Navigating liquidity – Michael Howell’s 2026 outlook

As we kick off 2026, I turned to UK-based Crossborder Capital’s latest global liquidity update by Michael Howell, noting booms and bubbles cannot occur without ample liquidity. The artificial intelligence (AI) boom was born of liquidity. Without ample central bank accommodation, we would not even be talking about AI, perhaps not even whispering about it except in a few university laboratories.

According to Howell, the 2026 financial landscape is a stage set for drama. His latest view on the prospects for crypto and risk assets in 2026 argues that while monetary inflation is here to stay as governments’ go-to fix for fiscal/budget woes, a looming downswing in global liquidity could produce turbulence for risk assets. Drawing from his analysis of cycles, correlations, and historical patterns, he likes positions in gold and cryptocurrencies as essential hedges – but advises investors to buy on dips.

The core thesis: Monetary inflation as the new normal

Howell kicks off by debunking ‘financial repression’ as a “myth”. Governments don’t control growth or rates; markets do. But governments can print money – or, in modern terms, lend it into existence via banks and central banks. This ‘monetary inflation’ is the government’s antidote to economic ailments and risk assets depend on, and even thrive on it, with crypto like Bitcoin showing extreme sensitivity.

Howell backs this conclusion with data on multipliers: since 2016, weekly changes in Global Liquidity correlate strongly with asset returns. Crypto tops the list, outpacing even gold and silver. Liquidity leads Bitcoin by about 13 weeks, with tight cyclical correlations. And Howell suggests crypto traders forget the Bitcoin ‘halving cycle’, and replace it with a 5-6 year Global Liquidity cycle, which might now drive demand.

But it’s not just Bitcoin in isolation. As part of a broader class of monetary inflation hedges, precious metals and other cryptos tend to track Global Liquidity over longer time frames. Up until now, there’s been an upward trend in liquidity, which has been tracked, for example, by precious metals. Howell now worries, however, they’ve overshot recently and reminds his readers that cycles are inevitable, and calm precedes turbulence.

2026’s Tug-of-War

Peering into his crystal ball, Howell identifies four converging pressures for 2026:

- Slowing Global Liquidity,

- Cautious investor positioning,

- An accelerating real-world economy, and

- Diverging U.S.-China liquidity paths.

This creates a zero-sum game for liquidity, with strong economic growth potentially draining funds from financial markets to the “real” economy.

His evidence? The U.S. is booming: a proposed US$500 billion defence spend, and gross domestic product (GDP) now at 5.4 per cent annualised for the quarter. Howell notes collective advanced economies’ Global Liquidity is negatively correlated to world business activity (-0.4), with business cycles lagging by three months. A trough in activity precedes liquidity peaks, implying causality. In essence, money shifts pools – from financial assets to real production when economies heat up. Howell’s optimistic view on global growth but bearish on liquidity (and therefore financial markets) as a result.

Yet, he notes trends persist. Governments are “bankrupt” in spirit, monetising deficits amid and despite resistance from bond markets and tax limits. As an example, Howell notes historical funding splits during wars (e.g., WWII: 47 per cent taxes, 27 per cent debt, 26 per cent printing). Secular monetisation rises, which in turn makes inflation a long-term solution, not a problem.

Howell’s proposed solution for investors is to own ‘monetary hedges’ in portfolios. A monetary hedge is an asset (or group of assets) that investors hold to protect the real value of their wealth against monetary inflation – that is, the long-term erosion of purchasing power caused by persistent increases in the money supply (especially when governments or central banks monetise large fiscal deficits). Classic examples of monetary hedges include:

- Gold – the traditional “safe haven” store of value

- Silver and other precious metals

- Bitcoin and certain other cryptocurrencies (viewed by many as “digital gold”), and

- sometimes broad commodity baskets or even real estate (in specific inflationary contexts)

