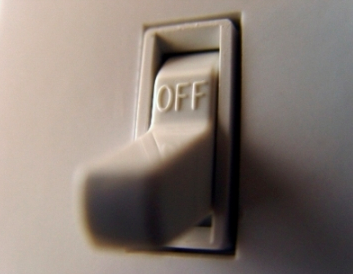

Is your stock market still turned off?

At this time of year, well-meaning articles on the subject of how to invest in the year ahead abound. Indeed I have contributed to the pool of wisdom in my recent article for Equity magazine titled Is your stock market on or off?.

At this time of year, well-meaning articles on the subject of how to invest in the year ahead abound. Indeed I have contributed to the pool of wisdom in my recent article for Equity magazine titled Is your stock market on or off?.

Value.able Graduates know to turn the stock market off and focus on just three simple steps. Even if you have read Value.able, or joined in the conversation at my blog, its not just me that believes they’re worth repeating. Ashley wrote about the article ‘More of the same stuff for the Value.able disciples but the more you read it the more you will practise it’ and from David ‘’twas a good refresher indeed!’.

Step 1

The first step of course is to understand how the stock market works. Once you understand this, turning it off is easy. And you do need to turn of its noisy distraction.

Step 2

The second step is to be able to recognise an extraordinary business (Go to Value.able Chapter 5, page 057).

I have come up with what are now commonly referred to by Value.able Graduates as Montgomery Quality Ratings, or MQR for short. Ranking companies from A1 to C5, my MQR gives each company a probability weighting in terms of its likelihood of experiencing a liquidity event.

Step 3

Finally, the third step is to estimate the intrinsic value of that business. Use Tables 11.1 and 11.2 in Value.able.

Three simple steps. If you get them right, you too can produce the sorts of extraordinary returns demonstrated and published, for example, in Money magazine.

The key is to buy extraordinary companies. To save you some time, I would like share a current list of companies that don’t meet my A1 rating. Indeed these are the companies that receive my C4 and C5 ratings, the worst possible. Avoiding these is just as important as picking the A1s because even diversification doesn’t work when your portfolio is filled with poor quality companies or those purchased with no margin of safety.

Whilst the eleven companies listed above are low quality businesses, they won’t necessarily blow up. This is not exhaustive, nor is it a list of companies whose share prices will go down. It is however a list of companies that I personally won’t be investing in.

If your first question is what are the chances of loss?’ then my C5 rating represents the highest risk. But of course risk is based on probability. And a probability is not a certainty. Nevertheless, I prefer A1s and A2s. More on those lists another time.

Posted by Roger Montgomery, author and fund manager, 3 February 2011.

Hey Ashley, thanks for your great posts. Your cut based on ROE 20% and Debt/Equity 25% was interesting. Don’t suppose you have done that exercise for the New Zealand market? My work to date has come up with very few NZX stocks that meet that criteria. Also hard to find stocks trading below IV.

Rainsford

Hi Rainsford,

No I have not looked at the Kiwi market,

If you find a goodie let us know,

I have identified less than 10 that are worth consideration.

Also RKN Rekon group i have a IV for 2010 of $2.50 plus they announced they are doing share buy backs of about 10% of share on issue they have no debt. surely this will increase their value and also they have not debt i believe they are an A1, maybe this is one you should add to your list roger

thanks john

Hi Roger,

my stock is HSN its engaged in the development, integration and support of billing systems software for the telecommunications and utilities (gas, electricity and water) industries. Other activities undertaken by the Company include information technology (IT) outsourcing services and the development of other specific software applications

I get an IV for 2010 for about $1.11 currently at its share price of .92 its not to cheap but it has announced a 50% NPAT increase for the first half of the year its future looks bright.

what are you thoughts.

Thanks

Hi John and Room,

I have been following HSN and have held the stock for some time now.

Since they released the H1 results the share price has made a strong move and the volumes traded have increased significatly.I have a 2011 IV @ $1.16, a small discount but I think the future looks very promising.

The company structure reminds me of MCE, private company listed with father son combination as Chairman & MD and very well run.

Being principally a sofware based company there future capital requirements are relatively low. Their competative advantage comes from signing up their utility and communication based customers to long term contracts of up to 10 years and i would expect changing to another provider would not be a simple procedure.

Tacking the American market has bought many Australian companies undone over many years but their recent purchase of proprietry software company, NirvanaSoft (New York) appears to be a good opportunity to establish a wider global base along with offices in New Zealand and England. I agree their prospects look bright and would be interested in any other feedback.

Thanks.

When I say these online businesses are not creating sales I mean they are not generating new sales by introducing new products or services but taking business from existing retailers who are not well represented online.

One site sells bathware – sinks, taps etc. They are based in Canberra and are selling goods all over Australia online. They have even had some international enquiries. These are sales taken from Harvey Norman, Reece and other local retailers.

There has been mention of online sales for JBH and other comments here relating to how it may affect retailing.

I own and run a couple of online retail businesses and help manage quite a few others. The last few years has seen growth in sales of 50-100% year on year for most of the businesses. Most of this growth is organic with little or nothing spent on advertising. I would love to say it is due to my brilliance but the truth is we are just on a speeding train not quite sure where we are heading.

These successful online businesses are not creating sales. Often they are just sitting in the middle of transactions and taking a bit on the way through. We are all building large repeat customer bases and mailing lists, giving us very inexpensive direct marketing opportunities. There is gold in these lists.

The accelerated growth must end sooner or later but it is early days yet.

Companies like Wotif must have huge targeted mailing lists. They can probably predict how many sales they will achieve by sending an email out this afternoon. This can be done at practically no cost. Companies like Harvey Norman have to spend lots of dollars and shout at you to tell you about their specials. Online marketers just push a button.

Many of the larger retailers in Australia are slow to tap in to opportunities. Some just don’t seem to get it at all.

The online store for JBH will end up being their most profitable shop with an amazing return on equity. Shame they have to have physical locations.

Your last line made me think of Oroton whose best performing store is their online one.

The Google Finance website is pretty good.

doh, this reply was regarding

“One question…does anyone know of any sites where I can screen for potential value opportunites on foreign markets, particularly the US?”.

You can filter by roe, debt, etc

Chris, CGF has no direct debt from what I can see, whatever that means and my broker says they have no debt. I don`t know the difference from direct debt and other debt. I studied accountancy after I left school but I couldn`t understand it properly so I`m not much help but I do have a few of their shares. Roger has a valuation on them somewhere around $3.50 I think. He mentioned them onYour Money Your Call last night. I forget exactly what price, but it was somewhere around there.

Firstly a huge thank you to Roger for his book, I have enjoyed it thoroughly and am recommending it to all my friends, it is very VALUABLE.

I would love to hear Rogers ideas on diversification as Warren Buffett believes that you should not hold more than 6 companies and he would probably have half of his money in what he liked best.

I have noticed some comments on ZGL, which seems like a good opportunity and is trading at a significant discount to IV. I personally would feel much better if they had more forward orders like FGE and MCE. Has anyone else got any ideas on this?

Thanks

Hi Brad,

Don’t buy the 6-stock diversification idea. Its not what Buffett does in his own personal portfolio or at Berkshire. Don’t bet so much that you can lose the farm. You should operate as though you only have 20 punches on your ticket, but that’s not the same as only having 20.

Yeah … based on recent disclosures Warren Buffett holds directly and indirectly positions in more than 100 stocks, plus a huge, multi- billion dollar exposure to derivative instruments. So don’t believe everything you read, or everything that has come from WB’s lips in years gone by (more often than not quoted out of context).

Times move on and opinions change, even with giants like Mr. B!

Although I believe Buffett had a huge percentage of his holdings in Geico at one stage if my memory serves.

Did you all see ‘our Leader’ on Switzer and then following that, on ‘Your Money Your Call’?

It was a ‘command performance’ on the latter I thought – very good Roger, and most interesting.

