Hold on tight: the great property sell-off has begun

The much derided prediction of a sell-off in Australian property prices has finally started. Prices in some cities are starting to fall. Rental yields are becoming unsustainably low. And many property buyers are now at the point of ‘no return’ (yes, the pun is intended).

Of course, you wouldn’t think the property bubble had reached its finale if you looked at the headline-grabbing median prices and the ridiculous prices being paid for shoe boxes in Sydney’s Paddington – “Hey, what’s an extra million when the additional interest is $45,000 a year.”

And that is the point. We know that the boom in property prices has little to do with anything other than historically low interest rates, which have made paying an extra million at auction as insignificant as an impulse purchase of a bar of chocolate at the supermarket checkout.

I have now heard every possible explanation for surging house prices and the only one that matters is interest rates being lower than at any time since Captain Cook first sailed across the Antarctic Circle. Surging house prices have nothing to do with a shortage of land; Hong Kong has less land and a much higher density of people per square kilometre and that has not prevented property prices from falling. Surging dividend incomes, retiring baby boomers and Chinese fondness for our climate and air quality are all ‘weight-of-money’ arguments that have never prevented falling prices.

Unwittingly, panicked Sydney, Melbourne and Brisbane property buyers are merely pawns in a global game of Central Bank Chess whose end has arrived. As central bank bond buying, also known as ‘quantitative easing’, pushed government bond yields lower, investors were forced to seek higher returns elsewhere. Corporate bonds were next to surge, then junk bonds, equity and property. And record prices for art, low digit number plates and collectible cars are proof the phenomenon was global and indiscriminate. Sydney property is nothing special, no matter what your real estate agent tells you.

And keep in mind few investors have any experience navigating a sustained secular increase in interest rates and inflation and even less would know anything about ‘credit events’, which long duration assets are always susceptible to.

Property income yields are at historic lows and yet property buyers couldn’t be more enthusiastic. Buyers who tell me that they don’t mind buying on a yield of 2.5% because they will get a capital gain need to understand that the capital gain will only come when a buyer is willing to accept an even lower yield. And yields cannot fall much further when your oversupplied property Is vacant and your yield is zero – as many leveraged Brisbane apartment owners are about to discover. The end of every bubble is marked by the appearance of the the greater fool principle; betting a bigger fool will come along and accept an even worse return. It’s speculation, pure and simple.

If you are buying a property on an unattractive yield, it is not made more attractive by borrowing. Record levels of household debt to GDP, and household debt to income, and record levels of credit card debt, mean that when bond interest rates rise – they’ve already started rising – investors will be able to least afford the additional costs thanks to having previously paid and borrowed too much.

Within 5 kilometres of Brisbane’s CBD, 5500 apartments were completed and available to be moved into by owners or tenants in the nine months to September last year. During the same period, vacancy rates rose from 2.7% to 4.7% – a near doubling – 5 to 15 kilometres from the CBD. Landlords who purchased a flat that has no tenant need to deeply discount their rent or accept zero income. And that puts financial stress on the landlord even if they haven’t lost their job. Most worryingly, another 13,300 new apartments will be completed within 5 kilometres of the CBD before September this year.

