How do your holiday homework results score?

I was thrilled to see so many Value.able Graduates dive in the holiday homework I set just before Christmas. Well done. It is wonderful to see so many Graduates from the class of 2010, and now undergraduates of 2011, keen to continue building on their value investing knowledge in real time.

If you didn’t do your homework, let me remind you of your school days. Homework is a vital part of the learning process (even Buffett has been described as a learning machine). It was through all those nightly exercises and practice that you developed and refined the skills you continue to use today. When it comes to investing, the knowledge that you continue to refine, over time, will empower you to make smarter investment decisions.

So get out your red marking pen, it’s time to check the answers. If you are new to my Insights blog, click here to review to the Holiday Homework I set on 22 December 2010.

Challenge 1, Task 1

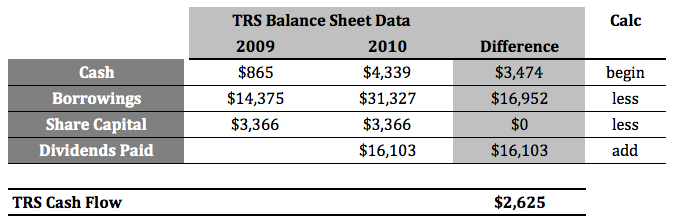

Using a Required Return of 11%, calculate the 2010 Value.able intrinsic valuation for The Reject Shop (TRS).

What is your answer? Using the numbers from TRS’s Balance Sheet, Profit & Loss and Dividend statement, I calculated $15.62. Here are my workings (click the image to enlarge):

Of course business is fluid and the most fluid businesses are impossible to get a bead on – so it’s important to constantly review your valuations and inputs based on fresh news and events. Even a quality business like TRS (which I wrote about becoming less enamoured with many months ago) requires this attention and is not immune to earnings downgrades or for TRS more recently, flooding of vital infrastructure that services 90 out of a total 211 stores.

Challenge 1, Task 2

Calculate the 2010 cash flow for The Reject Shop using the method outlined in Value.able on page 152.

What is your conclusion? The numbers tell me… had TRS paid more than $2.6 million in dividends, in addition to the $16.1m dividends already paid, the business would require even more borrowings to fund the dividends.

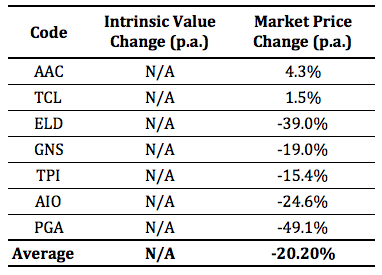

Challenge 1, Task 3 – C Rated Companies

Use the Value.able Valuation Worksheet to complete the Christmas Holiday Spreadsheet, and then rank the companies by their Safety Margin.

Before viewing these valuations (click the image to enlarge), heed the following lesson from Charlie Munger:

If I taught a course on company evaluation, I would ask the following question on the exam, “Evaluate the following internet company.” Anyone who gave an answer would be flunked.

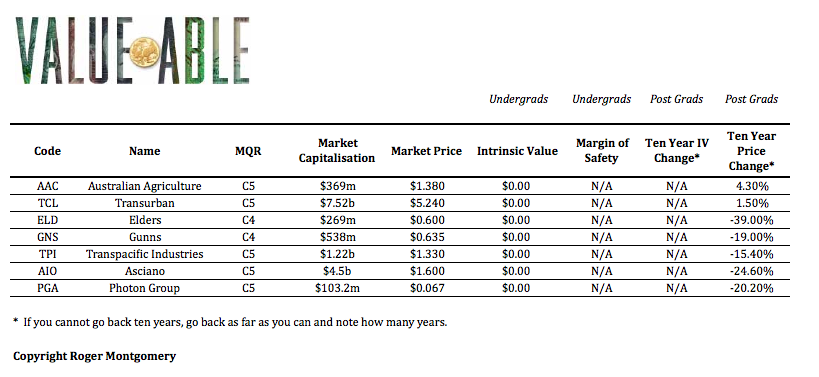

If you completed the Christmas Holiday Spreadsheet you will know my MQRs for the seven companies listed above – Australian Agriculture, Transurban, Elders, Gunns, Transpacific Industries, Asciano and Photon Group.