Now, having expressed a firm interest in oil, Roger didn’t (wasn’t asked) to name any picks in oil stocks. So my question for you ‘disciples’ is, what’s the best ‘Value.able’ approved oil stocks??

Hi Kim,

Lloyd is our resident Oil & Gas expert.

I understand that Lloyd has actualy sat on the Board of Listed ASX Oil & Gas Companies.

I hope Lloyd will give his views here.

My view for what it is worth is pure Oil & Gas plays in Australia are either expensive or poor quality or both.

BHP is the largest Oil & Gas producer in Australia so this will give you exposure.

MCE is my way for gaining exposure to rising Oil Prices. But I am a total chicken when it comes to commodity stocks

Kim,

I agree with the key points Ashley makes. Its tough to find quality at the right price in the oil and gas sector in Australia. Remember you are seeking exposure to long life low cost oil reserves to play the rising oil price theme that most people see arising from the Peak Oil hypothesis. I am a firm believer in the latter, but the inference that this leads to ever rising oil prices is a non sequitur for a number of reasons. Also remember that in the last twelve years oil prices have already risen ten fold to their peak in 2008 and currently sit more than six times where they were just twelve years ago. This has some significant consequences in terms of what may be expected in terms of a realistic future oil price path and the attractiveness of higher cost supply options, plus the uptake energy efficient technologies, which in turn alter the medium term supply/demand balance and thus oil price path.

I have written several times on Roger’s blog on oil and gas business investment and its pitfalls, but in the context of your question it is probably best to refer to my most recent comments which were made on the thread titled “What does my 2031 crystal ball predict?”

http://rogermontgomery.com/what-does-my-2031-crystal-ball-predict-2/#comments

Two key extracts follow as you might have problems locating them in the extensive comment this thread generated:

1. The Best play on Higher Oil Prices

Australian Exploration and Production sector companies are largely gas rather than oil producers. None have material long term oil reserves with the exception of BHP Petroleum, but then this is not a pure Exploration and Production sector play with the Petroleum division accounting for roughly 25% of the total business. So the search must be based on the producer with the largest, low cost, long life gas reserves, directly linked to oil price via LNG pricing. This brings us to Woodside Petroleum (WPL) with Oil Search (OSH) a distant second.

The coal seam gas CSG producers are ruled out by virtue of high cost production and the completely dry (no petroleum liquids in CSG which is why it is more accurately called coal seam methane CSM) nature of coal seam gas.

That said BHP Petroleum would be my choice if it were a pure play rather than embedded in a resource conglomerate. Of course if you believe the total commodity long term price story then this is inconsequential and BHP gives you both petroleum and pretty much everything else in one business.

The alternative is to play the oil price story via the contractor base to the petroleum industry and Matrix Composites and Engineering (MCE) is standout on the Australian listed business front in this respect with Worley Parsons (WOR) a distant second.

For the short sellers under this scenario the transport sector is the obvious place to take short positions at select times in the likes of QAN, VBA, TOL etc. Conversely you never want to be long these stocks under the long term rising energy price scenario.

2. On a query regarding Stuart Petroleum (STU) as a way to play the Peak Oil theme:

Brad/Ashley,

Rather than write a lot on STU specifically, I will simply note that playing the long term rising oil price under the Peak Oil Scenario via investment in oil and gas producers is fraught with problems.

As oil prices rise, so cost rise more than proportionally. Government take increases in most regimes (e.g. the PRRT in Australia, Special Oil Gain Levy in China and exponentially escalating price linked oil tax in Russia) and most oil company managements blow their brains out on risky, high cost capital investment development projects, plus ever increasing high cost, high risk, low reward exploration and fruitless (for the shareholder) M&A activity. In this sort of environment you will see the phrases “game-changer”, “company maker” and “high impact” thrown around by management and investment analysts with gay abandon. Run a mile when this happens, because the only high impact are the negative ones on profitability, balance sheet and thus shareholder value.

If you want to play the rising oil price/Peak Oil game via equity investment in oil and gas businesses, then you need to look for companies with established, developed, low cost, long life oil reserves, accompanied by brilliant shareholder friendly management who have profound understanding of capital allocation and the foresight and patience to see throuh the oil price cycle, which will still exist even in a post-Peak Oil world.

Does STU fit the bill? That is for you to decide rather than me to tell you. But before you answer the question take a good hard look at the company in light of Chapters 7 and 9 of Value.able.

But remember, the mugs out there will drive up the share price indiscriminately of each and every oil and gas company during an oil price spike, but this is speculation, rather than long term investment and it will unwind just as rapidly (look at any oil company’s stock price in the period 2004-2009 to see the effect). If you play this speculative game, just remind yourself of the rules of the game on rising from bed each and every morning, otherwise you’ll be incinerated in the long run.

So are you feeling lucky?

Regards

Lloyd

Hi Lloyd,

Just wanted to say how much I enjoyed reading your post. It’s quality contributions like this that set this blog apart from the rest and makes one realise how fortunate we are to be the beneficiary of the smart individual and collective minds that contribute to it. Breathtaking stuff to say the least.

Mully

Mully,

Thanks for the kind words. Happy to help out where I can. Oil, gas and energy operations were my career, which is probably why I am a very cautious investor in the sector! But you also owe thanks to Ashley for prompting me from my lethargy and sloth to put a few of my thoughts on the blog. Plus Roger who brought the discussion board into being and who generously provided the overall framework and initiates stimulating articles for discussion – very generous with his time and intellect.

Regards

Lloyd

Hi Lloyd.

Thanks for repeating that,

Sage words indead

Hi Kim and room,

One of the points Roger has made many times is that you don’t have to pick producers to benefit from the growing demand for a commodity. Yes Roger is long on oil, however he has pointed out many times that going long on a commodity stock adds 3 different types of risks. Market risk, Commodity price risk and board room risk.

For this reason Roger is far more interested in selling picks and shovels to the miners. To this end MCE will still be selling buoyancy devises regardless of the fluctuations in oil price. In 12 to 36 months time as more and more oil rigs take to the high seas MCE will profit from the organic growth in demand for their products, wear and tear on currently installed systems and new players entering the market to raise capital and spend it all with the likes of MCE, all without MCE being exposed to any commodity price risk.

All the best

Scott T

Hi All,

I have to agree that value investing ATM is proving difficult, especially if you are in a position where your portfolio is sufficiently diversified and you can’t capitalise further on MCE, FGE et al.

One question…does anyone know of any sites where I can screen for potential value opportunites on foreign markets, particularly the US?

Many thanks

Can’t help you with OS markets Wayne. With luck though, the current reporting season will throw up a few local companies to look at.

Hi Wayne,

Lloyd may be able to help.

If he does not reply to this post then post again and ask fior Lloyd help.

He loves helping out and knows heaps

Greg, Mc,

I usually go directly to international company websites (investor section of each) and download the last few annual reports, SEC filings, etc., for basic data and then do my own screening from this. However, I usually only invest abroad with a specific play, or macro-theme in mind, so rarely do I use data screening applications to drive my investment decision making or strategy formulation.

For summary views, some free services are available on sign up to the likes of MSN and Reuters and these include basic screening tools. Basic historical data can also be sources from Google Finance though I don’t think this has a stock screening facility.

For US listed stocks including ADR’s of non-US companies a lot of basic info is available for free from the NY Times website after you sign up for free (at least its free at present). Go to the Business section of the NY Times and explore the Financial Tools available there … you might be pleasantly surprised by the info and data you can glean. It also includes a screening tool, which I have not used. I also occasionally look at Hong Kong Exchange listed stocks for access to China plays via H shares of Chines mainland companies (no restrictions on foreign ownership here) and the Hong Kong Exchange website provides a rather clumsy portal to access company releases and filings … takes a bit of playing around to become familiar with it, but easy once mastered.

Personally, I think you need to be more careful than ever in investing abroad, due to the absence of the awareness factor that you have with local stocks, events, business dynamics, politics and economic dynamics. It is easy to be blind-sided by distance, poor news flow and lack or awareness of the businesses and reputations involved.