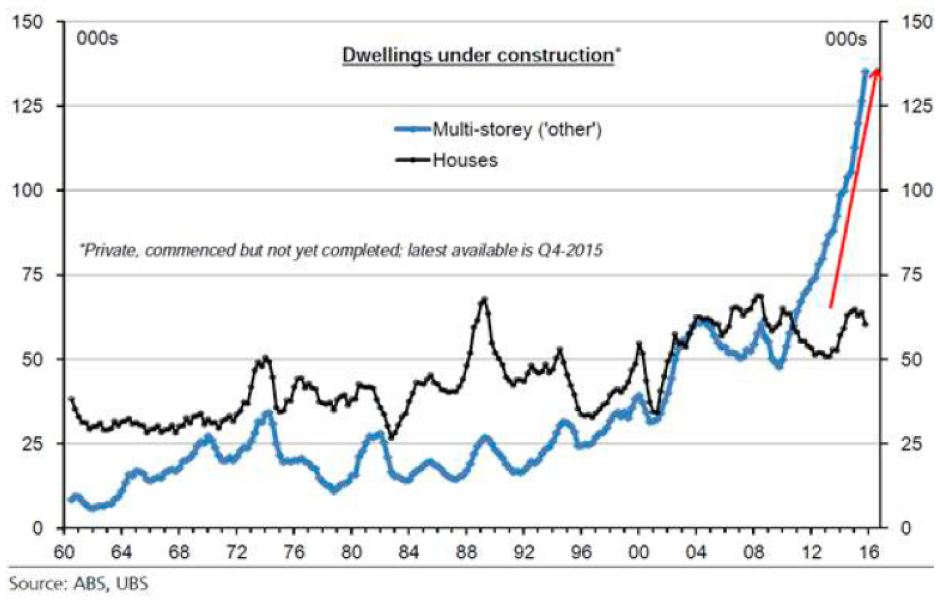

Meanwhile, some financial planners have reported to me being cold-called by developers and offered 7% commissions to market properties to their clients. This on top of the free holidays, free cars and free frequent flyer points being offered as incentives to property buyers. As supply increases (see the chart below), the discounts will become more aggressive, ensuring lower prices. Reports of some apartments being revalued 30% lower than 18 months ago isn’t going to help either.

Financial stress is increasing even though employment looks fine. Witness the tripling of calls to national debt helplines with much of the increase attributed to mortgagees with multiple investment properties. Note that at current low interest rates 30% of family income is required to meet mortgage repayments in Australia. And that’s using pre-tax incomes. Financial stress occurs when you lose a tenant, when interest rates move up, and when you have negative equity in your property thanks to the bank revaluing your new apartment lower upon settlement. Financial stress occurs when AMP and CBA, Westpac and others, tighten lending restrictions on particular types of loans or blacklist your suburb, thereby pulling the rug out for any new buyer of your desperate-to-sell property.

Many believe their suburb will be immune. Many believe the falls won’t impact houses and will be quarantined to apartments. Many believe their property won’t be affected because it has some special quality. Such beliefs are nothing more than head-in-the-sand wishful thinking. I have seen the same wishful thinking from 37-year old, newly minted millionaire property developers – customers of Ferrari and Lamborghini dealerships – who believe that their developments of 12, 30 or 60 apartments will be immune from the ravages that will befall their peers and their larger 100–200 unit developments.

My bankers have told me all of their smartest and most successful property investors have sold up or are getting out, and they cannot lend them a cent – they won’t take it.

Drop a pebble in a pond and the ripples will eventually impact the entire pond and everything in it.

Why should Tweed Heads and Bowral prices be 9 or 10 times incomes, when thousands of similarly-sized towns around the world – and the same distance from capital cities – can be purchased at half the multiple? It doesn’t make sense and it isn’t sustainable. And neither are low interest rates. Australia’s debt-fuelled property boom may be handing Australia an unlucky hand. Hold on tight.

Tony Morris

:

Bank term deposit rates for ‘serious’ amounts for 60 month terms are indicating that many prudent people and economic entities are, in effect, betting on a residential property market crash which will be both severe and lengthy. (They are ‘suspiciously low’. Bookies will tell you that they do not set the odds – the mug punters do!)

Any thoughts on demographics and particularly the all -important TFR? Australia and almost all other ‘developed’ economies are seeing a de facto ‘strike of bellies’.

It appears to me that the Australian residential property market has now reached that stage where a positive feedback loop is running strongly. Rising vendor nervousness bolsters confidence of potential purchasers that further falls are in the offing and that now is not the best time to buy. Vendor nervousness rises further (low attendances at OFIs and potential purchasers suggesting purchase prices way below asking prices) and away it goes!