MQRs for these businesses range from C4-C5. C4 and C5 represent the lowest quality and poorest performing businesses listed on the stock market. These businesses are not investment grade.

What would I pay for them if I wanted to own a small piece of them? I wouldn’t. These businesses generate sub-optimal and even negative returns – my Value.able intrinsic valuations for all seven businesses is $0.00.

My advice? Move on. Don’t spend another minute conducting your own research. You and your portfolio will be much happier, and you will have more time to spend with family and friends.

Challenge 2

Calculate the historical change in intrinsic value and price over the last ten years. To do this, estimate the Value.able intrinsic value a decade ago (2001) and compare it to the 2011 Value.able intrinsic value.

To do the calculations, I used the ASX website (www.asx.com.au) to access past annual reports.

Prior to 2003 annual reports were published as text documents, which made finding the relevant inputs confusing. So I chose to start at 2003, the first year annual reports were published as PDF documents (click the image to enlarge).

Since 2003, the seven C4-C5 MQR businesses listed in the holiday homework have returned an average share price performance of -20.2% p.a.

With the Value.able intrinsic value of all seven businesses ‘about’ $0.00, the average change in intrinsic value was much worse (even though it could not be calculated using the formula provided).

When Ben Graham said ‘in the long run the market is a weighing machine’, he was spot on. There is indeed a relationship between value and price.

So I present the completed Holiday Homework Spreadsheet. How do your results compare?

Some warnings – very important and must be read by all investors

First, my Montgomery Quality Ratings (MQRs) and Value.able valuations are subject to one constant – change. I can assure you they will change. A business achieving a high MQR (A1-A2) today may become poor quality at anytime and a business currently ranked lower on my MQR scale could become high quality. Moreover my MQRs may not have any bearing on the current market price and the Quality Score (A-C) is NOT a predictor of price. Share prices will move independently of my MQRs, but as you can attest, for these seven businesses, there is a strong relationship between my current poor MQR and share price performance.

Although this is to be expected given the businesses underlying fundamentals and low MQRs, you must not rely on these in any way whatsoever. Consistent with my previous comments, I insist you use my blog as general information and consult your adviser, who will be able to discuss decisions with full awareness of your financial goals, needs, circumstances and risk profile. I do not have this information and so cannot offer any personal financial advice.

Posted Roger Montgomery, author and fund manager, 2 February 2011.

Anyone able to post the image of Roger’s working for Task 1? It seems to have disappeared. Thanks

Hi Roger

Last night on Switzer you mentioned a company that you this has good prospects. It is to do with broadband and it sounded like you said “Focus Communication” but I can’t find that on the ASX. Can you please let me know the name of it.

‘V’ Lynne, for Vocus. You can read more here: http://rogermontgomery.com/valueline-making-money-underwater/. Be sure to do your own research.

Hi Roger

I have started doing my homework and have completed challenge one task 1. However i have one difference in your calculations that i cant seem to figure out. For the return on equity you have calculated it to be 50% but i seem to keep coming to the answer of about 57.7%. I have been dividing the the net profit after tax to beginning equity (23.352/ 40.428) and as a result of this my IV is much different to yours. What am i doing wrong? I would like to fix this problem before continuing onto the challenges.

Thankyou for your time

Stephen

HI Roger,

I’m just wondering what you make of TRS given the recent market pullback?

I would still consider this a A1 company and being offered at discount to Intrinsic value by my calculations. Also i think the floods and other recent events/company news is only a short term speed hump that is offering reasonable opportunity. I would love to know your thoughts?

Thanks

Pete

Hi Roger,

I am still working on the Christmas holiday assignment. Your published ROEs are based on total equity not equity per share. The issue is ROE calculated based on equity per share and total equiy do not match, although they are very close in most cases, in some cases they are different. My ROE calculations based on total equity perfectly match your published ROEs. Here are my calculations based on two methods (first figure ROE based on equity per share, second figure ROE based on total equity): TRS (50.65%, 50.78%), AAC ( -7.98, -7.96%), TCL (1.53%, 1.61), ELD (-31.5%, -25.65%), GNS (1.87%, 2.02%), TPI (2.22%, 3.89%), AIO (-18.84%, -31.41%), PGA (-23.53%, -33.15%). I checked to make sure number of shares are correct. Even when number of shares match, there is difference. I am just asking you to comment, if possible, as the method you used in your book is based on equity per share.

