How many of your Chips are Blue?

If you are new to the stock market, I believe it is possible that you have been lulled into a false sense of security. I say this because I regularly hear well-meaning advice that goes something like this; “just buy a portfolio of blue chips and hold for the long term”

If you are new to the stock market, I believe it is possible that you have been lulled into a false sense of security. I say this because I regularly hear well-meaning advice that goes something like this; “just buy a portfolio of blue chips and hold for the long term”

But what is a blue chip? Here are some of the definitions I have found around the place:

“a common stock of a nationally-known company whose value and dividends are reliable; typically have high price and low yield; blue chips are usually safe investments”

“A blue chip stock is the stock of a well-established company having stable earnings and no extensive liabilities. Blue chip stocks pay regular dividends, even when business is faring worse than usual. …”

“A large company. Blue chip shares are generally lower risk. FTSE 100 constituents are generally considered blue chips”

“Shares of companies that are considered to be particularly solid and with a high capitalisation level. Their purchase is presumably associated with minor risk when the Stock Exchange falls”

And my new favourite definition;

“Blue Chip is the third album by Acoustic Alchemy, released under the MCA Master Series label in 1989, and again under GRP in 1996.”

Clearly there is only rough consensus around what a ‘blue chip’ actually is, but I get the distinct impression that a lack of understanding about what truly constitutes ‘high quality’ has meant the resultant definitions are clumsy at best. And if advisors can’t define quality/blue chip with some consensus, then its quite possible new investors are plunging into a blind-leading-the-blind situation.

Here at my Insights blog, I don’t talk about blue chips. Why? Because they don’t exist. There is no such thing.

I define quality through my A1-C5 Montgomery Quality Ratings (the MQRs) using a raft of measures and scenarios, combined with measures of the financial relationship a company has articulated over the years with its shareholders and its competitive position.

Warren Buffett once observed that time is the friend of the wonderful business but the enemy of a poor one. You don’t want to put the shares of a bad business, even if it’s a big one, in the bottom drawer and forget about them. Long term buy-and-hold investing then should only apply to the truly high quality companies – A1 companies.

To that end I would like to share with you an early Christmas gift (until Value.able arrives under your Christmas tree).

One of the definitions noted above and a commonly held one is that blue chips have to be large companies. Companies that inhabit the S&P/ASX 50, for example, may be considered Blue Chips. Putting aside for a moment the fact that there are plenty of large companies that have gone to the wall, it is possible to re-rank the so called Blue Chips – the large capitalisation companies – and find out if any are more blue than the rest.

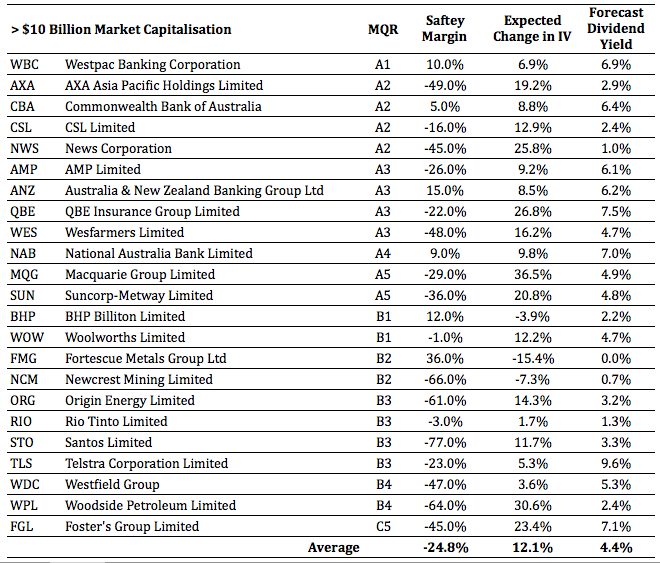

So in the pursuit of ‘blueness’, below you will find all companies with a current market capitalisation of more than $10 billion sorted by my MQR (followed by Safety Margin for good measure). I have also included my current expected (annual) rate of change in Value.able Intrinsic Value over the next three years and thrown in dividend yields because I know how adored they are.

Of course, all of this is purely didactic and not intended as advice. YOU MUST SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE. Also remember that I do not know what share prices are going to do, they could all halve or double and my MQRs andValue.able Intrinsic Values could all change tomorrow, possibly by a lot. They could go up or down and I am under no obligation to keep you updated. So please DO NOT RELY ON THE INFORMATION PROVIDED.

Having made that clear, and I am not joking about such serious matters, here is the list:

So its seems not all blue chips are entirely blue. As one of my friends – who likes to occasionally catch the amber light – says, “there’s still a bit of green left!”

Lumping all large companies into the ‘Blue Chip’ camp may not lead you to secure returns. Indeed, it could more likely see you merely lurch from one crisis to the next. If that is an experience you would like to change or avoid, then understanding the factors that indicate good quality is vital.

Value.able Graduates would have read the chapters about identifying extraordinary businesses in my book. If you haven’t yet secured your copy of Value.able you can do so at my website, www.rogermontgomery.com.

Posted by Roger Montgomery, 26 November 2010.

Hi Roger, becoming a disciple, just bought the book so only started first chapter, not sure of principles yet, give me a couple of weeks. One thing is bugging me though and I know I shouldn’t ask yet until I’ve read the book but I just bought LYC and they’ve had a bit of an upsurge, what is the rating for that company, anyone else can answer if they like

I finished the book recently and feel a lot more educated. Well done.

I believe the term “Blue Chip” comes from the blue chips being of the most value in a Casino. Just some interesting trivia.

Thanks Adam G,

Its not a positive that you know that!

A recent article entitled “Baby Blue Chips” caught my eye recently, particularly because ARB Corporation was the first company to appear (right next to BHP Billiton). The emphasis in the screening process employed was balance sheet strength. Company size was ignored.

The 12 companies discussed are: ARB Corp; BHP Billiton; Blackmores; Cochlear; Computershare; David Jones; Fisher and Paykel Healthcare; Fleetwood; Monadelphous; Singapore Telecommunications; UGL; and Woolworths.

The article concludes with the statement:

“There’s a natural ecology to the market. Companies get big, then companies get slow. Competitors catch up, then shareholder returns begin to suffer. A rooster one day can be a feather duster the next, and blue chips are no exception. The blue chips are dead. Long live the blue chips.”

In order to gain some perspective on the local market I have lately been investigating large US/global companies. With Value.able quality principles (and my ARB quality ‘benchmark’) in mind, I have found quite a few companies worthy of further investigation i.e. with a track record of high returns on equity, positive cashflows, lowish dividend payout ratios, low or no debt, high interest cover. By my calculations, many are currently trading at substantial discounts to IV. With that fresh perspective, I am now having a relook at my list of local companies.