Roger Montgomery

:

Back in 1971 (when I and my brother were born) women were each having 2.96 children. Today the Total Fertility Rate is 1.83 and that has been stable since 1980. The impact of Costello’s recommendation to have one for Mum, one for Dad and one for Australia did appear to lift the rate from 1.75 to 1.98 but the effect has faded. I suspect the ‘strike of bellies’ you describe is as much a function of careers, financial independence and non-committal men. Without debating the merits or otherwise of having children later (having no grandparents around to help is often an issue that isn’t considered) the slowing TFR has, in the minds of those who view everything through an economic lens, to be made up through immigration. Dick Smith would have some interesting things to say at this point about the pursuit of growth. Nevertheless I think with respect to its impact on property, the TFR is splitting hairs. According to the ABS Australia’s projected at June 30 2056 (38 years from now) will be 42.0 million if the TFR is 2.0, 35.5 million if the TFR is 1.8 and 30.9 if the TFR is 1.6. With the population at 24.7 million at September 2017 and growing at just over 1.6% we can safely rule out the third scenario. I would guess (and it is just a guess) that population will be between 45m and 49m in 38 years based on recent historical rates of growth, with risk to the upside. Under that guess/scenario there will still be business and consumer cycles but the banks will probably be writing a lot more mortgages.

Adelaide Mum

:

So what about Adelaide???

And if the house prices drop because of higher interest rates, won’t that encourage alot of other people to buy due to houses looking more affordable at face value, either because they are a) opportunists with a bit money to risk, or b) they are first timers who are not looking properly at the repayments due each week, just seeing a handy price drop?

But besides all that, if you’re not an owner, you must then be a renter. And there will be more renters to rent my big block with a little house on it, that I’m hanging onto. And surely the rent prices will remain bouyant.

wade

:

Hi Roger

Yes property is general is over price (income to price, record debt and to GDP, ect). However, timing and prediction is unpredictable. Prices can still go significantly higher. For example, Japan stock and real estate bubble reach a high of P/E over 100, tech bubble, and recently in China. The question we should be asking who know and does not know (Howard Marks) and the impact of potential government intervention.

Thus

:

Who ever thinks that property prices will not crash very very soon in this country are dreaming.

I lived in Ireland when the bubble popped there.

Weve comitted the exact same mistakes as Spain , Ireland and the USA.

Who ever thinks Australia is different is not right in the head.

This is going to be bad.

Property prices will drop like theres no tomorrow.

Nathan X

:

Interesting comment – when you same exact same mistakes….. do you mean debt fuelled growth ? The USA was out of control sub-prime lending to people with no money and sometimes no job…but what about Spain and Ireland ?

Mark

:

In Sydney we’re still dreaming…….. that property prices won’t crash New property construction in Sydney needs to really slow down, but so long as unemployment remains low, there’ll always be new buyers entering the market. Yes, a gradual increase in interest rates over the next few years will slow the market, but the reduced demand from Chinese buyers may have a bigger effect.

W Wang

:

How many people know the property price in Chinese cities like Beijing, Shanghai and Shenzhen? A two-bed apartment in Shanghai (100 square meters) can be sold at least 6 million Chinese RMB which is about 1 million of AUD.

Recently Chinese government has a policy to limit Chinese money to flow out, but we all know how ineffective Chinese policy is. The big and well-connected people can still get their money out. As long as Chinese money are flowing out, the apartment price in Sydney and Melbourne won’t fall. The cashed up Chinese will buy anything these days. They are very stupid and easily to be fooled. (I can say that, cos I am Chinese)

Once Australian government limits the foreign buyers, then the house price will fall in Australia. However, would our government (both major parties) stop foreigners (especially Chinese) buying our properties?? They won’t!! It is where the Australian economic engine is. Without housing industry, what will keep Australian economy going? (donot tell me education, tourism and mining will, we can debate another time)

Kris

:

Interesting article in the Fin today where Scott Morrison commented it’s up to APRA and the reserve bank to control house prices.

jimbo james

:

Yep and I wonder who signs off on the top appointments at these organisations? Ask Glenn Stevens and Wayne Swan.

