House prices in Box Hill down 41%

As you would well know, we have been bearish property for more than two years, warning those who feared missing out, to be extra cautious about borrowing to buy at the peak.

If you type ‘property’ into the search bar of this blog and read some of our posts you will find a bunch of respondent’s comments suggesting that factors like immigration and population growth will ensure that property prices would not fall.

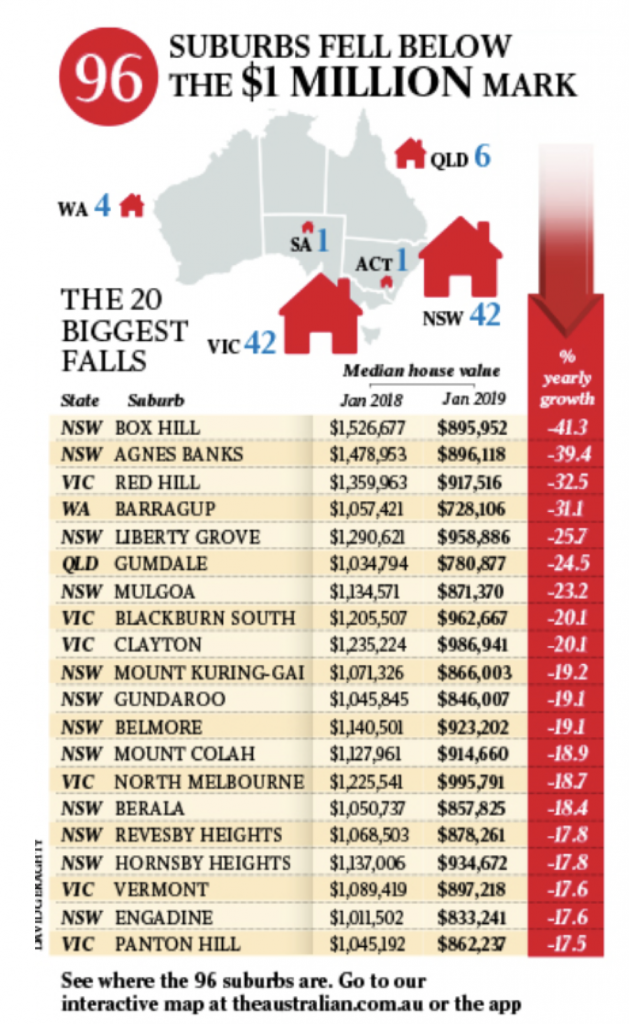

Today’s The Australian is leading with a story (see picture below) about property price falls that far exceed the national average. Box Hill in Western Sydney has declined 41.3 per cent in January year-on-year and Red Hill on Victoria’s Mornington Peninsula is down 32.5 per cent.

We make a couple of observations. Many of the owners in the suburbs listed will now be in negative equity. JB Hi-Fi and Nick Scali will not be seeing those families in their stores any time soon. As I will write about in coming days and weeks, we are entering a period of deleveraging.

With house prices now declining substantially, the record debt is what households will turn their attention to reducing. Credit growth is already slowing and possibly faster than GDP. And that means a decline in retail spending. Unsurprisingly, that is what we are now seeing. Big ticket items are the first to see the tide go out, and car sales are slumping. By way of example, national Mercedes sales fell 43 per cent year-on-year in November alone. Ford reported a 41 per cent decline in the same month. Retail sales slumped in January and the fashion category fell by 3.8 per cent – annualise that! Meanwhile foot traffic is plunging, and Westpac reported consumer confidence had “evaporated”.

When you are looking for reasons for all of this just remember everything goes in cycles. After a debt binge there must be a period of indigestion, followed by reflection. Therefore, after a great debt boom, expect it will take time for the debt to be digested and brought back to a ‘comfortable’ level. For some that will mean slow and steady repayments, for others at the pointy end of debt-to-income, expect some forced asset sales. Whichever path is taken however to reduce debt, expect retail sales and house prices to soften in the meantime. And then expect some time to pass before any sustainable recovery occurs.

The other observation worth making is that house price falls are not occurring where owners aren’t feeling pain. At the top end of the property market there has been little change with the exception of a more cautious approach by buyers. Vendors aren’t lowering prices unless they have to and with Investment Banker bonuses never higher, the loan repayments aren’t at risk so owners don’t need to sell. And of course, there will always be buyers who can pay cash. Turnover at the top end may slow but only a financial crisis or a deep recession, that 1) causes job losses in the finance industry or 2) the private equity funding tap to turn off for trade sales, takeovers and start-ups, will bring top end home prices down.

Top end homes aren’t immune to falls – they plunged during the GFC and entire Mosman streets were ‘quietly’ listed – but something much more pronounced than rising mortgage rates and a slowing economy is needed to shake things up.

You can be certain however, for the vast bulk of Australian’s, conditions are about to get a lot tougher.