Therefore, international stock screening tools should be used very judiciously as a small adjunct to international investment decision making. And this is before we consider the integrity (or lack thereof) of many databases on which the tools are applied.

Regards

Lloyd

Ashley,

“He loves helping out and knows heaps” …. I think you may be overstating it on both counts!

That said I came across this gem, which I want to share with you, from Charlie Munger to a recent graduating class of USC law school:

“Another thing you have to do, of course, is to have a lot of assiduity. I like that word because it means: sit down on your ass until you do it.”

I believe that those contemplating international investment certainly need to practice great assiduity, in the true sense of the word (constant or close attention to what one is doing), for the reasons I noted in the previous post…. please don’t rely on international stock screening tools as your sole guide!

Regards

Lloyd

Hi Lloyd,

I really love reading your posts.

They are very thought provoking.

Mostly I like reading them because you often come up with something I have not thought about.

You have helped me and others heaps Lloyd and I would like to say thanks for that.

Ashley,

Thanks for the kind words. Equally, I find your insights very Valu.able and thought provoking. You’re no slouch when it comes to the value investing game! This is aside from the fact that you frequently prompt me to rise from my usual state of lethargy and sloth, to write in response to you dropping me into the discussion! This in itself causes me to think about the issues involved. Thanks for the great contributions to the discussion board.

Regards

Lloyd

Thanks for the advice Ashley!

Ashley and Roger, you have both made comments that it is going to be difficult to find companies trading at a substantial discount to IV this year – that this year will be hard for value investors. Can you please explain why?

Yes. I did say that …but I am buying some stocks at the moment. Because its hard, doesn’t mean its impossible.

I have got to ask, what are you buying at the moment. I bet everyone is itching to know. I will understand if you don’t tell us. If you can’t tell us yet, can you give us a hint.

Hi John,

I will be putting up a post in the not too distant future.

Thankyou and bless your cotton socks. :)

Hi Roger,

As much as we like to know what you bought, i guess many of the Value.Able graduates would like to know “Are you selling already?”

So are you selling some of those great stock mentioned in 2010 already, which some of those (MCE, ORL) are trading inside your valuation range? How about those (JBH, DCG) whose valuation has dropped?

Look forward to an insightful reply :)

Again thanks for everything!! I would try to contribute more in your blog in near future!

Regards,

Austin

I am on holidays and do not have access to my valuation tables

In light of CPU interim result what is their new IV for 2011 and 2012

Would appreciate your comment

Don’t worry about replying, sold CPU bought MIN as Roger has estimated a 30% return each year for several years – not bad even though they are tracking their IV

Hi Kent,

Just keep in mind that forecasts are just that. They can change and therefore I always look for a big margin of safety right now.

I agree but i just hope your forecasts are well founded

cant wait for your new list of companies to look out for! will be awaiting it with heaps of interest!! thanks again roger absolute champion!

Hi Roger,

I’ve recently read your book. Thank you! My only regret is that I didn’t have it five years ago.

On the understanding that it doesn’t constitute investment advice, would you be willing to let us know some of the shares you’ve recently bought or are currently on your short list (still trading at healthy discounts to IV)?

Hi Stuart, I am working on a list to be released in an upcoming post.

Yes I agree it would be great to get some ideas on stocks that are looking good in 2011 for further research or perhaps a ‘Do these 3 stocks represent the last of the good value’ style of post (similar to last year). Although I guess the reporting season may unlock a few more ideas for us

Hi Emily, i would agree with them. The companies that i have identified and would like to buy are trading at around or above my estimated IV’s, some extremley above my iv. Unless these companies drop dramatically i cannot see a big enough margin of safety to see any value at the moment.

I am not one to go digging trying to find a company that is at a big margin of safety, i am only interested in the companies i like and this is the case with them.

As Roger said, it doesn’t mean there isn’t value there but finding it is the hard part. Its hard to see what might be a catalyst for the markets prices to drop the amount needed and the cobwebs from the GFC have been blown off.

Hi Emily,

I like A1s at 40% to 50% discounts to IV so If you know of any in this category let me know

Hi Ashley,

Here are a few which may be in the ballpark for you to look at if you haven’t already done so.

PRV

PET

BGL

MOC

IDE

MRN

Mully

Hi Ashley,

As a footnote, I should mention that I do not own shares in any of these nor have I reviewed their quality ratings or valuations in recent times.

Mully

Hi Mully,

Thank you,

I will have a look at these

Hi Mully,

Thanks for your list.

Please don’t be offended but these are my notes on my initial review( Given your footnote I know you wont)

PRV – A listed investment company (LIC). The correct way to value these in my view is NTA. The NTA as at 31 January 2011 is 95.2 cents per share after tax.

So they are at a discount but some of these LICs trade at a discount forever. I want to do things myself and not buy a company that gives money to other entities to Invest.

PET- another LIC but this one is more appealing due to their philosophy. If I ever wanted to go into this area I would prefer MFF.

BGL- Yes I have looked at this one in the past. It is a very competitive environment.

MOC-Yes I have this on my watch list but I am just not a fan off our Real estate sector going forward and MOC are leveraged to this. If Jim Roger is right Interest rates are going up and the mortgage business may be difficult. That said reasonable discount to IV ATM.

IDE- Yes I have looked at this but I just don’t understand quite what they do and it is a very competitive environment.

MRN- This looks like a great business but expensive

Thanks Mully,

Anyone else got something that they are interested in?

Hey Ashley,

what are you thoughts for ZGL ZICOM GROUP LIMITED ORDINARY i get an IV of just over a dollar and they announced a profit update for the first half of the financial year ??

Cheers

Hi Ryan,

I have had look at this in the past.

A few bloggers are mentioning this one ATM which raises an eyebrow.

Give me a week or two and I will let you know.

Hi Ashley,

Thanks for taking the time to look at my list and for your insights and feedback which is much appreciated. Of these, MOC is the only one I’m going to keep my eye on. Whilst recognising the headwinds and sentiment currently facing the real estate sector, I have contrarian view and actually see some upside especially in the context of the MOC service offering but that’s a discussion topic for another day. Thanks again for your feedback.

Mully

Yeppers Mully

MOC is the best of that bunch and well worth keeping an eye on,

Like your Contrarian view on MOC

Nice thoughts

“I like A1s at 40% to 50% discounts to IV”

I can imagine Ashley!

How many have you found like that, and what are they?

Hi Kim

Over the last few years their has been quite a few,

MCE FGE ORL last year JBH FWD a few years back just to name a few,

Most of the Banks were at big discounts during the GFC

The Market does really silly things sometimes. so (as Ben Graham’s Mr Market allegory testifies) it’s the Markets wallet we want not it’s wisdom.

Doing what I do will involve long periods where lethagy is the only solution

hi roger and room

i have been researching FPS and would ike to understand why it does not publish funds under management such as PTM and others. instead it issues quarterly cash flow statements to the market place?

Hi Sam,

The Oct’10 chairman’s statement reads: ” Funds under Administration grew 16.3% to $1.14 billion…” The company is not a pure fund manager its an advisory business as well.

G’day Sam,

I put my two bob’s worth down on FPS on the blog in October. I don’t think that much has changed in the meantime though I haven’t redone my IV since and perhaps I’d use a higher RR than I did at the time – I’ve become a bit more demanding in that respect over time. I still hold them however and am waiting for the half year report with interest. To expand on Roger’s comment, they report quarterly cash flow in an effort to give transparency, they are not obliged to do so.

Here’s what I wrote back in Oct in response to a post from Lloyd about where to seek the personal professional advice that Roger keeps advising us to get, and which companies that provide said advice might be worth investing in – Roger then brought up FPS as a possible one to look into. I responded:

“Ah, Fiducian, one of my little favourites (as a financial services company which I have held in my SMSF for some time, I’ve never been a client). I have respect for Indy Singh, I like their business model and the way they go about their business. They managed to maintain quite good ROE even through the events of 2008-9. From a shareholder perspective, they treat their owners with due respect and go to some lengths to provide transparency – even down to publishing quarterly cashflow statements when there is no obligation for them to do so. I imagine that given the ethical way that they run their business, people seeking financial advice from them would get if not high quality advice, at least honest and ethical advice.