Low rates get cheered in Parliament, the political milage is priceless.

nlouwdijk

:

Great article – just saw it pop up in the Australian with one confusing fact –

Which label for the ” dwellings under construction ” chart is accurate ?

http://www.theaustralian.com.au/business/opinion/brace-for-the-selloff-property-market-at-a-tipping-point/news-story/3b48c6724b028f579c3161344a221cd4

Michael

:

To second Anne’s question Roger, what is your feeling on Sydney and the cities most desirable suburbs (Lower North Shore, East, etc). Regards. Michael

Roger Montgomery

:

Hi Michael,

I do recall Mosman was not immune during the GFC. Of course you must always seek and take personal professional advice.

Cameron

:

Very informative Roger, what amazes me is the number of other financial experts (Peter Switzer, etc) who don’t believe that east-coast Australian property is overvalued and set for a significant declines. When the number of property investors whose ‘investments’ are only viable as a result of price appreciation, are as high as what they are in the east coast markets, it is inevitable that there will be a significant decline in dwelling prices if and when prices moderate and begin to decline. Worst still is the number of economists who believe it will require an increase in the RBA cash rate to bring about such a decline in dwelling prices. Such an increase in the cash rate simply represents a relatively more expensive monthly repayment for new mortgagees and those mortgagees who are subject to variable rates. There are other ways of achieving the same result (that being relatively more expensive repayments). Like it or not, people are acting based on what these people are saying and I fear that the repercussions will adversely affect all Australians in the future.

david

:

You are 100% correct – the real estate bubble will bust and the fall out will be ugley. Many people forget the huge Sydney real estate boom between 1987 to 1989 and the following bust/down turn between 1990 and 1993. Unfortunatley for some the upcoming bust will be far worse because this boom has been so heavilly influenced by local “mum and dad” investors who have purchsed on low or no deposits by using the equity in their own homes. Not to mention the huge recent popularty in interest only loans. Finally, to Anne, sorry to say, but the bubble will burst every where its just a matter of time and there is nothing anyone ( the government be it Liberal or Labor) can do to stop the inevitable.

david.keel.3597

:

The median price in Sydney in 1987 was 60k – 100k, I’m sure homeowners would have been happy back then to ride out the bust with current prices where they are now. There was a 10% downturn followed by 4 or 5 years of 0 nominal growth after that.

Same thing happened in Sydney in the boom of 2001-2003, huge price growth followed by a ~10% pullback and 4 or 5 years of little to no nominal growth. In fact the other capital cities played catchup until the current boom started around 2012, which leads us to where we are now. This boom has been fueled by record low interest rates which probably explains the length of it.

The market operates in cycles and this current boom is another part of it. It won’t be the apocalypse when it finishes and prices inevitably pull back again as everyone is seeming to suggest.

Roger Montgomery

:

Hi David, Your comment fascinated me. If median house price was $100k in 1987 and today it is $1.1 million, then the compounded average annual growth rate is just 8.3% p.a. Plenty of alternatives have performed better than that since 1987 and that return is dependent on $1.1 mln not falling. If, for example, the median did fall 10% over the next two years to $990,000 then the CAGR drops to 7.4% p.a. since 1987. Maybe the lower return ‘new normal’ has actually been around for a lot longer than we realise! The issue however David, and the reason for our warnings, is that many inexperienced people have heavily geared into a property whose return is dependent on a tenant and low interest rates to be maintained, and capital gain for profit. On all three fronts there are dark clouds forming (NAB and WBC have already raised rates again) and many will be undone because averages mask individual financil stress which we already know is accelerating. Read http://www.abc.net.au/news/2017-02-09/national-debt-helpline-overwhelmed-by-calls/8256508

Phil

:

The “smoke and mirrors ” continues…today’s paper reports a Sydney auction clearance rate of 82% but wait, our property (which didn’t sell at yesterday’s auction) wasn’t in there. The auctioneer told me that my property was his 4th and he’d only sold one property. My real estate agent had one more auction and told me that it wouldn’t sell. So it would seem that the headlines might be somewhat misleading??

david.keel.3597

:

I am getting quite disheartened with all these articles from Mr Montgomery bad-mouthing property, it is beginning to sound a lot like pure marketing to drum up business (property is no good, why not invest in shares with us?)

