How baby boomers won the genetic lottery

Baby boomers won the genetic lottery in so many ways, not just because a whole chicken in 1973 was $1.09 (Figure 1).

Take Wayne, for example, born in Sydney in 1945 after World War II. As a teenager, he lands a job earning the national award wage of £13.80 per week. He changes his mind after a couple of years and decides to study engineering. University is free (no HECS), so he continued to work part-time while at university and became an engineer in 1965, earning the average wage of £1,145 per year.

Figure 1. Woolies advertisement 1973.

In the same year, he had enough for a substantial 50 per cent deposit to purchase a three-bedroom house with a garage in Ashfield for £6,850 (Figure 2). By 1970, he’d paid off the mortgage and was earning $5,000 per year.

Figure 2. Sydney real estate sample 1965

By 1970, Wayne’s annual salary could proportionately purchase 5.2 times the number of Sydney homes it can purchase today.

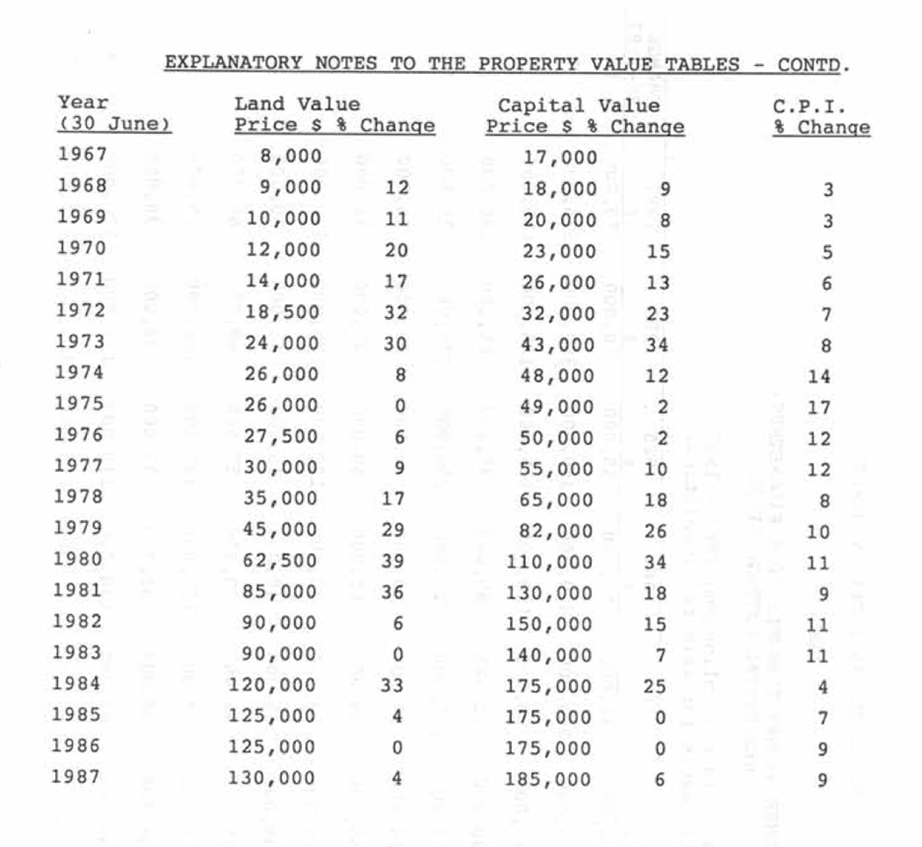

The following year, 1971, the first Sydney McDonalds opened in Yagoona, and the NSW valuer general put a $26,000 value on Wayne’s inner suburban cottage. High levels of migration were helping to drive land prices up.

Figure 3., NSW valuer general’s house price change for inner suburban cottage

In 1984, at the age of 39, with a couple more properties under his belt, and just as Wayne starts thinking about his health, Medicare is introduced helping with the cost of seeing a doctor and obtaining medicines. Paid sick leave had also been gradually introduced into federal awards until 10 days sick leave per year (with unused days rolling over into future years) became standard.

Elsewhere, during the 1980s, the removal of limits on the interest rates that could be paid on deposits and charged for loans, the floating of the Australian dollar, and the introduction of competition from foreign banks significantly modernised the financial sector, spurred improved access to credit (the biggest driver of house prices) and fuelled a house price boom.

Then, in August 1991, Treasurer John Kerin announced the superannuation guarantee. Just after Wayne turns 46 and is thinking, for the first time, about what he’ll do when he retires (comfortably for sure now), he’ll be able to invest more money by socking away tax-advantaged compulsory savings.

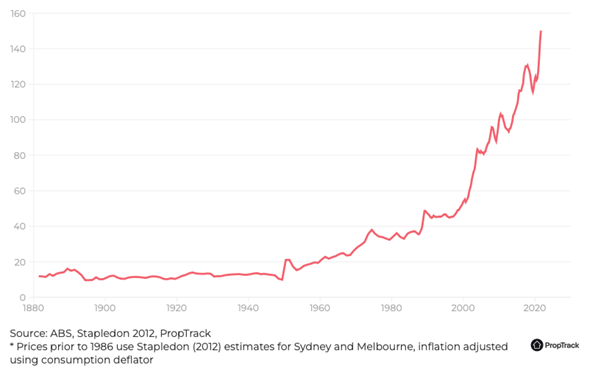

Meanwhile, as expected, migration and financial market deregulation sees the market value of Wayne’s properties beginning a north-easterly journey that will keep him sitting pretty.