For what it is worth, I value them at $1.56, and track record and the confidence I have that management aren’t going to do something stupid or screw me over makes me happy to hold on to them.”

It should be remembered that almost anyone can start up a funds management business and advisory service so they’re in a competitive industry. I think that their reputation and one I Singh are potential advantages for FPS, and Indy Singh owns nearly a third of the company so it is certainly in his interests to work hard for the business. While I like FPS, I don’t think this is a company that is going to shoot the lights out like some of the blog favourites, though I did buy them almost at the very low point of the GFC so the return has been worthwhile. Their payout ratio has been 70% for some years now and I expect ROE in the mid-high 20s so their implied growth rate is not in the stratosphere. I have more faith in the guys who run this business though than most companies and I can sleep well at night owning FPS.

Hi Daniel,

Regarding CCV

ROE of 17ish

2011 est Equity per share .461

Avg equity of 168,806,056

and RR of 10%

gives me IV of 0.82 this year and 0.87 next

Wayne

With the CBA results out today I headed back to my valuation check how the IV changed.

I ran into a problem of which profit figure to use. They report a cash profit and statutory profit! Confusing!

Hi Grant,

This reporting was started by from memory ANZ during the middle of the GFC.

They were trying to make the figures sold better than they really are.

Over time they should equal out but I have always used the stat profits

As long as you are consistent it won’t matter

Whilst a declining cycle of bad and doubtful debts is improving profits now, I worry what the numbers will be like in a high interest rate environment.

Hi Steve,

I agree.

I few months back Roger did a good blog on the Banks,

My view at the time was the time to buy the Banks is when the economy is in tatters.(My view is still the same)

This will happen I just don’t know when.

Hi Roger, Everyone,

Congratulations on your book and many thanks for your insights, blog and comments Roger. You have opened a window to investing that I did not know existed and I have become a disciple and true believer!

This month I have been trawling the market for possible purchases and been intrigued by the spin off of Dulux (DLX) from Orica (ORI) in July 2010. The fundamentals look good although it does have some debt, it has (in my view) a competitive advantage in its brand name and products. It also appears to be cheap and I wondered if you could have a look at it sometime in the future. If anyone else has a view about this company I would welcome their thoughts also.

Raymond

Hi Raymond,

The issue is declining valuations.

Hi Raymond,

There was some discussion of Dulux here:

http://rogermontgomery.com/what-a1-stocks-am-i-looking-at-right-now/#comment-5762

It looks like you are on to it though – there are some issues regarding debt and cashflow. I agree they do have a well known name, but I’m not sure that good paint is hard to make, although I have no experience or training in the area.

However, and I believe this is a reasonable litmus test: I wouldn’t have any idea what paint was used in my house. And none of my friends have ever asked…. and nor do I ask them what is on their walls… and nor have I ever heard of a house advertised as being “painted with Dulux”

I think I’m like most people, and to me paint is white, not easy to develop a competitive advantage in that area. But there are other competitive advantages that Dulux might have, it is just that the numbers and my research don’t tell me that (yet).

As roger has also more succinctly stated, there are also some other investment check boxes that get a red flag

I’m happy to watch from the sidelines on this one for now

Good post Matthew, i agree with a lot of your points.

Paint i feel that regardless of the power of a brand name is still a commodity style product. If i bump into a family friend who is a professional painter i might ask him what paint he chooses and why. Might be interesting to see if there is actually an edge you can get in the paint manufacturing world.

Hi Roger, Matthew R,

Thanks for the link and for both your inputs. I must confess I am curious about DLX red flags and declining valuations not withstanding and like yourself, will sit on the sidelines and watch how it goes.

Hi Guys been reading Rogers book did a val on cash converters CCV and got a crazy amount of $2.88 can someone check this for me

Thanks Daniel

Hi Daniel,

Welcome and well done jumping straight in to valuing companies and contributing to this blog. You may find a better response if you also provide your inputs. That way others here can compare and contrast for you.

Hi Daniel,

It is definitely high compared with my IV. I have $1.17 rising to $1.33 next year.

Later.

I agree with Ashley regarding the fact that there are no really cheap companies around. I am also a value investor, but I don’t utilise terminal value when calculating my intrinsic valuations (as I find that as soon as these growth companies mature and their ROE decreases, there can be steep declines in accompanying price- eg. look what will happen to BKNs price after the latest report). I am finding that whereas 12 months (even 6 months) ago, I could find a number of excellent (safe) underpriced companies- eg. SWL, CTD, MLD, MCE, CDD, MND, LYL, FGE, ORL the companies that represent value (at current prices) tend to be far riskier.

That said, my current list (and I do not exclude miners) of companies trading at a substantial discount to intrinsic value are (and I wouldn’t touch quite a few of these due to the risks associated). The only ones I would class as A1 are FMG, HSN, QBE, TGR:

MNF

GDO (gold miner)

KAM

CGX (gold miner)

RMS (gold miner)

FMG (iron ore miner)

AGO (iron ore miner)

EQN (copper miner)

MLX (tin miner)

DGX

SHU

ICP

IDE

DDR

SBD

CTD

HSN

EMB

FXL

TGR

QBE

HNG

PPG

Hi Mal,

Nice list

Thanks for that,

Please keep posting. I like reading them.

Not saying I agree with them but you are not right nor wrong because we disagree

Hi Mal,

Any insights you wish to share about the companies you class as A1. I understand QBE but would like to hear your thoughts on some of the others.

You will notice that all the companies on my list (excluding miners) essentially have:

– growing sales/revenues

– low-ish debt

– good free cash flow

The ones that I have suggested as A1 (and this is not a systematised rating system like Roger’s) – I would say have some sort of competitive advantage. TGR- large salmon farms are capital intensive, HSN technology- smart meters. You have to treat mining companies differently- they are very difficult to value (require a much more in-depth look through reports and have some sort of understanding of the drivers of the commodity in question), but Fortescue is obviously a very large successful producing iron ore miner, that is ramping up production massively (and is on track for at least 40MTPA production this year). The other companies on this list are significantly undervalued but don’t have any obvious entrenched competitive advantage (some of them are ridiculously undervalued), they would also be very difficult to invest in if you need liquidity (quite a lot of them are very illiquid). I am not sure about the business model of IDE in depth but the numbers look promising.

Since I last posted FXL just released an excellent report and would probably also fit this A1 criteria. With a NPAT of 50million FY 11- 259mill shares, equity of 205mill gives ROE of 0.24, and a current IV (with no growth factored in) 1.93 with a discount rate of 0.10. I suspect if you use the valuation tables it will be significantly higher :).

Have to say TGR to is a bit left field so couldn’t help but have a look at it. And sorry i know you didn’t ask for my advice or what i think but thought i would post my thoughts.

I can’t work out whether i think their is a competitive advantage in Salmon farming and distributing. Love eating it but looking at it from a business point of view is something different.

I know john west have done it too an extent but i cannot think of whether when someone is working through woolworths for instance they will look specifically for a Tassall branded salmon product. Personally i just get the woolworths generic ones which are pretty cheap.

One red flag about the business i can see is that it has negative company cashflow. This means that the operations are not generating enough cash to look after the investing activities which is basically paying for the property, plant and equipment which would lend to what you said about it being capital intensive. Not sure i would go as far to say that the capital intensivness is a source of competitive advantage. If Tassall were adequatley making enough money to pay for the PPE than i might revisit it a bit more.

Also with a ROE of just over 15% it does not qualify for me.

You are correct in it trading below its intrinsic value i have on a RR of 14 an intrinsic value of $1.92 and current price is $1.765 which is about an 8% MOS.

Once again, i could be completley wrong with my thoughts and it wouldn’t be the first time so don’t listen to me.

