If the VIX is low, is it time to go?

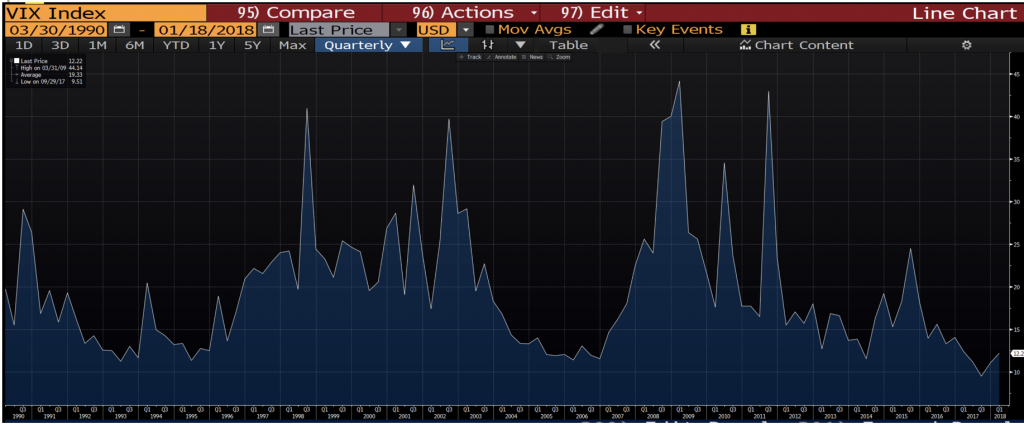

The Volatility Index – better known as ‘the VIX’ – is the most widely followed measure of stock market risk. Since March 2012, the VIX has remained stubbornly low, and some see this as a sign of a frothy market that’s about to sell off. I don’t necessarily agree, but what’s the best investment strategy just in case they’re right?

What is the VIX? The VIX is an index produced by the CBOE (Chicago Board Options Exchange). It is a measure of the stock market’s expectation of volatility over the next 30 days implied by a set of options written on the well-known S&P 500 Index (SPX).

To put it more simply, the VIX is a measure of whether investors are feeling worried (as reflected in a high VIX score such as 40) or feeling less worried (a low VIX score such as 15). That’s why it’s been nicknamed the ‘fear index’.

The VIX tends to move inversely to the market – i.e. when the SPX is up, the VIX tends to fall and if the SPX is down, it tends to rise. The relation isn’t perfect but strong enough to be a reasonable rule of thumb.

Naturally this sounds interesting as one could hypothesise that it’s a timing gauge of whether we should be buying or selling equities – i.e. buying when the VIX is high and selling when it’s low. This aligns with the idea of buying assets in times of fear and selling in times of greed.

However, there are issues in implementing such a strategy (beyond defining what exactly is high and low).

For one, if we examine history it becomes clear the VIX can remain low for a very long time. If an investor has sold during this timeframe, they will often miss out on much of the gains that bull markets produce in stocks – and arguably, too much to justify the lower risk taken.

In addition, the buy signals can often be infrequent – if an investor considered 40 as the right level to buy stocks and below 15 as the time to sell, they would have been out of the market since early 2013 and missed out on a large part of the recent bull market.

The VIX is often used by many market participants as an indicator of whether investors are pricing in enough uncertainty into their forecasts (there’s an implied link between investors in the market as a whole and option buyers/sellers upon which the VIX is constructed). Hence with the VIX low, many market participants have become concerned that it’s too low relative to underlying risks (geopolitical etc).

However, a low VIX is normal during certain parts of the economic cycle just as it’s normal to be high in other parts. Note the earlier chart which showed low periods in the early 90s, late 90s, mid 2000s and even 2013/2014. And given the historic levels of QE (pushing investors up the risk curve which puts upward pressure on asset prices, including stocks), this shouldn’t be surprising.

So where to from here? It would be fair to say that there is more upside than downside in the VIX, but the timing of this is an issue. Employment trends around the world remain robust and economic growth appears sound so a low VIX could persist for quite some time. But these sentiments are not sound enough to be part of a strong investment case.

We don’t know when the next crisis will occur and push stock prices down (and hence the VIX up). However, we take comfort in that the best insurance long term is to hold a portfolio of high quality businesses purchased at reasonable prices along with an allocation of cash suited to the stage of the market that we’re in.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

david

:

Another angle might be to say that If the VIX is historically low, then options are cheap. I thought this might be an opportune time for speculation or hedging using options ? For example bought put options could protect against a correction in the market relatively cheaply and also get a “kick” from a sudden increase in volatility.

Scott Shuttleworth

:

Hi David. There is the risk however that by the time volatility increases that the option’s theta will have reduced it’s value sufficiently that you end up with a smaller amount of profit or even a loss.

Hence you would require some edge as to determine when the market is going to correct – which isn’t always an easy task.

All the best.