Figure 4., Australian House prices, inflation adjusted, March 2011 = 100

In 2008, with a substantial nest egg already accumulated, Wayne experienced his first serious setback. The global financial crisis (GFC) makes the 1987 stock market crash look like a picnic because, back then, Wayne didn’t have much in shares anyway. Remember, superannuation was introduced years later, so Wayne started building his share portfolio after super was compulsory.

By the, GFC Wayne has built up a massive nest egg of cash and stock investments, alongside his properties. But being an engineer, Wayne’s reasonably bright, and he decides to invest more while prices for property and shares are depressed.

Just after he does, central banks globally coordinate an economic rescue plan called quantitative easing (QE). Every year until 2019, central bank liquidity climbs, and interest rates are cut significantly, making any loans Wayne has on his properties cost virtually nothing—he bought most of them when they cost virtually nothing anyway, so he has virtually no debt anyway.

Wayne’s share and property portfolio soars. His first house, valued in 1971 at $26,000, has risen more than ten-fold, his other properties have also risen between five and ten-fold, and his share investments have done equally well without much effort.

Wayne retires comfortably thanks to a rising tide that lifted all boats for the boomers, and as he watches Generation Y and the Millennials complain about housing affordability, he concludes, “they should stop complaining, stop buying avocado on toast at the café, and start saving.”

Doubt i’ll be around in 50 years time. But i bet future generations will be having exactly the same debate.

Sounds good to me. I was born in 1976, have worked hard all my life. Basically followed in my father’s footsteps but I went a lot further. I have four properties here and three overseas. I bought my first one in 2012.. I worked very hard and saved. The current generation, which my kids are a part of are not that savvy.. I’ve seen the evidence.

Stop voting for more entitlements, safety and big government.. that’s the root cause of all the so called crises we are having..

Not all Boomers were as lucky as Wayne. I was born in 1957. I married in 1984 and we bought our first house in 1986. I was on (unpaid) maternity leave when the interest rates went up to 18 percent. I counted out 2c pieces to buy milk when I first started work, women were unable to access superannuation and unable to access loans without a man to act as guarantor. We received no first home owners or baby bonus. Following my divorce in 2002 and with 2 teenage children, I struggled to pay my mortgage. I made my final payment at the age of 63. Everyone’s story is different.

Thank you for sharing Susan, It is indeed impossible to cover everyone’s scenario in a short article or blog. Thank you for pointing that out.

Sorry tertiary education was not free in 1965. You paid for yourself or got a scholarship. Free tertiary education was not introduced until after Nov 72.

YOu are right Irene, In 1940, the Curtin Labor Government saw a need for the country to increase the number of university graduates and for more civil and military research. To do this, it dramatically increased the number of scholarships it offered to enter university and allowed women to apply for these scholarships (they were previously exclusive to men). The Menzies Liberal Government also supported and extended the ability of ordinary Australians to attend university.

In the 1960s, the Menzies Government encouraged and funded the establishment of new universities to cater for increasing demand. These universities were built in outlying suburbs and offered special research scholarships to encourage students to undertake postgraduate research studies. Many of the universities that were established under this scheme are members of Innovative Research Universities Australia.

In 1967, the Government created a category of non-university tertiary institution (called College of Advanced Education (CAE)) that would be funded by the Commonwealth. These CAEs were easier to access and cheaper to attend than the traditional university, while delivering many university-equivalent bachelor’s degrees.

So yes, while it wasn’t ‘free’ it was cheap to broaden access.

Agree 100% Roger. Disclaimer: I am Gen X, own a PPOR and investment property.

Don’t forget the “18% interest rates furphy” that is trotted out as justification that “boomers had it tough too”, which, when we do the maths in terms of the average wage versus the average house price, the percentage of the wage versus fortnightly repayments and then (allowing for inflation), compare this situation versus today as a like-for-like comparison, and you’ll see that those “horror” 18% interest rates were not so, when compared to similar conditions today. The 18% interest rates were also not around for very long; they hit 17% in June 1989 and stayed there until March 1990.

In short, “normal” rates of 7.5% on the same sort of metrics today (percentage of wage versus repayments) are actually comparable to those 18% rates because the denominator today is so much larger, thanks to the amount that you have to borrow.

This means that comparatively, a small increase in rates means a lot more today than it would have done in the past. Add to the fact that in March 1990, owner occupier housing debt was 28 per cent of household disposable income (RBA figures) and has gone up steadily since; back in September 2016, it was 98.4 per cent and has probably gone ever higher since then. Despite being national figures, they would also be much higher in Sydney and Melbourne.

Wages have not kept pace anywhere near the same as house prices, and what you buy today in terms of house quality – the “new” (Hebel bricks, rendered blueboard and polystyrene waffle pods) versus the “old” (double brick) is absolute rubbish and not worth good money.

These are great insights Chris, thanks so much for sharing! When polystyrene was co-opted as a building material I voted never to buy a new apartment unless the materials absence was confirmed.