Is The Price Now Right?

There’s a lot in this post. So sit back and relax. Put up your feet, pull down the blinds and get comfortable.

There’s a lot in this post. So sit back and relax. Put up your feet, pull down the blinds and get comfortable.

Billionaire Oilman J. Paul Getty famously advised; “Buy when everyone is Selling and Hold until everyone is Buying”. Knowing what price to pay most certainly helps to enhance returns in the long run.

An investor without the knowledge to estimate Value.able intrinsic valuations is surely blind to the opportunities presented by a sea of red ink. Without it, one cannot see beyond today. And without intrinsic values one sees only falling prices and fears further declines – frozen in the spotlight of a market collapse.

Even though they told themselves they would buy if prices dropped, now they can’t. Tomorrow, they reassure themselves, will be a better day.

Focus instead on business quality. Seek out those whose prospects are bright and whose Value.able intrinsic values you expect to rise 10, 15, 20 per cent over the years. Identify those whose returns on equity puts your term deposit to shame and whose balance sheet can survive the next GFC, should it occur.

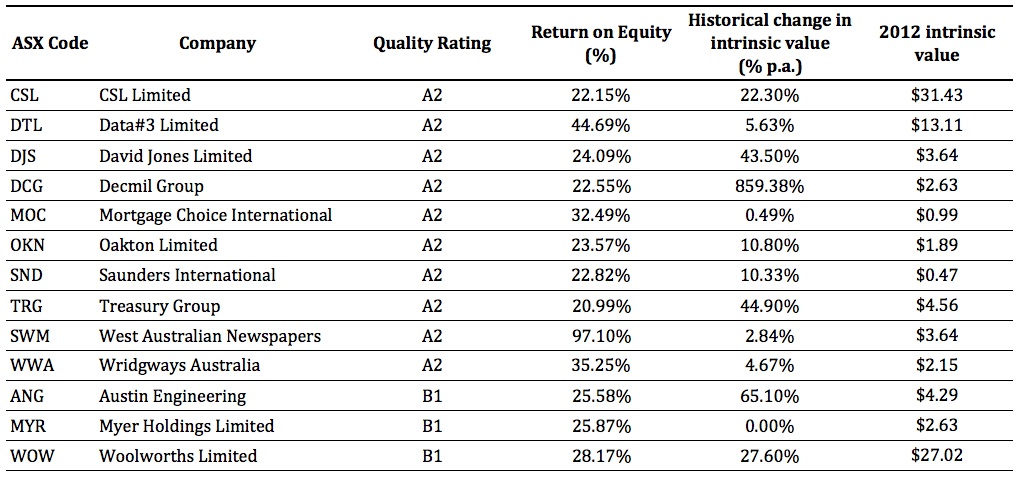

With the downturn in the US’s business cycle triggering fears of recession, I would like to share with you a list. It’s not a list of A1s, and it’s not a list of all companies trading at prices less than they’re ‘worth’.

It is instead a Value.able watchlist of companies that achieve some of our higher quality and performance ratings – A2 or B1 (I shared a list of A1s here a couple of weeks ago) and includes CSL, Data#3, David Jones, Decmil, Mortgage Choice, Oakton, Saunders International, Treasury Group, West Australian Newspapers, Wridgways Australia, Austin Engineering, Myer and Woolworths.

Each business reported return on equity greater than 20 per cent last year and may or may not be demonstrating a safety margin. Some have a track record of extraordinary performance; whilst others, well, won’t (p.s. that’s a clue)

Your Long Weekend Study Guide

The watchlist forms part of your Value.able education. Like the Insights blog itself, it is for educational purposes only. If you haven’t reviewed Value.able lately, I encourage you to spend some time over the long weekend (between periods of relaxation of course) reviewing Part Two – Identifying Extraordinary Businesses, then research your answers to the following questions for each company.

1. Extraordinary prospects: Does the future look bright? Or, if you don’t believe the future will be as extraordinary as the past, why not?

2. Competitive Advantage: What sets this business apart from its competitors?

3. Debt/Equity: How has management managed capital? What is the evidence?

4. Cashflow: Track record of cash flow? Use my quick back-of-the-envelope calculation to asses the true cash power of the business.

5. Which three are going straight to the top of your Value.able watchlist, and why?

Lets build a body of ideas under this post that adds value. If you complete the questions for one or all the companies listed, or if you have identified another company you would like included, go ahead and add it in. Please try and keep your comments under this post consistent with the above, five-part format.

And if all that seems like too much work, keep calm. My team and I are fine-tuning something that will knock your value investing socks off.

Those who have already had a private screening don’t want to be without it, and some Graduates are happy to pre-pay for it, sight unseen!

So ignore those ‘Beat-the-tax-man’ pre-June 30 ‘special’ offers from various investing experts and other ‘helpers’. Avoid the temptation of an extra one, two or three month ‘subscription’, a show bag full of tips, a free magazine, DVD, or even a set of free steak knives.

Wait for an A1 opportunity instead. Your patience will be rewarded.

If you like the taste of Coca Cola, you don’t settle for Pepsi. Even if Pepsi throws in more – an extra 300ml, an extra can or bottle, or even a free holiday – it’s just not the real thing.

Nothing matches what we are putting the finishing touches on for you.

We have been told it is the ‘next-generation’. Actually, its five generations ahead of anything else we have seen. It is A1, it is world leading with global plans and soon it could be yours.

So save your pennies because it won’t be discounted and we won’t need to fill a show bag full of other stuff to convince you.

If Value.able is the menu, then our next-generation A1 is the entire fine-dining kitchen.

Value.able Graduates will be offered first priority, followed by the loyal Facebook community.

So if you haven’t yet ordered your copy of Value.able, now is not the time to procrastinate. Remember, Value.able Graduates will be offered first priority.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 9 June 2011.

Treasury Group:

Extraordinary Prospects:

In the immediate future: no

Potential long term future: very bright at current prices.

Treasury Group essentially takes an equity position in a select funds management company and provides all the ‘back office support’.

Its current interests include Investors Mutual Ltd (47.5%), Orion Asset Management (42%), Global Value Investors (49%), Treasury Asia Asset Management (40%), RARE Infrastructure (40%), Celeste Funds Management (39%), AR Capital Management (30%), Aubrey Capital (redeemable preference shares entitling TRG to a 20% ordinary equity) and Treasury Group Investment Services (100%).

Treasury groups profit essentially a matrix of

(a) total funds under management of the underlying funds managers

(b) the ability of those funds managers to achieve returns in excess of their benchmark (since the funds managers receive performance fees which are far in excess of the basic management fee)

(c) the total number of funds managers and the size of their funds under management. (there are fixed costs in providing ‘back office support’, a funds management company needs to achieve ‘critical mass’ of funds under management, before it becomes profitable).

As can be seen from historical results, overall, treasury groups profit can be linked, in general terms, to the state of the equity markets as a whole. When equity markets do well, treasury group does exceptionally well, when equity markets go through a bear phase, then profitability also declines.

This is why i have stated that this company doesnt have immediate ‘bright’ future prospects, but over the long term it does have this potential.

The current state of global equity markets is not conducive for excess profit creation by funds management businesses because of its current subdued nature. But equity markets go through phases, when equity markets are bullish, then anything related to the funds management business is priced accordingly (just look at the PE ratio that treasury group historically traded at).

Competitive Advantage:

I would argue that treasury group has a competitive advantage as can be seen by the ability of the company to achieve long term growth in funds under management.

Once a fund manager is ‘joined’ to treasury group, its not so easy to leave since the underlying fundmanagement company achieves a ‘brand’ if successful. The key question that must be asked is what proportion of the brand belongs to the individual asset manager (ie the person ‘behind the brand) and what proportion belongs to the brand itself. To use an independent example, look at Perpetual. It has a strong ‘brand’, but who were the original asset managers of that brand, most investors in their products wouldnt know.

So the key to treasury groups competitive advantage is their ability to spot talent, and then tie them up.

Debt/Equity:

There is no debt, this company generates cash, look at the balance sheet and look at its historical balance sheet.

Cash flow:

This company generates significant cash flow. During times when equity markets are bullish it generates alot more cash flow. But the important issue to me, is that even during bearish market phases, the company still generates cash flow (but at lower levels).

Again look at the balance sheet, this company doesnt know what to do with its cash flow, as of the half year report, there is $9 million dollars of cash sitting in its bank account.

