Inflation remains steady

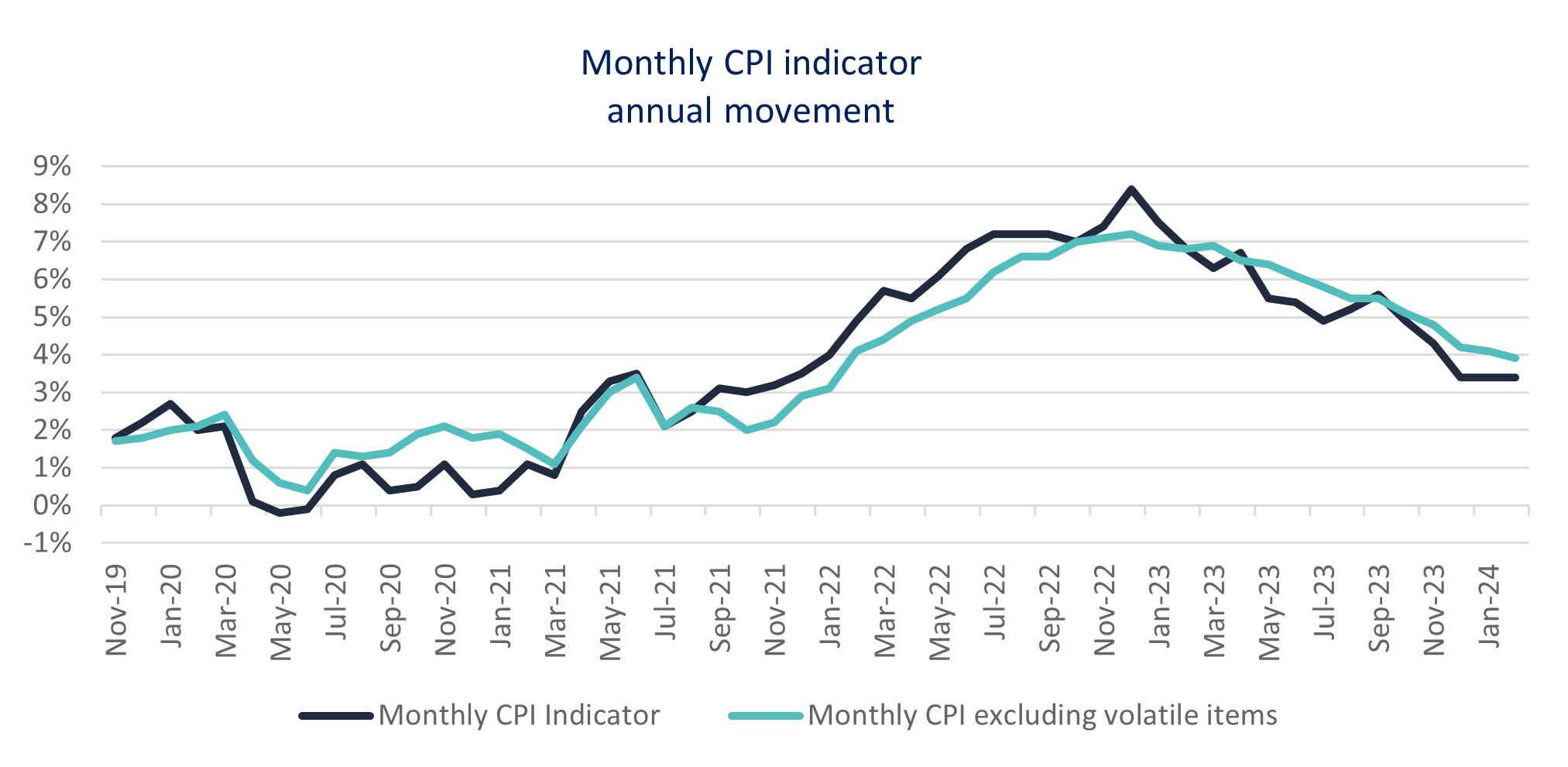

The Australian Bureau of Statistics (ABS) last week, released the monthly Consumer Price Index (CPI) figures for February. The consumer price index is a measure of inflation published by the Australian Bureau of Statistics. The monthly CPI read came in at 3.4 per cent in the 12 months to February 2024. The rate has now remained unchanged for three consecutive months. When excluding the volatile items, which included fuel, fruit and vegetables, and holiday travel, the CPI level was 3.9 per cent. This is a downward revision from the 4.1 per cent reported in January.

The figure reported was slightly better than what the market had anticipated with economists estimating the February figure to come in at 3.5 per cent. The Reserve Bank of Australia’s (RBA) latest decision to hold interest rates is further supported by the latest inflationary results. However, as services inflation is a threatening swing factor, data over the coming months will be closely scrutinised.

Housing rose by 4.6 per cent in the 12 months to February with rent specifically increasing by 7.6 per cent. The figures represent a tight rental market and low vacancy rates across the country. New house prices increased by 4.9 per cent, as builders passed on the majority of the cost increases associated with labour and materials.

Whilst the market widely does not anticipate any further rate rises, there are ongoing risks to inflationary upside particularly given the recent strength in the labour market, wage growth, and persistent services inflation.

However, as illustrated in the graph below, the road to reaching the RBA’s inflationary target is on track and even nearing the top of the target band. The RBA will continue to closely track all data points and will be looking for assurance that the reduced rate of inflation holds. At this stage, the data is on track, with the RBA forecasting CPI to fall to 3.3 per cent by June and sitting within the target range by the end of 2025. The RBA has some time before their next meeting on May 7 to assess additional economic indicators, critical for their decision making.