It’s time to take advantage of share price falls

The price-to-earnings ratios of many quality businesses have fallen sharply over the last six months. In many cases, the falls were justified. Now that valuations have dropped, I believe investors have a far better chance of making attractive returns. The proviso, of course, is that you buy businesses that grow their earnings.

Celebrating the recent fall in share prices might be a step too far, but investors who plan to be net buyers of equities should be at least a little excited about the recent declines.

The ASX 200 decline year-to-date of just 3.4 per cent masks the more serious declines of even the highest quality companies. Indeed, 112 of the biggest 200 companies listed on the ASX are below their price at the beginning of the year. And the average decline is 17.7 per cent. The median decliner is down 15.4 per cent.

Zip is off 76 per cent year-to-date, Pointsbet is down 60 per cent, Kogan is 47 per cent lower, Boral is 43 per cent below its price at the beginning of the year, and even high-quality company, Reece, is 38 per cent weaker. Meanwhile, other high-quality companies such as REA Group, Wesfarmers, ARB Corporation, Credit Corp and Super Retail Group are off between 15 and 25 per cent in less than 16 weeks.

Of course all of this is happening because inflation is surprising to the upside, scaring many investors as well as central bankers. And in response the central bankers are reversing the massive stimulus that was foisted on markets and economies in response to COVID-19.

The punch bowl that drove massive asset inflation during the pandemic is being taken away. It really is as simple as that. The US Federal Reserve will put its balance sheet on a new course, reducing its size by up to a trillion US dollars per year.

So there’s no debating; we are in the midst of a correction. There is however a silver lining.

PE ratios have compressed materially over the course of the last six months. Now that they are lower, investors have a better chance of making attractive returns, provided they buy businesses that can grow earnings. Let me explain with a few simple tables.

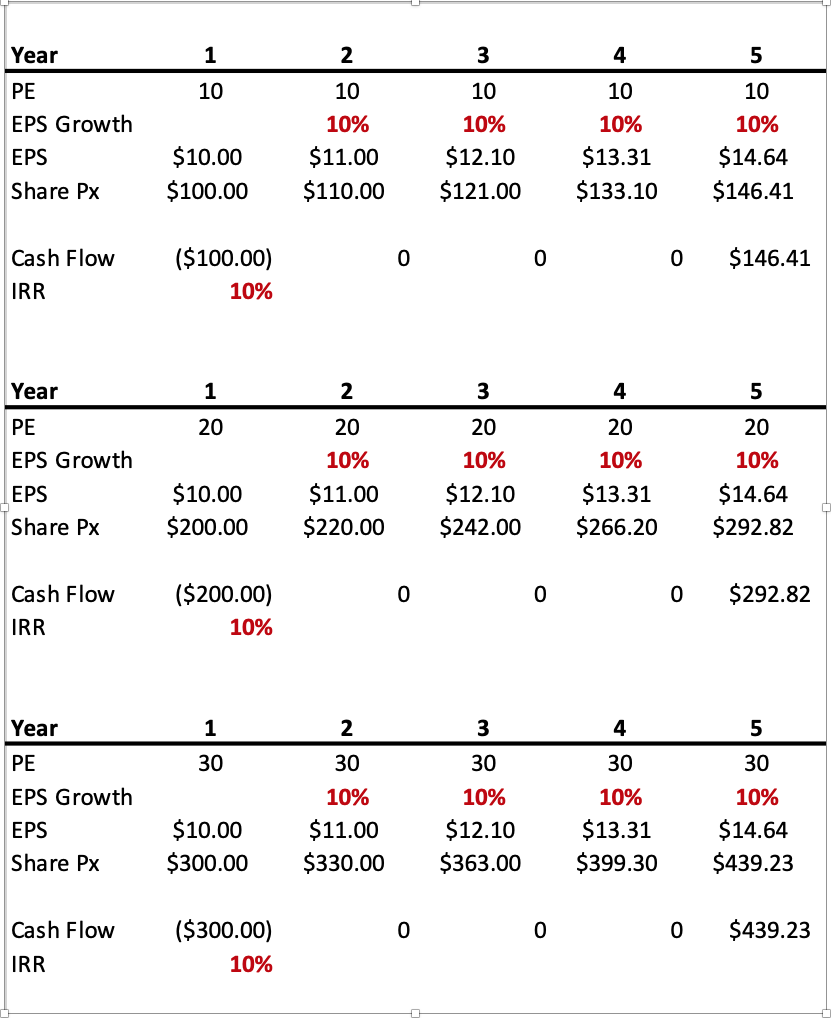

Table 1. Internal rates of return equal earnings growth when PEs remain constant.