Hi Andrew,

Salmon farms = no.

That was the answer i came up with as well.

Hi Mal

FXL has roughly just off the top of my head debt of about $550M and equity of roughly $220M.

Cashflow is terribile if adjust some of the figures to reach reality

This may do very well but it is not for me

I am also finding it difficult to find value in the market at the moment. I am having a fairly hard look at the moment, Thanks for the post I will have a closer look at some of them.

regards

George

Hi Mal

Please expand on your thoughts on KAM. Fund manager, no debt, forecast ROE 70-100%, 100% payout, no restricted capital, large management stake. CA people and processes locked in with aligned shareholding? Readily scalable business. Could this be a baby PTM?

Post result price rise seems to have resulted in a premium to IV. Using broker forecast have 2013 IV @ 60ish cents ROE 60% EqPS 11c 10%RR 100% payout ratio.

How can these types of businnesses generate “Returns on incremental equity”. If good they seem to be cash machines for the key staff and shareholders. They probably use their divies to invest in other companies with increasing returns on incremental equity.

Any fund managers out there ?

HI DC,

Thats the issue from a passive investors perspective, very high rates of return on equity but near 100% payout ratios. Still excellent but second rather than first prize, unless you own one.

I valued a couple of these the other day before I came across the list.

HNG – EQPS – 1.36

ROE – 20%

DIV – 70%

RR – 13%

IV – $2.34 for 2011 vs current price $1.435

Doesn’t rise at a rapid clip in the future but decent margin of safety

DGX – I’ve mislaid my figures but was actually able to find some forward EPS estimates! For DGX but not FRI. Come on brokers! Got a present IV of just over $0.50 with an RR of 14%. Current price $0.28 and had IV rising at a decent clip in the future to over $1.00 in 2013. Not an A1 company but not too bad either. Perth property is a bit depressed at the minute but tightening into the future so this probably counts as a contrarian play!

Some value out there but you have to look a bit and take a bigger margin of safety. It all comes down to your personal profile as no two investors are the same and no two will value a company the same. Use higher RR is all I can proffer as a buffer when wading in to some of the smaller companies.

Rambling a bit but I’m at work! See you on the bourse

Good rambling though Scotty. Thanks. Big margins of safety, is something I have been advocating for a long time here.

G’day,

Has anyone out there been able to find any forward EPS estimates for Finbar (FRI)?

I’ve come up dry on my search across the interweb!

Hi Scotty,

I haven’t been able to find any consensus forecast data either so I’ve done a little crystal ball gazing of my own taking into account the recent capital raising and come up with a 2011 IV of $1.43 based on the following variables.

EQPS – $0.85c

ROE – 20%

POR – 45%

RR – 14%

Mully

Roger,

Can you comment on your approach to grading and valuing companies like Computershare (CPU) which report statutory accounts and then focus all presentation material and management statements on another set of numbers, “management adjusted earnings”, which inevitably show the company’s performance in a more favorable light than the statutory accounts.

For example the just reported CPU statutory accounts interim shows a YOY reduction in earnings of 31%, whereas the “Management Adjusted Earnings” are only down 15%.

I use statutory accounts as the basis for IV and determine an 2011 IV of around AU$ 6.10/share based on my forecast statutory EPS which assumes a significant improvement in second half performance. Using “management adjusted earnings” with an associated higher ROE would generate a higher value.

As an observation the ROE of CPU seems to be declining to more normal levels (15% – 20%) after the peaks of 30 – 40% achieved in the years leading up to the GFC. As a result, the IV value path of the business is declining rapidly over the next few years (at least on my modeling).

How do you see this sort of CPU management approach, and does it influence your grading of the company, given the transparency issues that arise? I recall that you had CPU rated an A2 in one of your blogs last year. Does this rating remain.

Any insight on the subject and the business would be greatly appreciated.

Regards

Lloyd

Lloyd,

In such situations actions speak louder than words. The rating however is my measure of ‘cat.’ risk.

Hi Roger

I would like to get your thoughts on CSR. While I know it does not stack up on Intirnsic value I am a long time holding at around $2.40.

The company has advised they will return $0.4357 per share to investors as a capital return with the record date being 16 February.

Can you advise if a companys share price generally goes down by a similar amount to the return of capital amount once the share goes ex return of capital as it does when shares go ex dividend.

If price is not affected then it may be an apportunity for me to buy further shares before the ex or record date to further reduce my average cost base.

Your earliest thoughts would be greatly appreciated.

Greg,

When a stock goes ex dividend, theory says the shares should fall by the amount of the dividend (and more if franking is included) the drop however is not linked to any drop in cash because – as we all know – divs can be paid from borrowings rather than cash. The change, I believe, is related to the impact on the value. How ever the divs are paid, it will be a negative impact on equity and a corresponding increase in return on equity – all things being equal. A capital return – an entry that hits share capital rather than retained earnings – has the same impact on the valuation. In short, theory suggests an equivalent share price drop but of course, sentiment will determine share prices in the short term and the extent of the reaction.

Due to the fact that I do not hold Matrix or Forge I also price them at $ 3.00…….I hope you agree with me Ash……..Now where is that rope……….lol

Hi Room,

Just like to say how silly the analyst downgrade from that broker firm was regarding MCE about 4 or 5 months ago.

On the back of today’s Investor presentation how embarrassing is it to have a target price starting with a $3.

No advice BWT do your own research .IV could very well be somewhere in the 3’s……….but i am not getting that figure.

Hi Ashley

There has been big differences in Broker forecasts for MCE, I assume updates will be out soon and the forecasts will be closer now. At least one broker did have above $9 as their forecast so their clients will be happy.

I couldn’t agree more Ashley.

MCE is a great company and has a great competitive advantage in its industry.

By the way your frequent comments are very interesting and informative so thank you for your input.

Here here.

Thanks Greg,

Nice to hear that,

I sometimes think I am over playing my hand

Hi Ashley,

Great recollection, I have just gone back through the broker calls on Eureka, it was JP Morgan, and on the same day they went underweight MCE and Overweight Qantas.

Well well well.

All the best

Scott T

Having a very quiet and reserved chuckle and giggle. tee hee hee.

LOL,

Great move. sell MCE to buy Qantas.

yep sure to make you money by selling an A1 with big competitive advantage and buy an airline.(Not to mention the A1 was trading at a hugh discount at the time)

.

still laughing at that one

One might be suspicious that that number will be quickly and quietly changed, Ash. It might also illustrate the problematic nature of using analyst figures to try to estimate future IV, particularly in companies with only a few brokers covering them. Better perhaps to go with the company’s statements and not try to predict too far in advance.

Also remember my strong bias towards large discounts to present intrinsic values. Thinning on the ground now too.

I very much like your views Greg

And your sense of humour..Keep Posting

Not sure if it has already been commencted but GREAT updates today by both Forge (FGE) and Matrix (MCE), both of whom I own (thanks to reading Valuable and reading the posts and listening to the many outstanding views on this blog).

Based upon these updates I have forcasted IV’s for both these two above the $9 mark and that’s using some conservative figures.

Hi David

Excellent results from both FGE & MCE. No news on the dividends, so I am not sure what the payout ratio will be but for now I have an IV for Forge of above $7 and MCE above $9. I have estimated/guessed that the payout ratios for both of these may get to 40% in FY 2012 onwards.

Hi Pat,

For FGE I worked on the assumption the announcement of NPBT of $30mill for H1 would at least continue through to H2 (you may call this blind optimism). Allowing for a basic company tax rate of 30% and considering the current shares on issue of approx 83million, my estimated EPS for 2011 was nearly 51c. With a beggining equity per share of $1.19 that is an approx ROE of approx 42.5%. Allowing for an increase in Div payout ratio to 25% (was 19% in 2010) then I get an IV above $9 using a 12% RR.

I may be being slightly optimistic on the ROE being this high by the end of 2011 (which will depend on H2 performance) and also remaining this high in future years.

Would be interested to hear other peoples variations to the above.