A new one pops up every week and it is sounding more like Harry Dent, Steve Keen, Jonathan Tepper every time. Trying to play on people’s fears to make money, instead of focusing on buying quality businesses at a discount to intrinsic value.

A similar article was written around 2012 by the same author (and countless times since):

http://rogermontgomery.com/sinking-like-a-brick-are-house-prices-really-going-to-crash/

Selling property in 2012 would have cost maybe 400k – 1 million in capital gains, so when is this crash going to happen? I’m sure some of these gains will be given back but this is the nature of markets, they move in cycles. Prices would have to drop 50% from here just to get back to where they were in 2012.

Full disclosure: I have some money invested in the Montgomery Fund and also some investments in property, shares and property both have their place in a portfolio in my opinion. However I am seriously reconsidering whether I should continue investing in TMF if this is taking up all their time and energy.

It is also plain wrong to call property one single market. Analysing using this top-down, broad brush approach adds absolutely no value. No mention is made of state, city, suburb, even streets and individual properties, all of which have a huge impact on the capital gain / loss of a particular property.

You cannot lump a house in an inner city suburb with supply constraints in with an apartment in the CBD marketed specifically to offshore investors.

I do hope the team Mr Montgomery and the team at TMF refrain from these scare tactics to drum up business and stick to their knitting from now on.

Roger Montgomery

:

You’re right David. As value investors we’re used to being early. The purpose of the warnings is to dissuade the many who might be tempted to over gear and buy now. If you search the blog using the search bar for China and Iron ore we were calling for and to the commodity boom a couple of years early too. Iron ore rallied to $187 before it fell to less than $40. If you’re reading the blog daily you’re seeing lots of property warnings but I’ll continue to post updates as new data emerges and to ensure new followers on the blog hear to theme, which they may have missed previous coverage of. Hope that’s ok with you.

william-garbett

:

New data? How about the 5-15 km vacancy rate that is not 6 months old.

Roger Montgomery

:

You’ll find the data here William-garbett: https://reiq.com/REIQ_Docs/Research/REIQ_Vacancy_Rates_Dec_Quarter_2016.pdf

william-garbett

:

The data you cite (5-20km) for the 9 months to September is 2.1 to 4.5% not 2.7 to 4.7% not only that but you conveniently omit the December quarter where it dropped to 3.5%….. only partial truths.

If this is your depth of research, I question your value.

Roger Montgomery

:

Hi William, Thanks for that. I am pleased you have corrected the stat. Importantly your correction reinforces our point! – instead of a near-doubling of vancancies, we now have updated data to show vacancies have more than doubled! BTW I tend to ignore the December quarter data because holidays/Christmas does cloud the picture a little. Better to wait for March quarter stats, which is why we haven’t discussed the Dec stats. Hope that is acceptable to you and keep in mind, with a long enough time frame, we are likley to make every mistake before we are done.

jimbo james

:

Genial work William! You wouldn’t by chance happen to be professionally involved in business case modelling in property development would you?

Roger Montgomery

:

If WIlliam doesn’t appreciate our warnings – for over a year – against the ‘fools gold’ of leveraged proeprty ‘investing’ perhaps this warning from the RBA, reported by the SMH, six days ago (and possibly too late for anyone who recently purchased) may have more merit; http://www.smh.com.au/business/the-economy/reserve-bank-signals-tighter-standards-unless-banks-rein-in-lending-20170313-guxd74.html

william-garbett

:

James,

Not at all, i’m just a mechanical engineer who works with buildings and has a personal interest in investment.