Table 1 demonstrates the investor’s return, from buying and selling a share at the same PE multiple, matches the rate of earnings growth. In all three examples the earnings growth is 10 per cent per annum. It matters not whether the stock was purchased at 10, 20 or 30 times earnings; the investor’s internal return will match the earnings growth rate provided the shares are sold at the same PE multiple that was paid for them.

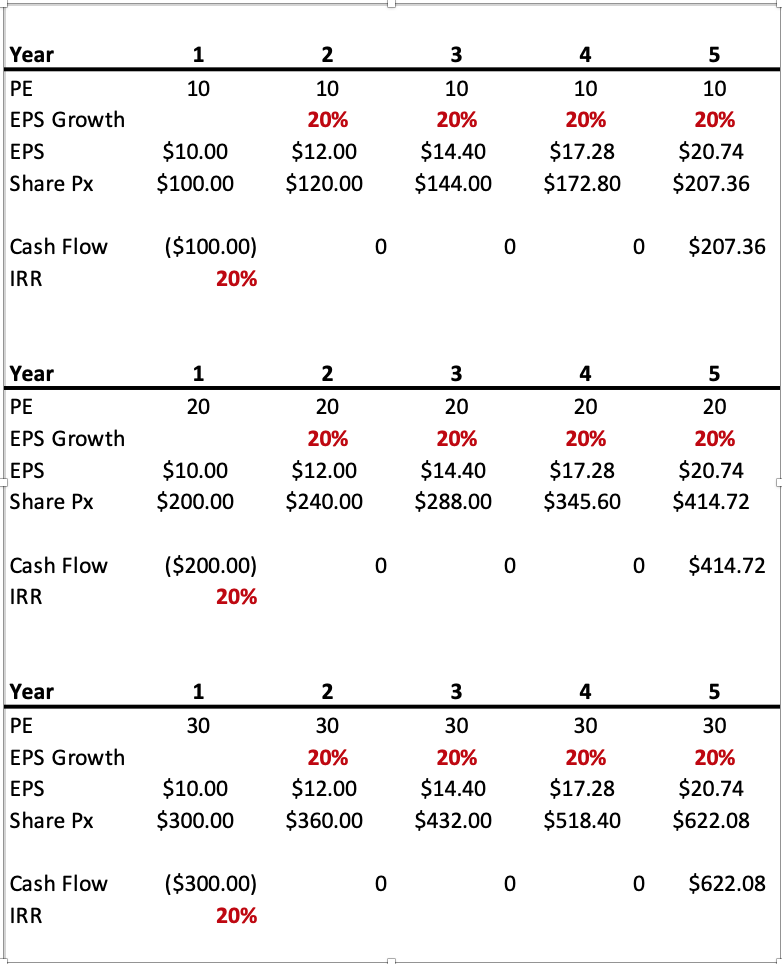

Table 2. Internal rates of return equal earnings growth when PEs remain constant

Table 2 simply reinforces the earlier point. On this occasion the EPS growth rate is 20 per cent in all cases and irrespective of the PE the investor’s return matches the EPS growth rate provided the shares and purchased and sold on the same PE.

China’s economic woes, the invasion of Ukraine, supply chain disruptions and the possibility of recessions and stagflation have all offered reasons for investors to sell stocks to the extent PE’s have compressed materially. As I mentioned earlier however it doesn’t matter what the contemporaneous catalysts are, throughout history whenever rates go up or inflation accelerates, PE have compressed – without exception.

Now that PEs have compressed, investors must find businesses whose earnings will grow. Warren Buffett once observed: “Your goal as an investor should be simply to purchase, at a rational price, a part interest in an easily understood business whose earnings are virtually certain to be materially higher, five, ten, and twenty years from now.”

Compressed PEs may offer that “rational” price.

PE ratios can of course fall further and any escalation of tensions between Western allies and China or Russia would certainly do that. Investors would have to simply ride through what we all hope would be a temporary interruption to the peace the western world has mostly enjoyed since the fall of the Berlin Wall. To protect oneself from the idiosyncratic risk of PE contraction, it is important that not only does the company’s earnings grow, but they grow at a rate that meets or exceeds market expectations. If growth is expected to be 20 per cent and comes in at 18 per cent, the PE may contract further, offsetting the benefits accrued to investors from the earnings growth.

