Is the AI bubble finished?

In July last year, here at the blog, I noted the AI bubble could only become a bona-fide boom if AI is monetised.

Back then I noted Google’s (NASDAQ:GOOG) “significant strides in the integration and security of artificial intelligence (AI) in their products and services” and Meta’s (NASDAQ:META) plans to incorporate AI text, image, and video generators into Facebook and Instagram, allowing customers to modify their own photos using text prompts and share them on Instagram stories weren’t meaningful in terms of generating additional revenue from existing users. Sure, they might assist users, enhance their experience, and be entertaining, but would they be meaningful enough for users and advertisers to be willing to pay more? The jury was out.

And it still is, despite Alphabet’s (NASDAQ:GOOGL) share price rising 43 per cent, Microsoft (NASDAQ:MSFT) 24 per cent, Apple (NASDAQ:AAPL) 13 per cent and Nvidia (NASDAQ:NVDA) 156 per cent in the last twelve months. While share prices have boomed, I am not sure a broad-based AI revenue boom has emerged yet.

According to several reports, more experienced billionaire U.S. investors are retreating from previous commitments to investing in generative AI tools and projects. And analysts are becoming less excited than they were when the bubble began. Goldman Sachs, for example, is now more cautious, acknowledging it may have overestimated AI’s immediate impact.

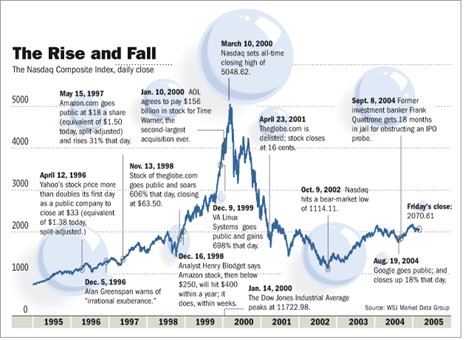

Figure 1. Tech Boom 1.0

Source: WSJ, 2005

In fact, it seems two key observations have emerged:

First, there are plenty of industries that AI will, at least in its current form, have minimal impact upon. For example, the construction industry won’t see much impact from the current suite of tools. According to Goldman Sachs estimates, less than seven per cent of construction tasks could be automated (you can be sure that number is too precise to be correct).

More importantly, the cost of implementation is likely to equal any productivity benefits (I’m not sure how they have worked that out, but the point is it is clear some of the unbridled enthusiasm for the technology is coming out of the theme). Other industries expected to be equally unimpacted by AI are those where maintaining quality necessitates human involvement, such as fast food, customer service, and transportation. Notably, McDonald’s (NYSE:MCD) have stepped back from their AI implementations.

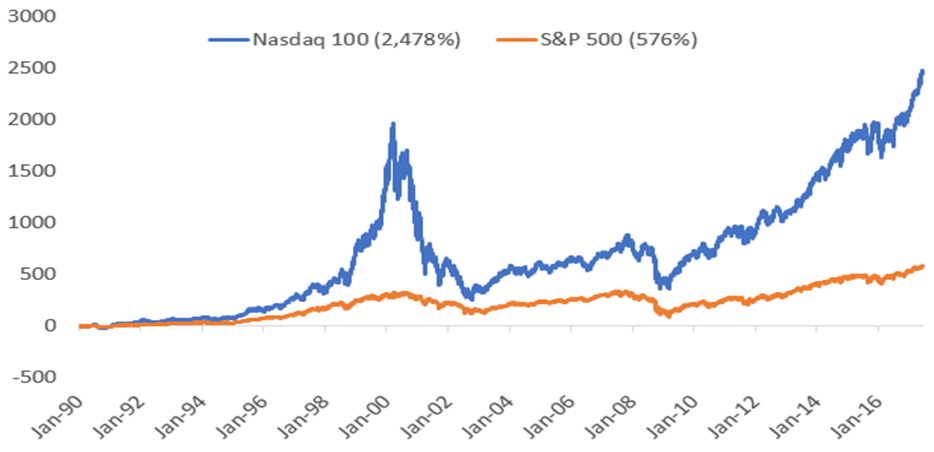

Figure 2. How long did tech bubble 1.0 take to be surpassed? Nasdaq 100 vs. S&P 500: % price change since 1990

Second, analysts are also stepping back from some of their estimates of job losses from automation. AI-powered automation is now expected to have a greater impact on white-collar knowledge workers, such as administration, legal work, financial analysis, marketing, and content creators, than on low-paying, physically demanding roles, thanks to a willingness of senior managers to replace original, innovative work with machine-generated content.

Second, analysts are also stepping back from some of their estimates of job losses from automation. AI-powered automation is now expected to have a greater impact on white-collar knowledge workers, such as administration, legal work, financial analysis, marketing, and content creators, than on low-paying, physically demanding roles, thanks to a willingness of senior managers to replace original, innovative work with machine-generated content.

Of course, there will be individual businesses that thrive. One emerging business stemming from generative AI is reflected in the plethora of AI companion apps (yes! AI boyfriends, for example), with female users noting their AI partners are better listeners and have better memories of what was discussed previously. Despite the privacy issues, Replika, which is one of the more popular apps, allows people to create their ideal partner.

Back to the AI theme more generally, despite its potential, its implementation often requires significant human intervention. While AI generates instructions, they need humans to execute them in sectors including manufacturing, healthcare, and logistics. And while AI might make things quicker, they aren’t necessarily better. We are all now familiar with the hallucinations (a euphemism for lies and factually wrong answers) produced by large language models and the results of poorly framed questions (which need to be entered by humans). Although AI can enhance the speed and scope of analysis, these improvements don’t equate to increased intelligence until humans evaluate and apply the results. We just don’t trust AI enough yet to automative everything.

Most importantly, as we warned a year ago, reports of a lack of tangible revenue improvements are becoming more frequent. In fact, analysts are noting not only a lack of significant revenue growth but also a simultaneous rise in associated operating costs for these large language model (LLM) engines, which results in minimal financial returns.

Until compelling, practical applications for these tools, beyond novelties and chatbots, become more widespread, this boom may remain nothing more than a bubble.

But that doesn’t mean the long-term wave will peter out. As Figures 1 and 2 reveal, the first Tech boom—the internet boom—wasn’t wrong; it was just premature. The hype pushed prices ahead of reality, but the reality did eventually emerge.

The AI share price boom we have witnessed more recently may simply be a repeat of 1999, a period when even mining companies added a ‘dot-com’ to their name and saw their share prices surge well ahead of any revenue. But without revenue and earnings to support prices in 2000, the bubble eventually burst. The current AI price bubble may do the same.

I remain sceptical that all companies with exposure to AI will be profitable. In every past bubble, investors failed to be discerning, assuming all companies would win. That has never been the case. Any close examination of AI’s potential today reveals that unless you’re Nvidia, selling the tech for all the other AI hopefuls, and doing so with virtually no competition, the immediate benefits of generative AI remain limited. And that will limit price gains, too.