Look also at the long term movement in NTA, its increasing over time, where is that NTA comming from (hint cash and investments in its equity partners funds)

Conclusion:

ROE is actually understated from a ‘business owners’ point of view because:

(a) equity markets are subdued, so earnings are likewise subdued

(b) part of that equity represents cash on hand and investments in funds (which generate a return equal to the performance of those funds which is less than the underlying return generated by the business itself).

I am surprised nobody has given any feedback re Treasury Group

So MCE has taken a massive whack recently.

What do you all think?

Mr Market doing his usual thing? or does using ROE as the be all and end all overvalue many companies with high ROE??

Tez

As you have probably seen, MCE is not the only company that has been declining in price. If you read Value.able graduates’ comments about the section in Value.able referring to implied growth rates you can be confident relying on ROE. Of course not everyone will take up the method and its certainly not our job to convince you but there is plenty of excellent academic research suggesting the relationship between ROE and share performance is a strong one. Given that Buffett suggests ROE is useful I will stick with it too.

Hi,

What’s the correct way to value a Listed Investment Company (LIC)?

Like a lot of SMSFs, mine has 3 LICs in the portfolio.

Australian Foundation Investment Company (AFI) is one of these, and if I use the Value.able method, I get an IV of about $1.20.

It’s currently trading around $4.40.

On the one hand, as a business, its price is nearly 4 times its IV.

On the other hand, when you buy a share of AFI, you’re buying part of all the other businesses it has shares in. This is represented in the Net Tangible Asset (NTA) backing per share.

Its NTA backing per share is between $4.85 and $4.21.

The question, I guess, is: is the NTA of a LIC automatically part of its Intrinsic Value?

In other words, is it sound to add the NTA to my Value.able valuation of IV to get a more realistic IV?

In this case, the IV would be more like $5.60.

Or is it impossible to use the Value.able method on LICs?

Comments please!

thanks,

Russell

Not impossible at all. Just a little re-weighting of the work you are already clearly doing.

Hi,

Thanks for your reply Roger.

However, it’s rather enigmatic!

“Re-weighting”? The only way to re-weight in the Value.able table algorithm is to change the RR. At RR=9%, the Value.able method gives IV=$1.35 for 2009, and won’t even produce a value for 2010.

AFI’s ROE is 5.33% for 2009 and 4.88% for 2010 using the Annual Report data and the Value.able calculations.

What am I missing here?

thanks,

Russell

I am sure there are many here at the blog that can assist? Thanks Russell.

Hi Russell,

Great question.

The reason LIC’s roe’s are so low is that conventional accounting does not capture the retained earnings of the securities in the portfolio. It only sees the dividends and intererst from those securities. However, the retained earnings are expanding the value of the portfolio as well, especially so if they are being reinvested at a high incremental return (a value.able like investment). Buffett referred to these retained earnings as “look through earnings” for Berkshire Hathaway.

Cheers

P.S. If you value a LIC portfolio and discover that the individual stocks are cheap, and then you find the LIC is trading below NTA then you have just added to your margin of safety (albeit adding agency risk with the LIC)

Hi again Russell,

Great questions. That one has been answered here by several Value.able Graduates. You will find their answers in some of the older posts. All the best with it.

HI Roger and room,

I am looking for a service that keeps investors automatically updated with company announcements which effect IV. Can any valeable grad or Roger help?

Thanks Adam.

To keep the Insights bog independent, I won’t be able to publish third party products or services here.

ASIC website has a facility to automatically send you an email notification on company announcements, these can then be filtered for the announcement types you’re interested in.

Hi All,

I’m looking for an easy way to get notification of promising upcoming IPO’s. I don’t want to waste my own time sorting the wheat from the chaff, so I am wondering if others out there in Value.Able land could point me towards any good sources they may be currently using.

(Roger, this might be something else that others are prepared to pay good money for).

There are some free services including fairfax’s service (see below)…

Company Offer Offer Offer Expected Issue Overview

Name Status Opening Closing Listing Price

Date

888 Resources Limited Open 27th Apr To be advised 14th Jul $0.20 888 Resources has entered into a Farmin Agreement with ASX Listed Oroya Mining Limited (ASX:ORO) to advance exploration for gold and other minerals at Oroya’s Beaufort Gold Project within the Victorian Gold Province.

2011 2011

Altius Mining Limited Open 27th Apr To be advised To be advised $0.20 Whilst Altius is predominantly focused on the development and mining of its primary gold assets at Forsayth in far north Queensland (“FNQ”), the Company has also amassed substantial tenement holdings across a broader spread of commodities. These include identified exploration targets for rare earth elements (REE), iron ore, copper and platinum group elements (PGE), all in NSW, which will enable Altius to spread it risk profile accordingly.

2011

Audalia Resources Limited Open 6th May To be advised To be advised $0.20 Audalia Resources is a lead, zinc and copper exploration company with interests in three exploration licences and two applications for exploration licences (Tenements), covering over 335 km2 in a new base metal province in Western Australia.

2011

Aurelia Resources Limited Open 2nd May To be advised 21st Jun $0.20 Aurelia’s strategy is to discover, develop and acquire mineral deposits in line with the exploration model as quickly as possible.

2011 2011

Commissioners Gold Limited Open 7th Apr To be advised To be advised $0.20 Commissioners Gold Limited is an exploration company in a hurry. The Company has completed five years of solid groundwork and drilling on its tenements, and now seek to delineate a robust gold resource. To deliver on this there can be no substitute for drilling holes.

2011

Conto Resources Limited Open 28th Apr To be advised To be advised $0.20 Conto Resources has entered into an option and farm in agreement with Sammy Resources Pty Ltd, a subsidiary of Cazaly Resources Limited, in relation to the Cardinia Bore Project that will enable the Company to earn up to an 80% interest in the project by completing, amongst other conditions, a minimum of 1,000 metres of RC drilling within 2 years of the Company listing on the ASX.

2011

Dynamic Agri Tech Ltd Open 25th Oct To be advised To be advised $0.50 Dynamic Agri Tech is a technology company that delivers effective products to the agricultural industry. It has developed an agricultural growing technology through the use of hydroponics, enabling agricultural growth in regions where existing climatic conditions inhibit the successful propagation of sustainable animal fodder growth (grown by traditional means) to meet local demands.

2010

Flinders Exploration Limited Open 29th Oct To be advised To Be Advised $0.20 Flinders Exploration’s South Australian Diamond Project is located in several areas over the southern Flinders Ranges and the Gawler Craton, where FMS has made significant advances in discovering and understanding the emplacement of kimberlites, and has recovered the highest concentrations of micro-diamonds from any kimberlite host rock in South Australia (SA).

2010

Melrose Gold Mines Limited Open 21st Apr To be advised 28th Jun $0.20 Melrose Gold Mines is a Western Australian based mineral exploration company committed to exploring and developing quality gold assets. The Company is particularly focused on developing its 100% owned mining tenements (excluding 90% uranium rights) which contain gold mineral resources (inferred, indicated and measured) compliant with the JORC code.

2011 2011

Mining Group Limited Open 20th May To be advised 24th Jun $0.20 Mining Group is an Australian company whose primary objective is to acquire commercially significant mineral properties that can readily be brought into production.

2011 2011

Peninsula Resources Limited Open 5th May To be advised 20th Jun $0.25 The Offer, which seeks to raise $6 million through the issue of 24 million Shares has come about as a result of a decision by Adelaide Resources Limited to improve the potential for exploration of the Company’s high quality tenements by allowing investors to gain a direct exposure to them.

2011 2011

Rumble Resources Limited Open 6th May To be advised 24th Jun $0.20 Rumble Resources Limited is an Australian-based mineral exploration and development company established for the purpose of acquiring a portfolio of highly prospective exploration projects or near term development projects.

2011 2011

RXP Services Limited Open 11th May To be advised 22nd Jun $0.50 RXP is an Information & Communications Technology (ICT) management consulting and delivery services company. With the acquisition of both Vanguard and Indigo Pacific, RXP will offer an expanded range of services including business management & technology consulting services, application development, delivery & integration services and ICT support & maintenance services.