Roger, Box Hill is a new suburb in Sydney’s North-west where most of the recent sales are land only and the average would be something around $500,000. There have been some house and Land sales but the vast majority are land only where consumers then contract to build a home separately. Last year, mixed in with all these $500,000 sales are a bunch of $7-10 million sales that occurred as developers bought up development sites. That is why the median price was $1.5m in 2018 and has now dropped to $895,000 as the big development sales are replaced by more $500,000 retail land sales and the median subsequently drops. Next year, as the area achieves more $500,000 sales the median will come down again though.

Thanks Mr Flanagan, I will have a chat with my friend Chris Joye who was instrumental in the algorithm that produces house price data (now owned by corelogic) and find out if the data adjusts for land-only sales. Good of you to take the time to explain. In the meantime, if you’re correct, we can agree that prices are falling, and at an accelerating rate. If 41% turns out to be wildly incorrect and instead there are still plenty of households more focused on their mortgages, well that’s the main message.

Roger, would like to know your opinion on recent headlines…

“this weekend’s auction results well above last year’s lows”

My observations had been, early 2018 no one saw the end of the boom, and therefore vendors weren’t prepared to discount, resulting lower clearance rate. Come early 2019, many accepted the fact property has fallen, and anyone who list their property, are sure to be prepared to sell at a deep discount. We have desperate real estate agents giving pressure to vendors come the third week of their Auction marketing campaign.

How can media say auction results better based on clearance rates when properties are settling at 10% or 20% lower than last year?

Would really appreciate your observations (just opinion, not advice).

One weekend does not a trend make! Hope that answers it Austin. We have entered a period of deleveraging. The pressure on property prices will continue to be down for a while. And worse if Labor wins.

Seasonality! There’s always a little spike early in the new year. They (MSM) don’t mention that though.

Two years Roger? Don’t be so bashful. You have been proclaiming the end of the property cycle for longer than that. Someone with too much time may indicate that it’s closer to four years.

I for one have been on the ‘population will save us’ bandwagon. Whilst unlike a Sydney Swans supporter in the second week of the finals, I am not prepared to abandon the ship just yet.

Due to weddings I had the opportunity to visit Dubbo and Tamworth recently and the volume of relocated Sydney people beggars belief. I know that the NSW Central Coast is groaning under the weight of people who once called the Harbour city home.

If we start to see declines that extend past suburban Melbourne and Sydney then we may have a problem until then it’s “cheer cheer the red and the white….”

Thanks Andre, Yes it was actually much longer. Anyone who leveraged heavily to purchase an apartment in the last four years may be in a bit of trouble. The population argument is correct for property in unique locations like Sydney’s beachside suburbs over the very long term. Keep in mind populations have been growing for centuries but it doesn’t prevent periods of sharply declining house prices, such as we are seeing now. For people in Box Hill and the other suburbs listed: Credit Tightening 1, Population Growth: Nil

Population growth has not changed, so why the pullback? It’s credit.

Ireland and states like Nevada and Florida had 4% population growth, even after the first 10% of their bust. They declined 60-80% in the end.

There are definitely consistent markers in both cases;

In US terms we’re at July 2007, about the time delinquencies start firing up. Overall market wide declines approaching 10%.

https://www.housingwire.com/ext/resources/images/editorial/BS_ticker/PDF/A-April-2016/mortgagerate.png

Also the same time unemployment rockets. Lets see what happens.

http://blogs.reuters.com/data-dive/files/2013/12/unemployment.png

Incredible when you run the same exercise on Ireland.

We’re early 2008 in Irish terms. Over the next two years their unemployment rate surges from 6 to 14% (enroute to 15%) and delinquencies from 1.5 to 4% (enroute to 15%+).

Clearly, at the point where YOY growth turns negative, you are 12-18 months away from mass unemployment and 4%+ delinquency rates. We’ll soon find out how consistent credit markets and human psychology really are. Judging by the US and Ireland, the parallels and mechanisms are similar.

More interesting charts;

https://qz.com/50615/welcome-to-ireland-where-house-payments-are-optional-apparently/ (delinquencies)

https://www.globalpropertyguide.com/Europe/Ireland/Price-History-Archive/irelands-residential-property-still-in-deep-crisis-127018 (Values Delta)

https://www.economicshelp.org/blog/7344/economics/irish-economy-summary/ (unemployment)

Enjoy the research.

Thanks for sharing Jimbo. I am certain Andre will be grateful for the links.

Yeh Jimbo. Thanks mate for the homework on the weekend

‘Remember, you can never, ever, ever go wrong buying quality blue chip property in good suburbs’

– Real Estate Agent who’s completed a two week TAFE course, circa 2016.

And that’s a highly qualified one, effectively providing unregulated financial advice. Welcome home chickens, roost away.

Nice job Jimbo, it’s hard to believe the RBA has Blown this massive bubble and allowed it to become systemically dangerous to the entire economy, all with the 20 20 hindsight vision of all the examples you have shown above, how do these people still have a job. I’m sure Burnie Maadoff could have done a better job running this circus.