What did the company really earn in 2011?

Last night on Sky Business, I discussed a quick back-of-the-envelope way to get to the heart of a company’s true cash flow performance. This will be useful for you during the upcoming reporting season to help you determine whether to investigate further, or to move on.

Last night on Sky Business, I discussed a quick back-of-the-envelope way to get to the heart of a company’s true cash flow performance. This will be useful for you during the upcoming reporting season to help you determine whether to investigate further, or to move on.

It’s very simple. The exception being financial services and insurance companies, which can be problematic and require many more ‘edge-case’ explanations that are best kept close to my chest (with apologies).

So here’s what you do.

1. Find the Balance Sheet and Cash Flow Statement of a business you wish to examine (use the current year’s annual report) and lay it out on a table.

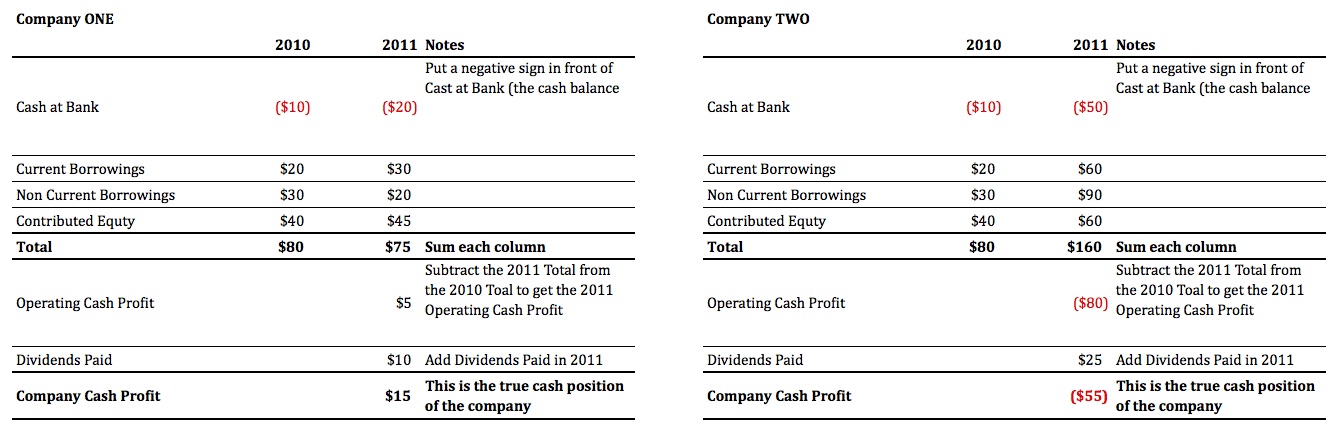

2. Pull out the headings you need and arrange them as illustrated below (Cash at Bank, Current Borrowings, Non Current Borrowings, Contributed Equity).

3. Put a negative sign in front of Cash at Bank.

4. Now sum the two columns.

5. Subtract the current year Total from the previous year. You can do this with half-year results too, for example, compare the 1HY11 with the final 2010 results.

6. Finally add back any Dividends actually paid in the 2011 Financial Year (get this from the Cash Flow Statement).

7. Done.

Now you have a number that better reflects the true change in the company’s cash position. The changes in every other item on the balance sheet will explain this number. But this number – Company Cash Profit – is the number.

The company at left earned a positive cash profit. What about the one on the right? It lost cash during the year (or spent it on an acquisition(s)). Click the image to enlarge.

Why don’t you run the steps yourself on a few companies in your portfolio and see what you come up with. Where there is a big difference between your calculation of the company’s cash position and the reported profit, pop it up here at our Insights Blog.

This simple calculation is just one of over a dozen other simple strategies detailed in Value.able to help you improve your investing. They’re all there in one comprehensive guide.

If you haven’t yet ordered your copy, now isn’t the time to procrastinate. The last print run for a long while is walking out the door right now. Order your copy at my website, www.rogermontgomery.com.

Posted by Roger Montgomery, author and fund manager, 3 June 2011.

Hi,

RE: Cash profit for MCE

I just updated my numbers for MCE’s cash profit.

It looks bad….

-$46 million for 2011

-$15.5 million if you add back in payments for PP&E (compared with +$25.8 million for 2010)

Can someone please let me know if they have similar numbers?

thanks

Russell

I got the same number. Are we doing something wrong? The business turned a book profit so that is quite different to my cash loss calculation.

Hi Roger

I have made an attempt to calculate Cash Profit for Campbell Brothers (CPB) as below using the Annual Report published on 24th June. Not sure if I chose the right figures for contributed equity. I used the figures in Cash flow statement (Page 47) “proceeds from issue of share capital”. Other figures all from Balance sheet on Page 45.

Hopefully yourself or another valueable follower can verify whether this is accurate or not.

Regards

Martin

CPB Campbell Brothers 2010 2011

Cash at Bank -57,937 -87,123

Current Borrowings Bank O/d 19 3,135

Current Borrowings Loans 8,364 42,782

Non current Borrowings 196,514 152,680

Contributed Equity 192,415 0

Operating Cash Profit 339,375 111,474 227,901

Dividends Paid 45,416

Company Cash Profit 273,317

Hi Martin,

I have no doubt someone will enjoy checking your numbers. Helping each other is what the insights blog is about!

Hi,

An AHA! moment with MCE.

I’ve re-read chapter 9 of Value.able, and I think I know why the cash generating position of MCE is better than it looked to me.

First, I figure out the “contributed equity” problem – it’s just issued capital, and doesn’t include the retained earnings.

Second, MCE is paying for PP&E. If you add that back in, the true cash generating nature of the company is a whole lot better.

The Value.able example is JB Hi-Fi on page 155, along why this makes sense.

MCE is investing heavily in its new site at Henderson and this will increase its production capacity by 100%, which has already been increased by 400% as at June 2010.

Roger, is this dumb Value.able graduate getting a little better now?

cheers,

Russell

Hi Roger,

Forge ( fge ) is a great company and if I did own it I would only check the price action once or twice a month and YES I was kidding about future movements,( how would I know! ) Roger using your formula helps me delete some more companies from my watch list which I love doing. From debt levels, working capital, return on equity and much much more, thanks again

Hi Chris B

RE VOC and Dark fibre “moat”

Thanks a great question – does anyone have any views?

Hows does having a dark fibre network give VOC a competitive advantage?

Cheers

Brad

I agree. AN excellent question and also interested in your views. And always remember Munger’s quote: “If I taught a course on company evaluation, I would ask the following question on the exam, “Evaluate the following internet company.” Anyone who gave an answer would be flunked.”

I’m really interested in all Charlie has to say although that is a perfectly ridiculous statement.

Not all internet companies are the same and to lump all together as one shows an incredible amount of ignorance.

