DOWNWARD PRESSURE ON SYDNEY PROPERTY PRICES

It’s been a long time coming, but it seems the much-anticipated end to Sydney’s housing bubble has finally arrived. And, Australia-wide, there’s a growing list of areas with owners struggling to cope with mountains of debt. The question is, how far will property prices fall?

According to two separate articles in today’s The Australian Financial Review, Sydney’s inner city suburbs are seeing falling house prices “as macroprudential controls on property investments kick into gear”.

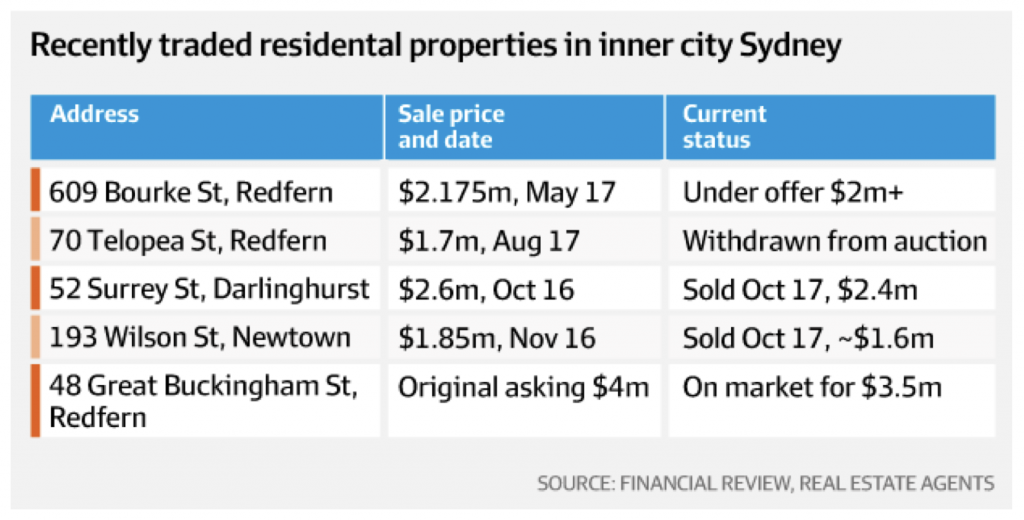

According to one article, “spoilt” vendors have been forced to eat humble pie in the inner city Sydney suburbs of Redfern and Darlinghurst as asking prices continue to fall.

“Asking and sold prices have come down by up to 18 per cent in the two suburbs in the last two months to match cautious and reticent buyers, agents say.”

Remembering that it is the marginal buyer and seller that determine the prices of real-estate for everyone else, The AFR printed the following table of anecdotes to illustrate the falls.

Our own take is that current conditions were predictable, indeed we wrote about them many times. Earlier in the year, prices achieved at auctions throughout Sydney were, no doubt, stunning neighbours who hastily spruced up their own houses for sale. Those properties are now all hitting the market at once.

With more choice, there’s no urgency for buyers, and they simply step back pulling back their bids with them. And remember, local and foreign buyers are also being adversely impacted by changing lending conditions from higher rates and deposit requirements to limits on suburbs they can invest in.

This phase has occurred much sooner than anticipated. Typically, there is a tension that exists when buyers’ lower bids are not met by vendors who hold out for the price their neighbour achieved a few months ago. It appears there are enough vendors who are happy to hit the lower bids.

However, there are some individual properties still exceeding pre-auction estimates and while this remains the case, price declines may not accelerate. Of course falls will accelerate, by definition, if all buyers pull back and the urgency at some remaining auctions dissipates.

The extent of the toxicity of a property decline will depend on the extent to which recent buyers of lofty-priced properties are placed under financial stress.