One interesting comparison is SMS Management and Technology Limited (appearing amongst a recent list here of companies with an A1 MQR) and US listed Accenture. SMS has a very interesting story (e.g. see Chairman’s reports through the last decade). I was particularly impressed by their execution of strategy which has resulted in a big improvement in terms of many of above criteria. Accenture is much larger and, not dismissing SMS, has a more favourable historical record in terms of above criteria. Furthermore, by my calculations, Accenture currently has a higher safety margin in terms of IV (SMS has previously offered a similarly high margin of safety). I will say no more, but if anyone is keen to follow up for themselves over the Christmas period, I would be interested in any insights from Roger and his Value.able college of investors in the New Year.

Merry Christmas to all

Ken D

correction/clarification: safety margin in terms of [current price relative to] IV

Hi Ken D,

In your investigation of US valuations and quality there are a couple of very important aspects of my book that need to be applied. I will discuss these next year.

Thanks Roger, I will look forward to that discussion

Today Goldman Sachs announced their top 10 tips for 2011, have a look at them:

Goldman’s top 10 stock picks for 2011 are:

Amcor,

BHP Billiton,

James Hardie,

News Corporation,

Qantas,

Asciano,

Computershare,

Lend Lease,

Onesteel

Woodside.

Talk about chips being blue!! Both Qantas and Amcor make the list. I have added a new work sheet to the end of my IV spready, and will track these stocks price movements from 1/1/11 to 31/21/11. I wonder how we will go?

All the best

Scott T

A nice project Scott. It would be good if you can give a monthly or quarterly update!

Thanks Roger I would love to, I think quarterly will suffice.

All the Best

Scott T

Hi Roger

Can I ask for your thoughts on bonus share issues by companies eg AQA who have done this on a couple of occasions.

On first glance this seems to have a similar effect as a buy-back but it results in more shares.

Cheers

Jim

Hi Jim,

This is a subject for a post. I have discussed Buy backs with reference to Woolworths here on the blog. You can search for the post in the search box on the right hand side. Bonus issues are the opposite of a buyback. The term can be misused. Some investors use bonus shares when they means rights issue. A capital raising is different to a by back. A buy back involves the company purchasing shares and cancelling them – reducing the number of shares on issue. A share issue involves additional shares being issued for the purpose of raising capital. Buy backs are generally preferable but whether either is good for the long term owners is a completely independent assessment to that which may come from simply looking at the terms of the offer.

Thanks Roger. I have re-read the Woolies buy-back reference. Look forward to the post. Best wishes for the festive season

Cheers

jim

Hi roger,

I have learnt a lot from you over the last 6 months or so and are well on my way to avoiding many of the pitfalls and I am certainly making better decisions.

I have recently bought DWS at $1.52 at basically intrinsic value based on its strong earnings outlook, after it fell from $1.75. last week it had what I would regard as a minor profit warning and the price fell to $1.20-1.30 range. Based on my revised estimates I still see its intrinsicbased value its strong outlook at around $1.35 with strong upside heading to $1.74 in 2102 and $1.91 in 2013.

So my analysis says this is now an even better buy or am I missing something

I would appreciate your view.

I look forward to you setting up either a financial newletter or fund based on the MQR.

thanks

regards

Peter

Hi Peter,

I cannot offer you any advice, however you do need to keep on top of any changes to estimates (they tend to be optimistic and human natures suggests the admission of previous optimism is slow to come and results in slower adjustments than should occur) and even more importantly you do need to take note of the rather unusual apparent operating leverage here. Perhaps the company is slower to reduce overheads when revenue starts declining. This would suggest they don’t have the sort of systems my friends in one of the highest margin Restaurants in the country has, that allows him to send part time staff home early in the evening based on the amount of wine that is being ordered. Falling margins over the years is something to watch too. There is macro risk with DWS. Also remember that I have only ever advocated very large margins of safety. SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE.

Hi folks

DWS. Having a quick look at the annual report, with decreased margins but increased staff cost, could it be that the company is positioning itself with high quality and sufficient staff to attract new high quality customers. DWS unique sell point will be they have everything in place to provide the customer with exactly what they need?? I’ve not owned a business but it would seem to me using some of the previously high margins to invest in people that make the company attractive and profitable shows a confidence in their future earnings prospects? They are dealing with very safe companies that would find it expensive to move away from DWS if their service remains at the top to the tree? this makes the business even more safe as a long term investment to me. i wish i have more cash to invest!!

like to know what you think.

Thanks

Dunc

Hi Roger, have you had any updates at all to the valuation of jbh, seen the price decrease recently- have there been any fundamentals that have driven this drop?

Hi Ron,

Yes there has been a fundamental reason for the drop. A deteriorating consumer confidence level and consumer spending is the key. JBH also said some time ago that they were tracking 5% behind budget. My valuation is $20.06 to $23.85.

a small bit of scuttlebutt…

I invested a small amount myself in a JBH store today, only to find out they didn’t need my help – the sales rep said their store is actually tracking ahead of last year’s sales…

Thanks Matthew,

I think thats the point; Tracking ahead of last year but behind budget (forecast).

Was interested in anyones opinion on IDEAS International (IDE). It is in the same space as DWS. Only made it’s first profit in 2008 but no debt and has grown profits over the last 3 years. Has had a big rise in 2010 already but on the numbers I have, still seems under-valued. I have a valuation of 1.65 for 2010. One problem I can see is that profits are not increasing all that fast but was wondering about other readers and Rogers’ opinion.

Hi Adnan,

I have a valuation of 94 cents and its an A1 (seek and take personal professional advice). This company has a very different business model to DWS.

Hey,

Although I find this company to be quite different to DWS, I did have a look and ran a rough IV. I used a RR of 13% as the company is quite small, with a market cap of only ~$9m, and very little liquidity on the market.

My values were 2010 – $1.19, 2011 – $1.02

This was achieved by assuming the lower end of the profit guidance for 2010, and by estimating 2011 profit as the optimistic end of the 2010 guidance (to be conservative). Also for 2011 I included $500k in dividends as the company stated dividends were likely to resume in this year.

Hey Roger,

I was wondering if you could possibly do a blog on ethical invseting. I remember once on Sky Business you told a caller that you would never but shares in a company because it was an arms manafacturer. Alot of people are asking about uranium, which i might not consider due to ethical considerations. Thanks

Good topic suggestion Matt C.

Hi Roger,

I was wondering what your thoughts were on “Seek” (SEK). They seem to have a great ROE of about 30% and are looking to increase revenue in FY11. However they have an MRQ of 28%

Is Seek a strong company and when looking at MRQ numbers, what would be a good number in most A1 companies?

Hi Jackson, What do you mean by MRQ?

Hi jackson,

Just like Roger, i am unsre what you mean by MRQ. I have only heard about MQR’s which after the publicity these classifications have been getting i would expect to be patented by the owner very soon.

I am not Roger, but thought i would share my thoughts anyway on Seek due to me being such a nosy blogger.

I like Seek, if i remember Roger gave it an A2. I think it has great competitive advantages. I think it is the employment equivalent of realestate.com.