During the tech bubble anything remotely connected with the internet showed dramatic increases in price irrespective of their earnings or prospects. That said there are some standout companies in the internet sector whose business can be evaluated, who have superior and insightful management, a clear business strategy, who provide an excellent service and who report profits and show excellent prospects to increase future sales and profits through a diversification of services whilst being able to maintain margins.

Vocus is one although I’d agree that its future is harder to predict than say Coke or Gillette.

I wrote to James Spenceley shortly after the Dark Fibre acquisition and he gave a very precise and simple explanation as to how the acquisition would benefit Vocus and its customers. I wont go into detail although now they wont just be providing internet services but metro data services as well that ISP’s buy to provide to their business customers. Also, owning the infrastructure will allow for higher margins.

The competitive advantage comes from their owning the infrastructure, the speed of the network and managements ability to operate the network.

Very, very, very high margins.

Talking about IT related companies. How does ASZ rate in Montgomery world. Consistent ROE in mid-teens for many years, healthy dividend payout rate – yet the market is either bored or dislikes it and has sold it down significantly over the last 6 months. Am I missing soemthing?

Estimated Valuation = 69 cents. B2. IV has been rising 8.00% and forecast. For HY11, ASG revenues increased 27% to $74.1m but NPAT fell to $6.1m 1) increased finance costs, 2) higher employee expense, 3) higher depreciation cost and an increase in operating lease payments.

The more i look into this type of company the more i think it isn’t for me as i just don’t understand them and the change is so rapid i am not to sure about what to expect in the future. Indeed, i think i understood the heiroglyphs on the artefacts of the Tutankhamun exhibit in melbourne more.

I would also be interested to hear from others in the know about this company and why it has such a big “moat”. I get part of its competitive advantage but when it comes down to the technology part of it i am sometimes just scratching my head.

Until i understand it more i still have a red mark next to the company saying do not invest yet.

Hi Andrew

It would take a very long message to explain all the deatils involved but essentially internet traffic into OZ comes pretty much from undersea cables and then from there goes thru telstra old copper network, and various other companies (mostly major city networks – which is why reginal oz needs satelitte). People have mentioned BGL and their great new 4G style wirelesss network that can have upto 30km range but all the data that supplies this wireless network comes from the cables under the sea out of OZ just like mostly you and I get from our ISP’s. VOC has IRU’s for the undersea cables that supply all our internet traffic and its a bit like a tool road for the internet. And with all the Y-Generation younger people and tech savies with their Iphone’s blackberries, IPod, iPad, antroid tablets and various other devices becoming more prevalent by the day the growth in the use of data from the interent is predicted to be quite large.

A recent cisco report said “By 2015, annual global IP traffic will reach 966 exabytes – showing a compound annual growth of 32 percent from 2010 to 2015, according to a new Cisco report. This huge number is nearly a zettabyte – or a trillion gigabytes – equivalent to 20 billion DVDs or 19 trillion MP3s.

According to the Cisco Visual Networking Index, network-connected devices will outnumber people two to one and a million minutes of Internet video will be transmitted every second.

In the same period, Australia’s IP traffic growth is slated to overtake the global rate – increasing sixfold from 2010 to 2015 and showing compound annual growth of 41 percent. That’s 514 petabytes a month in 2015 (up from 91 petabytes in 2010) or that equivalent of 2 billion DVDs per year. ”

seeing so many people on the train going to work (and at work) using their internet enabled devices checking facebook, twitter, weather , sport scores or when you are having a chat around the water cooler and you not sure on something everything whips out their device to check on google so it was in this space where data usage is on big increase and VOC is a stock leveraged to it…..

Also on the data usage front meant major software companies are also turning to not supplying software via disks any more but via download services. EA a game company is setting up a itunes like store to release all of their ipod, xbox 360, ps3, wii games this way and then there is STEAM, telstar t-box which you can download movies, new DTV’s which download movies as well and netflix etc etc

.

I think this may be why some people are big on VOC style companies

CHeers

Darren

PS I don’t currently own VOC

I forgot to add that its quite expensive and time consuming to lay new cables which adds to VOC moat!

The BIG thing with Voc is the fact that contracts expire in 24 months on average of course staggered. If you believe that internet usage is going to grow then profits for Voc will grow due to these contracts, even if Voc does nothing else. In the short term this is the most important thing. Also Voc is not expensive at the moment and is likely to look very cheap at these levels for 2012.

I own Voc and this is my opinion so please do your own research.

It may be expensive and time consuming to lay new cables, but I have seen plans for two new undersea cables announced in the last month! If there is as much demand for data transfer as everyone thinks then I would expect that it is only a matter of time before supply increases to meet that demand. The risk, of course is that the additional supply may exceed the additional demand, which will erode everyone’s profit margins.

I am currently with Andrew in that Vocus is well outside my current circle of competence. I still can’t see clearly where their big advantage over other providers of data transfer (including dark fibre) and data storage services lies. I am willing to accept that their management team is one of the best in the business, but even the best management will perform better with the support of a decent competitive advantage.

David S.

Thanks David…unless they themselevs are the competitive advantage?

BHP Billiton Ltd. announced this week that it has begun producing oil from a new well in the Gulf of Mexico, the first company to do so since the Obama administration lifted a ban on deep-water drilling, and has begun drilling a second well. This bodes well for companies like MCE going forward into 2012 and beyond, as The Shenzi facility is located about 195 kilometers off the Louisiana coastline and is in about 1,300 meters of deep water.but I want to focus on BHP in this post.

The SB-201 well (1st well) in the Shenzi field was brought online at the end of May and is currently producing about 17,000 barrels a day of crude oil and is one of only 11 (current) producing well in the field.

BHP’s petroleum division has in addition received approval for a second deep-water well on the field, and drilling began on this well last week, given that U.S regulators have allowed companies other than B.P to resume drilling operations. BHP in adding oil production from the deep-water Gulf of Mexico portfolio, may show an intent by Michael Yeager the chief executive of BHP Billiton Petroleum, to expand BHP influence in deep-water oil production and could see several new oil wells drilled in a series of joint ventures with other U.S companies.

Given the fact that B.P is yet to return to oil exploration in the area after the explosion of the Deepwater Horizon drilling rig in April 2010, which killed 11 workers and set off the worst offshore oil spill in U.S. history.

It would appear that BHP has filled a void left by B.P, given that in last month BHP had become the first oil company to pass a complete environmental assessment for an initial exploration plan in the Gulf of Mexico since the spill.

So in the near term we should expect BHP to further invest and entreath its competitive advantage as being the most reliable safe oil exploration company and may be viewed in favour over B.P for future joint ventures in the region.

Thank you very much for sharing and for taking the time to write. This is the sort of Insights that should be encouraged on the blog. Thanks again Simon.

Hi Roger

Just thought I’d do a cashflow analysis on AA co (ASX :AAC) even though they’re C4. I’ve done it for 09/10 so when 2011 figures come out it’ll be easy do compare to see if there is any improvement by the new management.