2011 2011

Silver City Minerals Limited Open 3rd May To be advised To be advised $0.20 Silver City has been building its asset base in the Broken Hill region for almost three years and has spent more than $2,000,000 on exploration and acquisition activities. This has been undertaken by a team of geologists with over 50 years combined experience in the Broken Hill District and has resulted in the Company having one of the largest exploration positions at Broken Hill, covering almost 1,700 km2 across 20 Tenements.

2011

Silver Stone Resources Limited Open 6th May To be advised 24th Jun $0.20 Silver Stone has entered into the Sale and Purchase Agreement to acquire the Cheriton’s East Project tenement in Western Australia. The Project comprises of approximately 60km2 exploration ground and is located 48km south-east of Marvel Loch in the Eastern Goldfields in Western Australia.

2011 2011

Sunseeker Minerals Limited Open 19th Apr To be advised To be advised $0.20 Sunseeker owns 100% of the Lucky Downs Project located 220 kilometres west of Townsville, Queensland. The project in prospective for gold and other base metals and comprises of exploration permits for mining EPM 14346, EPM 18638 (in application) and mineral development licence MDL107 over an area of 203 square kilometres.

2011

Yellow Brick Road Holdings Limited Open 6th May To be advised To be advised $0.40 The YBR Group was established in 2007 to provide integrated wealth management advice, products and services to Australian retail and SME clients. Since integrating a number of cornerstone acquisitions during 2008 and 2009, the YBR Group has grown its distribution network significantly during difficult trading conditions and aims to become a diversified one-stop wealth management business.

2011

Regalpoint Resources Limited Closed 21st Feb 23rd May 30th May $0.20 Regalpoint has secured a large diverse holding of highly prospective projects – primarily for uranium but also for gold and other minerals. The Company is now poised to undertake a major exploration programme to progress these projects rapidly with the aim of identifying significant economic ore bodies.

2011 2011 2011

11:00:00 AM

Brimstone Resources Limited Closed 26th May 10th Jun 21st Jun $0.20 Brimstone has entered into two farm in agreements for acquisition of interests in the Golden Feather Tenements that includes the 52,000 ounce JORC Code gold resource at Penny’s Find, located approximately 50km north east of Kalgoorlie in Western Australia.

2011 2011 2011

Naracoota Resources Ltd Not Open 28th Apr 10th Jun 24th Jun $0.20 Naracoota, once listed, intend to use modern geophysical techniques to identify deep copper-gold targets within the Naracoota Volcanic unit that underlies the Tenements, and then move quickly to a deep drilling program to test these targets.

2011 2011 2011

Western Gold Resources Limited Not Open 23rd Mar 10th Jun 4th Jul $0.20 Western Gold is currently a wholly owned subsidiary of Golden West Resources Limited (GWR) a company that is listed on ASX (code:GWR) and whose principal business is the development of the Wiluna West Hematite Iron Ore Project.

2011 2011 2011

CB Australia Limited Open 10th May 17th Jun 1st Jul $0.20 Following shareholder approval, the Company has agreed to become the Master Franchise holder for the Coldwell Banker System in Australia and is now seeking to raise capital to accelerate expansion for the Coldwell Banker brand across Australia.

2011 2011 2011

Orpheus Energy Limited Open 3rd Jun 21st Jun 8th Jul $0.25 Orpheus Energy Group Pty Ltd (OPL), an entity which will be a wholly owned subsidiary of Orpheus following completion of the offer, is already pre stripping overburden to expose coal at its B26 project for a trial mining program supporting its feasibility study.

2011 2011 2011

Cohiba Minerals Limited Open 31st May 24th Jun To be Advised $0.20 The Company has entered in to the Farm-in Agreement whereby it has the exclusive right to earn an initial 50% interest in the mineral rights (excluding iron ore)

2011 2011

Signature Gold Ltd Open 26th May 28th Jun 14th Jul $0.20 Signature Gold is exploring in and adjacent to the New England Orogen (NEO) and Drummond-Anakie Province (DAP) areas in Queensland for Intrusion Related Gold Systems (IRGS). The Company is building a portfolio of prospects covering over 680km2 through the purchase of four Tenements.

2011 2011 2011

Firestirke Resources Limited Open 27th May 29th Jun 5th Jul $0.20 The Company is a speculative exploration company and following the receipt of approval to be admitted to the Official List, will acquire advanced exploration gold projects in Western Australia and an option over a gold project in Victoria providing the Company with a good opportunity to identify and develop gold resources in a time of high gold prices.

2011 2011 2011

Strategic Elements Ltd Open 19th May 29th Jun 15th Jul $0.20 Strategic Elements Ltd is seeking to become the only ASX listed rare earths company with Pooled Development Fund (PDF) status. The Company is an investor across the rare earths and rare metals exploration and materials development sectors.

2011 2011 2011

Kinetiko Energy Ltd Open 10th Jun 1st Jul 8th Jul $0.20 Coal Bed Methane is a proven process with successful commercial examples of commercial production established particularly in North America and Eastern Australia.

2011 2011 2011

Messina Resources Limited Open 7th Jun 1st Jul 13th Jul $0.20 The Company is a speculative exploration company which has acquired rights to exploration gold projects in Western Australia providing the Company with a good opportunity to identify and develop gold resources in a time of high gold prices.

2011 2011 2011

Strickland Resources Limited Open 16th Jun 8th Jul 19th Jul $0.20 Upon completion of this capital raising Strickland will be able to complete the acquisition of an 80% interest in the 14 Mile Well gold project, consisting of 7 granted prospecting licences and 1 mining lease located east of Leonora in Western Australia.

2011 2011 2011

Hey Roger,

Not sure this sorts the wheat from the chaff.

Ray,

I have found this blog the best way to sort the wheat from the chaff for IPOs

Hope this helps

I’m behind on this homework…oh well, real investing isn’t a race.

Two results so far:

CSL

Prospects

Growth in existing products and new products. R&D in future products for human illnesses.

Strong prospects.

Competitive Advantage

IP in products. Major player in the US and Europe, a handful of large competitors, some smaller ones.

Very large hurdles to market entry.

Debt/Equity

Debt is about 10% of equity.

Cashflow

+778 million 2009-10

+656 million in 2008-09

+492 million in 2007-08

DTL

Prospects

DTL is an IT solutions and services company with many major players as partners. It should grow at least as at the same pace as the IT industry generally.

Competitive Advantage

Since DTL key stragety is to form non-exclusive alliances and partnerships, these can be relatively easily replicated or destroyed.

No real competitive advantages.

Debt/Equity

Zero.

Cashflow

2008 – $6.5 mil

2009 – $18.7 mil

2010 – $44.7 mil

Next two results from me (FWIW!)

DJS

Prospects

David Jones is an iconic retailer in Australia, which is a bit of a “turnaround”. It is growing by increasing stores in appropriate areas, however, the growth in online shopping may be hard for all retailers, even good ones, to overcome.

Competitive Advantage

Hard to find an enduring one. Image/brand of DJs is about the only competitive advantage.

Debt/Equity

About 14%.

Cashflow

2008 – +$135 mil

2009 – +$466 mil (major debt reduction occurred)

2010 – +$124 mil

DCG

Prospects

Strong prospects due to the mining and resources boom.

Competitive Advantage

Long-term relationships with major organisations as customers. Ability to take on large projects (> $150mil).

Four core areas of expertise which are interrelated.

Ability to work in remote areas.

CEO claims the ability to deliver projects on time and on budget is a competitive advantage.

Debt/Equity

17% as at 2010, down from 34% in 2009

Cashflow

2009 – +$11m

2010 – +$24m

1H2011 – +$9m

Thanks for taking the time to post your thoughts and workings. This will be very useful and hopefully many of the readers (who haven’t yet posted- thanks for all your many hundreds of emails) will take up the challenge to submit their own workings…

My take on DJs,does the future look bright? I am not convinced. With the strong $A, popularity of on-line shopping and the emergence of tech savvy a GEN-Ys with disposable incomes, I think the Australian retail sector is facing hard times ahead. Has management done good in the past? i think so,if you consider where they were sitting 5 years ago share price and debt wise it is fair to say the former CEO put the company in a good position given the current climate and competition retailers face . My wife has worked for this company for some time now and believes at best the current CEO can only skim the fat off an already tightly run operation.DJS currently operates 35 stores throughout the country after one recently closed down in Newcastle CBD due to the landlords decision, its intention for 2013-2016 are to open 4 new stores in Sydney,Perth,Gold Coast and Sunshine Coast.They currently run a debt/equity around 12% and forecast to rise 21% for 2012 increasing the long term debt to apprx $270 million with a forecast cash flow of $212 million forecast for 2012.