I have no exposure to investment property (except CGF) anywhere in Australia at the minute but am seriously considering it if the purported ‘catastrophe’ eventuates. I also hold no exposure to the Montgomery funds.

Roger,

I do appreciate your warnings but you must understand your limitation when applying a thesis broadly to distinctly different property markets. Brisbane has been below the ultra long term averages across virtually all performance metrics for over a decade. The price to income ratio is currently c.5, which is a stable & internationally comparable level. Yes the apartment supply is excessive but a dramatic collapse in prices would mean detached housing/townhouses in ‘nice’ neighborhoods MUST become undervalued. Especially if you, in any way, believe in Australian economic strength over time.

david.keel.3597

:

Hi Roger

Thanks for taking the time to reply. I do agree that investors getting in now (in Sydney especially) are speculating and there will be a pullback in prices. Fair enough if you want to warn investors lured to property by all the headlines and show a different side of the story. There are always two sides to a story and that’s what makes a market, as you have said (or words to that effect).

You called the end of the mining boom very early, perhaps you will be right on this topic too.

It has certainly generated some lively debate!

Dan

:

Great article Roger! My thoughts exactly. Although I’ve been surprised how resilient the property market has been to date. I suppose it all comes down to those greedy banks and investors .. it will defiantly swing back to bite them.

So how does someone position a small part of their portfolio against this nonsense? Without entering the complex world of put options.. Thanks

Bartek Stepien

:

Hi Roger,

Great article. Thank you. I came back to Australia after 2 years break. I went for a coffee in the morning. Everyone happy here, paying $100 bills for breakfasts and celebrating $2 mil real estate clubs with glass of champagne at 10:30am. Fantastic. Credit card debt at $ 50 billion. Banks valuations at 2.7x equity, pe 16. Wages stalled. interest rates record low. Unemployment starts to go up. Apartment investors with 3-4 apartments will soon start rental war after investor loan increases and how they will pay for vacant property if not 2 or 3 of them as neighbour will drop the rent to stay competitive? Dow jones chart looks impressive and 2008 gfc looks like a blip on it. Wondering how the coming one will look on that painting. I sit on 100% cash as of last friday including super. Happy to wait 1 or 2 for short opportunity. No home loan on the books. I feel comfortable with that approach. Just a question: what will happen to big4 balance sheet if properties fall by 20% or 10-20% loans will default? I feel a bit worried about what I observe.

dean morris

:

Great comments.

Anyone with access to RPdata or the Domain site property report will see numerous houses in WA being sold or on the market for much less than what it was purchased for years ago. In many cases as far as 2007.

In Perth suburbs and most country areas except for a select few its shocking and It is much worse when you factor in the ownership & interest cost.

Higher end properties have fallen hundreds of thousands. Life changing losses that make a mockery out of the ‘cant go wrong with bricks & mortar’ mantra your friends, family and realty agents blindly recite. Time wont help you here in WA either, it wont get better.

This is what must be heading to NSW and Vic. God help those who bought in the last couple of years. It wont be pretty!

Dave B

:

If someone was not invested in property, banks, mortgage insurance nor furniture businesses, and let’s assume was hedged against a falling AUD/USD, do they need to hold on tight? Why?

Terence

:

If this bubble pops, the RBA is still able to lower the official interest rate. This will help to combat the decline. However, not sure if RBA has enough “ammo” to sustain it since interest rate is already at a historical low.

Gavin Hegney

:

When the residential markets with a total value of around $5 T drop 10-20% it wipes off $500b – $ 1 T in equity , which in dollar terms equates to around 30%of the superannuation pool of money or about 25% of the total share market . That’s why the wealth loss can affect the economy .

Usually people make money in wages , dividends , bonuss , profits and other investments which they then make a decision , thru the wealth effect , to buy a bigger house. Hence housing runs at the end of an economic cycle . So residential turning down can also equate to am downturn .

So it’s not just a housing decision in my experience .