From my understanding it gets the most eyes and there for anyone placing an ad online for a job needs to put it on seek in order to maximise the amount of applicants. This then has the reverse effect as because it has the most jobs it then will continue to get the most eyeballs from applicants.

This means that it sits perfectly in the middle and lets those two factors fortify their competitive advantage whilst they get money through fee’s from the advertisers. I actually think Seek has a better competitive advantage then some mentioned internet based A1’s like Webjet and Wotif.com. They also have an extra income stream through their education products that they offer in conjunction with educational institutions.

I do not own Seek shares but i am doing a Diploma of Business through them and TAFE.

I have an IV of $3.82 currently with it rising to $4.94 in 2011 and $6.68 the following year with ROE rising each year.

Seek your own advice, the above is mine and not to be taken as a recomendation.

Hello Roger and Forum,

I enjoyed reading the definitions you had collected on what exactly ‘blue chip’ means. It is a little bit like trying to describe to someone what a ‘heap’ is. What size or how many defines a ‘heap?’

Both exercises in futility.

In his excellent book ‘The Black Swan’ Nassim Nicholas Taleb rightly points out that ‘blue chip’ stocks are the most vunerable to unforeseen negative surprises precisely because they are ‘blue chip!’ This is something else your readers may keep in mind.

I am not saying don’t buy traditional ‘blue chip’ stocks, just don’t buy them for that reason (that they are considered blue chip.) Concentrate on the facts, not the perception.

The herd mentality is alive and strong within the investing community and I guess that ‘blue chip’ stocks provide two ‘perceived’ margins of safety. Not a margin of safety with relation to price although a perceived margin of safety with regards to,

– (safety in investor numbers) everyone else knows about them, owns them, is recommending them, it is not my fault if it goes wrong, and

– (safety in market capitalisation) it has such a large market cap, it must be good or how else could it have grown so large in the first place!

A very dangerous game this ‘blue chip’ business.

Another great article Roger, by continuing thanks.

Thanks Nick,

Talebs book is good but I think he may have borrowed some ideas from his mentor – B.Mendlebrot. A discussion for another time perhaps.

Hi Roger,

I periodically look at your blog and also watch your Youtube videos and find your investing information very useful but if there is one thing that would make tables like the above more insightful, it would be to include the current intrinsic value, as without the starting point, the expected change in IV is less meaningful.

I also understand graduates of your book, come up with their own IV’s so they can and often do vary from your IV’s but you are presenting information based on your data, so lets remove graduate IV’s from the scenario for the moment. All these tables tell me at the moment is do your own IV’s and see if you get my numbers or thereabouts.

The next point I want to raise is that without your IV’s for the starting point or even the end point (3 years for the above) bloggers can draw no conculsion on if the stock is trading at a significant discount to it’s current ASX trading price.

For example the IV for WBC might well change 20.7% over the next 3 years (6.9% p.a) but if the stock is currently trading at a premium of 30% to the IV, then it will take more than 3 years for the IV to catch up to the current price, so it would be a bad investment right now.

Lastly just some feedback, I know you write for the Eureka Report and Money Magazine but I would like to get your thoughts on whether you would ever setup your own subscription service that gave graduates access to your full MQR listings, IV’s and specific reports on market segment or industry IV’s with your own written insights. Sure this blog is part the way there but it is hard to navigate around to find that piece of information you once saw in a blog or get a full picture of your MQR’s without trying to piece together information from half a dozen or more separate blogs.

Keep up the good work, you have made me look at investing in a new light.

All the best for Xmas

Hi David,

Thanks for the suggestions. Yes, I am interested in the idea of a subscription or member-based service.

I think subscription is a very good idea. Additionally, if members have access to some of your tables and work, we can post our own IV in a more consistent format so that other members can understand.

Also, if you add-in an investor education seminar for new members. I will be first to sign up.

Thanks for the suggestion Joab.

The blog was posted on the 26th November. So, assuming closing prices on the 25th of November were used, I get the following IV’s.

Intrinsic 25/11/10

Value Closing price

WBC 23.32 21.20

AXA 4.15 6.18

CBA 50.41 48.01

CSL 29.87 34.65

NWS 11.03 15.99

AMP 3.98 5.01

ANZ 25.84 22.47

QBE 13.30 16.23

WES 21.75 32.19

NAB 25.40 23.30

MQG 27.62 35.63

SUN 6.73 9.15

BHP 48.26 43.09

WOW 26.73 27.00

FMG 9.02 6.63

NCM 24.16 40.10

ORG 9.69 15.60

RIO 80.63 83.05

STO 6.97 12.33

TLS 2.34 2.88

WDC 8.29 12.18

WPL 24.79 40.65

FGL 3.92 5.68

That layout didn’t work too well!

I have also been thinking recently that a subscription service seems like a good and logical idea (preferably at a reasonable rate!). From my point of view if I was paying for the service I’d like to see full listings of companies including MQR’s and estimated IV’s and other info such as competitive advantages etc. I’d also like to see regular articles/insights and perhaps some recommendations as opposed to just thoughts. That’s just my opinion of what I’d like to see if that helps at all!

Thanks Steve,

Exploring this idea further and considering possible conflicts before committing to anything; what do you think is a ‘reasonable rate’? Given that recommendations are not thoughts and recommendations are infrequent and irregular, I would rather not send some ‘filler’ to you every week, but instead, send you a suggestion when one is being presented. That could mean that you get six a year or ten or two. In between might be the lists you describe.

Hey Roger,

Glad to hear you are considering this. In regards to the rate, I note that a well known subscription service charges $385 per year. That seems fairly reasonable to me.

I agree that only receiving suggestions when one is presented is a good idea rather than just sending something for the sake of it. It should be a genuine potential opportunity. I think keeping the lists updated would be a key factor. Having access to full lists with constantly updated IV’s and ratings would be very helpful, especially for those people who don’t want to or can’t keep on top of everything themselves.

hi roger,

if i were you i would charge a ridiculously expensive subscription rate to really maintain ur brand…think of gucci, ferraris and tiffanys, they are so expensive but because of the brand and quality people are still willing to pay these high prices!

im sure u can get 1000 people in Australia paying $1000 per year. that’s a cool million a year roger! :-)

good luck.

i just thought of something else,

you can increase ur subscription rate every year depending on the performance of ur recommendations. so say the first year ur stocks went up by 20%, so next years rate will go to $1,200 and so on. (though it should also work the other way)

this way ur income from this service will be compounded in relation to your share performance.

Now that’s unique!!

taking this further,

if an average portfolio for your members is $100k and they made 20% that year, thats $20k profit. whats another $200 per year to keep receiving ur service.

taking another example, lets assume u only recommended one stock for that year, and its share price tripled, u can charge $3000 for next years subscription. now that’s big money roger :-)

by the way if u like these ideas I’m happy to do the marketing for you.

regards.

