Markets at a crossroads

Goldman Sachs Research represents one of the largest stockbroking firms in the world. So, it should come as no surprise that the investment bank has recently published its stock market outlook for the next decade, predicting an average annual return of almost eight per cent.

But if you’ve grown accustomed to smooth and steady gains, you may need to recalibrate your expectations, despite Goldman Sachs’ reassurances.

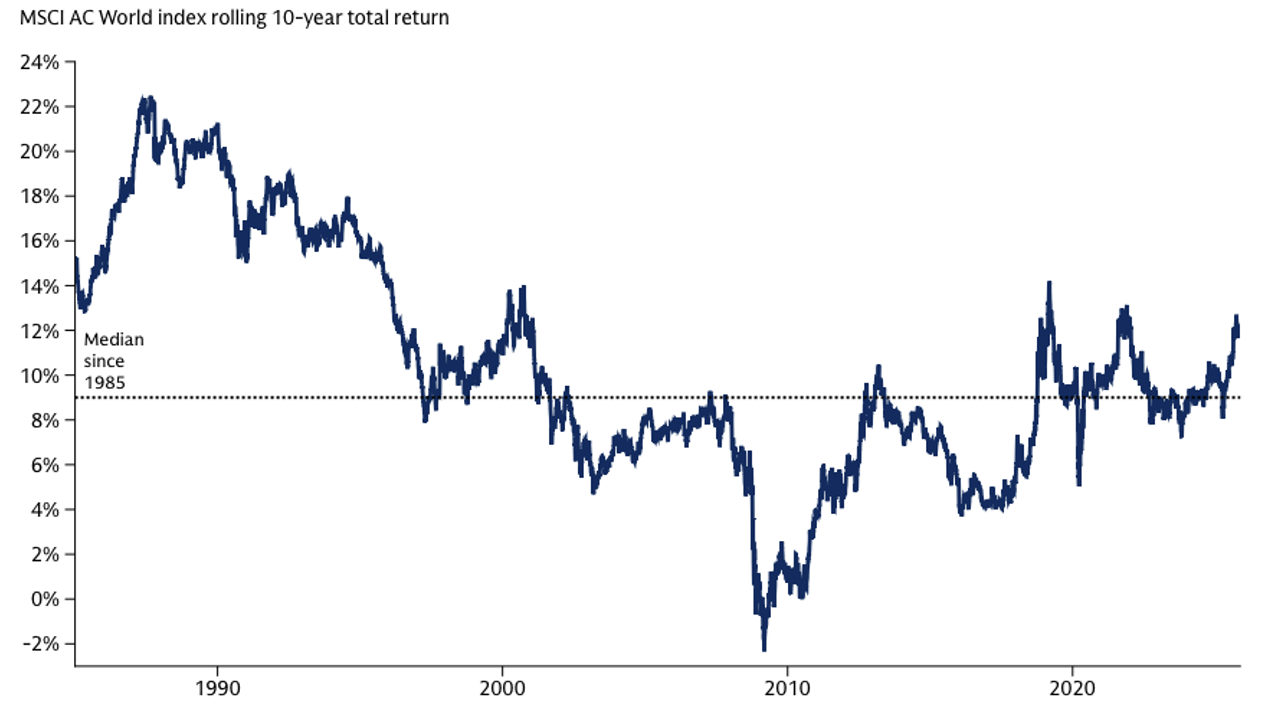

In its November report, Goldman Sachs paints a picture of a “new normal” for global equities, forecasting an annualised return of 7.7 per cent over the coming decade. The estimate roughly aligns with the average return since the turn of the century, but Goldmans claims it marks a distinct downshift from the ‘heady’ 9.3 per cent long-run average enjoyed since 1985.

Figure 1. Recent returns have been high compared with the historical median

Source: Datastream, Goldman Sachs Research as of November 18

The core of the Goldman Sachs thesis is the era of valuation expansion is over. For years, falling interest rates and rising optimism saw investors pay more for every dollar of earnings.