AAC

09 10

Cash (9.6) (17)

C/B 27.5 86.6

NonC/B269.2 270.7

Cont.Eq 172.8 172.8

Total 459.9 – 513.1

Operating prof (53.2)

Divs 0

Company Cash Prof (53.2)

As we can all see there is a lot of room for improvement and I feel that if there is going to be a reliance on agricultural companies to help feed the world in the coming years they need to step up to the plate and get their finances into positive territory so we ,the investor can help them grow and be confident with our investment in them. I chose AAC ( I don’t hold and won’t unless there’s a big change) because they are a leader in my industry and I have a far greater understanding of them . I hope that the new ‘leopards’ running the show don’t have to wear the ‘old spots’. Time will tell.

Just my view

Cheers

Pete

Great stuff Peter. Thank you for taking the time to share.

As well as FGE and Matrix looking like attractive buys, here is a cut and paste from yesterdays Australian about Zicom. (disclosure – I am a holder).

Zicom Group (ZGL) 51.5c

YOUR columnist has mentioned this specialist manufacturer and precision engineer as an undervalued mining services stock, but no one seems to have taken the bait so let’s weigh in again.

Apart from its silly name, there are reasons why Zicom is unpopular: it’s Singapore-based (no offence) and operates in obscure or underappreciated sectors. But to date its performance has spoken for itself and there’s no reason why it can’t continue.

In oil and gas (40 per cent of revenue), Zicom makes heavy-duty winches for offshore vessels, as well as off-the-shelf gas processing plants. Its construction arm makes cement mixers (operations have recently moved from Australia to Thailand), while an engineering division makes niche stuff such as medical devices.

EL&C Baillieu analyst Simon Dumaresq notes Zicom’s “exceptional” first-half earnings growth. Earnings doubled to $S9.08m ($6.9m) on revenue of $S70m. “Zicom is a conservatively managed company” that is benefiting from capital investments in its businesses during the global crisis, when many competitors struggled for survival.

After a recent squiz at Zicom’s ops, Austock analyst Heath Andrews argues Zicom’s potential “is better than we first thought”. It services the Bangladesh gas market, which sounds unappealing until you realise the nation relies on gas for generation but has little associated infrastructure.

But “Zicom has several elements, such as reporting in Singapore dollars and having operations mainly in Asia, that mean a (valuation) discount will apply”.

But the markdown looks more suited to a Borders liquidation sale. On Baillieu’s numbers, Zicom trades on a current-year earnings multiple of 7.3, compared with the sector average of 15 times.

We rate Zicom a buy.

Roger and valuables

Roger I dearly love your book and use it as part of my own personal analysis approach. Put simply I combine quality, i/v with a technical edge to make my entry point into and out of a stock. For example, there is an obvious head and shoulder pattern on the fge chart that I simply recognised and that made my decision easier not to purchase it (yet). My hand has been on the trigger for the last couple of months yet in my eyes companies like fge, jbh and mce had yet to correct properly to provide me with an opportunity to purchase them, so I missed out on any rise in price that these stocks have had even though I calculated them well under i/v. Fast forward to now these stocks are now presenting both VALUE and a technical setup to buy into.

Great that you love the book Richie and that it’s helping your investment. Not sure that Roger would approve of chart patterns with regards to investing decision, but as long as it works for you, that’s what makes the market. For me, the only point that matters to me is that a great company is available at discount to intrinsic value, with a margin of safety. I don’t mind whether the price is going up or down, as long as that discount is there, that’s all that’s important to me.

I am content for people to use whatever works for them. I think the idea of combining a successful technique (if you have one yourself) with quality and discounts to intrinsic value is fine.

Hi all,

My first post and a big thankyou to Roger and this community for all their insights, I think it’s a credit to all of you for sharing your experiences and thoughts. Now I know this is not a technical forum but just in relation to Fred’s post on the 6/6/11, concerning his thoughts on the Forge (FGE) price retreating back to the $3.50 or $4.00 level, here’s my two bobs worth.

I’m certainly not a technical analyst either although I have dabbled in the past and while not an exact science I like the price support at $5.00. This area provided some stiff resistance back in Nov and Dec of last year before the price broke through in January. Resistance becomes support when broken. I also like the classic head and shoulders formation that formed before this latest sell off, with the left shoulder forming in March, the top of the head forming in April and the right shoulder forming in May. These formations can be used to predict how far the price will fall (or so the theory goes), so in order to do that we measure the distance from the Head High ($7.03) to the “neck” of the formation which sits at approx $6.00. So we have $1.03 difference. We then work out $1.03 off the $6.00 neck line and get close to $5.00 at $4.97 approx, the same area where the key supports are.

Talking of “necks” I’m sticking mine out so this was never written if we fall too far below $5.00. I should declare my hand also that I do own some Forge shares.

Cheers….Paul

Thank you Paul.

I am all for investors combining their Value.able tools with any charting technique that works for them. As there are many other avenues for charting, please keep the Insights blog a chart free zone.

Hi Roger,

Yep agreed, just thought i’d add something to Fred’s early post.

Cheers,

Paul.

FGE:

ANNOUNCED A $65M EPC CONTRACT WIN ON 2 JUNE 2011 FOR SANDFIRE, WORK TO COMMENCE SEP 2011, FOR THOSE OF YOU WANTING TO SEE SOME CONTRACT WINS…

Hi Roger

In Fred’s blog he mentions that Forge is heading downward which may provide an opportunity to buy more.

What if you had bought the shares at say $4 and see it rise over a couple of years to the IV of $8-$10 and to see it now decline from those levels. What is the valuable approach to this scenario?

cheers

darrin

FGE + MCE

I am rubbing my hands with pleasure.

I just bought more FGE( $5.01) and MCE ($6.82).

UNAFRAID

Zoran

Darrin,

The precise approach will be completley down to you. I think until you turn the sharemarket off than you will never truly get the value.able mindset you are in search of.

Markets rise and fall based on supply and demand for shares. The precise reasons between the spikes of supply and demand are quite huge in number and some are completley without logic. You can;t take your cues from the market to try and work out whether what you are doing is right or not.

How would i act?

In the scenario you mention, i would instead of focusing on how high or low the company share price has gone, i would be looking at whether the future prospects of the business, its environment (competitive advantage etc) and health has changed. If the answer is no and my estimate of intrinsic value is higher than the market price i will simply hold or use the low price to accumulate more shares in a good thing if a big enough margin of safety exists.

Truth is nobody knows for sure where the price of any company is heading over the short term – it’s crystal ball stuff. I personally originally bought FGE at around $3.30, and I couldn’t care less if the price drops further – in fact I hope it does.

The price a stock happens to be is only ever relevant at two times – the exact moment you buy and the exact moment you sell. Otherwise it should be of little concern to you.

If you beleive it is a wonderful business, and there is a margin of safety great enough for you – then don’t try to wait it out or pick the bottom – this is not investing.