Their competitive advantage has been the loyalty of shoppers who have been with them for many years and their customer service which will count for little the more that online shopping continues to strengthen.Go easy on me this is my first real contribution i usually just ask questions.

Hi Grant, the above post was great and has a few good points in there. Don’t need to worry about the reaction.

I am a follower of DJ’s i was going to use this homework style post to do a comparison between Myer and Dj’s but other projects got ahead of it.

I think DJ’s future is slightly murky at the moment. I believe they can offer something that will attract customers that online shopping cannot by providing more of a shopping experience.

A major plus for DJ’s is the brands that they sell which help enforce its brand perception of it being a luxury retailer. These however are also some of the brands however that people are going to take advantage of online retailing for. THis as i said makes the short term future a bit murky and haerd to predict but they will still do a lot better than Myer. I have my thoughts on Myer and believe it could be turned around with a bit of change in its brand and product offering but i am not into a turn around business.

One thing i have been thinking about is that online retailing in regards to the type of product DJ’s offer might be a seasonal thing and there for maybe less exposesd to this area, at least in some of their product range. DJ’s offer high end clothes , shoes and assessories which are attractive to buy online at the moment because of a high Aussie dollar, this means that you can save a lot of money by buying through american dept stores etc online. i think cosmetics will be one area where they will be vunrelable to online retailing but they have a differentiating factor in that you can buy at DJ’s and then have a professional do your make up for you.

I think one question that needs to be examined in regards to DJ’s is whether online retailing is still a threat if the Aussie dollar goes below parity like it used to be. I know no-one here is expecting it to happen in the short term but i am a long term investor.

I have had a thoug

Hellow Rodger and everyone else in here

I cannot seem to reconcile your IV for MOC or OKN

Figures from my online Broker’s research pages give me the following

MOC Shareholders Equity 77M

Shares on issue 118M

= $ 0:65/share

ROE 30%

Pay out Ratio 62%

at 10% RR table 11.1 gives .65 x .62 x 3 = $1:209

table 11.2 gives .65 x .28 x 7.225 = $1:315

Total = $2:524 Your IV = $0:99

OKN gives me a similarly higher figure than you quote

I realise that I am using 2010 data but your ROE figures are close so do you see the shareholders equity dropping in half by 2012 ?

Am I using unreliable figures from my el cheapo brokers research pages? Or is there some other multiplier that I’m missing? Is this going to be detailed in your next book? ( just a dig here, couldn’t help myself…sorry)

As these are both A2 companies I believe that they should be relatively solid so I’m at a loss as to why our IV’s differ so radically

Regards as I scratch my noggin

Cameron

Hi Cameron,

You won’t get the same as me. The model I use to generate these is quite different to the one you are using. Be sure to read page 193 of Value.able again. The ROE I have shown in the table is for 2010, but its not the ROE I am using for the 2012 valuations. In addition to that difference, you will probably find we are using different assumptions for required returns and these can have an impact on valuations.

Ok page 193 details with the fact that a past ROE figure cannot be expected to remain constant as market factors along with management are always changing. However the ROE figure used to obtain our respective IV values is at this time effectively equal. The above chart claims a ROE for MOC as 32.49%, I used 30% Your IV value, using practically the same ROE as me is less than half of mine. I am using the formula in the Valueable edition that you are still promoting while explaining to me that in fact now “The model I use to generate these is quite different to the one you are using” Have you moved on ? In the case of MOC Your new model generates IV’s half the value of the method ascribed in your book using the same ROE. Do you now believe that the Valuable Ch11 IV calculation method is obsolete?

Even more confused

Cameron

Hi again, I am pretty sure page 193 says a lot more than that! As I haven’t disclosed the required returns, which could be be quite different, they might be another source of the disparity. The ROEs are NOT the same because the ROE shown should be for 2010 while the valuation is for 2012. Also, are we applying them differently (see page 193 again)? The straight line nature of the Walter approach to valuation is something that can be overcome. You should know that I have always said here at the Insights Blog that Value.able is a “leg-up” not a “hand out”and many Value.able Graduates will be able to explain just how useful it has been for them. There is no sudden change in rationale from me. All steady as she goes over here.

Roger I have used 10% for my RR. This is an A2 Co. on the MQR scale, 1 lower than the highest achievable. I’d have thought in the case of A2 Co’s 10 % was a reasonable RR. If your IV for MOC was within 20% or 25% of the value achieved using the Ch 11 method I wouldn’t have a problem but when yours comes out at less than half I feel that, in this particular case, if your IV is on the money then the Ch 11 method is obviously way out.

Hi again Cameron,

We won’t get every valuation exactly the same. Let me put together something for you.

Hi Cameron,

There has been much discussion on previous posts on how to decide on a RR. There are many ways. Quality of the company is not the only (or even the major) part of it. I will leave it to you to investigate further.

Personally, for a company like moc I would use an RR of at least 14%.

Welcome to the blog! We look forward to hearing more from you :)

I am writing about how to establish the Investors Required Return as we speak…

Its proving to be a bit of an epic writing about RR’s. It is way beyond the word limits we try and stick to here at the blog..I use a very quantitative method that tracks more than a dozen variables and accords weights to each. WHile that sounds very scientific all it does is ensure that I don’t apply any personal bias to the decision making when it comes to choosing a RR. Buffett also has a method for ensuring the same thing: He chooses 10% then looks for a discount of 50% or more. It really is that simple.

Thanks Roger

I hope you still write about it though

Where are you getting your 30% ROE figure from? Can you supply the NPAT figure you are using for 2012? I have 119,948,000 shares on issue…I think my payout ratio is much higher than yours too. Will put something together for you…

My 30% ROE comes from my online broker research pages. It’s for last year. Basically if the past few years show an increasing ROE I average them out, if they’re decreacing I take the lower. I realise that past performance cannot be relied upon but I feel they’re real and future estimates are, well, estimates and in any case there’s not much information on the forecast page with respest to MOC. I’m trying to get the lowest feasiable IV so when I saw yours at less thah half I began to panic. As such I haven’t regarded any estimate for NAPT for 2012. Same for the shares on issue and payout ratio, all from my brokers research pages. Your thoughts of more shares on issue along with a higher payout ratio and Mathews views above on RR start to come together to shine a little light on our valuation differances.

I have a much lower ROE, EPS of 14 cps, more shares on issue etc etc…I am delighted if you work it out but I am not going to give it all away on a platter. The reason I don’t is 1) because you will stick with the approach through thick and thin if you reach the conclusions yourself and 2) because, despite the fact that – as I say in the first couple of paragraphs of Page X (10) of Value.able – “Everything I have learned about investing has come from reading…everything you find in the book is already widely available“, I have not found anyone who puts it all together the way it is presented in Value.able. In that sense the combination is unique and original. Fortunately there are a great many Value.able Graduates who understand the methodology and are happy to share. To them I take my hat off because they have helped thousands and thousands of investors find a superior approach to that which they were previously using. And, based on the track record many here have observed, there is value in the method. Patience, focus and persistence is all that is needed.

Roger

I have been away and just come across this post. Rather than not comment at all I have made comments on 5 of the companies you listed on which I have a reasonable amount of knowledge (I own 4 of these).

I have commented on competitive advantage / prospects, debt, and which of these companies I would invest / reinvest in – at a healthy discount to IV (I note that cash flow calculations have been submitted elsewhere in the blog).

Competitive advantage / prospects:

CSL Global leader in plasma protein biotherapeutics industry – results will be affected by high AUD which will create a buying opportunity. No reason to suspect that competitive advantage will be eroded.

DCG A leading civil, infrastructure and building contractor servicing resources, energy and government infrastructure sectors.

Competitive advantage lies in the ability to grow revenue and margins – this has been achieved over the last three years.

Could be a worthwhile investment at the right price, given DCG’s exposure to the

mining services sector.

DTL An ICT solutions company with no obvious competitive advantage other than evidenced by increasing revenue and

margins. Revenue has increased at a very healthy clip. Margins declined in the past couple of years but have now

stabilised and are showing signs of increasing. Seems to have carved a bit of a niche for itself.

ANG Has niche products – dump truck bodies and shovel heads – with robotic systems to provide cost effective product. Has expanded

into South America via an aggressive series of acquisitions spending $69m in the last 18 months to December 2010.