Thanks for the offer Ron! I will keep it in mind. Feel free to send me an email with any links to your services. IF I go ahead with anything I will indeed consider your offer.

Really great idea Ron. Might be a problem for new subscribers who haven’t benefitted from the previous five year’s recommendations.

another way of looking at it is, if your subscription does become expensive for future and existing members it only reinforces the success of your recommendations.

look at Berkshire Hathaway shares, at $150,000 a share people are still buying them…. (though they did offer B class shares at some point)

maybe you could offer limited subscription numbers and when they get too expensive you can “split” them and create more subscriptions at a cheaper price…. but now i think its getting too complicated. :-)

I would also be interested in a subscription and would be perfectly happy with the ratings, IV and the odd opportunity which come up through the year. No weekly newletters full of junk.

We have all the info from your book to arm ourselves with the knowledge to do it all ourselves, but it is always nice to have some reassurance that we are on the right track and making correct choices.

For me the subscription levels would have to reasonable, if they were to high I would just use all the info from the book. $1000 would be to much for this baggy ass fireman.

To be honest I love just reading the blog and watching your you tube. They together have enriched my knowledge greatly, and I have not even started reading Valuable yet.

So a subscription would be a bonus, but not essential.

Graeme

Thanks for that feedback Graeme.

Hi Roger,

I would subscribe.

The less recommendations/ideas the better, if the aint no opportunity then I keep my powder dry.

One feature I would like is the ability for easliy find the latest blog entries. without having to scroll up & down looking at dates.

Regards Greg

Hi Roger and bloggers,

I am a little bit surprised that you have ranked FMG higher than RIO and certainly surprised of your RIO rating. Obviously you have your reasons, but as far as I understand FMG is “one” commodity company which relies on market prices and demand for Iron Ore. Has huge debts and planning to increase them.(as well as the production). RIO is a lot more diversified, has lower debts and has a proven track in business management and performance.

Would you share your thoughts about these two.

Hi Mark G,

There are a lot of factors that go into the ratings. The difference between B2 and B3 however can be one or two degree difference. I have learned not to question the results as much as I should question my preconceptions.

This sounds like a sell recommendation for me based on the current price. Perhaps time for me to take profit as the trend seems to be against FMG now as well

Oh I was reading the MOS incorrectly. All good for now

Hi Roger,

I am confused!! Yesterday I submitted a reply to a blog dated around 16th Sep this year. I have not seen my entry.

Where should the entry appear? at the position where I replied or elsewhere.

Cheers PeterB

Hi Peter B,

Try hitting your refresh button and emptying your cache.

Roger,

Many thanks.

BTW, As the first Edition was so great, I have ‘indulged’ and just ordered 2nd Edition of ValueAble. Has it been printed and released?

Cheers,

PeterB

Thanks for the support Peter,

As I have mentioned here before, the second edition has an extra and short Appendix added but is otherwise the same so I have suggested its an ideal gift for friends and family and for those who missed out on the First Edition.

I think a great example of the blue chip mantra is HSBC in the Hong Kong market. It is essentially their version of BHP since HK is a finance economy with no resources they just dig up money.

Most HK families like to own HSBC, as I have in my portfolio over there. But that was a mistake I made before becoming Value Able’d. Once I finish the book I will apply the ratings to some stocks in HK. HSBC made all the GPC mistakes and took a serious dive, giving some of us the chance to ride the wave back up. However they got hit with serious bad debt, hardly A1 stuff.

Hello Roger, was wondering about my book, arriving soon?!

also, was wondering about the article you were going to write on uranium,

Take care.

Tiago

Thanks Tiago,

Stay tuned on both scores.

Hi Roger,

Just a quick question about your future IVs of Acrux. Do these valuations take into account the US FDA’s approval of its drug last week? This would seem to be a steady (and probably growing) source of revenue over the next few years.

Thanks so much for all your effort in promoting the only truly logical way of investing in anything.

Hi Matt,

I will review my forecast valuations again in a few days and watch for any significant changes.

Roger,

You may have answered this question before but I haven’t seen an answer so I will ask it. Is the MQR on a linear scale (that is, B1 is below A5) or are the A-C and 1-5 two separate categories (so and A1 can drop to either A2 or B1 depending on what aspect of the quality deteriorates)?

Hi Roger,

Are you planning to explain this in a subsequent post on this issue, or do you not want to answer the question?

My reason for asking is that consistency is important to me. A big jump in quality one year could easily be reversed the next year, so I want to know whether a company that has gone from B1 last year to A1 or A2 this year has made a big jump or a small one. It is clear that quality gets progressively worse as the rating drops from A1 to A5, but how does B1 fit in? Is it immediately below A5 as the table in your post implies?

David S.

David,

I believe the order is;

A1,A2,A3,A4,A5,B1,B2,B3,B4,B5,C1,C2,C3,C4,C5

Unfortunately not correct guys.

Mind games again?

Certainly feels like mind games Lloyd. Roger has now confirmed that his MQRs are not a linear scale but he is no closer to telling us what the significance of the A-C rating is. It is frustrating, because it makes the MQR much less useful than it could be otherwise. What is the point of telling us that Wotif was a B1 last year and Blackmores was an A3 (both currently A1) if we have no idea how to compare those ratings. It would be just as helpful to tell us that Wotif was rated purple and Blackmores was mauve! Neither gives us any information about which has improved the most in the past year. OK. Rant over now. Everyone get back to what they were doing.

Go for purple! As you know I invest professionally so they’re very useful to me. Buffett doesn’t give you his intrinsic value for Berkshire but says that all the information required to calculate it is in the annual report. I am happy to tell you what my MQRs are even though I am under absolutely no obligation to do so, nor to continue doing so. So no apologies from me David. I am glad thats over!

I think it is more A1, A2 then B1 maybe B2 and then Roger probably wouldn’t care about the order of the rest. I’m speculating here and we all know what we think of speculators.

I think it’s fair enough that Roger doesn’t want to give away all of his secrets – if they were widely known it is not just part time investors like most bloggers here that would use them but also many potentially professionally jealous fund managers and tipsters too. If Roger has future plans in the industry (surely he wouldn’t just maintain this blog and do YMYC for the next 20 years) it doesn’t make sense to let his competitors see all of his cards. I’d be keeping those ones pretty close to my chest as well.

And let’s be honest, who here could honestly say that he hasn’t been generous enough already?

The road map is laid out in front of you. You now know which ones are A1, A2, B1, B2 and even the Cs. It becomes quite obvious why each has the rating.

For starters A1s tend to have no debt or net cash, great cash flow, high ROE and rising intrinsics values. Competitive advantage plays a roll because it guarantees the durability of the cash flows.

Most of the companies in my portfolio have been given a A1 MQR by Roger and I bought the majority prior to these ratings being puplished. Why? Because these are the attributes I look for and they are spelt out in Value.Able on many occasions.