It’s also very important to always have a cash reserve, to avoid the need to sell shares at an in-opportune time to cover any unforseen expenses.

Hope this helps

Hi Darrin,

Roger is continually reassessing his holdings. He turns the market off. Unless something changes in the business then he will be happy to stand by his initial decision and continue to hold.

Darrin, this is regardless of whether Mr Market has the stock under or over priced. Business value and Mr Market price are two different dogs with different masters.

Whether Mr Market is up or down does not matter. The value investor is only concerned with the opportunities he throws up.

Cheers

Rob

HI Rob

As always keeping me back on the valuable track.

cheers

darrin

Rob,

If Roger turns the market off as you say, his reply to another post re Atlas Iron – “They rallied above my future valuation. See the Chapter entitled Getting Out in Value.able.” must indicate that he is psychic. How could he know that if he had the market turned off ?

Brian

I sleep with one eye open too. Seriously, you have to turn it on to see if anyone is doing anything silly.

Hi Brian,

One of the great advantages of value investing is our ability to turn the market off. While TAs are addicted to the price movements value investors are more concerned with what is happening on a business level.

Turning off the market doesn’t mean going to sleep (even with one eye open), it just means your decisions (and emotions) are not based on what Mr Market says.

You have to be awake so that you can take advantage of the opportunities (buying and selling) that Mr Market sends your way.

Roger talks about tuning out on p13 of Value.able and posted a great blog on Switching the market Off here – http://rogermontgomery.com/is-your-stock-market-still-turned-off/

Darrin, Chapter 3 of Value.able is where Roger talks about “Value not Price”.

Cheers

Rob

Hi Roger

I know your guidelines have asked for blogs to not be directed to anyone in particular but the frequency of these types of blogs is driving me (I can’t be the only one) insane! Not to mention devaluing the worth of this resource. If you permit this I believe it can serve as constructive criticism. I understand if it doesn’t get through.

Darrin

With all due respect your blogs seemingly appear to be just veiled queries for financial and investing advice. Most bloggers here are very obliging with their time and knowledge (led by Roger) but we simply cannot tell you when to buy, sell or hold any shares.

The legislation regarding who can offer financial advice in Australia is quite strict. Whether some of these people should be offering advice is another subject altogether ;)

You really need to learn as much as you possibly can about value investing and then apply your new found knowledge to your investing based on your own decisions according to your personal investing profile.

No one can know your personal circumstances and personality, psyche, stage of life, investing knowledge and investing tolerances all effect our decisions and are individual and unique. What’s good for me or you will not suit many others.

Constantly asking should I buy, hold or sell at such and such price is not investing and really diminishes this blog as a great resource where like minded individuals can share information and insights on investing, businesses and industries.

My advice to you is read, re-read and absorb all you can handle from Roger’s book and any other investing resources you can lay your hands on. The wisdom of Buffet, Munger, Graham and Fisher and other great minds are at your fingertips with the internet.

Roger offers this fantastic resource and I’m sure his goal is to arm us with our own tools to apply to our own circumstances. He has made mention of this being about offering a leg up but it’s not about giving us a hand out!

If you are looking for advice or share tips perhaps you should engage a full service broker, invest in ETF’s or managed funds who will make these decisions for you until you feel that you can make these informed decisions independantly for yourself.

Good luck and kind regards.

HI Sean

Thankyou for your comments.

I am certain it will help me become a better manager of my money

cheers

darrin

Well said Sean,

I particularly liked this ” Whether some of these people should be offering advice is another subject altogether.”

Thought that was good but all of it is very good.

Couldn’t have said it any better Sean! The generosity on this site (particularly with RM’s time and input) is without peer. The one thing I will add is to those that continue to push the boundaries of integrity, be prepared for a corresponding Karma cost…

Well said Sean.

Cheers,

Peter A.

That’s very neat, Roger and so simple

Hi Roger,

Forge Group ( fge ) I am NOT a technical analyst but I can see forge retreating back down to under $ 4.00 and maybe $ 3. 50. I know that this room does not believe in P/E levels but history does show a average low P/E level for Forge. Watching TV the other night and things they said well the trend seems to be down. ☟☟☟☟

Good opportunity to buy more $$$

How’s that MOS looking for MCE ? Red Alert! Fallen below $7 prices that haven’t been seen since January.

Fred, Maybe FGE, JBH, CCP and MCE, have retreated because the technical analysts are selling because they have broken some sort of support level. If there were no technical analysts around maybe there would be fewer buying opportunities.

Spot on Ken, or are we just going through a period of time where the market is in transition. Perhaps shares are just moving from Scared Blue Chip Investers (with really smart Brokers to guide them) as well as speculators and Day Traders into the value investers portfolios, Then we can give them back when the share price goes well above our IV. :)

hi All,

I was hoping ot have a bit of a discussion on the blog post above using Oroton as an example. (2009/2010)

Cash -197/-267

Current 1325/1396

Non Current 4319/8210

Contr Equity 22523/22523

Total 27970/31862

Operating -3892

Dividends 19214

Company Cash $15322

So in Orotons case the operating cashflow figure (i.e before adding back dividends) was a negative figure but after adding back the dividends you get a pretty healthy positive figure.

What are the potential reasons for the negative before dividends and positive after? I will re-read the cashflow chapter on this when i get the chance but was hoping someone might be able to point me in the right direction.

Obviously the negative operating variance is due to the increase in borrowings both short and long term, so what does this mean in regards to the company cashflow figure? Does this mean that an element of the dividends was paid out of cash reserves or debt?

Just want to try and get my head around this as this is the first time i have seen the combination of one negative and the other positive.

Hi Andrew,

I am not directing this at you however, I would like to issue a stern warning. I am happy to continue helping but I have noticed a few people coming here to “get help” but have discovered its not for their personal use. They undermine the insights blog and my work by plastering the results everywhere else. I can’t support this.

Hi Roger, I fully support you in this. I think i haven’t made it as clear as i usually do, when i ask for opinions, i mean from the people on the blog and actually don’t expect you to answer, you have bigger things going on and i like others can’t wait to see them.

Keep up the good work with everything Roger.

I have always viewed a dividend payment as discretionary – ie. this is something a company elects to do with its cash, rather than something it has to do to pay its bills. Where it does become strange is where a company is effectively borrowing money to distribute as a dividend (which is how the above appears), which I do have trouble getting my head around. This almost smacks of the mantra around ‘optimum’ levels of leverage, which I don’t buy into.

If the company needs the money for its business, and can generate great ROE’s on that money, I’d much prefer it kept my potential dividend payout and used that – chances are, I can’t get that return on it anywhere else, and that’s before any potential tax or other implications of the forced realisation that a dividend implies (even imputation credits are only of value to a Australian resident shareholder). If I needed the return, I’d prefer to simply shed some shares – with modern brokerage its a minimal cost, and the shareholder can totally control the need and the timing.

