Is $1.00+ unreasonable for BigAir?

When BigAir Group Limited (ASX:BGL) was trading in the low $0.70 range back in September last year, we asked a relatively simple question: was $0.80+ unreasonable for BGL? Our thoughts at the time can be found here.

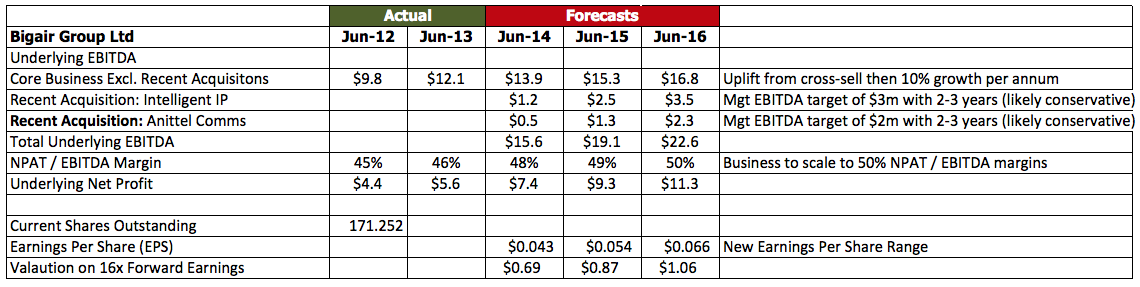

To save you some time, as a quick recap, management were then guiding for an annualised EBITDA run rate of $14m, versus $12.1m reported for the full year 2013. At a minimum, the business was therefore reasonably expected, albeit conservatively in hindsight, to grow 16 per cent in 2014.

Following a meeting with management and undertaking our own modelling post our conversation, we took management’s guidance a little further. Given the business had just made their largest acquisition to date (in IP Intelligent Communications), which, when coupled with the leverage the business would extract from cross-selling products, we saw reason to be a tad more optimistic.

Our EBITDA ballpark run-rate forecast of $17m was produced, and assuming approximately 50 per cent margins, a net profit after tax of between $7.5 and $8.5m was likely in future periods. This equated to an earnings per share range of 4.5 to 5.2 cents at the time, which, when compared to the average industrial company trading on approximately 16 times forward earnings, a share price range of $0.72 to $0.83 was derived.

And while it hasn’t been a smooth ride, this has remarkably been the range of the share price over the past 5 to 6 months since.

This however, is all history, and we can’t make money from the past (unless you’re a historian). So the question now becomes, where to from here?

Management is now guiding an underlying EBITDA run-rate of $18m. This is coupled with continued impressive underlying momentum within the business, the expectation of further acquisitions, wholesale cross-selling opportunities and organic growth, meaning a reasonable earnings per share range is now 5.4 to 6.6 cents, as demonstrated below.

Applying the same ~16x forward earnings multiple as before, and a potential share price range of $0.86 to $1.06 is not an unrealistic expectation. Notwithstanding the fact that we continue to have no ability whatsoever to predict share prices or the events that may influence them.

Applying the same ~16x forward earnings multiple as before, and a potential share price range of $0.86 to $1.06 is not an unrealistic expectation. Notwithstanding the fact that we continue to have no ability whatsoever to predict share prices or the events that may influence them.

All this leads to BGL remaining one of our longer-term holdings here at Montgomery Investment Management. And all things being equal, it will likely remain that way due to current indicators pointing to BGL becoming a much larger business than it is today.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hey Russel,

What are your current thoughts on Big Air Group?

Are the future prospects still bright?

Regards,

Dan

I noted that Annitel had much lower margins than BGL is currently achieving. With Annitel representing ~30% of future revenues – have you factored any potential margin contractions?

Or will the merged entity overcome the limitations that cause Annitel’s margins to be lower?

Hi Grant,

Thanks for your comment. In answer to your question, I might pose another: When you make an acquisition, do you want the business to be an already high performing one, or do you want it to be sub-scale, exhibiting low levels of profitability and have assets you can shift onto your own network and get a material uplift in earnings and margins?

– Russell

2nd level Telecoms (TPG, IIN, AMM, MTU) have had a brilliant run over the past few years, but is this coming to an end, with less room to grow?

Also what threat does TPG policy of fibre to multi story buildings threaten the NBN? And will the Government do something to stop them? http://www.afr.com/p/business/companies/turnbull_queries_tpg_bid_to_skirt_FRzXpQsdo1IkyjjqSRV5EI

Maybe the next level of Telecoms (BGL, VOC) are the new area of growth?

Hi Russell, thanks very much. Just a query – I thought you guys don’t believe in the use of P/E ratios as a tool for valuation? Thanks.

Kind regards,

Kelvin

Hi Kelvin,

I just find it an easier way within the limitations of a short blog to get our ballpark valuations across.

Don’t read into it too much.

Russell