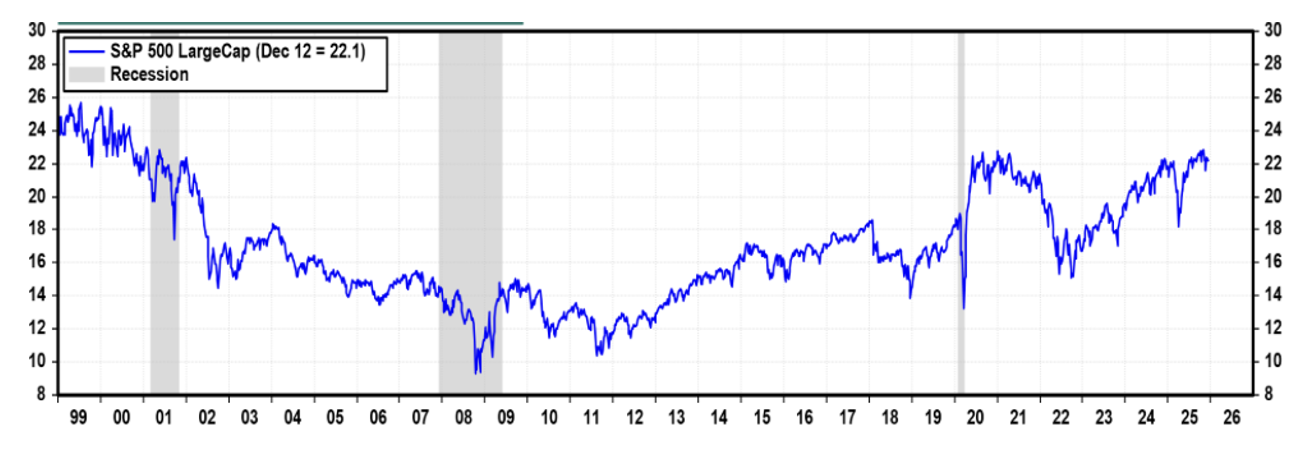

Now, with global stock valuations elevated at roughly 19 times forward earnings (our estimate for the U.S. S&P 500 is near 22 times), the tailwind of price-to-earnings (P/E) expansion is turning into a headwind.

The bank expects valuation multiples to contract slightly over the next ten years, acting as a drag on performance. Consequently, the heavy lifting is expected to be done by fundamentals: earnings growth and dividends. The report projects earnings to compound at roughly 6 per cent annually, with dividends bridging the gap to reach the 7.7 per cent target.