Cycles and asset allocation: The roadmap

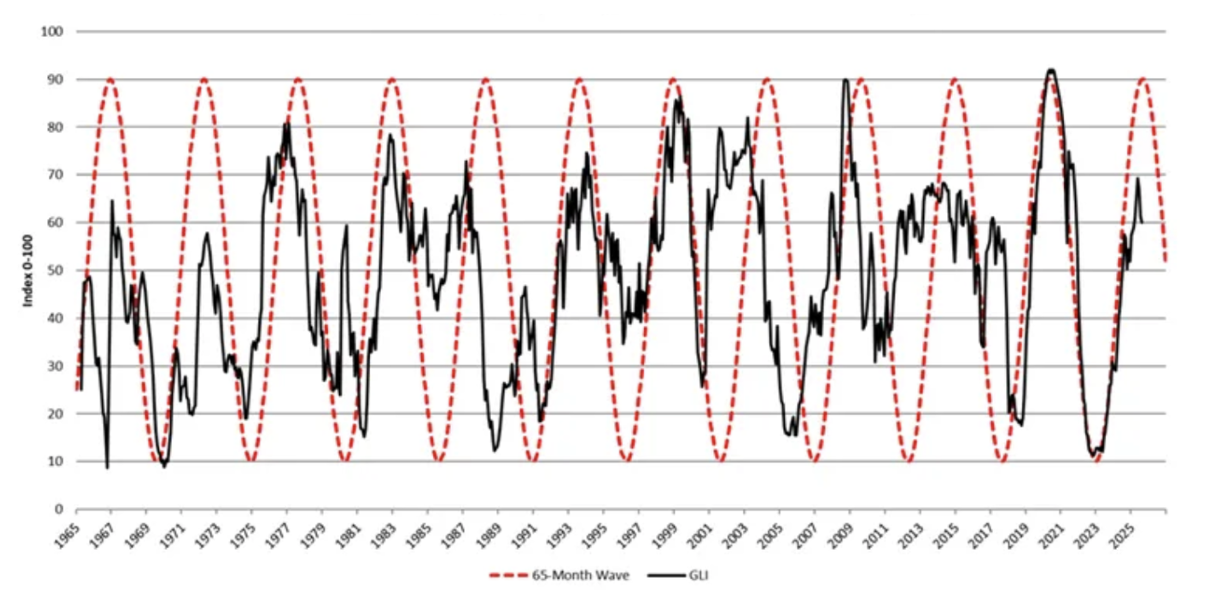

With cycles still alive Howell suggests investors ignore them at their peril. Global liquidity is inflecting lower, aligning with a 65-month sine wave (Figure 1). This could trigger counter-trend moves in markets, making 2026 tough for risk assets.

Figure 1. Cross Border Capital’s Global Liquidity Cycle (11 Jan, 2026)