Large increase in equity and debt as a result of this program – the queries are whether it can grow profits sufficiently to

maintain its return on capital and whether it is a serial acquirer of businesses

WOW Obvious competitive advantage as one of the the two major supermarket chains in Australia and the only one that can realistic be

invested in unless Westfarmers spins off Coles. The expansion into building products, competing with Bunnings is a concern.

Revenue continues to grow and margins are holding up reasonably well.

Net Debt – all numbers are at 31 December 2010:

CSL -8.61%

DCG -54.32%

DTL -2.93% Big reduction in net cash from June 2010 due to reversal of cash from May / June peak and the reversal of $21m in prepayments

ANG 34.81% increase in debt and equity due to acquisition program

WOW 40.48% fairly consistent levels of debt easily manageable

The ones to pick:

On the basis of where I think the best growth may come from I would tend towards the smaller companies – DCG, ANG, and DTL

great work grant. Thank you for posting those insights. APologies my earlier thank you note wasn’t published.

OK, here’s a go -first time for me to comment on the blog.

Have not yet worked my way through all the companies; but I did know that West Aust News had been taken over, so wondered Roger what you were expecting from us there. Now I know – just to see if we are on our toes! As for Wridgeways – I was not going to bother with it as it seemed to me it was a tough business. Interestingly I had already been looking at Austin Engineering; was quite interested, but a bit concerned about the acquisitiion bent, and wondering, as an earlier blogger asked, are they about done? However, they seem to be managing the cash flow OK.

CSL – a good business, managing capital quite well, never having excessive debt, keeping divs low so as to have retained earnings to fund R&D, but not always cash flow positive. Not an extraordinary business because it must discover new products to keep a competitive advantage.

Data3 I like – no debt, good cashflow, strong organic growth, efficient use of capital to produce excellent ROE. If it can retain its talented people it should be able to maintain a competitive advantage.

Unlike Oakton – Revenue rising and rising, but not a great deal of increase in profit, hence ROE declining. Growing by acquisition, large people costs, depleted their cash position in 2009 with large dividend payout; why? – keep shareholders happy?

Decmil is a mystery. Performance seems to be on the up since it got rid of some areas, but there does not seem to be a lot of margin in its operations. Cashflow looks good, and it is building on its cash reserves, and has little debt. Perhaps worth watching, though as a retired person with need for income, it does not suit me at the moment.

David Jones is a good retailer, though the sector is up against it currently. Its competitive advantage is that suppliers and labels are attracted to it. It has good cashflow, despite undertaking capital spending to own its own stores in Melbourne and Sydney.

Mortgage Choice was an excellent business with its competitors reducing; but its diversification into risk insurance and commercial loan services concerns me.

Have I done my homework properly?

Glenice.

Thank you Glenice, for taking the time to contribute. I am delighted to hear from you. I hope you will continue to post your thoughts and contribute to the library of knowledge being built and shared by the community.

As of their last AGM in Nov 2010 Austin saw themselves as nowhere near done, viewing Africa as a potential multi-facility continent, like Australia and Sth America.

Researching the prospects for a presence in central and northern Asia, before the end of FY12, was also on their to-do list.

Hi Roger and room,

Had a look at the cash power for the 13 businesses in this post (less WWA) and how they compare to reported profit.

Also looked at MCE as an example of a business that is profitable but cash-flow negative (mainly due to capital expenditure on Henderson plant).

Figures use 2010 annual reports (‘10 vs ‘09 for comparisons). Liabilities include borrowings or interest-bearing liabilities only.

Interestingly, of the 12 companies, only DTL, DCG and SND have company cashflow > reported profit.

Company/Cash Flow/Profit/Difference

1. CSL: 778,993 / 1,052,901 / -273,908

2. DTL: 44,539 / 10,914 / 33,625

3. DJS: 124,260 / 170,766 / -46,506

4. DCG: 24,487 / 7,838 / 16.649

5. MOC: 17,430 / 23,479 / -6,049

6. OKN: 12,033 / 20,235 / -8202

7. SND: 8,268 / 4,031 / 4,237

8. TRG: 5,509 / 11,676 / -6,167

9. SWM: 89,892 / 96,223 / -6,331

10. WWA —

11. ANG: -14,978 / 19,264 / -34,242

12. MYR: 8,996 / 67,182 / -58,186

13. WOW: 1,007,000 / 2,021,000 / -1,014,000

MCE: -15,449 / 18,155 / -33,604.

Would need to research further (particularly on management’s handling of capital) to call out a ‘top 3’, but of the companies listed, none currently have a high enough MOS.

Be interested in others thoughts.

Cheers

MarkH

Good work Mark. Thoughts anyone?

I like the way you approached that exercise, Mark. Thanks. It seems to me it’s a quick, simple way to find an extraordinary business. Think I will cross ANG from my watch list.

Glenice.

I’m still working through this, but it seems to me that CSL is a good prospect.

My reading of Value.able makes me pretty much ignore the profit figure.

Sure, it goes into the IV calculation to provide the ROE, but I can’t see why the “cash profit” should *always* be above the NPAT.

I guess if it’s always under, that would signal something (probably bad).

So, I again checked CSL and their NPAT is always larger than their corresponding “cash profit”.

Could it just be due to timing issues? After all, you can make $100 profit as at 30th June, but not get the cash for that profit until later in the year….and doesn’t that mean that cash is actually counted in the “cash profit” for the following year?

Soooo many questions and difficulties!!! Maybe you *do* need to be an accountant to understand this stuff….

Any insights into my sea of confusion here?

My MOS (at RR=10%) says the price needs to be around the $24-$25 mark. I don’t see that happening soon. But that all disappears if I can’t understand the problem MarkH has shown me!

cheers,

Russell

Hi,

So, my question that MarkH prompted in me is: what does it mean if cash profit is often below NPAT?

I’ve re-read lots of Value.able recently, and pp 145-147 clearly show a disconnect between cash profit and accounting profit.

Here’s my example of 2 companies. Both started business in Year 1 with injected equity.

Company A

Start Year 1: Assets=100, Liab=0, Cash at bank=100, Equity=100

Company B

Start Year 1: Assets=100, Liab=0, Cash at bank=100, Equity=100

At the end of Year 1, they are almost identical:

Company A & Company B

End of Year 1:

Revenue=1000

Expenses=500

Gross profit=500

NPAT=350

Equity=550

Assets=450

Liab=0

Dividends paid=0

But here’s the difference…

Company A: Cash at bank=450, cash profit=450, profit difference=+100

Company B: Cash at bank=250, cash profit=250, profit difference=-100

What happened?

Company B bought an asset (e.g. a building). (For simplicity I’ve ignored the tax effect of depreciating the asset.)

The point is, both companies could do this indefinitely, and MarkH’s method of subtracting the NPAT from the Cash Profit to “filter” companies may not be useful.

Because….which is better to own? The answer is: it depends.

Company A builds cash every year, but has no other tangible assets. For example, it rents its buildings.

Company B builds cash *and* other tangible assets every year. It decides it’s better to own its buildings.

It all means exactly what Roger has been saying – you have to understand the business, not just run numbers.

Company A has lease risk. What if its lease expenses double or triple? Company A may no longer be a viable business.

Company B doesn’t have lease risk, but does have to maintain its building etc. If leases double or triple, Company B is still a viable business because it is unaffected by the increase in leases.

So, this convinces me to investigate when NPAT is greater than cash profit, but it doesn’t work as a filter for me.

Roger or anyone, do you have any comments?

cheers,

Russell

If I understand your scenario, equity at the end of year 1 for company A and B would be $450? Adding back the purchase of the building by company B would produce the same cash flow number too so while subtracting NPAT from cash flow will miss many good businesses in ‘edge cases’ , in this case, they would both end up equal????

Hi,

Thanks for the reply.

Yes, my Equity figure was wrong. It’s $450 at the end of year 1.

