Is $0.80+ unreasonable for BGL?

Bigair (BGL) is a small business with a market capitalization of just $126m, so the chances are you’re unlikely to be familiar with the story. But perhaps importantly, you don’t need to be a rocket scientist to quickly get a handle on the business’s underlying drivers which we think can be broken out into two core elements.

The first is their stated competitive advantage. Over the years BGL has either installed or acquired competitors to develop Australia’s largest national fixed wireless network for business use. A network made up of ~300 installed pieces of infrastructure (microwave emitters) around Australia, capable of delivering wireless broadband internet at speeds of 25Mbps to 1Gps.

These speeds are comparable with the NBN’s (National Broadband Network) targeted speeds – years down the track from now. With blanket wireless coverage in all major metropolitan markets to boot, BGL has a unique selling proposition.

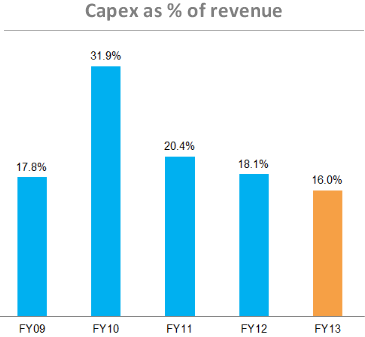

The second element is an ability to leverage their infrastructure network. As can be seen, the level of investment required for each dollar of additional revenue is falling year on year. This reflects the efficiencies from scale.

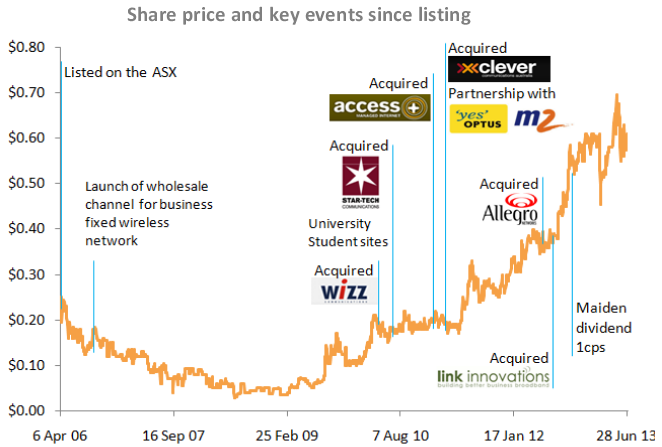

A material amount of the businesses growth has come from the ‘rolling-up’ of sub-scale, low margin competing microwave businesses and transitioning them onto their own infrastructure. Clever Communications, Allegro Networks and Link Innovations are all examples of recent business acquisitions made by BGL which have delivered meaningful scale benefits following their integration.

These acquisitions and continued strong organic growth have created value for shareholders, which in turn has been reflected in the shares’ price performance.

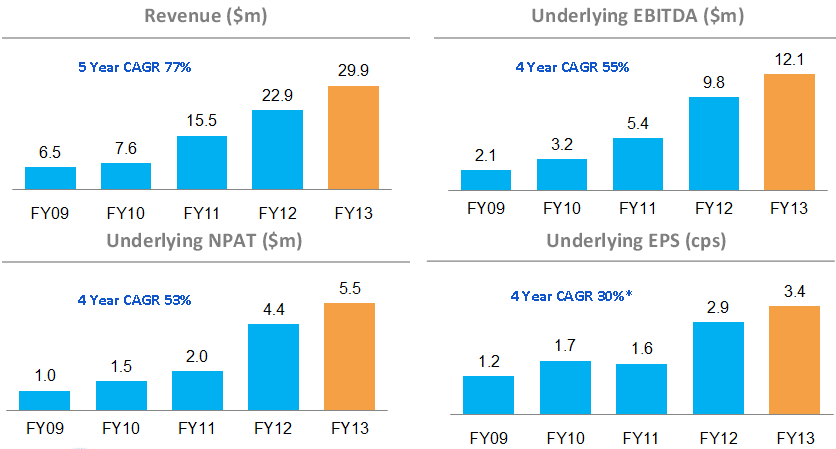

From a big picture perspective, the following chart(s) from the business’s FY13 results presentation pack should provide an insight into the business’s current underlying momentum.

As the business has grown and more customers have been acquired or ‘on boarded’, so too has BGL’s opportunity to cross-sell other services.

And this is where the recent acquisition announcement of IP Intelligent communications (not shown prior) fits in. With IP Intelligent, rather than simply buying out a sub-scale competitor, management has focused on bringing in assets and intellectual property to the business that leverage off all points in BGL.

Along with continued infrastructure network scalability and expansion into new markets (mining camps), BGL’s sale force (a large fixed cost) has the opportunity to be leveraged, targeting existing clients who are likely to benefit from packaging up existing BGL fixed wireless with unified communications and managed services. This is an exciting development and one we are watching closely, particularly penetration rates.

At Montgomery (please be aware Montgomery funds own BGL), we currently believe all of the above factors point to continued business momentum into 2014. An annualised EBITDA run rate of $14m at June 30 versus $12.1m reported for the full year 2013, suggests at a minimum, the business might reasonably be expected to grow 16 per cent next year.

Our own modelling for the full year suggests an EBITDA forecast of $17m for 2014, which on 50 per cent margins may equate to Net Profit After Tax of between $7.5-$8.5m. In turn this is equivalent to earnings per share in the range of 4.5 to 5.2 cents.

With the average industrial company currently trading on ~16x forward earnings, a share price range of $0.72-$0.832 could be a reasonable expectation, notwithstanding the fact that we have no ability whatsoever to predict share prices or the events that may influence them.

BGL is one of our longer-term holdings at Montgomery Investment Management and all things being equal will likely remain just that. We are cautiously optimistic that in the years ahead, BGL will be a much larger business than it is today.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

stephen

:

0.85 cents when do I sell

mark

:

Russell, Our son is on a campus where BGL is on tap. He says the speed is nothing close to say our big pond connection in the bush. He’s looking forward to moving off campus to improve the data speed. We both liked the Big Air story and model. A disclosure. We used to own BGL shares. At the end of the day the underlying driver of business should be satisfied customers. Rolling up is good as long as you can service your acquisitions and actually deliver on the hype.