Roger has given us an enormous “hand up” don’t expect a “hand out”

HI Roger/Andrew,

I was in the UK in June, and read the financials of a wine company, not sure which one but they had increased sales on line by 40% by selling in half dozen lots instead of dozen lots.

I am not a drinker so not sure if this strategy is being applied in Australia.

Took a “research” weekend with my fiance to the hunter valley. I did learn quite a few interesting facts when it comes to the wine business. The biggest threat to these companies is the weather. bad weather can devestate a crop. Also, despite the size of some of these vineyards they don’t tend to produce a lot of fruit to use.

I also think these wine businesses focus too much on the rules of wine drinking and not on a potentially more lucrative marketing strategy. If any wine company wants to go down a different route and wants to take a punt on a young upstart, give me a buzz :P

Don’t know why fosters was so eager to get into the wine game that they were willing to pay such a huge price for it. Too much fiddly stuff that can cause things to go wrong when simple rain is a threat to production (which came on Sunday as predicted by the Misty Glen Winery guy, perhaps vineyards could get additional income as weather reporters)

Don’t be surprised if you have some competition Andrew. Mind you, I agree that keeping on label design, taste and price is difficult when barriers are so low. One of the most successful ‘upstart’ wine businesses I have seen has sought to introduce a rather disruptive delivery system – Barokes – and sells wine in a can. I met CEO Greg Stokes at the Sky Business Green Room back in March and he explained millions has been spent defending patents all the way to the Hague.

Canned wine? Yum! About as inviting as that other marketing success “spam in a can”. Maybe they can sell it to the military?

Sounds odd, but a huge hit globally Lloyd.

Roger,

By globally do you mean the good old USA? The home of good taste, the home of spam, the big mac, the peanut butter and jelly sandwich… say no more!

I’ll continue to take mine in a bottle thanks! But then I am pretty conservative when it comes to matters of taste and fashion!

Regards

Lloyd

Roger,

Aside from excess supply due to massive over planting in the last fifteen years and the resulting depressed price of finished product, the working capital requirements are the dead weight on the financial performance of wineries. All that stock sitting around in casks and bottles maturing for months to years is a real drag on returns and there is no escaping it. Can, or bottle, the financial outcome is the same regardless of the container.

Regards

Lloyd

Hi Lloyd,

You might be right if they weren’t outsourcing the supply of wine or operating a JIT inventory system. Don’t know if they do or not.

I agree – the can makers and marketers of canned product will make the money, not the wine makers!

Wine making is a text book example of an industry with low barriers to entry and few competitive advantages.

What competitive advantage can you have when any person can buy a piece of land, plant grape vines and a few years later be bottling their own brand? I know plenty of doctors who viewed the tax incentives as a good reason to invest in a vineyard. Sadly, they found it to be a very tax effective way to lose money. The point of investing is to pay more tax, not less – a point too often overlooked.

Although I’m not directly involved in it any more, my background is in broad acre cropping (wheat, barley, legumes etc). I thought while we were on the topic I’d mention some of my experiences in the area.

Primary industry is very important to the future of Australia and will become increasingly so in the future. As China modernises they are increasingly getting a taste for the western diet and this will drive greater demand for wheat, barley and other ingredients of our diet in the future. This will cause upward price pressure.

However, broad acre cropping participants have little competitive advantage. The problem is that nobody goes to Woolworths to buy bread that is made with my families wheat. Or beer that is made from our barley. Buffett said the same in Snowball. Australia produces some of the best wheat in the world (a result of our weather) and that is something of a competitive advantage but there are other very good places in the world to make wheat and the ROE of the Australian Wheat Board and that of our farmers would suggest that it isn’t creating a very wide moat for us. There are grades of quality within a commodity, but it is still a commodity.

Farming is also a game where it is survival of the biggest. If you don’t buy a farm that is at a price which is economic when it comes up for sale your neighbour will and use that economy of scale to buy the next one and the next one until he eventually buys yours. You can’t double your own land’s productivity to keep up.

There has been much research into how deep to sow seed, how to minimise soil disturbance (“direct-drilling”), how to minimise weeds etc which has all required new equipment and in the last 10 years that machinery has even started to drive itself, or at least show you exactly where to drive it, around the paddock. This has all resulted in greater efficiency and output from the land, but each piece of new technology has also been available to every other farmer. There is no advantage to individual participants of an industry if every other competitor also has access to the innovations. Profit margins have therefore remained static.

The plant items (harvesters, tractors, air-seeders, ploughs etc) are costly, and like airplanes, when they need replacing the new one’s are bigger, faster and more expensive (maybe not quite as much additional expense as airplanes though!).

On top of all of that our main income earner, the weather, is completely out of our control. If it doesn’t start raining in winter crops don’t grow, and if it doesn’t stop raining in summer crops are spoiled. A drought can still be a very good year if you get the rain at exactly the right times while a wet year can result in a bumper year or a wipeout. It really is a luck of the draw every year. I remember a neighbour who after three bad years in a row had decided to have a year completely off, he didn’t sow a single paddock – and that was the best year we had ever had. We harvested two years worth of seed that year.

This all goes to show that not all businesses or industries are made the same. Some are better than others and it is our job as investors to focus on the better ones. Those businesses with a competitive advantage. There will never be a shortage of money or people available for investing in new businesses – the key is to find those businesses resistant to the competition.

Regards,

Matt

The market can’t grow faster than the economy in the long run.

So how can an index weighted portfolio of blue chips (read “large cap”) stocks grow earnings as a whole greater than GDP (say 4%) plus inflation (say 3%)? It can’t.

Take out fees (1-2%) and as a punter you’re making say 5-6%.

For the risk and effort of equities you’d want a decent chance of making, IMHO, double the risk free rate or forget it.

Humans are herd animals so we can take advantage of mispriced securities or fall victim, lemming like, to the siren call of the market.

What did Gordon Gekko say about why most fund managers couldn’t beat the S&P 500 index?

‘Cause they’re sheep, and sheep get slaughtered.’ Blue chip sheep at that!

Hi Roger,

I heard your comments on TV regarding Lynas corporation. If the analysts predictions are anywhere near correct the company is very undervalued. It also has no debt and negative gearing. I know it is a commodity and therefore its profits are subject to changes in demand and the price of it product.

It should be in production in 2011.

Any thoughts

Regards

George

Closest to production of all the rare earth explorers globally. Next on the list would be a couple of Canadian companies.

Lynas have been saying that demand won’t be falling any time soon and I think it is reasonable to think that the rare earth prices will stay high for now. In 5 years time it might be a different story though (as Roger alluded to). So I think the analyst forecasts look reasonable for the next few years but there is a lot more uncertainty after that.

It’s an interesting company regardless – I will keep my eyes on their performance.

Cheers,

Luke

Hi Luke,

Thanks for that. Also, never ask a barber whether you need a haircut! BTW, Tried calling you but phone number is not working.

Hi Roger,

Is the second edition of ValueAble available now? And, are you going to write a third edition!!!