So, the revised scenario is:

Company A & Company B

End of Year 1:

Revenue=1000

Expenses=500

Gross profit=500

NPAT=350

Contributed Equity=100

Total Equity=450 <====

Assets=450

Liab=0

Dividends paid=0

Cash Profit Calculation (borrowings always zero):

Start of Year 1

Cash ($100)

Contributed Equity $100

Total $0

End Year 1 Company A

Cash ($450)

Contributed Equity $100

Total ($350)

Subtract from start of year: $0 – ($350) = +$350 (cash profit)

End Year 1 Company B

Cash ($250)

Contributed Equity $100

Total ($150)

Subtract from start of year: $0 – ($150) = +$150 (cash profit)

Summary:

Company A: Cash at bank=$450, cash profit=$350, NPAT=$350, difference ($350 – $350)=0

Company B: Cash at bank=$250, cash profit=$150, NPAT=$350, difference ($150 – $350)=-$200

If I've got that right now, the same argument applies.

Company B could keep making a lower cash profit to its NPAT each year, simply because it keeps buying a $200 building each year.

Or, maybe I've misunderstood the accounting here?

Roger, you said "Adding back the purchase of the building by company B…". Why would you add that back in? It's an asset, not cash.

My scenario is designed to show how cash can be "used up", thereby lowering the cash profit, while keeping the NPAT unchanged.

I'm using your cash profit calculation from here: http://rogermontgomery.com/what-did-the-company-really-earn-in-2011-2 (which is a version of the one from page 153 in Value.able).

Each year there are retained earnings in both companies, but that's not contributed equity. Contributed equity remains at a constant $100 each year, right?

I'm really just trying to understand why CSL – as an example – keeps generating a smaller cash profit than its NPAT.

If my simple scenario is right, then it's perfectly reasonable for this to happen, and not a signal of a problem.

I don't think I understand your other comment: "subtracting NPAT from cash flow will miss many good businesses in ‘edge cases’".

Are you saying that MarkH's technique of examining the difference between NPAT and cash profit is a useful thing or a non-useful thing?

Reading "Cash and EBIT" on pp 158-159 indicates to me that cash profit will almost never be greater than NPAT for the vast majority of businesses the vast majority of the time.

Therefore, I'm concluding that measuring their difference has no useful meaning.

Am I wrong?

many thanks for your time,

Russell

Hi Roger,

I DO NOT trade in the commodity market but would like to watch the day to day movements of the commodity market. Would anyone know of a good site to do this from?

barchart.com

Bloomberg app for iPhone or iPad. It’s great!

I use it myself. It is great. The helpful thing at barchart.com is that you can easily get teh entire futures curve and see whether the market is in ‘contago’ or ‘backwardation’.

Could someone please tell me where I have gone wrong?

Code HDF

Current Equity $Millions 557.4

Current Issued Shares Millions 518.3

Equity Per Share $1.08

Earnings Per Share (Cents) 3.60

Dividends Per Share (Cents) 12.00

Payout Ratio 333.33%

Payout Ratio Selected 333.33%

Prior Years Equity $Millions $607.1

ROE 3.20%

ROE Selected 3%

RR 10%

Table 11.1 0.320

X EQPS $0.34

X POR $1.15

Table 11.2 0

X EQPS $0.00

X 1 -POR $0.00

IV $1.15

Code HDF

Hi Kent,

My comments follow each of your bullet points:

Current Equity $Millions 557.4 = correct

Current Issued Shares Millions 518.3 = I get closer to 530

Equity Per Share $1.08 = for the purposes of calculating intrinsic value you need the last financial year and the estimated next financial year to get ROE and you need next year’s equity per share for the valuation calc.

Earnings Per Share (Cents) 3.60 = that depends if you are estimating 2011 or 2012

Dividends Per Share (Cents) 12.00 = looks ok. some analysts have less.

Payout Ratio 333.33% = these sorts of entities have higher operating cash flow than reported profits. You may want to consider the cash flow statement. Transurban is another typical example. Depreciation overstates the operating costs of the business.

Payout Ratio Selected 333.33% = no point going over 100%

Prior Years Equity $Millions $607.1 = I get slightly higher.

ROE 3.20% = just over 4% for me for 2011

ROE Selected 3% = fine

RR 10% = perhaps conservative. Depends on what you are looking for.

Everything else flows from what you have chosen…

Thankyou Roger, I am increasing knowledge daily

SND: Saunders International

1. The future does look promising for this company who make specialized custom made storages for Oil, gas, water and chemicals. Exposure to the oil and gas industries should see a steady order stream improving regardless of what happens with mineral mining.

No outstanding competitive advantage. Perhaps the quality and experience of the board in this industry is some advantage. A downside of the management is a lack of youth on the board. The company listed in 2007 and given the age of directors, who are major shareholders, the listing could be an exit strategy. If this is the case expertise could be lost if key directors head for retirement in the next few years.

2. Capital Management is very conservative and capital is only being used to support existing contracts in hand. The company has no net debt and has 20mil cash in the bank. Raw Materials and consumables purchased in 2009 was $31,349,000 and in 2010 was $15,326,000. This could be a run down in inventory to bump up 2010 profit. CFO to explain.

Book value is 1.7 mil for 2010 and 2.3 mil for 2009, this may indicate aging plant that has not been upgraded. A contract dispute which arose in 2008 is still in the resolution process and the timing and financial outcome cannot be forecast at this stage. All costs relating to the contract have been recognised in profit and loss as incurred. However no mention of how big a payout will be as a worst case.

3. Company cash profit was $6,797. (I think)

My opinion is this company is running like the private company it was a few years ago and the risk of key persons leaving is too great for long term investment comfort.

Cheers Punchy

A source of some data.

http://www.afrsmartinvestor.com/asxdata/

This may not be sufficient but price and per share are included.

For calculating an accurate IV the annual reports etc are better than the per share estimates.

I am not sure of the current charges though.

Hi Brad,

Regarding Credit Corp Group ( ccp ) if you have entered into ( ccp ) sometime ago and are looking for a exit price then thats OK but if your looking to enter NOW and believe that you are entering at a big discount to intrinsic value well thats another.

If you want to see something amazing go to Pitt St Sydney and look at the queue of women still outside Zara. Then walk into Westfield and you will see another queue outside another entrance to the store. Inside it is shoulder to shoulder. As a mere man I have no idea what is going on here but it is remarkable.

It is something like the queue being formed of value.able graduates outside the promised, all new, sparkling RM IV listing system. People are now starting to ask will they qualify – more remarkable pre-launch marketing.

As cynical as I may be, I have to admit it has got me in. I am sitting here queued up with all the rest, prepared to sleep out to get a front row seat. I have a good book to reread and will wait as long as I have to. However I am old and cranky so please don’t make me wait too long.

And LukeS – you will be amazed. Grab a sleeping bag, a good book and see you at the grand launch!

Luke S, I am right beside you, mine is the navy blue sleeping bag, we can swap novels when we have finished reading them.

Never in my wildest dreams would I camp out overnight for a Zara frock or an i-thingy but I will happily join the sleep out for Rogers new A1 IV system, looking forward to the roll out Roger!

All the best

Scott T

Great Scott. Thank you for the support. I do think you will love it.

Could be timing risk if the market tanks this month and all Grads get set at big discounts to IV and have no money left for products.

Cheers Punchy

Edited your post because the suggestion was incorrect and I have previously requested you use your name.

You should always have some powder dry Mike!

I use Craigs forecasts which for CSL are very bullish it seems .My 2011 IV is 33.50 (RR 10%, ROE 25%, Payout 48%. EQPS $8.59) Craigs forecast for 2012 is eps $1.99, dps $0.91 and for 2013 $2.34 and $1.00) that gives forecast EQPS of $9.67 and $11.51 by my calcs which together with ROE of 27% for both years and payout ratio of 45% for 2012 and 35% for 2013 gives IV of around $44 for 2012 and over $50 for 2013.

Does anyone else get similarly bullish figures? This ceratinly puts CSL near the top of my watch list if my figures are right!

Rainsford

I think perhap wait until 2010, carbon tax, mining tax and flood levy will have an impact on economy in second half and maybe in 2012

100% agree….

…trying to “predict the future” of earnings and ROE are all very well in a stable political enviroment, but Roger, how do you “model” for political risk?

Indeed there are many risks in investing, not just political risk, and it is for taking those risks that we are rewarded. “No government featherbedding” may be a hurdle a company needs to jump to get into your portfolio.

Roger

Can you please refresh my memory on what defines a ValueAble graduate? My memory tells me is that it is to have purchased a copy of ValueAble, read it, and to have started to apply its principles to ones investing journey.

Does one also have to supply a photo in order to be eligible for your new service?