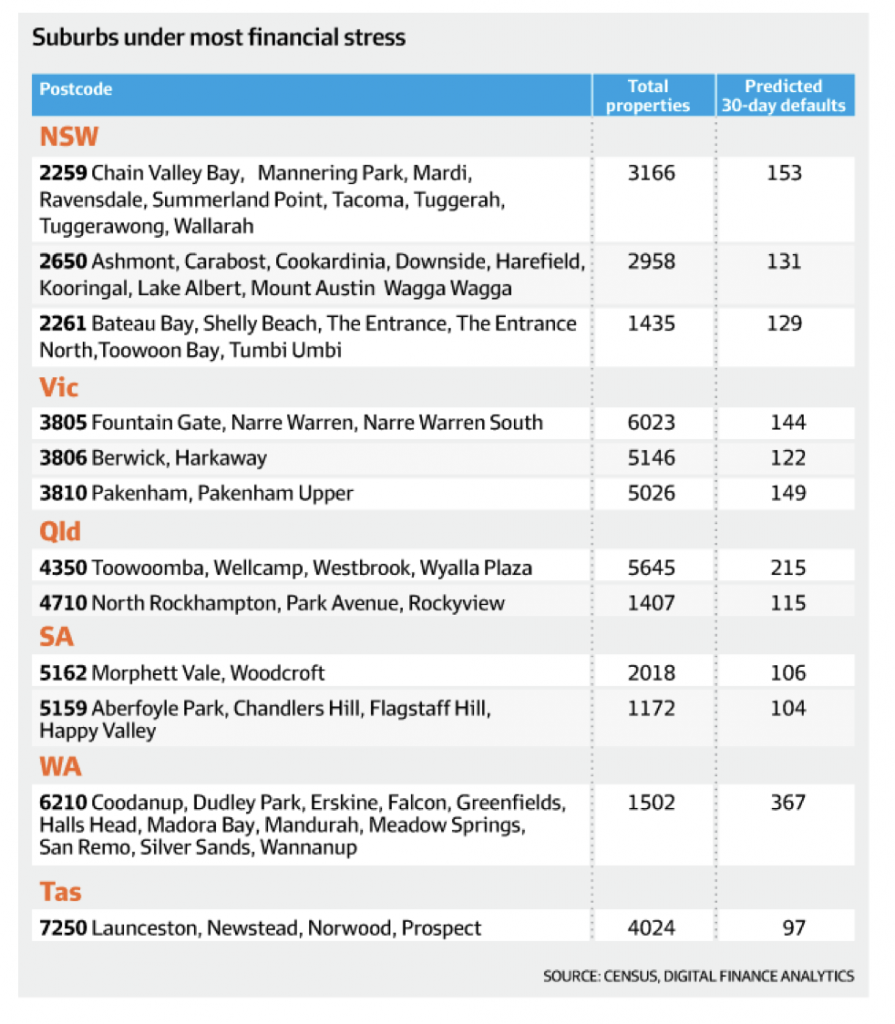

The second article in today’s AFR entitled ‘Mortgage stress signs appear’ observes: “Census data and independent analysis from commercial and academic researchers show a long period of record low interest rates has eased mortgage pressure for some but been used by others to leverage debt.”

“It also shows that mortgage stress is emerging on the urban fringes of the nation’s biggest cities where borrowers are likely to have recently purchased at record high prices and have large mortgage repayments compared to incomes.”

The AFR published the following table.

If you are a subscriber to the AFR website, the full articles can be read online:

Mortgage stress grows in the suburban fringe

Inner-city Sydney property asking prices fall

I live in Germany, and you tell a German what Australians pay for a property and they wont believe you…..they think you have got to be mad or insane

mammoth bubble gonna burst

This bubble gonna blow.

I’ve always found it worthwhile having an alert set up on Domain that picks up the word ‘mortgagee’. Over the last few years it would be lucky to produce one or two a month for Victoria. The hardship departments at the banks were transferring struggling homeowners onto interest only deals to cut their repayments. Failing that the properties could be sold quickly in a very brisk market. Suddenly there are a number of alerts, coming daily from those exact outer suburban localities listed in the mortgage stress table above (postcodes 3805, 3806 and 3810 are very well represented, as is 3064). Even the blue chips such as Brighton are making an appearance.

That’s a handy indicator Jimbo

Very interesting Jimbo. I wonder if you’ve just described one of the reasons for the ever falling delinquency rates at the banks. I hope I’m wrong but from what you’ve said they maybe using some dodgy practices to keep them low.

You make a great point Peter. If you look at the US experience on this around late ’05 when house price growth rates started falling off the proverbial cliff, you’ll see delinquency rates hadn’t even bottomed yet (they did about 12 months later). Delinquencies are an interesting indicator but with the level of manipulation possible inside the banking system, they don’t appear to be a leading indicator.

https://www.housingwire.com/ext/resources/images/editorial/BS_ticker/PDF/A-April-2016/mortgagerate.png

Good one Monty. The quality of analyses and level of transparency in your blog and media appearances are the reason yours are the only funds I would recommend to anyone else. It really sets you apart. You’re one of the few, or maybe only Australian fund managers willing to raise this issue for a while now. It is amazing to me how few people are not ‘freaking out’ about the imbalances caused by the property bubble in Australia. I guess this is because, despite the number of so called distressed mortgages rising, the banks keep reporting lower and lower bad and doubtful debts. So everything is great right?

By my rough calculations Australia has approximately 10 – 12% of GDP from construction. Other developed countries are generally at 4 – 6%. Population growth cannot continue to support this disparity I would think, as we are not producing any new wealth creating jobs. It’s all healthcare, retail and construction. Why are so many in finance so sanguine about the Australian economy? Is there something I’m missing? Let’s not mention the results if a property downturn is coupled with a commodities slump due to the China debt bubble moderation……Our own economy is driven not only by our own property bubble but also that of China’s. Have I been reading too much Zerohedge or is my alarm justified?

It is possible that you are visiting sites that reinforce your view. if you were going to be fairer to your finances, you would test your view by reading or researching all the arguments against it.

There was a Facebook article I read “Domain state of market report”. Stating Brisbane’s lacklustre property performance in apartments. Worth a read.

Thanks for sharing Kyle!