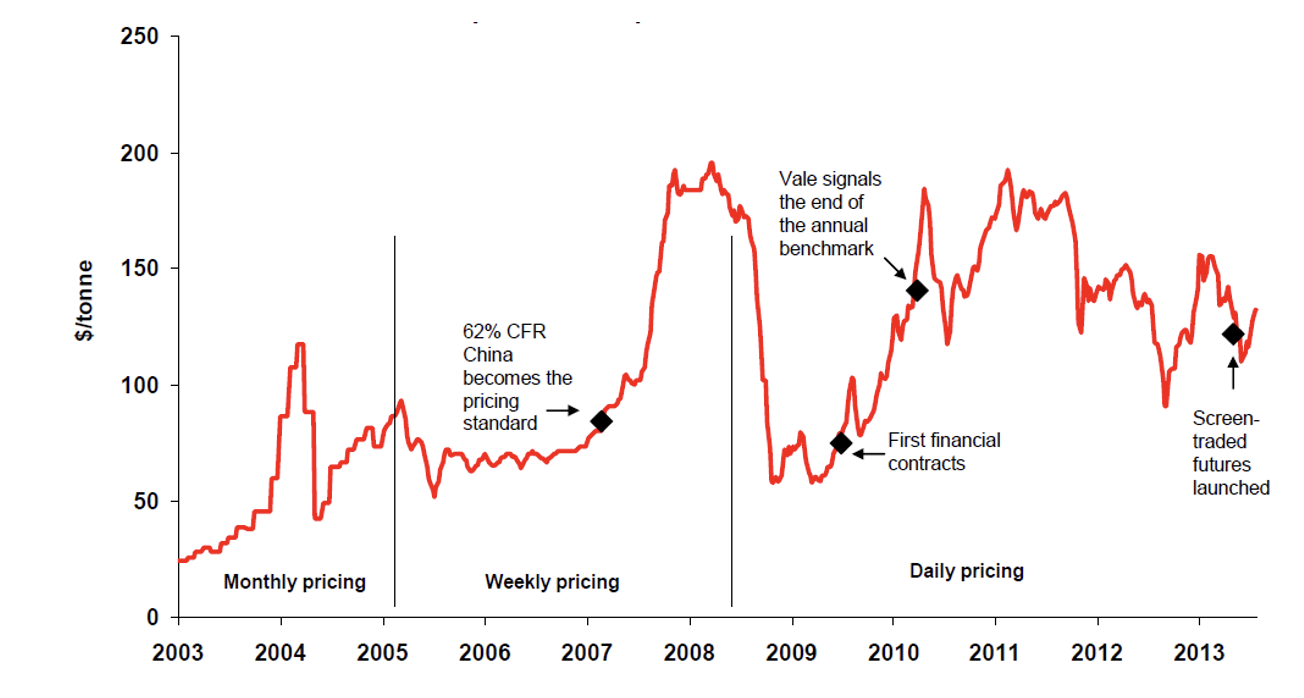

One observation of big investment bank forecasts is they tend to subscribe to the idea that sentiment changes slowly and smoothly. Consequently, their price forecasts tend to be smooth and gradual. By way of example, in 2011, amid oversupply forecasts, major investment banks predicted a slow, steady decline in iron ore prices. As Figure 2., reveals, however, the spot iron ore price fell more than 50 per cent in less than two years. Price moves, particularly declines, tend to be violent rather than smooth.

Figure 2. Spot iron ore prices – 62 per cent cost and freight (CFR) China

Source: CRU, Platts, Macquarie Research August 2013

The idea the P/E ratios, which are a measure of stock market popularity, will contract slowly and smoothly over time is not born out by experience.

Figure 3. 1-Year Forward P/E Ratio, S&P 500 (weekly).

As Figure 3., reveals, price-to-earnings (P/E) ratios can swing about wildly in relatively short periods of time.

Goldman Sachs’ reliance on earnings growth places a heavy burden on corporate profitability, and widely accepted market valuation models, such as Robert Shiller’s Cyclically Adjusted Price-to-Earnings (CAPE) ratio, suggest annual returns over the next decade could fall below 5 per cent.

This time is different (oh-oh)

Goldman Sachs, however, argues these models are “incomplete.” Instead, in an observation reminiscent of Irving Fisher’s October 1929 pronouncement that the stock market had reached a “permanently high plateau” just days before the Black Tuesday crash that heralded in The Great Depression, Goldman Sachs contends the structure of the modern market has shifted, with technology-driven efficiency gains and higher-margin companies justifying permanently higher valuations.

Perhaps the most actionable advice is that after years of U.S. exceptionalism, the next decade will favour the broad diversification into Emerging Markets. This view relies on two critical levers: faster economic growth in developing nations and a weakening U.S. dollar. The bank’s foreign exchange team predicts a depreciation of the greenback over the next 12 months, which would mathematically boost the returns of foreign assets when converted back to dollars.

The second observation about Goldman’s forecast for stock market returns is that it possibly understates the impact the S&P 500 has on the rest of the world’s markets. And the S&P 500 is expensive.

Figure 4. S&P 500 forward P/E ratio vs subsequent 10 year annualised returns.

Source: Bloomberg, Apollo Chief Economist

Figure 4., establishes a relationship we all know intrinsically; the higher the price you pay, the lower your return. As PE ratios rise (right, along the X-axis), annual returns over the subsequent decade fall (Y-axis).

According to Apollo Global Management’s Torsten Slock, the current S&P 500 P/E ratio of approximately 22.25 predicts an average annual return from the S&P 500 over the next decade of less than zero (red dot in Figure 4.).

And given sentiment shifts are rarely smooth, investors should expect bouts of serious volatility and sell-offs contributing to that ‘average’ negative return over the next decade. Even Goldman Sachs predict lower P/E ratios ahead.

Ultimately, Goldman Sachs forecasts a “soft landing” in equity markets. Ignoring the repeatedly violent changes in sentiment of the past and rejecting the bearish view that high prices will end in a crash, they instead propose that smoothly eroding sentiment will be evenly and equally smoothly offset by earnings growth.

Whatever path sentiment, and therefore markets, take, the “free money” era of expanding multiples is likely behind us.

See our previous blog posts with suggestions for rebalancing portfolios here: From bullish to cautious – why 2026 may bring lower returns and higher volatility and here: Digital Income Class – October 2025 performance update.