Source: CrossBorder Capital

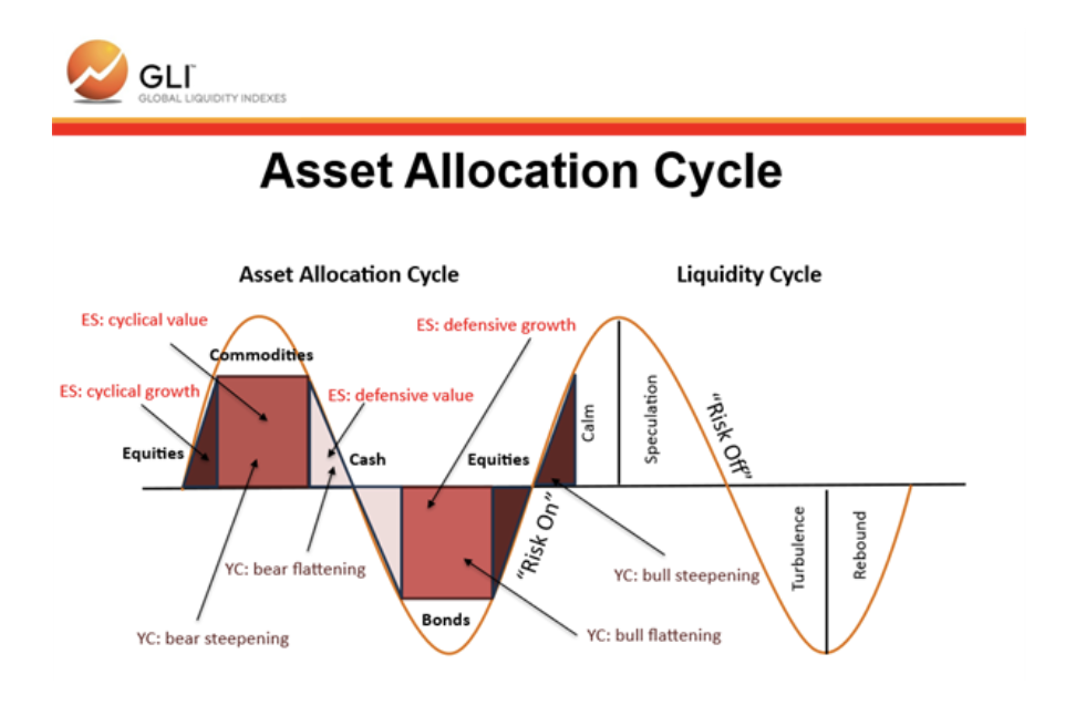

Figure 2 is a schematic cycle diagram that maps liquidity regimes (left) to asset classes (right): U.S. in “Speculation,” Europe/Asia ex-China in late “Calm,” China in “Rebound.” World markets hover near the peak, favoring commodities late-cycle.

Figure 2. CrossBorder Capital’s Asset Allocation Cycle Schematic

Source: Global Liquidity Indexes

Over three years, rotations have followed liquidity theory: bonds to credits to stocks to commodities; tech to financials to resources; small/mid-caps gaining. Markets discount 6-9 months ahead, so a liquidity downswing signals “Risk Off” – more cash, then long-dated bonds. Yield curves flatten, the U.S. dollar strengthens.

Strategically, Howell suggests loading up on gold and Bitcoin, but tactically, buying on weakness (20-25 per cent below trend). Downswings in liquidity also raise the prospect of defaults, widening credit spreads, and narrowing term premia (flattening yield curves). Equities rotate to defensive value (staples) from cyclical growth (technology).

Howell’s asset allocation guide is to reduce credits, reduce what he refers to as “top-slice” equities, stick with commodities, build cash, and eye long bonds. Industry-wise: boost energy/resources, cut tech; top-slice financials, rebuild staples.

My take

Money flows dictate more than fundamentals because money flows ‘drive’ fundamentals. Howell’s emphasis on monetary inflation resonates in a post global financial crisis (GFC) and post-pandemic world of endless kicking-the-can-down-the-road with central bank stimulus. Crypto’s hypersensitivity also makes sense. Bitcoin will remain a “systematic barometer” of liquidity, holding a role as digital gold in inflationary times.

That said, if global growth accelerates and drains liquidity as Howell predicts, risk-off moves could hammer speculative assets first. And keep in mind, all bets are off if geopolitical flare-ups or policy pivots flip Howell’s script. While the cycle alignment (65 months) offers predictability, markets love to hate surprises.

If Howell’s right, 2026 might echo the bearish returns of 2022′, but with monetary inflation as a backstop, recoveries could be sharper.

To be clear, Howell isn’t predicting an apocalypse but rather a challenge for risk assets in 2026, offset by the longer-lasting monetary trends. He suggests hedging against monetary inflation and navigating liquidity cycles. If you’re positioning for 2026, Howell’s roadmap suggests diversification. And if you can find those funds that offer desirable potential returns with no exposure to public markets then adding to those may provide protection as well as a low opportunity cost.

If you’re among those rethinking your exposures and balances, and are interested in exploring Montgomery Investment Management’s offerings, speak to David Buckland or Rhodri Taylor at Montgomery on (02) 8046 5000 or email us at investor@montinvest.com.

Alternatively, you can find more information via the links below:

Digital Asset Funds Management (DAFM) – Digital Income Class

Private Credit – Aura Core Income Fund (ACIF) and Aura Private Credit Income Fund (APCIF)

Disclaimer:

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not a reliable indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through the online application form that accompanies the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura Private Credit Income Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.

Disclaimer:

The Digital Income Fund is available for wholesale investors only.

Performance of the Digital Income Fund – Digital Asset Class since its inception on 1 May 2021. Net returns after fees and expenses as at 31 October 2025 and assumes reinvestment of distributions.

This is general information and doesn’t take your personal circumstances into account, so seek independent advice before investing. Investing involves risk, including the possible loss of principal. Past performance is not a reliable indicator of future performance.

Diversification does not ensure a profit nor guarantee against a loss. Montgomery Investment Management holds AFSL number 354564.