Unfortunately, there are companies around that view consistent dividend streams as important, and, shareholder communities that demand them (probably the same thing). To me its pandering to shareholder naivity, and to a major degree, laziness.

Andrew

Well articulated and in some respects a position I share. Like trying to stop the tide though…

Paying no dividends and reinvesting is great in theory. In practice Berkshire Hathaway is about the only company that has done this over a long period of time. Where companys earning high rates on return don’t pay dividends they accumulate cash – and then there is a risk that after exhausting their logical areas for growth, they go and do something stupid, like overpay for an acquisition. Paying dividends can lessen the risk of such value destroying behaviour.

Indeed, Berkshire takes the retained earnings of all the companies he buys (dividends?) and buys others with it. If Woolies or Commonwealth bank ceased paying dividends and used their cash flow to buy everything else that generated 20% ROE, then they would be able to replicate…

Hi All,

All this talk of retained earnings applies very well to MCE. Peter Switzer did an interview with Arron Begley a few months ago, and asked him why Roger supports the company so much. One of his first answers was that they pay dividends! At this stage of growth, they shouldn’t. I want them to keep the money and finish their factory.. The dividend isn’t a meaningful amount anyway. They are cash flow negative – they just paid a dividend – and then raised more money. I like their prospects.. But running the company this way gives me some concerns.

RobF

I doubt anyone here would ever hear me say that I support any company ‘because’ it pays dividends.

Hi Roger,

One quick check I do is check if ROE is high ( say 20% or more) and it is equal to ROC. This quickly concludes if company is making profits using borrowed money. anything right/wrong with this approach? Any pit falls? Obviously this is on the only test I do, but if this fails I wouldn’t even look at the company.

regards

Prasad

If ROE = ROC then debt = zero. So for companies with no debt, there’s not much point. For companies with lots of debt, there’s no point in doing the calc either.

“The company at left earned a positive cash profit. What about the one on the right? It lost cash during the year (or spent it on an acquisition(s)).”

If the implication from this statement is that company one is somehow better than company two then I would suggest that’s a misleading conclusion to draw.

The -ve cash shown for company two can either be because its a lousy business but also it can be due to due to high growth rates and internal reinvestment needs that are greater than internal capital generation from the business.

An example of this that people seem to like is MCE. In 2009/2010 they had -ve cash profits under this method. So here is a company fitting company two profile even though earnings were just really starting to kick into high gear and which subsequently seems to have become a favored stock. The -ve cash profile was due to the high capital reinvestment needs that were satisfied by IPO cash and borrowings.

I’d be careful of any conclusion that “this number – Company Cash Profit – is the number.” without understanding the growth and reinvestment needs to support that growth.

Agreed, and precisely why I wrote: “(or spent it on an acquisition(s)).” It may end up being a very lucrative acquisition. Your future posts will not be published unless you use your name.

Roger, I think everyone should have to post their full name at the very least. Also I reckon they all have to have purchased Valueable before they can post. Also everyone has to register with a password and a small yearly contribution.

Have to disagree with the full name part. i am not trying to hide anything but, and you can call me paranoid, i prefer having very little out there that can be directly traced back to me, i deleted facebook for this precise reason. Especially when the view i have is that other followers on this blog wil google the full name to see what they find. Roger can work out my ful name from my e-mail address and i trust him as i know who he is and that he is professional. I would not want some people on this blog searching me to see what they find (which wouldn’t be much).

The buying the book part i have no problem with as i have done it and i have no problem with registering so it is easier for it to be moderated.

I wouldn’t be here if we had to pay a fee (i know that does not necessary mean a loss to this blog), you could argue i have by buying the book. As informative as this blog is and as much as i enjoy it i would walk away if i had to pay as it is a bit of a luxury in my view and i could use the money, whatever amount, better elsewhere.

I actually think by charging a fee you might find that the peole who stay are the ones who simply want the others on the blog to manage their ivestmensts indirectly or try to self promote themsleves and result in less quality discussions for them and the people who want to have an insightful discussion will just go away and keep things to themselves.

One thing i am truly worrying about still is the future of this blog quality, rogers views are worth the money but the comments area let it down. In this blog for example we have a topic which is interesting and directly relates to the style of investing that we like and is a large part of identifying quality companys but there has been next to no discussion on the actual topic of the blog and instead the only discussion is on what is happening to Forges price (without even doing the exercise above for forge).

I thought for sure this topic would have had a bit more chance in keeping the discussion to the specific blog post topic.

Andrew,

I won’t be charging anything for access to the blog. I am raising the standard here in the background. Lots of comments aren’t being published. they need to add value to the communities knowledge base. Notice some previously frequent commentators are gone? For every really great insight there were a hundred “whats happening over at XYZ, Share price down 3%!” “LOL’s” “IMHO’s” etc etc. Gradually we will get there.

Hi Roger and fellow bloggers,

‘the market still seems expensive’ has been covered here before (Jan. 2010) and more recently, but I would like to bring this opinion up again. Reason being, I am working on a method for calculating most recent 6th month reporting year’s IV of the major indices around the globe – in particular ASX200 and the S&P500 as a means of comparing against the indices. If anyone has attempted this before I would be interested in your thoughts (and or inputs). I think it would be a useful set of numbers to use as a benchmark rather than relying on index based reporting.

Regards

MarkAb

Hi Mark,

Yes, I have attempted it Mark and its already complete. Works a treat too. Stay tuned…

(Don’t go subscribing to anything annually or take up any ‘beat the taxman pre-June 30’ offers until you see this!)

Hi Roger,

I hope your forthcoming service is available for iPhone (or other handheld device).. Im often checking information and ideas when I’m on the run – and have a few minutes. There is often two versions of any given website.. laid out depending on the device viewing it. I recently purchased an iPad for my wife.. googled you and your old URL came up.. On the iPad, you can navigate the posts as if it were a book – its a nice effect. I have to say, very excited about seeing what you’ve been cooking up – and I think (hope) it will solve allot of headaches in regards to what I’m currently doing.

RobF

Delighted you like it. Get ready for a headache-free zone.

Days away? Weeks away? My wallet is open and ready!

I have done it and do it for the DJIA and XAO every day.

Not really hard, just the same as a company except with an index.

Cheers,

Paul

Just make sure the data inputs you are using are the best and updated daily. All the student/investors ‘spreadsheets’ and valuation graphs etc I have seen are taking sweeping data from their online broker, (Etrade or any of the others) yahoo or google finance. The result is some nice looking graphs and lines and tables but not a serious investment tool. Producing something that looks nice needs to be secondary to accuracy.

I agree accuracy is better than appearance.

What data do you use? I use IBES for future estimates, I don’t think anyone can get better than that.

I have historical data for the Dow going back to 1915 and XAO back to the 1980’s. With backtesting there is some very interesting results.

I hope yours wont be a blackbox where all the inputs are mysteries like your MQR’s.

Paul

It will provide the answers you need.