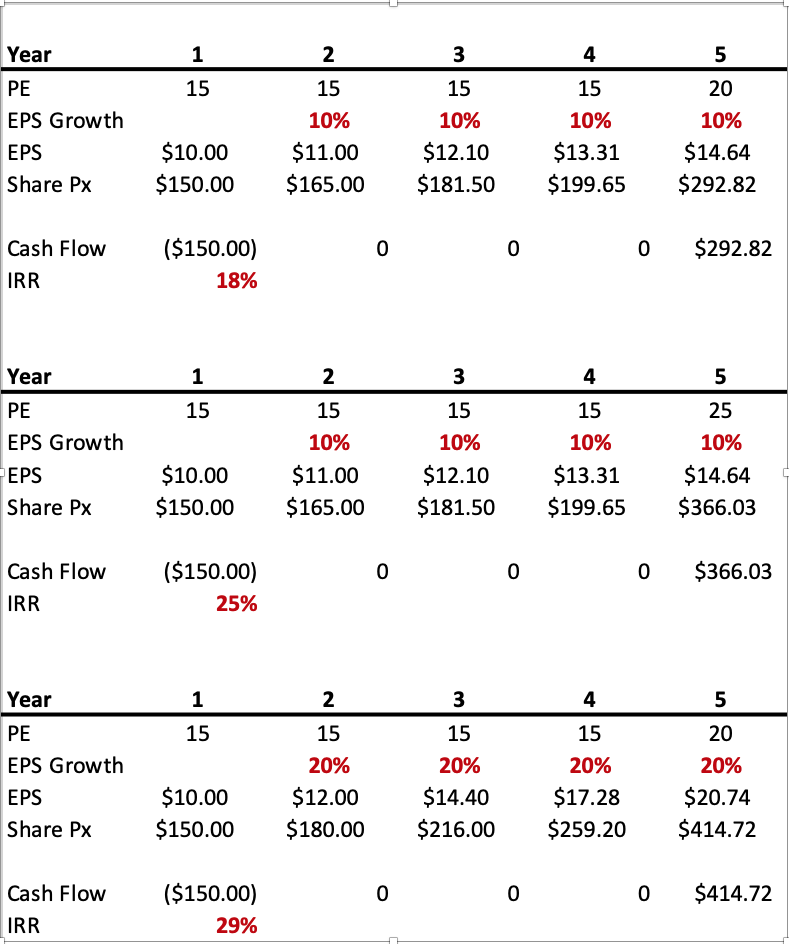

Table 3. A bonus from PEs bouncing.

Assuming global peace is maintained, investors have another benefit from investing after PE compression. Inflation will eventually peak and interest rates will eventually stop being raised. At that point PE ratios may start to expand again.

Table 3 reveals the bonus in terms of internal rates of returns earned by investors from a jump in PE ratios at the time of sale.

In the first example, shares are purchased on a PE of 15 and earnings grow by 10 per cent per annum. If the PE stayed at 15 at the time of sale, the investor would earn 10 per cent per annum. But in this example, in the final year, the PE jumps to 20 times. The result is an 18 per cent per annum return.

PE compression and stock market falls may just be the rational price investors in equities and managed funds have been waiting for.

Peter Carroll

:

Wonderful post Roger. Do you think earnings could compress further in businesses like Kogan and Super Cheap.

Or am I too greedy?

Jeremy Grantham is talking about 50% plus falls in the US.

Read Valuable twice, future investor, cheers Peter.

Roger Montgomery

:

yes Peter, there will be companies that do better than others in terms of business performance and so it’s vital to filter for quality and growth. Jeremey Grantham is what we call a ‘permabear’ (permanently bearish). He might be right this time but he has called a crash many times. Even a stopped clock is right twice a day.

stewart

:

Great book Roger, Can you email the latest table 11.1 & 11.2

Thanks Stewart

Roger Montgomery

:

G’day Stewart, It’s on its way to you.

Paul Andrews

:

Excellent article as usual

How can I get rid of the annoying icons ( FB,twitter,email etc) that are now covering the left side of the page? Is this intentional?

Paul

Roger Montgomery

:

Not intentional Paul. Can you send us a screenshot please?

Wesley Horn

:

“Your goal as an investor should be simply to purchase, at a rational price, a part interest in an easily understood business whose earnings are virtually certain to be materially higher, five, ten, and twenty years from now.”

Who would be prepared to question Warren Buffett, but how is it possible to be virtually certain earnings will be materially higher 5, 10 and 20 years from now? My Dad was also a wise man and he often said, ‘no-one can predict the future.’ I have a saying myself: good companies are capable of doing stupid things, i.e. their business can be going well, but then they decide to push the envelope and stuff it up. Sometimes they can’t stick to what they know and grow at a sustained pace.

So, I believe picking a company on those time frames is about assessing the potential market for its products, and looking at its past performance to try to determine if it’s capable of capturing its share. But at the end of the day, it’s still a calculated risk that must always be monitored.

Wes.

Roger Montgomery

:

Thanks Wes! Great comment. Of course virtually certain is not the same as certain.