Cheers

David

Hi David,

At some point the payout ratio will rise. That should impact your valuations. You should also look at previous half year and full year results and determine if there is any observable seasonality. Or just call the company and ask.

Steven, Great minds think alike. Re TRG, I paid $4.99 and got IV $7.09 for 2010. On one brokers forcast I got $5.50 for 2011 and on another broker forcast $8.22. We will just have to wait and see. If we lose money on this one it shouldn`t be much anyway. I also bought CGF. I don`t know what Roger thinks of these type of companies, probably not big enough discount for him maybe and history not consistent enough and not big enough increasing profitability. Maybe Roger could mention something about these two stocks. Ken.

Hi Ken,

Will add both financial services stocks onto the list to write about soon.

was looking at cgf (challenger limited), using the commsec financials sheet it seems to have a good ROE but quite a lot of debt..

Hi Roger, Im also disappointed that market moves has been axed. I have been watching Market Day, but it is a completely different program

Hi Scott and all,

This year I will be working with all the same excellent people as last year.

Roger,

Just on Sky Business, you can sit and watch YMYC for the full hour and see 95% of the stocks covered be speculative mining ones.

Why don’t they have 3 slightly different versions of the show on Tues, Wed, and Thurs?

Perhaps Mining firms one night, small caps the next, then the rest of the market on the third night. Or something like that.

If it wasn’t for fast forward on Foxtel IQ it would be 3 hours out of every week for little info pertinent to value investors.

Any thoughts?

Hi Craig,

Send your thoughts to the program/network producer Kylie Merritt.

Hi Craig,

I agree with you as most nights you hear the same callers chasing different highly speculative stocks looking for their ten bagger. However I actually find it reassuring and a validation that I have chosen to invest the Val’u’able way. Still a work in progress mind you. Hopefully one day they too will purchase Rogers book and read this blog.This is one band wagon worth getting on.

Hi

anyone know MCE’s NPAT/FY11 equity forecast yet? I can’t find it on any of the sites…

regards

Hi Matt

From the Comsec website today:

2011: EPS 45.6 DPS 13.5

2012: EPS 62.9 DPS 21.3

2013: EPS 68.1 DPS 20.4

Using RR of 12%, the forecast payout ratio of 30% and basing ROE on ending equity rather than average equity I get the following intrinsic values for coming years

2011: $7.96

2012: $10.77

2013: $13.03

Hi MattR,

Try reading this

http://rogermontgomery.com/wp-content/uploads/2010/08/Where-to-find-the-Source-Data-for-Value.able-valuations.pdf

Hope this helps

I should add i used # shares as 109M, giving Eq/share of ~2.96

Guys

Current JBH IV calc for your comment:

average EQ- 293m (2010) +352m (HY11)/2=323m

NPAT forecast- 134-139, use 136.5

POR 0.6

ROE 42%, use 40%

RR 12%

gives a current/2011 IV of $16.27

this seems significantly different to Roger’s IV of low $20s in late 2010 (did I hear this incorrectly?)

would love to hear other’s thoughts or IV calcs.

Hi Matt R,

A “late 2010” valuation is not a feb 2011 valuation!

It appears that 12%% may be too high RR for a stock such as JB. Excellent track record over the last decade, excellent business metrics, entrenched competitive advantage – all this points me to a RR of 10%, 11% to be conservative.

Let us not forget that the required rate of return should be heavily influenced by the risk free rate of return. As interest rates rise, so too should your required rate of return.

Is it worth risking your capital for a 10% return, for example, if you can get a 7% or 8% return from a (government guaranteed) term deposit?

The only companies that I am still using 10% RR for are large corporations that are likely to maintain pricing power in an inflationary environment (eg CSL). Everything else I require 12% or better.

Roger – might be worth putting this concept on your ideas list for a blog post?

Hi Ray, I cover it in Value.able too. Interest rates act like gravity on the value of all assets. Its an invisible force that gets stronger as rates rise.

Roger, I’m posting this a tad late.

What are your thoughts about rising oil prices and the impact on margins acting in a similar way to interest rates?

Hi Steve, I think it means steer clear of QAN, TOL, VBA et. al. Seek and take personal professional advice. See my first post for the year http://rogermontgomery.com/what-does-my-2031-crystal-ball-predict-2/

Thanks for the answer Roger, good to know. Could you give us your view on QBE latest acquisition? I think they will never overpay for anything, would like to know your view on future IV followed by the acquisition and maybe higher competitive advantage after having a higher market share and maybe higher ROE. Thanks a lot

Ok Tiago. On the list for a post.

Thanks Roger, could you share your opinion on QBE latest acquisition? I believe they wouldnt over pay on any acquisition but wanted to thoughts on future ROE, QBE’s increased market share and competitive advantage maybe generating a higher roe in the future, your view would be good too Ashley!

Thanks heaps

Hi Tiago,

I have not looked at this QBE are not on my radar,

Sorry

All fellow value investors, I came across ZGL around 3 months ago and was impressed by their annual report. Comments contained within the report seemed liked they came straight out of Roger’s book. i.e:

-shares trading at discount to intrinsic value.

-share buy back to increase the value of the business etc.

Their post GFC recovery looked as though it was tracking nicely, yet ROE was to low to warrant investment at the time.

Yesterday, they released their 1H11 profit guidance, which indicated NPAT up 115% – 130%.

Extrapolating the results for full year guidance looks as though EPS 6.75 – 7 cps, indicating ROE in the 20% for 2011.

Prior to this upgrade I had it trading at a slight discount to intrinsic value, however, the released guidance has confirmed the success of the companies goal for growth, and consequently indicates intrinsic value and ROE ‘rising at a good clip’.

Being a small cap and relatively illiquid seem to be outweighed by the future prospects of the company as they plan to further grow this multinational. Also seems much more of a diverse engineering company than MCE.

Would like to hear some thoughts from fellow bloggers.

Hi Leigh,

I wrote about ZGL on the Jan 13 post (Crystal Ball). Have a look.

Seems like a great opportunity to me, but I’d love the maestro to offer his thoughts.

Its on the list.

Had a look at this one and came up with a conservative IV of .69 @ %13 taking into account the recent profit upgrade.

What IV have other posters here come up with?

This one looks interesting. A well established business who have had maintained a good ROE over the years. Low debt etc….

As has been mentioned before when an opportunity arises it pokes you in the eye. Could this be one?

Hi Craig

Raised an eyebrow from me

Do you or anyone else here know anything about the company’s competitive advantage. I can’t find one but would love to be enlightened.

That will be the key to seeing it being a much bigger company in 5 or 10 years time.

All views would be good as it is obviously cheap on a pure valuation metric

Sorry I me Craig an Leigh

Sorry Leigh

The ROE doesn’t yet look high enough to consider investing in.OLlie EPS reduced beyween 2009 to 2010, one to watch I think?

My observations on ZGL for everyone. It reports in Singapore Dollars but figures below have been converted to AUD. Using FY 2010 data, ROE of 15%, Bookvalue, $0.26, RR 10% = IV of 0.51 cents. Note – Net Cash position of circa $5million and it has a low dividend payout ratio.

Feb 7 Profit guidance for 1st Half 2011 stated that 2nd half should be higher than PCP. I estimate FY EPS of 6CPS, ROE of around 20%, so IV will rise higher than current $0.51. Net Profit Margin seems to be on the up and up, which may indicate good pricing power or cost control.

Mr Sim Executive Chairman,Managing Director since 1995 owns more than 1/3rd of the company and has been adding to his position.

Using a higher RR there is still has a good margin of safety to future IV. Hope this info helps. – BelloWood

Hi Manny,

Great post i agree 100% with you.

Ashley or Roger any thoughts in ZGL ??