Ross

:

Spot on Roger,

Isn’t the fact that one hell of alot of investors “mums and dads” will have the property negatively gears (less or no income -v- higher repayment and outgoings) going to be a massive problem for the government going forward.

Most will be claiming against income and reducing the tax payable. Not sure the government has thought to long and hard about this.

So in effect the government will be handing people a discounted tax payable and in effect be caught in a downward spiral with the investors. I think it’s wrong that the government assists investors who were punting that the real estate ponzi scheme would continue for many years to come.

william-garbett

:

As always this is only part of the story. Brisbane dwelling price to income ratio is c.5 times at the moment and has been at this level since about 2004. Note this level is comparable with international destinations. Given the decrease in mining employment & engineering design/construction is largely over, household incomes have little downside (barring full economic collapse). Prices for property are either unlikely to fall or will fall below a fair value. I consider Brisbane property a medium quality investment likely to be at bargain prices in the near to medium term.

I respect your commentary roger, but please tell the full story if you decide to use an example, avoid cherry picking stats.

Edit: I am only considering investments in detached housing or 70/80s apartments in the ‘nice’ neighborhoods.

Rusty

:

One reason house property prices are high in Australia is that the primary residence is a tax haven, it has no tax on price gain, hence you can stay home, improve it, flip it, pay no tax. Other countries have differing tax treatments. Switzerland for example, infers an income from your house if it was to be let, and adds that inferred income to your earned income and taxes it. Result, house prices are realistic.

Ashley

:

I agree Roger , and thank you for your insights , all of what you say is correct and readily available for people to cross check if they disagree with your opinion’s , the gov bond rate is where it all starts , and overseas borrowing’s , ie : 34yr between a high of 16:5 ℅ and its lowest 1:39℅ in August last yr , but having said all that their still is good value options out their !!!!!

Boris

:

I agree with you, everything you say sounds logical, something that people dont want to think about and start laughing. The idea that property prices always rising is so deep in people’s mind. You can hear conversations about property everywhere, in gym, at a hairdresser salon, taxi, just everywhere. People think I am silly when I say that property prices may fall. Certainly property may rise for another 12 months and no one knows when they fall but risk investing in property rising daily.

Kris

:

Hi Roger,

The government is about to mandate the greater fool upon the last entrants into the property market.

It’s rumoured that the government will allow first home buyers to access the equity in their Super to buy a house/apartment as part of their “housing affordability” announcements.

Let’s not forget Howard started the first home vendors Grant in the early 2000s, Rudd introduced it again in 2009 and Labor also allowed property investments in Super around 2011.

The treasurer is ex property council of Australia. Whether this buys the big four enough time is yet to be revealed.

No one is making the obvious analysis that property is overvalued. They are just looking to boost prices higher and keep two thirds of voters happy. One third own outright and one third owe a mortgage.

The RBA set rates for a declining WA/SA economy and just pump primed Australia’s property addiction. With a property addicted nation all these factors have pushed and will continue to raise prices.

I’m not sure how much longer the Ponzi scheme can stay afloat. I’d hazard a guess that it will require sustained debt just to keep it afloat.

Cue ten irrational reasons why Australia is immune from the exact date that beset the USA,UK,Ireland, Spain or Japan.

Andrew Rowan

:

Well written Roger. I ran a calculation taking the median proprty price in melbourne in 1990, then adjusted the value using the change in affordability (falling interest rates and increasing houshold income – all sourced from the rba site), and came up with a price $30,000 different at December 2015.

This proved to me that prices are set to fall as interest rates flatten (or rise) and wages growth slows (happening). As a financial planner my concern is that most people (and politicians) don’t understand this. The shake out is coming.

