If Buffett is buying, should I?

Equity markets have borne the brunt of investor panic. Rising interest rates, the biggest bond market rout since the 80s, persistent inflation from labour shortages and consequent supply chain constipation, as well as an entrenched military conflict in Ukraine, lockdowns in China, and finally an admission from the U.S. Federal Reserve they took too long to commencing reversing hyper-accommodative monetary policy is all but a pile-on for investors desperately seeking returns above the punitive rates offered by cash.

We have previously written about the compression in PE ratios – a common experience throughout history whenever rates rise or inflation accelerates. And none have experienced PE compression more than holders of small cap stocks domestically and globally.

By way of example, my own personal investment in October (around the market peak) in the Polen Capital Global Small and Mid Cap Fund has fallen about 40 per cent.

But is it time to panic, or should I be adding to the investment?

In a classic example of being greedy when others are fearful, U.S. regulatory filings reveal billionaire investor, and one of the world’s most successful, Warren Buffett, has used the market selloff as an opportunity to buy tens of billions of dollars’ worth of stocks, adding several material new positions to Berkshire Hathaway’s portfolio.

Most of Berkshire’s buying occurred in early March with more than US$51 billion invested in equities in the three months ending March 31. This was Berkshire’s largest quarterly splurge in recent history.

Now, the S&P500 is 6.5 per cent lower than its lowest March print on the 14th of that month.

According to Rob Forker, Polen’s Portfolio Manager for the Global Small and Mid Cap Fund;

- The past five years earnings growth of the Global Small and Mid Cap portfolio was circa 24.5%

- The past five years revenue growth of the portfolio was circa 18.5%

- Polen estimates the next five years earnings growth will be 20 – 25%

Meanwhile, with respect to market valuation, the forward PE Ratio of the portfolio as of 16 May 2022 is circa 25 times. This is down considerably from the 44 times multiple of the portfolio at inception.

Thanks to subsequent earnings growth, if the portfolio of today was the portfolio at inception the forward PE would have been circa 39 times.

The multiple compression of the portfolio since inception has been roughly; 70 per cent driven by lower prices and 30 driven by higher earnings.

In regards to margin of safety, Rob Forker believes the expected return from here will be in excess of earnings growth given the considerable multiple contraction and a belief that multiples for high quality names in the portfolio should be higher over time.

If Rob is wrong and inflation continues to challenge multiples, he believes the base level here still will deliver compelling long-term returns given the high earnings growth.

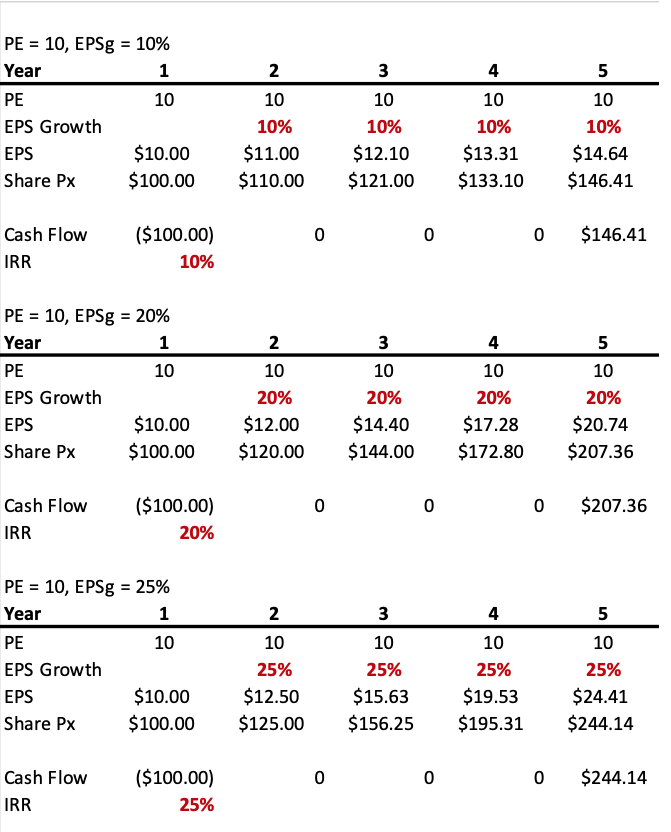

We have previously written here about the investor’s internal rate of return equalling the EPS growth rate, when shares are bought and sold on the same PE. Table 1, demonstrates this important fact.

Table 1. Low PE’s are an investors friend.

As Table 1 demonstrates, if a share of a company is first acquired on a PE of 10 times earnings, and subsequently sold on the same PE ratio of 10 times, the investor’s return (IRR) will equal the earnings per share growth rate the company produces.

You can run your own table and see no matter what the PE ratio, as long as they are the same at purchase and sale, the IRR will equal the EPS growth rate.

Given PE ratio have now compressed significantly, and could stay lower for some time, it is more important than ever, investors seek to acquire shares of quality companies able to demonstrate strong growth rates. This way, even if PEs don’t re-rate the investor can still secure an attractive return. Of course, I invest also because I believe PE ratios will rerate at some point in the next five or ten years.

Warren Buffett once wrote; “Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten, and twenty years from now.”

Looking for quality and growth

The earnings growth is provided by the companies selected by portfolio managers with an eye to quality and growth. And the rational price is provided by the massive compression in PE ratios we have just witnessed.

For every investment Rob Forker makes, he demands a mid-teens IRR or better. Right now he estimates the expected IRR of the Polen Global Small and Mid Cap portfolio is in the 20s.

Polen’s Global Small and Mid Cap Fund owns no companies without earnings, nor any companies deemed cyclical in nature. Additionally, the balance sheets of the companies are very strong.

I do not presume to know what the market, Putin or China will do in the next month, quarter or year but I have a reasonable basis for believing ‘this too will pass’ and in five years’ time, we will have something entirely different to be fearful of.

Investors always wish for lower prices when markets are expensive. Wise investors baulk at paying hyper-stretched prices for even the best quality stocks. But the circumstances that deliver lower prices are usually successful at reigning in investor enthusiasm for buying.

However, it is precisely when the outlook appears worst that the most “rational” prices are offered. Being greedy when others are fearful however is what Buffett has recently demonstrated. And now Rob Forker has demonstrated why now might be a rational time to commence a dollar cost averaging program of investing in smaller quality global growth companies.