Hi Paul,

Was wondering 2 things.

1. What costs are invloved in using this service?

2. If there was one thing about the service you could change, what would it be?

Regards,

Chris B

Hey Paul,

Out of curiosity, why do you check the IV for the indices?

I just did a quick check for the top 20 companies, these make up about 50% or so of the XAO and given how often these companies are promoted for their income/cornerstone of a good portfolio/etc etc (blah blah) I imagine most of these companies would be over their IV a majority of the time except for black swans such as the GFC so I would imagine this causes the indice to appear overvalued most of the time. Is this what you have found?

I’m guessing the way roger does it is the compare the average MOS, or lack there of, for all the companies which would probably give you a closer answer to over/undervalued. (Pure speculation)

Thanks

Probaly not doing this correctly but for CCV

2009/2010

Cash (7)/(50)

Cur. Borr 4/3

Non Cur Borr 12/10

Equity 82/162

Total 2009 = 90

Total 2010 = 125

OCP = -35?? I dont think this is right, as through buffets owners earnings, CCV’s true earnings were clost to reported profit of 22 mil.

I think you might have used the wrong equity figure. Instead of using the total equity figure, my understanding is that you use “contributed equity”, which I think is sometimes referred to as “issued capital”. Can anyone confirm?

Doing it this way I get 2010 Operating Cash Profit of -22.8m

Adding the dividend of 9.2m gives a Company Cash Profit of -13.6m (negative cash flow but not as large as your result)

Hope this helps

Hi Tim,

I use the contibuted Equity, issued capital or sahre capital (whatever you want to call it).

My understanding if i can remember correctly from the book is that it is measured to see if the business is being funded through issuing new shares which on the balance sheet is shown as the above mentioned titles where as the total shareholder equity figures is the above figure plus retained earnings etc.

An interesting article in the smh today about a consortium planning to establish a new underwater fibre optic cable between Aus/NZ and USA. If it comes to pass it may reduce the size of the moat for Voc.

See: http://www.smh.com.au/business/rodents-with-a-taste-for-travel-20110603-1fkpf.html

NB: You have read through a bit of waffle about Qantas before you get to the relevant bit …

If you are thinking about Vocus, you need to start researching Dark Fibre! Find out everything you can about it and then look at Vocus again.

HI Roger

After researching dark fibre I now see how large the MOAT is for Vocus.

More than happy to hold this stock long term and buy more if MOS is there.

cheers

darrin

Hi Darrin,

Can you please shed some light on what you believe Vocus’ moat is, pertaining to dark fibre?

You may be aware that VOC recently acquired Digital River for $3.95m and this does provide VOC with a new product – a dark fibre network – which they can leverage off to sell bundled products. However, VOC is not the only player in this space to have a dark fibre network (Amcom also owns dark fibre).

So what is it about VOCUS’ 59 km dark fibre asset that gives VOCUS a moat?

Chris B

Yey Guys,

I must admit to spending a fair portion of last weekend looking at Amcom. No purchase decision at this stage but I like the Moat. Claims of spends 10 times faster than the NBN are very impressive.

This is not to sugest VOC does not have a Moat as well

Hi Peter, pacific fibre will only service new Zealand IF they manage to get the money together to lay the cable. In addition it’s the operators knowledge, independence and service quality that can give it an edge over other competitors. Cheers

Hello,

No insights or intelligent comments – just asking a question out loud and hoping for some words of value…

So, on review of my portfolio I realize that I have overpaid on two companies (not bad companies just no MOS, lesson learnt) – thank goodness these are very minor holdings. Now the share market is tanked, do I wait for them to come right (original plan, turn the share market off) or do I break the rule of not losing money and take the opportunity to top up my ANZ (one of my top 3 holdings – favorites) as I am really liking the current price?

Hey Emily,

The answer is in Value.able

Re read the capter on when te sell. That will give you the answer.

Hope this helps

Emily,

I don’t think you should take your cues from “the rule of not losing money” as you put it. I think that despite the current price of your holdings – and all things being equal – your money should be in the best opportunity available to you. If that means selling something at a loss to purchase something else (hopefully a great business at a bargain price) then so be it.

Of course, your personal situation has all sorts of factors that might weigh on your decision -such as tax implications – but if a better opportunity is available to you then cutting your losses may make perfect sense.

regards

Hi Emily,

There is no need to sell if ur happy about the business and it’s prospects.

If u wish to buy more for dollar cost averaging then you need the price to drop by at least 20% in order to have any meaningful impact on ur original purchase price. I’m only guessing, but say u paid around $23 for Anz, if it was me I would look to buy more under $19.

Remember, be patient, there will be plenty of opportunities in the next little while.

Hope that helps and good luck.

Hi Emily

I recommend re-reading Value.able Chapter 3 as well as 13. If you have only recently purchased the shares has anything happened to change the value of the businesses ? We are getting close to the reporting season for many businesses and data from the preliminary reports, annual reports and company updates will enable us to better understand the current value of the businesses and their future prospects.

Thanks everyone for your comments. They have really helped me work out what to do. For now I’m happy to wait, well at least until reporting or if the share market decides to reveal a better opportunity. The real lesson for me is to be a bit more ruthless with demanding a bigger MOS.

Hi Roger,

I think there is an easier way – go to the cashflow statement – take the cashflows from operating activities and subtract the cash outflows from investing activities. This should give basically the same answer as your formula above.

One with a big difference between cash profit and reported profit – MCE: Reported profit for half: $19.3m, cash loss $32.6m – more than $50m difference (Henderson construction and progress payment received in prior period big contributors here).

Hi Michael, I hope you have read Value.able? The chapter on Cash flow covers a couple of methods!

Yes, have read it twice, but will all the books I read I sometimes forget where the knowledge came from. I have checked and now know it was your book that refers to operating cashflows less investing cashflows as ‘company cashflow’.

Thanks for that Michael.

I love the pre-emptive game that is being played by Bunnings now against the incoming Woolworths. Textbook competitive advantages.

Quote from the MD today: ” John Gillam, said yesterday he would go “very, very hard” in defending its position in the $36 billion home-improvement market in the face of competition from Woolworths.” [From The Australian]

Both companies could be in for a few tough years. The damage Coles can do to Woolworths with $2 milk etc. surely won’t compare if Woolworths decide to fight on price with Bunnings. For an extreme example, imagine Woolworths run their hardware business at barely break even. When customers go to Bunnings for a price match and Bunnings then have to take off another 10% as per their lowest prices guarantee this could really hurt that business. Especially with the comparative market positions of the two, although this is hard to define for Woolworths at this stage, it will surely be significantly less than Bunnings’.

I must say I’m a bit concerned about what Woolworth’s hardware play will do to their performance. It seems like it’s going to be a really hard struggle against Bunnings who have been at it for what now? a decade? And doing it so well. And it’s not like we need more big hardware stores – there seems to be a Bunnings close enough by where ever you are.

