If rates are low forever, can asset prices fall?

There’s an increasing frequency of articles I have read suggesting that low rates are now a permanent feature of markets, as is the likelihood of central banks rescuing investors from themselves through the perpetual deployment of unconventional monetary policy tools.

One argument goes that when rates are high, hard assets such as plant, machinery and property are more valuable because they are expensive to replicate and costly to replace. But when rates are low, as they are today, intangible assets, such as brand, numbers of users and IP, are worth more. The reason they are worth more is because they can be used to disrupt incumbents and eventually transfer the industry revenues and profits to the disrupter.

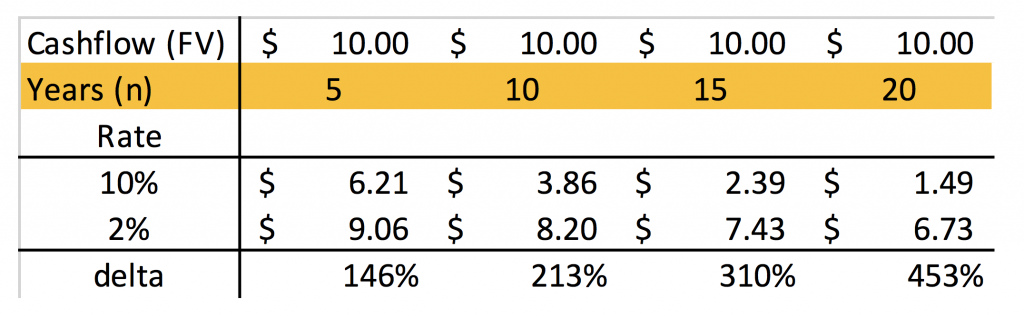

Those arguments are somewhat tenuous and the answer is far simpler. When rates are low, the market places more value on future growth. The below table shows, that when discount rates fall, the increase in valuation is greatest for earnings that are further out.

Changes in valuation for various time periods

Ten dollars received in five years is worth 146 per cent more today when rates fall from 10 per cent to two per cent. But ten dollars received in 20 years’ time is worth 453 per cent more today at two per cent than the value at ten per cent.

At low rates, the math rewards companies that have a large proportion of their assumed value in distant years. In this context it is easy to see why currently-profitless companies such as Lyft, WeWork and Uber in the US and Appen, Xero and Afterpay in Australia are benefitting when rates are low.

But if this were the only source of the high valuations, we might agree with those who argue that if rates stay lower for longer (a new interest rate paradigm) valuations can remain elevated forever.

But low rates are not the only source of the high market valuations. Analysts are too optimistic in the rates of growth assumed and the period of time those high rates of growth continue. Analysts typically assume very long periods of high rates of growth, often with substantial excess returns accruing to the disrupters. In reality, and throughout history, growth companies experience challenges maintaining high growth rates for long periods, especially while generating excess returns.

Consequently, the risk to valuations is not the possibility that interest rates start rising (although that is a very real risk), but that optimistic assumptions for growth and returns are thwarted by the realities, for example, of size limitations, competition and regulation or even simply the dawning realization that the company will never make a profit.

Putting that to one side however it’s worth remembering that asset prices can and do fall, even in declining interest rate environments. By way of example, Japanese 10-year bond interest rates have been declining since 1990 and despite this supportive influence, the Nikkei stock market index declined 76 per cent from 30,000Y to 7054Y at the depths of the GFC.

In Australia, we have had low rates and a declining bias for a long time. Property prices have fallen.

There may be individual reasons to which an investor or analyst can point to explain why these asset classes fell, but the point is this; in a falling or permanently low interest rate environment, asset prices can fall and do fall.

I personally think arguments such as there not needing to be a recession, or that interest rates can remain lower for longer or that companies can thrive in the absence of profits are all versions of ‘this time is different’. Those four words are the most dangerous ever uttered and in various forms they are common today.

That aside, the optimists are currently winning, but investors should be aware just how optimistic assumptions need to be to justify valuations. Investors should also be aware that assets are not rendered immune to falling prices by low rates.

Many argue that if rates stay lower for longer, valuations can remain elevated forever. Although is this really the case? Share on X

Wait until someone says “Yes”…because “this time, it’s different”

Rodger

Great article.

The Romans debased their currency over a period .

That is less silver in the coins (purity decreasing) coins in circulation increased ,effectively quantitative easy

.

In the end the assets inflated, more currency was minted, with less and less silver in it to fund all their Emperors pet projects.

The Currency in the end was worthless.

(By the way only the mercenaries got paid in gold)

Your correct

It can’t end well

I suppose that’s why everyone should study history(humanities) as everything that has seemed like a good idea has been tried before with the same devastating results.

Ben

“Those who cannot remember the past are condemned to repeat it” and “History doesn’t repeat itself but it often rhymes”.

That’s a great point. In today’s context, it’s just a matter of time until the reality sets in that it’s impossible to revert these easy fiat money policies and normalise interest rates. We should all be looking at what the Central Banks are doing, not what they are saying. Same can be said about our politicians.