How much to retire comfortably?

There’s some good news for a handful of the approximately 3000 Australians who retire every week, and some more challenging news for others. But, for all retirees, there are at least partial solutions to consider.

According to the Australian Financial Review[1] (AFR), “Retirees with a $3 million portfolio in super can generate an annual income of $105,000-$190,000 – depending on dividends and capital growth – while preserving the capital, which could be bequeathed in a will to assist their family, according to an analysis of returns over the last 16 years.

For retirees with $1.9 million, the amount of annual income produced without capital loss could be $70,000-$125,000, research by retirement specialist Challenger Group shows.”

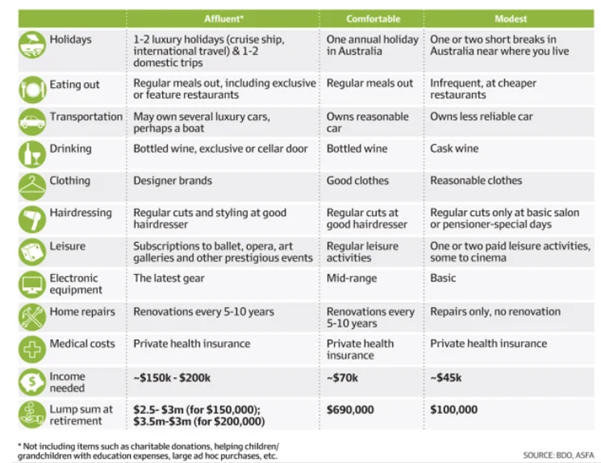

Separately, according to financial advisory firm BDO and the Association of Super Funds of Australia, with an annual income of $150,000 per year; “a couple can probably plan two luxury holidays a year, home renovations every five to 10 years and comprehensive health insurance.”

Table 1. What you can afford by the level of income

Source: BDO, Association of Super Funds of Australia

A portfolio of $3 million earning $150,000, as suggested above, is equivalent to a yield of five per cent.

The AFR article suggests this can be achieved through a “basic approach” of living off the dividends of a share portfolio given “the current dividend yield [is] around 4.3 per cent and franking credits [are] worth almost an additional 1.5 per cent”, concluding “there is the potential for a robust income stream.”

But of course, keen observers will note that the same circa five per cent returns can be achieved by investing the entire portfolio in a 12-month term deposit today, without any risks or volatility associated with public markets such as equity markets.

Of course, the issue with a 12-month term deposit is that the interest earned is not accessible until the end of the 12-month term.

While Private Credit offers a vastly different risk profile to a term deposit, the yield should also be higher, and cash income can be generated monthly.

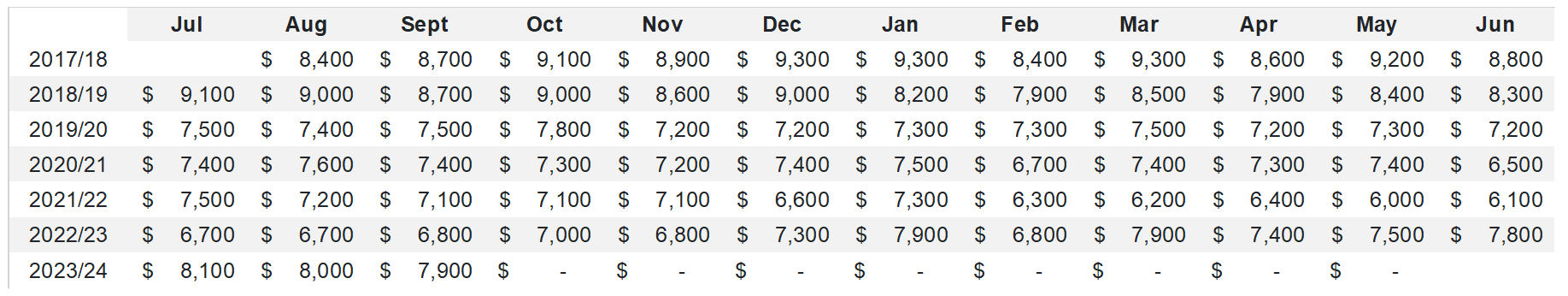

Take, for example, the Aura High Yield SME Fund, which has returned 9.6 per cent per annum on a distribution reinvestment basis, net of fees or a 9.21 per cent per annum assuming cash distributions are paid out monthly since its inception over six years ago to 30 September 2023. Its monthly cash returns on $1 million invested at inception are shown in Table 2.

Table 2. Aura High Yield SME Fund cash income on $1 million invested since inception

Table 2., reveals the cash income generated by an investor with $1 million invested in the Aura High Yield SME Fund, a Private Credit fund, since its inception in August 2017.

The issue for me raised by Table 1, is that the yield required to ensure an affluent lifestyle is easy to achieve for a retiree with a $3 million lump sum at retirement.

