, meaning Uniti also benefits.

Irrelevant of what is causing confusion in the market, the domestic and international super-funds, infrastructure funds and private equity groups will continue to make proposals and takeovers bids for more interesting relatively secure cashflow plays.

The Montgomery Small Companies Fund owns shares in Uniti Group. This video was prepared 29 March 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Uniti Group you should seek financial advice.