It also seems to me that there will be loads of room for Woolworths to ‘fudge’ a bit what their hardware operations are really costing them – with support etc from their existing IT, fulfillment, transport and other back-office operations. Will we really know the figures?

I’d like to hear what others think of all this, and how they think it might play out. I know it’s speculation, but interesting stuff.

I don’t know whether it is just here in Tassie, where Bunnings big tin sheds are cold and inhospitable, but in my view I would shop at any reasonable alternative in preference to Bunnings. Every time I go there they have moved what I want to buy, the staff are disinterested and ignorant, and if Woolworths can find a friendlier cosier format they will kill Bunnings. But they probably won’t, because Bunnings is accepted as the standard, even though it is a lowest common denominator recipe.

Hi Roger,

I did the above exercise for FY10 on 3 companies with the following results:

-MCE: Cash “outflow” of $15,2m vs Reported profit of $18,1m – negative variance of $ 33.3m

-ORL: Cash “inflow” of $15,3m vs Reported profit of $22,6m – negative variance of $ 7.3m

-BHP: Cash “inflow” of $7,1bn vs Reported profit of $13bn – negative variance of $ 5.9bn

A few comments:

-The above variances largely arise due to capital expenditure incurred during the year.

– Another, arguably easier, method of calculating the cash “profit” is to take (per the cash flow statement) the sum of the cash from operating activities and investing activities for the year (which results in the same, or very similar numbers).

And a question:

Is there any merit in your view in using the cash “profit” (adjusted to exclude capital items etc.) as opposed to the reported profit in the return on equity equation when calculating intrinsic value? The idea being to exclude accounting anomalies, unrealised items etc.

Thanks!

Johan

Hi Johan,

You will find a couple of methods in the Cash Flow chapter in Value.able.

Hi,

I’ve been lurking for a while and enjoying the useful insights about FGE, BGL etc. I’ve been noticing that MCE has been trading at a substantial discount to IV for some time now and the price is still dropping day by day. But I also noticed that Roger’s estimated 3 year IV for them is -5.39% (see http://rogermontgomery.com/is-it-time-to-clean-up-your-portfolio/). Another concern is the extra shares issued in May. Things have been quiet on the MCE front for a while now. Can any of the more experienced bloggers give their opinion about the company’s future prospects? With price at $7.5 today and 2011 IV around $11, it’s looking pretty attractive even if IV is estimated to go down by 5% or so in the next 3 years

Thanks for the informative post Roger.

Matt, being able to think independently when making investment decisions is essential if you want to be successful and make money and just because Roger thinks MCE’s intrinsic value will be worth less in 3 years time does not necessarily mean that it will be or that you have to share his opinion.

MCE with the completion of their Henderson plant has the opportunity to double revenue and even possibly triple revenue if it keeps its Malaga premises operating. Combine this with the new products currently being developed and the huge amounts of capital oil and and gas companies are currently investing in offshore drilling and the future looks incredibly bright.

It’s my belief that MCE will be worth considerably more in 3 years time although you should examine all the information available and come to your own conclusion.

Hi Nick

Good Stuff,

I am agreeing with nearly all you say

If they can go to then next level(which I think they can) Then Rogers IV which is based on analyst forecasts will look very cheap.

hi Matt,

if you already own MCE then nothing has changed. lets wait for their full year results to see how well they are doing and what is happening with their order book. if you don’t own them, and you are thinking about buying, you should seek very large MOS. for me its at least 40-50%.

regarding the share price, the reason its falling could be due to the rising Aussie dollar, though in that case it can also mitigate some of their input costs, and it may also be due to some fear in general about the world economy.

Look at it as an opportunity and remember to have a slight diversification in your portfolio. cheers.

I heard this the other day about Forge that they have been quiet lately. Their half yearly report was only 3 months ago and besides the cashflow it was very good. I find it strange that people want an update on the company every month or expect the company to release some new contract that they have won every couple of weeks. It feels like there are few long term investors here and more short to mid term investors. On the update front MCE recently won the exports category at the Subsea Energy Australia awards for its subsea buoyancy product. The Subsea Energy Australia awards have 90 members including; BHP Billiton, Woodside Energy, GE Oil & Gas and Chevron Australia. So they are in good company.

Thanks for sharing that Nic. Keep contributing.

Nic,

How many other Australian companies export subsea buoyancy products ? So MCE won first place in a one horse race.

Brian

Hi Nic,

WB buys companies like farms, which just produce more and more over time. He is very much a long term investor and only sells if the market offers him a price well above the existing IV which is too good to turn down. The most important thing to him is the Moat and he doesn’t worry about short term fluctuations in earnings/ profits provided he’s confident about the companies future prospects. This is very much the way I invest and I feel MCE is a company which would fit the WB criteria.

Do you think that FGE has a good enough Moat and is it a company you are prepared to own for a long time as a result of this? How do you think it compares to MCE and which one would you be prepared to own if the market was turned off for five years. Bloggers seem a lot more worried about FGE than MCE and could there be a reason for this? Do you prefer the management of MCE or FGE?

Now I like both companies and hold positions in both but for me MCE is the winner hands down and I hope their shares drop further so I can buy more. With $80k worth of orders booked in the quite Christmas period and $400m in quotes at the time and their fantastic Moat the future looks very bright.

I am not surprised they won the Subsea Energy Australia awards and this is more evidence of their Moat.

Brad,

Since you want to compare FGE & MCE, let’s look at a couple of numbers;

Net Debt to Equity MCE 45% FGE -49%

2011 Est NPAT MCE $36M FGE $39M

2011 Est Equity MCE $127M FGE $127M

Free Cash Flow MCE -$31M FGE $19M

Order book MCE $180M (Jan) FGE $340M (May)

Which one looks best to you ?

Brian

MCE by far Brian as they have the best Moat

Brad,

A moat is protection from competitors, but you still have to have a financially sound and profitable business to protect in the first place. Are you completely ignoring the numbers simply because you think they have a moat ?

What, exactly, is their moat anyway ?

Brian

Hey Brian,

MCE have 4 competitors worldwide and are getting 80% of all new build work. If they had the capacity this would probably be higher.

This is a nice moat but they have to keep defending it over time.

Buffet once said something like….. no matter how much money I was give with the idea of taking down coke I would give it back because it is impossible.

If I was given enough money I am sure I could take down FGE but I am not so sure about MCE, After all they have their own IP.

The world known oil supplies are running out at 6% per year. Oil consumption will only increase over time with Chindia gaining traction (This will not be a straight line). This means more offshore oil drilling.

I own both FGE and MCE but I am very certain that MCE has a far wider moat than FGE.

Just my thoughts

Ashley,

Are they really getting 80% of all new work? Where did you hear or read that?

If my memory serves correctly, didn’t another poster point out recently that MCE have no patents registered and therefore no IP at all.

Brian

Brian,

It is vital that comments for and against a company are supported by research and if new information or insights are provided, where appropriate, provide a source.