Cheers Ryan

B2 and IV rising at 13.8% p.a. for next three years. Prefer organic to acquisition-led growth which has resulted in halving of ROE over last 4 years. Hopefully the latest half is the beginning of improved performance.

thanks for the response roger much appreciated

Regards Ryan

Not sure how many people saw this but myer announced a forecast drop in earnings which I am sure will make the mums and dads who jumped on the float even happier.J

They also announced that they bought 65% of fashion label sass & bide for 42.5 mill which I think also includes some type of option agreement for the rest of the 35%. Haven’t seen the specifics yet.

What’s everyones opion of this? As they are a private company I have not seen any financials but my gut is telling me that is too much for this company. I think I read that they had revenue of 30 odd mill, so who knows what their bottom line is after costs.

This will mean that david jones will no longer be stocking this brand although I am not quite sure yet what to think og the impact. DJ’s said they only add 0.5% to their sales. Part of me thinks that it will actually hurt sass and bide not being stocked in dj’s as if you want to be seen as a high fashion company you want your clothes in dj’s and not myer which has the reputation of being cheaper.

I think it is a dangerous move for a dept store to be sercuring brands exclusivley by taking them over and if my feeling that they paid too much is true than profitability will of course be hit and those share holders will be probably seeing more downgrades.

As I haven’t seen much detail yet the above is purely speculation and please take your own advice. Any ithers have a view on this?

Below is a piece on Myer I wrote at the time of the float.

By Roger Montgomery

Investors keen on a quick profit from the Myer float may get their wishes fulfilled but the opportunity is not certain and the odds remind me of the man who jumps from a great height, hoping that the landing won’t hurt.

There is no doubt the Myer float is popular – 146,000 people have apparently registered for a Myer prospectus – but you can’t buy what is popular and expect to do well.

Popularity or otherwise aside, the way to put the odds in your favour is to buy shares below their intrinsic value. Before floating and selling my last funds management business, I bought The Reject Shop at $2.40 (now $13) and more recently bought JB HiFi at $8.50 (now $19), Fleetwood at $3.50 (now $8.00), I sold my Platinum Asset Management shares at more than $8.00 on the morning they listed (now $5), and warned investors who attended my ASX investor seminars to get out of ABC Learning at $8.00 (last traded at 54 cents before delisting) and to get out of Wesfarmers at $38 as they acquired Coles (recently traded less than $20).

In all these examples, I simply assessed the price by comparing it to the intrinsic value of the company. And the calculation for the intrinsic value of a company is simple. It’s just a multiple of equity based on the profitability of that equity. For example, if a company has $1 of equity per share and it will forever generate a 20% return and pay all the earnings out as a dividend, then an investor seeking a 10 percent return can pay no more than $2 for every dollar of equity. There’s a little modification for a company that retains profits but essentially that’s all there is too it. And provided you are not in too much of a hurry, it works really well.

Three years ago, Myer was purchased from the Coles/Myer Group by a private equity team called TPG/Newbridge. The Myer Family were also involved and together the consortium acquired Myer for $1.4 billion. The group used $400 million of their own money and borrowed the rest. Before the first anniversary, a very long-term lease on Melbourne’s Bourke Street store was sold for about $600 million and a clearance sale, reduced inventory and netted $160 million. All this additional cash allowed the new owners to reduce debt, pay a dividend of almost $200 million and a capital return of $360 million. In other words, before the first year was out the owners had received all of their $400 million outlay back, and arranged a free ride on a business with $3 billion of revenue.

But you are not being invited to pay $1.4 billion, which was 8.5 times the earnings before interest and tax (EBIT). You are being asked to stump up to $2.9 billion or more than 11 times forecast EBIT. You are also being asked to replace the vendors as owners and while they know a lot about extracting maximum performance out of department stores, you don’t.

In estimating an intrinsic value for Myer, I have ignored the fact that the balance sheet includes $350 million of acquired goodwill as well as $128 million of capitalized software expenses. I will also ignore the addition of sales made by concession operators “to provide a more appropriate reference when assessing profitability measures relative to sales”, the removal of the incentive payments to retain key staff – not regarded as ongoing costs to the business, costs associated with the gifting of shares to employees and most interestingly, the reversal of a write-off (meaning it has been left in) of $21 million in capitalized interest costs; all regarded as non recurring.

While ignoring these in my estimate of intrinsic value seems irresponsible, it merely means that whatever number is produced by the calculation, it is going to be higher than it really should be. That’s fine; I just have to ensure a larger margin of safety.

Taking a net profit after tax figure for 2010 of $160 million and assuming a 75 per cent full-franked dividend payout, I arrive at a return on equity of about 28 per cent on the stated equity of $738 million – equity that could have been higher after the float if $94 million in cash wasn’t also being taken out of retained profits. Using a 13 percent required return I get a valuation of $2.90.

Alternatively, I am buying $738 million of equity that is generating 28%. If I pay the $2.9 billion that is being asked for that equity or 3.9 times, I have to divide the return on equity by 3.9 times which produces a simple return on ‘my’ equity of 7.2 per cent. For ‘my’ money it’s just not high enough for the risk of being in the department store business.

And in the future things don’t become dramatically more attractive either. Based on the numbers in the prospectus I estimate that the value only rises by 6 per cent per year over the next five years and delivers a value in 2015 of $3.90 – the price being asked today.

I am going to pass on My piece of Myer.

And from a previous Blog Post…

Have I changed my view of Myer’s float?

October 26, 2009

In short, the answer is no. Three years ago Myer was purchased from the Coles Myer Group by a private equity team called TPG/Newbridge. The Myer Family was also involved and together the consortium acquired Myer for $1.4 billion. The group used $400 million of their own money and borrowed the rest.

Before the first anniversary, a very long-term lease on Melbourne’s Bourke Street store was sold for about $600 million, and a clearance sale reduced inventory and netted $160 million. All this additional cash allowed the new owners to reduce debt, pay a dividend of almost $200 million and produced a capital return of $360 million. In other words, before the first year was out the owners had received all of their $400 million outlay back, and arranged a free ride on a business with $3 billion of revenue.

But as a participant in the upcoming float of Myer you are not being invited to pay $1.4 billion, which was 8.5 times the Earnings Before Interest and Tax (EBIT). You are being asked to stump up to $2.9 billion, or more than 11 times forecast EBIT. You are also being asked to replace the vendors as owners and while they know a lot about extracting maximum performance out of department stores, you don’t.

In estimating an intrinsic value for Myer, I have ignored the fact that the balance sheet includes $350 million of acquired goodwill as well as $128 million of capitalised software expenses. I will also ignore the addition of sales made by concession operators “to provide a more appropriate reference when assessing profitability measures relative to sales”, the removal of the incentive payments to retain key staff (not regarded as ongoing costs to the business), costs associated with the gifting of shares to employees and most interestingly, the reversal of a write-off (meaning it has been left in) of $21 million in capitalised interest costs; all regarded as non-recurring.

While ignoring these in my estimate of intrinsic value seems irresponsible, it merely means that whatever number is produced by the calculation, it is going to be higher than it really should be. That’s fine; I just have to ensure a larger margin of safety.

Taking a Net Profit After Tax figure for 2010 of $160 million and assuming a 75 per cent fully-franked dividend payout, I arrive at a return on equity of about 28 per cent on the stated equity of $738 million – equity that could have been higher after the float if $94 million in cash wasn’t also being taken out of retained profits. Using a 13 percent required return I get a valuation of $2.90.

Alternatively, I am buying $738 million of equity that is generating 28%. If I pay the $2.9 billion that is being asked for that equity, or 3.9 times, I have to divide the return on equity by 3.9 times, which produces a simple return on ‘my’ equity of 7.2 per cent. For ‘my’ money it’s just not high enough for the risk of being in the department store business.

And looking into the future, things don’t become dramatically more attractive either. Based on the numbers in the prospectus I estimate the value only rises by 6 per cent per year over the next five years and delivers a value in 2015 of $3.90 – the price being asked today.

In valuing Myer I am not predicting its price. Remember what Benjamin Graham said; In the short run the market is a voting machine. Shares that are popular can go up a lot even if the value is much lower. In 1999 and 2000 Telstra’s value was less than $3.00 and yet the shares traded around $9.00 for a long time. But Ben Graham also said in the long run the market is a weighing machine. In the long run, Myer’s share price will reflect its value.