Regards,

Yavuz

Consistency is more important. Don’t change boats mid steam.

I too found a problem with the cash flow calcs for TRS. By the ASX report (page 30) the Dividends paided for 2009 is stated as $13,166 not zero as appears to be ther case in your answer.

Regards

Frank

Hi Frank,

There is no problem with Roger’s cash flow calculations for TRS. You should not be including previous year’s dividends paid in the cash flow calculation method as described by Roger. The method works based on the differences between two successive years. It makes sense to take difference between two years for all items (i.e. cash, borrowings and share capital) but not the previous year’s dividends paid. Because dvidends paid is already reflected in one or more of the items (either total borrowings if company borrows money to pay dividends or underwritten, for example, or decrease in cash if withdrawn from bank account). This is how I understand it works. However Roger can correct me if I have misunderstood.

Regards,

Yavuz

Thank you for your valuable contributions Yavuz!

I thought the purpose of this exercise was to calculate a future value not just a 2011 value based on FY2009/2010 numbers? If the companies are forecast to have some earnings in the future then they must have some value in the future, even if it may be without a MOS and not stable or of high enough quality to be investment grade. In the end it was a good exercise and an eye opener. I hope quality will now hit me hard in the face in the future.

Matty,

You are right. But is not lower risk to buy businesses with a demonstrated track record?

Hi Roger, I totally agree. I wouldn’t consider investing in these companies, it ‘s just that I spent a few hours working on an IV based on analyst forecasts when a quick zero was all that was warranted. Just a little misunderstanding of what a 2011 value means. Still wasn’t wasted time as I am now more accustomed to financial reports and there are now at least 7 companies less in the invest.able universe.

I guess we can add TLS to that uninvestable universe…

You bet.

My first attempt at a blog. Also have not purchased a share to date. Please keep up the terrific info flow, have found them very educational. Most of the topics I find I need answers to also.

Thanks

Gail

Keep going Gail!

Hi Roger,

Thanks very much for sharing your calculations with us here. They are very useful for me to check my calcs. No issues with TRS, cash flow and AAC. I have the following issues with ELD. They did not pay dividend in 2010. For example the annual report page 66 clearly states no dividends paid to ordinary shareholders. As I can see the only payment made is to hybrid holders for 8.2 cents per hybrid. However in your table you used $3,198 (p.71). This figure represents paymeny made to non-controlling interests. Is this for hybrid holders? There is also $42,949 made to ordinary shareholders. This contradicts what is on p66. There is also dvidends underwritten to the amont of $26,879 (all on p.71). In the end, what is basis of using $3,198?Also the number of shares you used correspond to Sep 2010 period, which is for 15 month period to Sep 2010. The number of shares on issue reduced drastically from Jun 2009 (consolidation?). Also for the reported NPAT, you included the amount distributed to non-controlling interests, whereas for the equity you excluded the portion attributable to non-controlling interests. Again I assume this is for preference shareholders (or hybrid holders, which gets priority in terms of payment).

In the scheme of calculating IV for ELD all these questions may not make any difference at all to the final result, as it wil be zero regardless of what happens. But I want to understand how all these came about as it may make significant difference for another company in the future. Your assistance is appreciated.

Cheers,

Yavuz

Its a good point and I will have another look and correct if needed. I must confess to already knowing the outcome before engaging in the exercise which may have influenced the level of detail my team went into. But that is no excuse and they will be tarred and feathered for this if you are correct!

Roger,

In challenge 1, task 2 you had omitted the dividends for FY2009. Can you explain the reasoning? Thanks.

Hi Phil,

WIll have a look at them and get back to you. Thanks for bringing it to my attention.

I have found a page on commsec called ‘company wrap’ (under research-company info) this gives a fairly complete breakdown of the companys stats, including shareholders equity, shares outstanding, ROE, payout ratios and estimates of future earnings. Using their details for 2010 quoted, the ROE is 45.3% with a payout ratio of 75 percent which gave me a significantly lower valuation.