Peter

Hi Roger,

One small thing I am confused about.

Westpac makes the list in this blog as an A1 but not this one…….

http://rogermontgomery.com/wp-content/uploads/2010/11/Roger-Montgomery-reveals-his-October-2010-list-of-20-A1-stocks-to-stock-market-investors.png

Can you explain why?

The only thing I can think of that it’s valuation or A1 rating has changed in the last month.

Thanks,

Michael

Hi Michael,

Yes the rating changed. I mentioned this on the TV the other night too.

Hmm…23 companies and only 5 that I would ever want to own. (CBA, ANZ, WBC, CSL & WOW)

The term “Blue Chip” really is a nonsense isn’t it ?

Regards, Ken

yep. Thanks Ken.

Hi Roger

I’m pleased to report Christmas has come early for me with your book.Terrific article, yet again. I am always impressed by people that have such clarity of thought-whatever their specialty.

When you refer to expected change in intrinsic value over the next 3 years,is that per year or 3 years total?

Cheers

Jim

Per annum Jim. Thanks for the encouraging words.

Hi Roger,

On your money your call you had a caller ask about( Acrux ) ACR which he valued @ 9 or 10 dollars. ACR did not make my watch list for a few reason’s. Maybe I am getting to demanding!

I understand what you are saying about blue chip company’s finally!

Thank’s for all your help always!

Hi Fred,

Thats great. There will always be ‘edge cases’. Even amongst my closest colleagues and friends we share differences of opinion on some companies.

I am very happy to say that I received my copy of Valuable last Wednesday, but my wife quickly wrapped it up for Xmas.

I do have one thing I would love clarified in the blog above, you wrote,

“I have also included my current expected rate of change in Value.able Intrinsic Value over the next three years”

Are the percentages in the above table for the change in the IV each year for 3 years, or a total % for the next 3 years?

Love reading the discussions here and I am looking forward to reading your book so I can make some more constructive comments.

Hi Graeme,

Its an estimate of annual gains. Happy Christmas!

Roger,

You state that YOU MUST SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE. But from whom? Every adviser I have spoken to drops the magical two words “blue chip” at some point in the conversation. Immediately, my eyes glaze over and my feet start walking.

On a five year basis, half of $10 billion cap, default blue chip list are underwater on a capital basis …so much for the indiscriminate blue chip investment strategy. Yet the latter is the PROFESSIONAL ADVICE one is likely to receive from the typical guy beneath the AFSL shingle.

Regards

Lloyd

Hi Lloyd,

Great question. On this score I can tell you what but not who. Interested from anyone who feels they have met the best advisor and we may run a story about them all in the new year.

Hi Lloyd,

After many years of searching and investing I found the best financial advisor and EDUCATOR.

He only cost me $49.95 and hasn’t failed me yet !

I am happy to share it with you;

It’s, “Value-able” by Roger Montgomery.

Paul

Can’t tell you any good ones but can give you some bad ones. Fancy paying for bad advice. Exactly what I have done. At least after reading the book I can pick the bad advice. No longer paying for it either!

The problem also is if thats the common results from receiving professional advice, imagine how bad the results (on average) would be from people who tried to go it alone.

Personal Financial advice is very important, most amateurs do worse than professionals by a wide margin. Cheers.

Hi Lloyd,

The problem that you have is that most advisers are constrained by the licence of the dealer groups that they work for.

They are very much constrained with what stocks they can give a client. I haven’t looked at the rules for ages but it’s something like a maximum of 20% of the entire portfolio(including other assets) outside the ASX 200, must have a market cap of a certain amount, no more than 5% in any one stock etc etc.(I know know its garbage)

Believe it or not it is designed so that when the market goes up all is good but when it tanks you can blame external factors.

The two planners we have are very much aware of the ROE method of investing. In addition I purchased a copy if (In)Value.able for them both and they are huge fans but their hands are tied to a certain degree.

At least they don’t buy everything on the day the client gives them money to invest and they often will use a ROE valuation model to stop a client buying an overvalued stock and buy them a small quantity of a A1 business trading at big discounts.

We have had discussions about getting our own licence but our fee turnover in only 6 Million (Includes Accounting, lending, financial planning and marketing) for the entire practice so we can’t justify the costs.

I was originally an Accountant and became a Financial Planner (not for where I currently work) then quit my job and became an Accountant again. The reason I quit was that I found it so frustrating that I could not give the advice that I thought appropriate and had to buy clients second class stocks that I knew where no good.

The advice you are seeking Lloyd is very very difficult to find.

I am of the view that Roger uses the phrase “SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE” because he can’t offer personal advice in such a forum. The quote I absolutely hate hearing but is appropriate here is that his advice here is GENERAL IN NATURE AND THEREFORE CAN”T BE RELIED UPON.

So Lloyd don’t be too hard on the advisors mate it’s not really their fault, it’s just this silly system we have

BTW Lloyd,

How about putting a picture up it would be nice to put a face to the names that has given us such great insights

Ashley,

Thanks for the comment. My question was somewhat rhetorical and tongue in cheek. I always have taken my own counsel and believe that if an investor is not prepared to do the same, he shouldn’t be investing in anything more complex than an index fund.

I’d prefer that Roger cautions by adding DO YOUR OWN HOMEWORK AND TAKE YOUR OWN COUNSEL in addition to TAKE PROFESSIONAL ADVICE.

Everyone else in the financial sector hides behind the latter to the extent that its is almost meaningless, other than providing those that proffer it with a thick wad of legal paper to place across their backside in the event of litigation. Of course this is also ASIC’s get off-the-hook disclaimer for any oversight responsibility as long as the proposer any some scheme that fails has offered the caution to TAKE PROFESSIONAL ADVICE. .

The whole financial sector regulatory environment could be improved if the modus operandi was not ALL CARE AND NO RESPONSIBILITY. Poor mug punters think they are being looked after by it!

Truly, my experience of the professional advice that has been offered to me by the likes of private banking managers and financial advisers in a major bank (one of our illustrious four pillars) has been appalling. I’d be broke if I had followed any one of six pieces of investment strategy that they had offered me over the last ten years. On each occasion I presented the contrary investment case, including analytic models, to be told that they really didn’t have the economic expertise to comment on my suggested likely outcome. In the most recent case, five years back, I was offered what were nothing more than CDO’s . This fact was unknown to the manager advising me. I presented a statistical model of the consequences of 8-10% default rate on the package of mortgages and demonstrated that it wiped out the investment. The response from the Private Client Manager concerned – a shrug, followed by no more advice sent to me (which suited me just fine). The bank involved then went on to invest billions in said instruments and wrote off $1.5 billion on the same investment three years after I had shown them the problem! Professional Financial advice of this sort will seriously damage your financial health!

Now as to my photo, I am not as handsome as Roger, nor as young as you. I look more like Socrates in his prime – not a pretty picture if you’ve seen his bust in the National Museum in Athens – therefore best I decline the invitation to post an image, rather than scare the readers!