So no, I have not changed my view of Myer’s float.

By Roger Montgomery, 26 October 2009

On thing i would also add, i don’t like Myer, i think it is lost and can’t decide whether it wants to be high end or middle range and this is confusing customers. I also expect some a certain new player to make a big splash in the market and it will affect Myer more than David jones.

I do, however, like David Jones and think they are run extremley well and management have great clarity as to what they want to be.

I remember being down on the Myer float myself and thought it was expensive. I don’t believe they have the brands needed to challenge DJ’s and i guess in a way buying some of DJ’s popular brands and giving themselves exclusivity helps fix this problem. I wouldn’t want a business i own to do this however.

Also, for further clarity of what i meant about myer being confusing. I think Myer is the cashed up bogan of the dept store scene. Tries to look more fashionable than it actually is.

Not surprised with the downgrade as i think they are becoming a bit irrelevant at the moment and will need big changes in their strategy. This will cause less sales.

Also, my fiance, whose finger is more on the pulse than me in this area is of the opinion that online shopping is making a big dent in this market despite my initial thoughts on the subject.

Hi Andrew,

Very interesting insights. Value and ROE just mediocre. You might enjoy the following shot of Aussie workplace safety: http://www.bogan.com.au/photos/index.php?album=2&image=167

Lol

Very Funny

Still laughing at that.

Very funny, but I should say don’t laugh… many a well meaning volunteer in the flood clean-up was not so well equipped!

And they were encouraged by politicians to do so!

If the said politicians had been business managers or directors they would have been potentially at risk of criminal prosecution, under Occupational Health and Safety Legislation… go figure!

Two standards depending on which side of the public/private divide you operate.

Roger, do you ever make profits by short selling C4, C5 companies trading at an expensive price comparing to IV? if no, why not?

Sorry if the answer is in your book, I have only read until page 153 where you teach us about cash flows.

Take care

Tiago

Hi Tiago,

I think you can but there are a very specific set of circumstances that you need to reduce the chances of losing money. In Australia we have relatively few large cap A1s and A2s and so fund managers are forced to invest in companies based often, only on size rather than quality. The result is that you can get it right ultimately but lose a lot of money (a la LTCM) while waiting. Its better to have a catalyst. One of the best is a large, debt funded acquisition that has a negative impact on ROE and IV. I hope that helps.

MMmm that sounds like Wesfarmers buying Coles doesn’t it!

When markets turn

Jan 22nd 2009

From The Economist print edition

A parable of how modern finance can go wrong

GEORGE SOROS, one of the original hedge-fund managers, believes that every boom in the making is tested. Often the potential bubble succumbs and is forgotten. If it survives, the market’s misplaced faith is redoubled. That, Mr Soros says, is when things become dangerous.

The test for the credit boom was Long-Term Capital Management (LTCM), a super-brainy hedge fund created by John Meriwether and his team from Salomon Brothers, along with Robert Merton and Myron Scholes, the pair of Nobel laureates who had worked with Fischer Black on options pricing. The markets should have learnt from LTCM’s collapse, but they were too busy making money.

Click here to find out more!

LTCM’s strategy was to scour world markets for pairs of assets with prices that appeared to be out of line with each other. For instance, at Salomon Mr Meriwether’s team had spotted that the 29-year Treasury bond was surprisingly cheap compared with the 30-year Treasury bond. If you think about it, the 30-year is just months from becoming a 29-year Treasury. It was dearer because a lot of people wanted it in their portfolios, but did not think to buy the 29-year. So Mr Meriwether sold 30-year Treasuries and bought 29-year Treasuries and waited for the gap to close.

For a while LTCM was outstandingly successful. Over time, it found 38,000 of those mispriced pairs. In 1996 alone LTCM’s investors made a profit of $1.6 billion. By 1998 it had so much money that it returned more than a third of its $7 billion in capital to its investors. But in August 1998 Russia defaulted on its debt, sending financial markets into a frenzy. LTCM began to lose money. According to Charles Ellis, the author of the Goldman book, in the second week of September its losses were as follows:

Thursday 10th: $145m

Friday 11th: $120m

Monday 14th: $5m

Tuesday 15th: $87m

Wednesday 16th: $122m

LTCM’s collapse was the credit crunch in miniature:

• The fund depended on debt. Its real return in that bumper year of 1996 was a modest 2.45%. It made so much money because only $4 out of every $100 was equity. Earning $2.45 of profit on $4 of equity is pretty good. Unfortunately, as LTCM discovered, equally small losses could wipe out the fund.

• It was secretive. LTCM traded each half of its pairs with separate brokers because it did not want anyone copying its strategy. That was an advantage when it was riding high. But when the tide turned, its brokers wanted more security, as they could not judge the risk of its pairings and its hedges.

• In a crisis everything correlates. LTCM’s asset pairs should have been independent of each other. But when Russia defaulted, the whole market bolted for safety. LTCM had been buying the less liquid of each pair of assets and selling the more liquid. Suddenly all its positions were in trouble at once.

• LTCM failed to grasp how much it was affecting the market. Allegedly Goldman Sachs and others eventually began to copy LTCM. When it got into trouble and had to start unwinding its bets, others sold first. Its own positions were so big that its selling put further pressure on prices. Whereas the prices of asset pairs should have converged, they were forced further apart, making LTCM’s losses even bigger.

After Wall Street bailed LTCM out, Mr Meriwether quoted his colleague, Victor Haghani, on how other firms had traded against it: “The hurricane is not more or less likely to hit because more hurricane insurance has been written. In the financial markets this is not true. The more people write financial insurance, the more likely it is that a disaster will happen, because the people who know you have sold the insurance can make it happen.”

It was an example of something that Mr Soros calls “reflexivity”. Once people come to believe that house prices never fall, they will buy too much property—and house prices will fall. When they believe that shares always do well in the long run, they will buy too many shares—and the market will do badly for years. When funds believe that diversification always pays, they all invest in the same exotic instruments. Diverse markets suddenly have something in common: the funds that have bought into them.

People often talk about financial markets as if they were casinos, but reflexivity makes them much more dangerous than any gambling den. The numbers on a roulette wheel never change, but markets offer no guarantee that yesterday’s odds will be the same tomorrow.

Short selling carries a higher risk profile- at the end of the day you are borrowing the stock off a broker… selling it at the price at time of borrowing and then repaying it back at a later date. The major problem is that there is unlimited upside which means you could potentially lose out alot more than you put in.

Example: buying a stock for 25 dollars, means you could potentially lose 25 dollars.

Shorting a stock for 25 means you would lose Y-25 where Y is any number above 25! So it could mean you could lose 8000 (by which case the price of the share was 8025)

Nice Post Simon

Hi Room,

I have always loved my JBH shares but today I am now officially in total awe of how well they run this business.

The cash this business is generating is simply amazing and this in an environment when same store sales are down 1.5%.

During the last 6 months JBH spent about 30Mill on PP&E . Now not all this will be on the 13 New stores they opened due to replacements and upgrades in older stores but to be conservative let’s assume that it is

That makes fitting out a new store at roughly $220,000. The average stock per store is roughly $250,000 and the average profits per store per year are roughly $800,000.

Now for anyone who likes looking at payback period this is the payback period from heaven.

But wait it gets better, the average stock turn is 50 days and the average creditor days are 55 days so on a cash flow basis they are not out of pocket stocking the new store at all. In fact it’s like consignment stock. That is they are paying the supplier 5 days after selling the stock.

What that means for the JBH shareholders is that payout ratio will continue to rise.

They are just spitting off so much cash and they really don’t need much cash to grow at all. Expect further rises in payout ratios despite what the boffins think. This is not a bad thing,

My only concern is mention again of a capital management review due to the strong cash flow.

So often in the past capital management reviews are code for Investment Banks telling boards to do silly things. Let’s hope this is not the case