Regards, and looking forward to whatever it is…

Spot on. Regarding the photo, you don’t don’t have to supply one. I think you might be glad to part of it all when you see what some of the team are working on…

Hi Ron,

I concur, CCP is cheap . My val for 2012 is >$9.

Notwithstanding their issues in the past, current mgt is doing a good job.

It will be interesting to see how the claim goes, any idea how many shares they owned? I saw last wk a shareholder claim vs HIH didn’t get up.

Cheers

Brad

Euroz (EZL) is a stockbroker and funds manager which on the face of it is hardly an extraordinary business but this company’s results have been extraordinary and for the past 6 years it has held signiicant net cash positions. My ROE calculation is based on current period’s NPAT divided by shareholders funds at the close of the prior period. Set out below is a cameo of the past 6 years results:

EPS EPS inc. ROE net cash (000’s)

2006 35.12 43,794

2007 44.30 26.1% 60.2% 50,661

2008 66.6 50.3% 96.7% 93,464

2009 8.07 (87.8%) 10.1% 63,885

2010 20.07 148.7% 28.4% 62,473

2011(H1) 13.72 36.7% 33.7% 52,237

The directors said profits nearly doubled in the first half in difficult conditions (my EPS increase of 33.7% is crude……I divided the prior year’s EPS by 2 to get my base). The two funds that EZL manages are OZG and WIC both of which are trading at a discount to their NTA which is predominantly made up of shares in small to medium public companies.

At 14% return after tax and based off net assets 0f $0.89 I come up with an intrinsic value of $3.03 against a market price of $1.60. One of the things that really appeals to me about this company is that it has $60.6m in current assets and $9.8m in current liabilities so it ain’t about to go broke…….the financial engineers of yestyyear would describe its balance sheet as lazy but I think it’s great…….lots of cash always gives me a warm fuzzy feeling. By the way margin on revenue is consistenly above 30%………I don’t own EZL because frankly I think I’m missing something in my analysis and I’m looking forward to being told what I’ve overlooked.

I do however own TNE but when I used Roger’s formulae the stock price was greater than the intrinsic value so in theory I shouldn’t have bought …..what I did was take the future cash flows (which can be easily measured) and applied the long term bond rate as a discount which produced a significantly higher intrinsic value and thus allowed me to purchase….this is the same formulae that Buffet uses after his other tenets are satisfied. Unless I’m wrong Roger’s formulae is a lot tougher than the value basis that Buffet uses?

Hi Peter,

EZL is described by Morningstar as a ‘specialist financial services co. – stockbroking, corporate finance and funds manangement’, operating PRIMARILY IN WA (my capitalisation).

It occurred to me it’s not a bad thing for a money manager to be based in what might be considered the engineroom of the ‘2 speed economy’. Maybe even a competitive advantage?

Hi Roger and all,

Without wanting to distract the blog from their long weekend homework, I just had a quick query regarding one of your listed homework companies Roger, CSL, with a 2012 IV of $31.43. The only way i can get near this is with an RR of 7% which gives me $31.06. At 10% RR I get $27.16. EPS, DPS and 2011 Book value provided by commsec.

Anyway would appreciate anyone’s assistance with this or your own IV calculations. Enjoy the long weekend and thanks to Lizzy for Monday.

Cheers,

Paul.S

##############

MY IV FOR CSL

2011 – 24.58

2012 – 27.16

2013 – 30.92

ROE (%)

2011 – 21

2012 – 20

2013 – 20

BookValue ($)

2011 – 8.65

2012 – 9.697

2013 – 10.919

EPS ($)

2011 – 1.782

2012 – 1.957

2013 – 2.236

DPS ($)

2011 – 0.802

2012 – 0.91

2013 – 1.014

DIVIDEND FACTOR (divide ROE by RR)

2011 – 2.060

2012 – 2.018

2013 – 2.048

NB: The only change I have here from the book is to directly divide ROE by the RR to 4 decimal places for added accuracy. Not a significant difference to my IV and it’s easier for the spreadsheet, without reference to the book. In the book for instance the factor is 2.00 at 20% ROE.

RETAINED EARNINGS FACTOR (from p184 value-able)

2011 – 3.482

2012 – 3.482

2013 – 3.482

SWM is Seven West Media instead of Western Australia Newspaper.

Seven West Media Group is Australia’s largest diversified media business, formed by the sale of Seven Media Group to West Australian Newspapers Holdings Limited (WAN). It has a leading presence in broadcast television, radio, newspaper publishing, magazine publishing and online.

i.e. when WAN bought Seven Media Group they formed SWM

Roger,

Is it possible for the data in the “homework” table to be presented in a format that would allow me to copy into XLS? Currently I have to manually enter the data from the table into XLS. — Such a pain.

Cheers,

PeterB

PS please note my change of email address.

Hi Peter,

If you want to stay in the Insights notification group, you will need to email roger@rogermontgomery.com and let the team know of your new details. Sorry about the format of the table. Its in the current format to suit the blog template.

Many thanks. Will do.

Roger,

WWA was a valueable business. It is no longer valueable because it was subject to a takeover.

Jarrad.

Well done Jarrad, thats seven! See comments elsewhere here.

G’day Roger, I was a bit alarmed to see your 2012 valuation of ANG. I had $8.73 using 11% RR and obviously too high a ROE. I’ve readjusted to 12%RR and a ROE of 25% going forward to achieve $5.54 – Still considerably higher than yours. Any ideas? They are ramping up expansion, which I believe will pay dividends in the next 12 months, especially here and through South America. They are becoming the complete package offering Design / Construct and Repair Maintenance of the machines.Three things are concerning me though:

1. At what point will they stop acquiring – have your talked to management to see when their business model is complete? – I feel its getting close.

2. Management / Directors have been buying a lot of options for considerably less than the share price (less than $2) is this a case of them serving themselves and not us!

Your thoughts would be appreciated.

I am writing something on buybacks and will discuss options in that.

I’d use a significantly higher RR for ANG as well, Scott.

Hi Everyone,

With markets falling here and overseas, I have noticed a lot of talk here about share prices falling and renewed concerned about the blog’s favorite stocks, FGE & MCE.

With all this distraction, I have discovered value in a quality small cap that has been mentioned here in the past, but seemed to have been neglected with all the distractions around.

No ‘build up’ here! :-)

Credit Corp Group (CCP)

CCP is a receivables management company, specializing in debt purchase and debt collection, primarily focusing on the acquisition of purchased debt ledgers (PDLs) comprised of distressed consumer debt from Australia’s financial institutions.

How does it work?

The business of debt collection for those of you who don’t know, does not involve a collection team going around with baseball bats breaking knee caps, but is more of a call center operation based around chasing up payments from customers who have unpaid credit cards, loans, bills etc. By offering customers flexible payment options, CCP is able to recover successfully the PDLs it purchases from its clients. Part of CCPs competitive advantage is its ability to assess the chance of recovering the debt ledgers it purchases and pricing it accordingly. In addition, the training and systems it uses within its collection teams represent some sort of intellectual property it has built over the years.

CCP has a bit of checkered history with management somewhat misleading investors as recently as 2007, seeing their share price fall from $12 to about 50cents at the depth of the GFC. Fortunately for us, new management has been placed and has delivered on their promises with profit forecast for this year of $20mil. This profit will be achieved on equity of about $100mil. For next year, according to analyst forecasts, they are estimated to earn between 52c – 62c with a payout ratio of about 35% I estimate ROE of approximately 20 – 25% which is quite respectable for this kind of business and is what it has achieved on average over the last 10 years.

Improving metrics:

When looking at debt collection businesses, it is important to see improvements in collection efficiency, which has increased from about $200 per hour 2 years ago to $240 this year despite a 14% increase in head count from last year. Also the percentage of old PDLs recovered from total has increased to 39% compared to 32% last year.

Looking at their balance sheet, CCP (A2 MQR rating, I hope Roger can confirm this) has $35mil in long term debt, but with strong cash-flow allowing to reduce their debt over the last couple of years I feel confident this trend can continue. As of this week’s price of $4.35 it is trading at a 20% upside to this years IV and looking ahead to FY12 I have IV at $6.80 – $8 which is a HUGE upside and safety margin from today’s price.

Verdict:

With relatively high interest rates affecting already debt constrained consumers and businesses, CCP seems to have bright prospects in increasing its careful PDL purchases going forward and has indicated about $60mil in PDL purchases going into FY12 with management stating:

“Expanded FY11 purchasing will contribute to strong profits in FY12”.