Regards

Lloyd

Thanks Lloyd,

“Wall Street is the only place that people ride to work in a Rolls Royce to get advice from those who take the subway” Warren E. Buffett.

“Do you own homework, understand all the risks and if you are still not comprehensively informed, seek and take personal professional advice”.

Roger,

I think the second statement “Do you own homework, understand all the risks and if you are still not comprehensively informed, seek and take personal professional advice” would make an appropriate caveat to everything you say/write on the blog.

Maybe you should use it as a header or footer to all posts?

It is definitely better than the simple statement to “Take Professional Advice”, because it throws responsibility for decisions and actions back onto the investor.

The alternative of wishful thinking to the effect that anyone can invest blindly, based on the assumption that advisors are acting solely in that investors interest is so naive that beggars belief. Yet it is exactly this wishful thinking on the part of investors that is played to by the Ponzi scheme artists, the Madoff’s and the sell side of the financial sector.

Regards

Lloyd

Thanks for the affirmation Lloyd.

I forgot to add in respect of financial advisors and the financial sector generally:

“Where are the Customers’ Yachts?”

…. also the title of a very funny yet immensely informative classic on the financial sector by Fred Schwed written in 1940.

The more things change the more they remain the same!

Financial planners and advisers are all about selling you their preferred suite of financial products. With all the associated fees it’s hardly independent advice or necessarily in the best interest of investors. Go to one hoping to get the best investment advice for you and you’ll inevitably get recommended a whole lot of other stuff like managed funds and the whole swag of insurance products – life, TPD, trauma, income protection etc. From what I’ve seen, the fees in many managed funds simply don’t justify the high risk and low returns. Particularly when you look into their holdings and see stuff like Telstra, Qantas etc.

To be a successful investor you need to rely less on advisers and become educated yourself. Financial advice is really for people who don’t know what they’re doing. Reading Value.able is a great start for share investing, I couldn’t recommend it more. It’s a must read in my opinion.

Hi Roger,

Anecdotal evidence: A friend recently realised their portfolio, which had been held for over a decade and was comprised of ‘blue chips’ under the popular definitions you list. Individually, some had done well. Others hadn’t. The net result was a shade worse than term deposits over the same period.

The returns on the stocks that had done will didn’t match the annual gains attributable to the company which CEO’s boast about in their annual reports. To me, this highlighted two of your fundamental points: Firstly, ‘blue chip’ don’t mean wealth accumulation or safety, because it doesn’t mean anything. Secondly, it still might be a good company, but if you don’t pay the right price, you won’t get a good return.

Spot on Chris!!!

Also in regards to ‘blue chips,’ I have some concerns about where dividend policy in Australia might be headed. It’s always been a mess, but changes to s 254T of the Corporations Act have the potential to encourage irresponsible behaviour. (Of course, this won’t be an issue for value investors seeking A1’s).

Under the old s 254T, companies could only pay dividends out of profits. This included trading profits, investment profits, profits arising by way of revaluation and profit reserves. So while companies could, and did, pay out more than their operating profit (i.e. Telstra), there was at least a requirement for a profit to be made, however dubiously it might arise.

After June 28 this year, s 254T allows a dividend to be paid whenever the company’s assets exceeded its liabilities immediately before the dividend is declared, with the excess being sufficient to fund it. The dividend must be fair and reasonable to the shareholders as a whole and mustn’t materially prejudice the company’s ability to pay its creditors, with assets and liabilities being determined by accounting standards in force at the time.

What does all this mean? For one thing, many senior lawyers admit they have no idea. It’s a mess. But what does this mean for investors? Blue chips which underperform often seek to maintain their popularity (and share price) by offering attractive dividend yields. This can be a trap, as paying out more than you earn is not sustainable, and can seriously hinder the performance of the business. Under the new system, dividends are even less regulated. A company might not even make an accounting profit yet still pay a large dividend, so long as it did not prejudice the repayment of its creditors. Personally, I think super funds are especially at risk of being tricked into a downard spiral which will see good dividend yields but irreparable damage to the company over the medium to long term. In short, this is no way to do business.

Thank you Chris,

You hear any arguments here from me. I think its a reaction to pressure brought about by the GFC but the demands for it should have been retested after a few years had passed.

G’day Roger,

First post for a while. Firstly, congrats on the book. I have also picked up second edition as a Christmas gift. I love reading the blog and appreciate all contributions from the readers.

I just wanted to share some observations on the table above. In defence of those that follow the “buy and hold blue chip” philosophy (I don’t subscribe), the group above, despite being approx. 25% overvalued at present, would still represent 12% growth in value (price could do anything) in the short term, which is still not too bad, if forecasts hold.

Interesting for the group of 23 “blue chips” listed, only half are rated “A” quality so are unlikely to dilute value. Presumably the other half could potentially see their value reduce due to a capital raising, or similar.

Assuming this group make up a large percentage of the ASX200, then one could surmise this indicates the market is overvalued at present? Of course, this doesn’t mean there aren’t still some bargains to be had.

Only nine companies listed above are rated as having good business performance (rating of 1 or 2).

Those companies with the largest forecast growth are generally those most overvalued. Therefore could have the longest wait for value to catch up to price. Also, four companies with forecast growth of 20% or more are rated 4 or 5. Presumably this could also mean that this growth is at risk since the business performance may be less reliable. So there may be a double whammy of being overpriced and still not able to deliver the growth.

Finally, no companies have the desired combination of decent safety margin and good IV growth.

Cheers, Bruce.

Thanks Bruce,

Your observations are precisely why the most important ingredient in investment management is patience.

I reckon ARB Corp is a blue chip – imagine trying to start a business to compete with these guys. You could easily blow $50- $100Mn on factories, distribution systems, retail outlets and other start up costs and still be up against the ARB Brand – which would be a mighty, if not impossible river to cross. Take the money and have a big party instead!

I remember walking into a well know art gallery in Melb a few years ago. The owner, unsolicited, opined to me his secrets of sucessful art investing which were, “buy blue chip, well known artists”. Of course he was selling what may be considered “blue chip” art by well known artists.

Maybe when some brokers and fund managers construct share portfolios for their clients its an easier sell for them if they include well known names, like the ones in your table above.

Might take a bit of explaining if you had a proposal with a portfolio of ARP, FGE, MCE, etc… (not to mention the tracking error!).

Hug the index – it’s much safer!