Yes Brian 80% of New builds. Do some digging, you will get the answer. and IP as well.

Company also fully hedged untill 2012.

Risks after that as the competitor in the UK is not useless and will probably have a currency advantage

This is a very very good business and in an half decent space In my view

Roger said “It is vital that comments for and against a company are supported by research and if new information or insights are provided, where appropriate, provide a source.”

and that is exactly what I asked for but I get “Do some digging you will get the answer”

Consistency is vital too.

ditto.

Hi Roger and fellow graduates,

This is my first comment on this invaluable blog.

I want to ask regarding the Cash Flow of MCE,

2009 2010 1H 2011

Cash -1.46 -13.55 -3.27

Current Borrowing 1.6 2.26 1.79

Non Current Borrowing 3.99 5.79 28.32

contributed Equity 13.11 40.44 42.24

Total 17.24 34.94 69.08

Operating Cash Profit -17.7 -34.14

Looks like its running negative cash flow ( Please correct if I am wrong), but ticks all other boxes. How do we value company in this situation especially when its trading with good MOS.

Regards,

Prerak

Hi,

Yes, I’ve just run the cash flow on MCE and I’m getting similar results.

I think the problem is there is no thing called “contributed equity” in their balance sheet, so I’ve just added in the total equity from there which was around $59 million at end of 2010.

Something must be wrong with our numbers.

Roger, can you tell us where we’re going wrong?

thanks,

Russell

I would be delighted to help. I will try and look at it for you this week.

Hi Russell, “contributed equity” is the same as “issued capital”. I think MCE refers to it as issued capital in their reports. If you use this figure instead of total equity, it should be more accurate.

For the record, I did this calculation for MCE and I get the same as Prerak above (he has used the issued capital figures too, not total equity)

Hi Tim,

Yes, thanks for confirming that.

I eventually figured it out and also improved my analysis on MCE.

Here’s the post: http://rogermontgomery.com/what-did-the-company-really-earn-in-2011-2/#comment-14684

(For some reason my comment didn’t appear in this blog thread.)

Thanks again!

Sorry Russell,

I often receive multiple versions of the same comment under different threads, but only publish one and try to make it on the current post. Apologies for the inconvenience.

Second that, Ash. What is special about FGE that you can’t also say about Decmil or Monadelphous? When (not if) there is a downturn in the mining area, will FGE stand tall while all the others fall over? I doubt it. MCE though is a cut above its competitors (in my humble opinion), and I also feel that the area it is in (oil) is less likely to suffer from a major and prolonged downturn.

I still regard FGE as a good company, but the bare numbers that Brian posted only tell half the story. This is my opinion only and others can feel free to disagree.

Hey Ashley,

I would be interested in your references.

My records are that MCE has 40% of new builds (http://www.matrixap.com.au/files/Prospect%20Magazine.pdf) and 25-30% of replacements (http://www.matrixap.com.au/files/MCE%20310311.pdf).

40% of new builds is worth about $150m in revenue

I can’t find a reference online for the lifespan of riser buoyancy devices except for one company that says all of it’s devices (risers, clamps etc) have a 25-30yr lifespan. If Austock are too pessimistic about the lifespan and we assume a 20 year life rather than 10 then the replacement market is worth about $175m pa. At current win rates, that would provide about $50m pa to MCE’s revenue.

This adds up to about $200m in revenue this year. In light of the above, this is probably conservative.

However, if MCE has a product that lasts longer, is easier to use, more reliable or cheaper etc (and by the looks of their order book it likely is), then their win rate of both new and replacement builds will increase over time.

I’m not sure it is at 80% yet though…. if so, I can only assume you are doing your own modelling or have another source. Please reveal!

Cheers,

Matt

Foot notes:

(1) if an oil field has a life span of less than 20years then the replacement revenue would be transferred across in to the new build category…

(2) in my opinion there is a surge in profits coming for MCE shareholders once Henderson processes the order book. That could then lead in to a much larger win rate on quotations as they can complete orders more quickly. With the expansion of BDMs across the globe and a good quality product – the future is still bright in my opinion for MCE.

(3) disclosure: Long MCE

I believe they have just hired someone in Houston Texas that is ex-Trelleborg.

Hi Roger,

I like these type of posts and thought i would throw up a couple of examples and hope others do so with other companys so that we can all have a look and discuss the findings. I did a similar thing to you with one good company and one bad company.

(All figures are 2009/2010 as per the annual report)

Qantas

Cash -3617/-3704

Current Borrow 608/619

Non Current Borrow 4895/5099

Contr Equity 4729/4729

Total 6615/6743

Operating Cash -128

Dividends 0

Company Cash Profit -128

So unsurprisingly Qantas lost money despite it reporting a NPAT of $116 so this is a difference of -246. I only included the intreset bearing liabilities and not the other financial liabilities. Will be interesting to hear if others think this should have been added or not.

The next Company is REA group

Cash -41588/-88163

Current Borrow 488/0

Non Current Borrow 32/0

Cont Equity 56002/64695

Total 14934/-23468

Operating Profit 38402

Dividends 12,726

Company Cash Profit $51,128

REA on the other hand is the opposite of Qantas and actually has a company cash profit above the reported NPAT figure of $50,643. Not surprisingly at the end of 2010 REA had no debt, look at the cash, why on earth would they need it?

I don’t think anyone really needs me to point out the superior company out of these two.

I hope everybody contributes some companys to this blog and we can debate the merits of the results and what the reasons may be. Lets have a great informed discussion on this as it is such an important part of finding quality companys.

I’ve been gradually entering these up on companies I am following.

Here’s one which interested me.

WTF

2009 Earnings 43.5m Cashflow 73.4m

2010 Earnings 53m Cashflow 41.05m

2011 Half Earnings 25.4m Cashflow 39.6m

Hope my calcs are right!

Hi All, Just a question regarding a stock i am looking at buying. ESW an environmental, surveying, mapping, town planning, engineering, project delivery and specialist consulting services company across the infrastructure , resources and energy sectors. im curious it is currently trading at around 5 times earnings and mgmt expect earnings after tax to be around 2.5mil-3mil next year. the directors have brought on market on numerous occasions. they appear to be in it for the long haul. it has been sold down on very low volume and they missed guidance this year due to a one off writ off from their latest merger. the director holds a majority of the company and the order book is improving dramatically from my discussions. is there any other comparable companies in the service sector that anyone is aware of? i’m keen to buy and looking at alternatives but the director needs to hold a large portion of shares.

hi Chris, i looked at this company before. its not investment grade for me. look at their profit history and cash flow. they cant seem to make much money. also they mention margin pressures. it is also highly illiquid. save yourself the time and focus on better quality businesses. cheers.

Does this mean that you should really look at the value from this formula instead of the net income after tax.

Also does this change any of your thought process in regards to using ROE from the net income figure for a valuation.

Kinda confused?