I know im taking a huge shortcut in using this information that is already alculated, my question is however, where the discrepency comes between their figures quoted and those obtained from filtering through annual reports? Any thoughts?

Hi Roger. I’m really pleased with how I did! I understand much better now, particularly with how to use beginning and ending equity. I struggled a bit with the 10year history and those text docs but eventually figured out to use 2003 as the starting date. Finding the ASX archived reports made the homework worthwhile in itself. thanks!

Still looking forward to your comments on the KCN DOM takeover and what you make of the price paid for DOM, one of your once-rated A1 or A2 companies. I’d love to hear your comments on Price paid and what that does to goodwill.

thanks again for the homework and everything else.

Hi Roger

In calculating 2010 IV for TRS, I used the dividends declared of 67c in respect of that year giving a Payout ratio of 75%, rather than the divs paid during the year of 62c giving a payout ratio of 69%.

Clearly if actually doing the calculation at June 10, you would have to use the cash figure of 62c as the final div was not declared until after the y/e but with the benefit of later information is the interim + final for the year of 67c the better figure to use?

The actual answer is not materially different in this case but I want to better understand the methodology.

Thanks

Eugene

Hi Eugene,

I use declared divs

As long as you are consistant over time it will not matter

Hi Roger

Thanks for your answers to our homework – although I calculated an IV $0.00 for all companys – I have also used your answers to check the figures I used – reading annual report isn’t easy!

For ELD I thought because they didn’t pay dividends for FY10 – I used $0 forr reported dividends – looking back at the annual report I can find your figures DRP=$16.07 and the underwritten DRP $26.879 but can find dividends of $46.147! Help!! Denise

Hi Denise,

I think you can find this figure – P.71, “statement of changes in equity”- in total equity column, directly below the 16,070 figure. However, these figures appear to coincide with 2009, but I’m probably wrong.

I agree readings reports isn’t easy,

Regards

Thanks Steve B – found the figure – I must have been reading another section of the annual report! I’ll keep reading the blog to gather further insights. Denise

Hi Roger,

I understand that in this exercise, you used 2010 reports to calculate the intrinsic value but I was wondering whether the other values that you post are simply based on the most recent report of the company like this exercise or whether they are weighted from the time passed between the most recent report and your forecast for the next years report.

I have recently tried doing this to make my valuations more accurate but most of my intrinsic values have become noticeably higher than yours. Could you share your thoughts on this?

Thanks,

Chris

Still learning the finer points here, but I came up with a different TRS Cash Flow in Challenge 1, Task 2 of $1,725. I think the 2009 Borrowings should be $13,475 rather than $14,375; perhaps a typo?

The 2009 borrowings figure of $14,375 is made up of Current Liabilities borrowings of $11,379 plus Non-current liabilities borrowings of $2,996. This is on the Balance Sheet.

Only 4 cents off the TRS valuation which is probably due to rounding and got the cashflow correct. Didn’t get to complete the other challenges but i did get a $0.00 IV for the ones i had a look at.

Nice activity Roger.

Funnily enough a few of your C4 and 5’s in the example were listed in an article in the herald sun if i remember correctly as top stocks for 2011. Transurban wa slisted for paying sustainable high dividends. When i looked at the financial information i saw nothing that even borders sustainable.

I believe the obsession with dividends by some people is doing them more harm then good.

Hi Roger,

Think i did OK for challenge 1, Task 1 & 2, but don’t understand why you used prior years equity instead of average equity for Step 3?

As for the rest of it i made a bit of a dogs breakfast eg. Task 3, AAC, if this is 2011 IV, shouldn’t current equity figure be 633,058 instead of 645,109? Discrepancies to numerous to mention, i’ii keep plodding along.

Thankyou

I was wondering the same thing. I used avg equity for 2010 and 2009. Was the 2010 equity only used instead of the avg because it would be more simple. I also tried the excercise using a slightly lower ROE because I thought 50% might be non-conservative.

My mistake I should have used 50% – forgot we were working out last years IV.

Got it wrong myself, Roger is using avg. equity. I’m beginning to realize where the rest of the figures are coming from too. Very informative.

Thanks Roger