All solid points Brad, Thanks for the contribution. If you buy good companies, volatility will take care of itself. For long-term investors tracking error is not a measure of risk but a measure of opportunity.

hi Roger,

i have ordered your new book and am looking forward to reading and learning from it ,as I am a novice investor I would appreciate some guidance on i.v. calcs.Working on QBE(as that is topical at the moment) I get a payout ratio of 12.77 and a ROE of 17.654 giving an i.v. of $19.10-I get this using a 12%rr from the tables ,am I on the right path? if so is there a reason that you have not used the 10% rr to calculate your i.v.of $19.92 ( I get an i.v. of 26.17 using the 10% rr from the tables ) -is this your safety margin?

many thanks for providing a comprehensive and insightful blog for dummies like me .

cheers

Bruce

Hi Bruce,

The ten percent required return is that rate I use for a handful of companies but there is a bit of a process I adopt to attribute the required return that I believe is appropriate. My QBE valuation is $17.89 for 2011 (not 2010). Hope that helps.

RR is one of the most important inputs but one that is probably the most difficult to determine in your calculation of IV. A couple of posters have put up their methods of determining RR (start with 12, +0.5 for this, -0.5 for that), Pat Fitzgerald did it once I think. I have a method of trying to work out a RR but it is a work in progress.

Hi Roger,

As a Man utd fan, I can’t believe you’ve dedicated an entire post to the Blues…what were you thinking? :-) I’m prepared to forgive you however seeing as you posted your xmas gift a whole month ahead of schedule.

Just goes to show bigger isn’t always better (look at man city), with some companies lacking both quality and being available at a bargain price. For a lot of these companies ROE also looks ordinary, unlike the colour of your cookies.

Regards, Mark H

Hi Mark,

Something Red to come, still a month to go.

Hi Roger,

I amazed that you only give WOW a B1 rating. Is this because it is subject to new entries from overseas?

Interested to hear your opinion

Regards

George

Hi George,

Based mostly on the numbers being produced by the company itself.

Hi George,

There was a post previously that Roger did on BHP and WOW. This was during the reporting season. I suggest checking it out, i think it was called “Did BHP and WOW survive the avalanche” or something like that. just type wow or woolworths into the search box and i am sure you will find it. It touched out the buy back, cashflow and debt amongst other things.

fmg b2 & fgl c5? must be typo

The great thing about consistent approach to looking at numbers is that it can sometimes cause us to reconsider our perceptions Nan.

Roger.

Roger how should we interpret the MQR Ratings?

Obviously you regard A1 as the best and C5 as the worst – but is A5 better than B1?

Is MQR simply a quality rating on Balance sheet strength? Are the numbers a graduation of the letters or are they measuring two different aspects such as the letters relate to likelihood of a default event whilst the numbers relate to profitability or something like that?

And what in general does MQR signify? When I assess the investment quality of a company I am concerned with three things; Management, Balance sheet risk and earnings risk. I have read in your comments somewhere that an MQR A1 rating doesn’t mean the company has a competitive advantage. Without a competitive advantage a company has high earnings risk and would therefore not rank very high in my assessment of quality. Does MQR address current management calibre at all?

I’m not sure what you are trying to communicate when you put up your MQR ratings. Without a proper definition of what MQR means, an awful lot probably gets lost/changed as everybody interprets it their own way.

I understand that you want to keep some details of MQR private – but please if you are going to continue speaking in the MQR language at least tell us how you think it should be interpreted.

Hi Gavin,

I invest my largest proportion in A1 and A2 companies. I hope that helps.

Out of interest, Roger, what rating did you have for FGL have before it swallowed Southcorp?

Hi Greg,

Low Cs Greg.

Hi Roger,

Great stuff,

Just wanted to clear up one thing. Your expected changes in IV over the next 3 years is that a per annum increase or in total. I think I know the answer but just wanted to clear it all up for the other bloggers.

Keep up the good work

Per annum change Ashley.

Hi Roger

I have recently read your book and thought it was fantastic – a very valuable (pardon the pun) insight into the investment game.

But having looked at the table in this & a couple of previous blogs I realised there is something from your teachings that I haven’t yet grasped. Can you (or one of your learned regular posters) please explain to me the concept of the safety margin – how have you calculated it and what does it represent?

For example, how do I interpret ANZ vs CBA vs AMP which have (give or take) the same expected increase in IV but vastly different safety margins? Is it something you can compare between companies? Can I say that ANZ is a better choice than AMP because it has a positive safety margin rather than negative?

(by the way that was a completely hypothetical question on my part – I’m just trying to get my head around the safety margin concept).

Thanks

Hi Scott,

There are many sources of safety margin in business. The one you refer to is the difference between the price and the estimate of intrinsic value. If the price is below the estimate of intrinsic value, there is said to be a positive safety margin. A negative one exists (there is no margin of safety) when the price is above the estimate of intrinsic value. Warren Buffett/Ben Graham says that ‘Margin of safety’ are the three most important words in investing.

Wowwww…….BHP a B1, overvalued, with a falling IV…….is that the sound of every stockbroker and financial adviser falling off their chair ??

Is there a better example than this of what is “generally perceived” as truth, compared to the cold hard logical analysis ?

I’ve said it before and i’ll say it again here…..this is seriously good stuff.

Thanks Graham! I appreciate that feedback.

Thank you so much for this. I listened to the podcast today from last nights show, and heard you mention only 6 of the >10bl companies were trading under IV, and I thought there is a bit of homework for me, get home from work just now and BANG here it is.

Thanks again.

All the Best

Scott T

Delighted to be able to help. Please tell all your friends!

Wanted to know anyone’s thoughts about Acrux. I’ve been in tune for a while and now they got their FDA approval. I am waiting for them to hopefully fall back in price when some hype wares off. I believe this company has big potential. I was wondering what kind of IV growth someone might have on them and at the current price around $3.38 is it at any discount to it’s current IV. Another stock that has not been mentioned that I have done really well with is ANG – Austin Engineering.

Looking forward to getting Roger’s book this week!….keep up the good work and I’m so glad I’ve found this website.

Hi Bret,

Acr is an interesting business (I believe an A1). The problem is it’s past performance (more than likely an A5 the past 2 years – which means it’s performance has been low) (I’m guessing on MQR for past 2 years!) Last year and the year before they didn’t make any money and their ROE was -25% and -13%. Ret Earnings are negative while common stock is high and you want to see that balance out a bit more. They do have a high NPBT/rev. For every dollar that comes into the company they keep 88 cents as a profit before tax, which is very good. Plus they have no debt!!! If they have another good year this year their IV will jump significantly – but I would only be speculating regard their NPAT and performance for next year. At the momnet their share price is above my IV. On a EQPS of .50, 35% ROE and an RR of 14 (because of past performance). I get an IV of $1.94. Hope that helps.

Thanks for your reply. The big jump in their earnings came from the royalty payment and from speaking with the company they need to hit certain targets to receive other royalties. I believe the product obviously has one of the strongest sales force and their next earnings report should look impressive because of the new cash they will receive in the next two weeks. I figure that the earnings from last quarter were all it’s cash from royalties and this payment will be even larger. In my dreamland I would like to see the price pull back quite a bit over the next couple of months. You never know… the markets have a mind of their own….or just don’t us their mind. This worked for me with Gindalbie GBG after they fell out of the spotlight.