With that trend set to increase over the course of the year together with its expansion of its low cost facilities in the Philippines, significant entry into New Zealand market and tight cost controls, I believe this company’s prospects are very bright.

Regardless of what happens to china, commodity prices or the Aussie dollar, what I like about businesses such as CCP, BGL, VOC, MTU is that their services are essential to proper functioning of our economy and livelihood.

Finally, I know Roger has mentioned his interest in this company in the past and now happily, so can I.

AS ALWAYS please do your own research before rushing in to buy this company. I also suggest you perform your own IV calculations to make sure you are happy with the results. Good luck.

Hi Ron,

Did your research reveal any further developments in relation to the pending litigation against them? The last time I looked, the next hearing was scheduled for August. As far as I’m aware, the plaintiff’s action against CCP is being professionally/externally funded and CCP have not made any contingent provisions in their accounts for any claims or costs which may arise from this action. This tends to suggest that that they are

either confident about a favourable outcome on the action against them, are fully insured against it or both. Would be good to be able remove this uncertainty from the investment opportunity and would welcome any thoughts you or others may have on the subject.

NOTE 9: CONTINGENT LIABILITIES

On 23 December 2008 the consolidated group received a Statement of Claim (Statement) and an

Application under Part IVA of the Federal Court of Australia Act (Application) from Clime Capital Limited

(Clime).

The Statement contains allegations that from 7 November 2007 to 11 February 2008 the consolidated

group engaged in misleading conduct by making certain express and implied representations for which it

had no reasonable basis and breached its continuous disclosure obligations by failing to promptly

disclose certain matters regarding its profitability.

The Statement contains assertions that the consolidated group’s alleged conduct constitutes breaches of

certain provisions of the Corporations Act 2001, the Australian Securities and Investments Commission

Act, the NSW Fair Trading Act and Australian Securities Exchange listing rules.

The Application seeks an order for compensation for Clime and other parties represented by Clime who

are part of a group which has entered into litigation funding agreements with IMF (Australia) Limited.

The consolidated group maintains insurance that addresses this type of claim. Notwithstanding the

existence of this insurance, the consolidated group is not insulated from all costs and damages which

may arise from this claim. The consolidated group maintains an appropriate accrual for litigation defence

costs at the reporting date. No provision has been recognised to cover any potential damages that may

be awarded by the Court.

A tentative hearing date in August 2011 has been set for the matter.

Nothing new by the look of it but thanks for taking the time to respond.

Hi Peter, all I can add is that if management is not too worried, neither am I. Cheers

I have been looking at CCP for a while now and the numbers are very good. However, I haven’t purchased it because of a lack of competitive advantage for me.

I have worked in this area (call centres) for many years and across 4 difference call centres part time during my studies and it is my view that there are very low barriers to entry. It is very easy to start up a call centre and with high staff turnovers being the norm in call centres (perhaps CCP bucks this trend?) any IP from training and internal systems walks out the door and is easily replicated. Furthermore, in the call-centre debt collection space there are already a number of competitors including the big banks and others like Dun and Bradstreet.

And I struggle to see that they have a competitive advantage from “its ability to assess the chance of recovering the debt ledgers it purchases and pricing it accordingly.” I think more information is needed on this and how it translates into a competitive advantage.

As I’ve said the numbers are all good, high MQR, a good MOS as well as it being a business which diversifies our portfolios away from the retailers (JBH, ORL) and mining services (MCE, FGE, SWL etc), however the lower barriers to entry have prevented me from buying it.

But I would be happy for someone to show me otherwise (with the numbers being so tempting!) because my focus may be limited to the call centre aspect of the business.

Hi Parag, you may be surprised but most businesses don’t have a clear competitive advantage but if their track record shows some attractive consistent characteristics and looking forward their prospects are bright and in addition they are trading at a big discount to current and future IV then i am always tempted!

Thanks very much Ron. Most informative and confirmatory. I decided Credit Corp was near 20% below IV at $4.35 too.I seem to remember Roger somewhere suggesting IV was over $5.

I had been watching CCP with covetous eyes and a sinking feeling go up and up over the past year, then bought too early and too high (exactly as in Roger’s kind and accurate observation!).

Fortunately I was able to buy some more and so ‘average down’ – a great ‘fix it’ strategy for premature purchasers, providing the stock’s good.

Also, doesn’t “the training and systems it uses within its collection teams represent some sort of intellectual property it has built over the years” sound like a competitive advantage?

Is there a patent on the training systems? I would have thought its hard to get patents on such a thing, but need confirmation. If not, it would be easy to replicate in any other call centre, for example if a senior call centre worker leaves CCP and goes to another debt collection call centre as a ‘team leader’ or ‘team manager’ and trains their staff on the same training systems/collection processes. Again, this is all from my experience working in numerous call centres.

Also, I agree, it is very difficult to often find sustainable competitive advantages in too many companies. But I have learnt that when you have to look hard to find one, it probably isn’t that strong…a sustainable competitive advantage smacks you in the face and is obvious.

This raises an interesting point, for example I am currently looking in the IT sector, there are some really good companies with no debt like SMX and DTL that are showing a bit of value. Looking at their numbers, they have sustained high ROE (on no debt) for a number of years. It’s hard to find a competitive advantage with IT firms as it is hard to know if they will be bigger in 5, 10 15 years from now or if other competitors will come along and dominate the market in the future with low barriers to entry. However, they clearly have something great going on achieving 30-40% ROE over the last 5 years. So I suppose my approach for this scenario would be to buy with big MOS (20-30%) on conservative future projections.

In my opinion it is. Also don’t underestimate their ability in assessing and buying debt ledgers successfully.

G’day Ron,

I was among those who were severely burned by CCP a few years ago and it has taken until recently to forgive them, even though the CEO at the time is long gone. I didn’t even look at them again until about 6 months ago. I feel that they have learned from the experience and to me look to be back on track. They are disciplined in their ledger purchasing and I also feel that the economic situation will continue to present them with plenty of opportunities. One point I disagree with you on is your comment about relatively high interest rates. I don’t regard current interest rates as high, but I do think that small upward revisions will have a big impact on the many people who have overborrowed. Bad for them, good for CCP.

I disclose that I bought a small number around $4.50 on the recent dip.

Hi Greg, notice I wrote ‘relatively high’. I wrote that specifically for the reason that relative to consumer’s high debt and mortgages, current rates seem high. Obviously if wages will double overnight then these rates will seem relatively low, but whats the chances of that? Thanks for your feedback.

I’ve taken the opportunity to add some FGE at $5.12

Rainsford

WWA seems to be not listed anymore.

And thats six grads who have picked it up: Have to keep it in though to see if anyone else picks it up – which will show who’s doing the homework properly.

I noticed this too. Are you messing with our minds, Roger? ;-)

It’s the little things that make a falling market fun over at Montgomery Inc. headquarters

I was disappointed when forced to give up my wwa shares, they were a great little company to own.

Yes, they were good. A reasonably tax effective takeover though for the SMSF.

“5. Which three are going straight to the top of your Value.able watchlist, and why?”

Well it won’t be WWA thats for sure!

You may want to check your computer generated output run.

WWA was delisted 22/12/2010. Better raise a bug request to the programming team before the Value.able software is launched!

— Kisses, LL —

Thats five people who have picked it up: Just checked. No bug. Perfect. Have to keep it in though to see if anyone else picks it up – which will show who’s doing the homework properly. Note the comment in the post: “it’s not a list of all companies trading at prices less than they’re ‘worth’”

Hi Roger

Is WWA still listed on the ASX?

cheers

darrin

Well done. Four grads have picked it up: Have to keep it in though to see if anyone else picks it up – which will show who’s doing the homework properly.

I am exhausted doing IV and they keep changing with the downgrades! And yes I will sign up yesterday for your new product Roger. In regard to Woolworths I have back tested a bit and cant find any point in time when WOW traded at a margin of safety of 30%.

This either means I have to compromise my min 30% to say 10% or buy something else. Anyone else share this problem? Just in case the market tanks I have a falling trigger buy at MOS 30% for 4000 shares but I am not hopeful of getting set.

Good luck with the new product.

Cheers Punchy

You could write puts down there while you wait…Better get some personal professional advice first.