More challenging however is achieving a “Comfortable” lifestyle income of $70,000 per year on a suggested lump sum at retirement of $690,000. I say this is more challenging because the yield required to generate this income is 10.1 per cent, and that cannot be achieved with a term deposit.

The $3 million retiree can throw all their funds in a term deposit at the current rate of 5.25 per cent and comfortably achieve the Association of Super Funds of Australia’s definition of an “affluent” lifestyle with an income of $150,000.

If, however, a retiree with a lump sum of $690,000 were to throw it all on a term deposit at 5.25 per cent, they would receive only $36,000, which is less than the income required to meet the Australian definition of the poverty line for a couple[2].

To meet the $70,000 income requirement that defines a ‘Comfortable’ lifestyle, a higher-yielding investment is required, or more capital needs to be withdrawn from the portfolio.

Alternatively, and hypothetically, a retiree with a $690,000 lump sum who had invested in the Aura High Yield SME Fund at inception would have generated $66,240 per year on average over the subsequent six-odd years. While the income still hasn’t met the $70,000 target, far fewer compromises would need to be made. (This strategy is not recommended of course, because diversification is essential to offset the risk of any single asset class performing poorly).

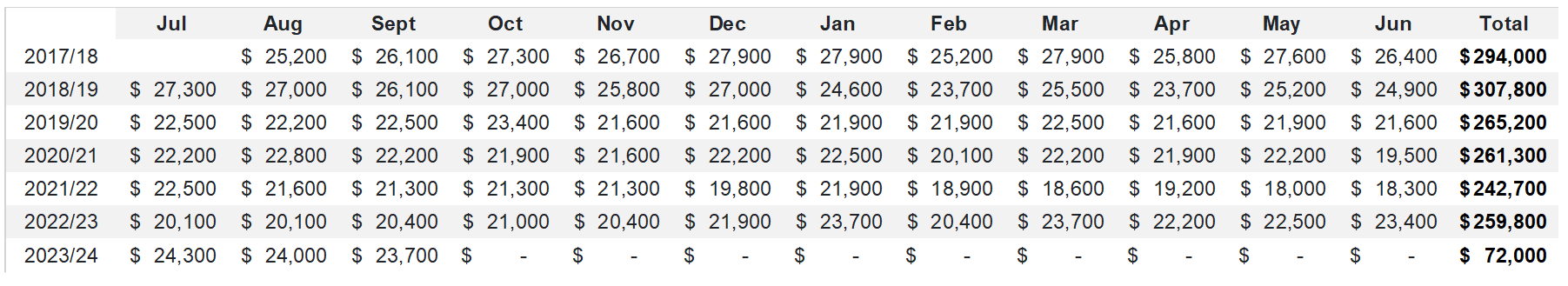

Table 3. Living it up with $3 million (hypothetically, of course)!

Table 3., reveals the monthly income produced by the Aura High Yield SME Fund for a hypothetical investor who committed $3 million at the inception of the fund in 2017. If $150,000 income in retirement is defined as ‘Affluent’ by the Association of Super Funds Australia, then the fund has provided its hypothetical investor with an income that also provides the opportunity to support children and grandchildren as well as donations to favoured charities.

Concluding thoughts

The question of the appropriate amount required to retire comfortably can only be answered through the lens of uncertainty. Interest rates, market conditions and lifestyle expectations at retirement are only some of the variables needed to answer the question more formally. And diversification is always necessary. What is becoming clearer however is that Private Credit funds, like the Aura High Yield SME fund, should be considered for at least a portion of a retirement portfolio.

While past returns are not a reliable guide to the future, the Aura High Yield SME Fund aims to maximise yield with little or no monthly volatility. To date, that aim has been convincingly met. The Fund has, thus far, produced a 9.6 per cent annual yield, and monthly cash income with zero volatility. With the passing of time, advisers will increasingly consider the Private Credit asset class as a vital contributor to satisfactory retirement outcomes.

Disclaimer

Find out more about the Aura Private Credit Funds

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura High Yield SME Fund (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and may be issued equity in the investment manager or entities associated with the investment manager.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and Aura do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.

[1] How $3m can fund your retirement and still be passed on to the kids

What most of these studies fail to clarify is how important it is for your house to be paid off, because many people think “I’ll just take it out of super and pay it off when I retire”; you’ve just killed or partially maimed the golden goose because that money in there now can’t grow further…you want to live off your capital.

Most people also read it and think that their house is included in it, but it’s not; you can’t make money from your house unless you rent it or sell it (and then, where are you going to stay ?). Are you really going to rent for your retirement ?

So those saying that they have a $1.9m portfolio and including their $1m PPOR in it is only kidding themselves. Having half your money tied up in something that you can’t or won’t make money from, you might as well have it in gold or something else that doesn’t pay you anything for the same effect.

Thanks, Chris; yep, that’s a definite recipe for a loss of liquidity. You can’t trim the portfolio by selling a bedroom here or a laundry there. The need for more liquidity is a big issue if it’s all tied up in the Primary Place of Residence.