Bill

:

I’m 33 years old and have been avoiding property since I saw the irrational jump in prices after the doubling of the first home buyers grant during the “GFC”. This year my younger brother, who earns 60-70K has bought 1 property and is buying another 2 with a lot of “help” from the banks. He had a good deposit due to saving diligently as well as an inheritance, but the amount he borrowed/is borrowing compared to his salary is scary. In the meantime my Mum is constantly on my back that I need to buy a house and start to establish a portfolio of properties because apparently that’s how you get ahead in life, despite the fact have I a senior position in an military systems engineering company and a high income. As a rational person, the unwavering faith of so many (perhaps most) Australians in property and the willingness to take on huge amounts of debt is astonishing.

Kris

:

Hey Bill,

I’m in a similar position. Perhaps our Mums can get together and complain.

Their generation only saw a massive decrease in interest rates over time and increased debt into residential property. Prices rose for decades.

As a result they figure that will continue infinatum, blind to the reality that we are hitting a debt ceiling.

Wages growth is slowing. The more people insist “it’s different”, the more they are blinded by risks.

I don’t want to be the last lemming off the cliff thanks. Trust your intuition.

Steve

:

Thankyou for the insight Roger.

Im bias in my opinion as I chose to sell, downsize and pay down my mortgage agresivly for the past 5 years as opposed to jumping on the investment property bonanza train with my savings. I don’t own a Ferrai, but now, I won’t ever lose my home either!

The real victims of this crash won’t be the investors, politicians or the banks but the younger, first home buyers who lacked the wisdom to know it was all doomed to fail and paid far too much for something they will have to waste 25-30 years of their life to pay off… and that’s if the interest rates by 2020 don’t get them first.

Phil

:

So how does one short property?

Carlos Cobelas

:

By shorting the banks.

Very risky though….

frank muller

:

I absolutely agree , I work in Coles , when even high school students wanna become property investors then the end is here. haha

nicely written,how it really is thanks

regards muller

Laurent

:

Awesome article! Seems like Melb/Syd house prices will be the last to fall and until then they are as cocky as ever..

reusachtige

:

ha! Heard this a million times before. Losers keep losing while all the good looking property investors double down on Sydney and Melbourne! LOL lol lol lol lol!!!

rafio

:

A very refreshing, thorough and rational piece, one of the few.

Thallus

:

You are not following the “program”. Australian property is different, prices always rise. Highly likely you’ll get a nasty phone call from the Property Council.

Max Zan

:

Hi Roger

We hear from Malcolm Turnbull and Scott Morrison that a lack of housing supply is the reason prices are so high so increasing supply according to them is the solution – their view is that more properties equals lower prices . One of them recently said wprds to the affect that “prices are real” – in other words there is no bubble. If what you tell us in your article is correct ( we should have no reason to doubt you) then are these two out there with the fairies and pixies in la la land with their views that increasing housing supply is the solution ?

Roger Montgomery

:

Remember when John Howard recommended T2 “the great Australian company to everyone”? That was at $7.40. Something about politicians and financial advice.

Dee

:

Maybe an answer to the question of whether Australian families are willing to swap the suburban dream for the urban dream and thus the potential for a ripple effect reaching the burbs.

http://www.abc.net.au/news/2017-03-17/schools-overcrowded-residential-apartment-construction-boom/8359898

jimbo james

:

Tweed Heads and Bowral at 10x incomes versus comparable international cities. Sounds like a recipe for a 50% haircut to me. Of course we’ll overshoot that mark prior to settling back in that range. This will be epic Roger, the next question being how to preserve one’s wealth when the entire economy is tied to it and bail-ins potentially on the cards?

karl

:

Thanks Roger. I’ve noticed a shift in sentiment over the last couple of months, where people who were very bullish on the property market have now reversed their positions. As noted by RBA Assistant Governor Michele Bullock, sentiment can turn fast and things may get sold down much faster than they otherwise would. Interestingly, we haven’t heard a peep out of politicians complaining about the unilateral rate rise from NAB. Everyone knows the sooner the heat gets taken out of this market the better, and the banks are in a great position to improve their margins under the guise of de-risking the market.

Anne

:

I’ve heard a lot about Brisbane and Melbourne unit oversupply, but what are your thoughts about Sydney? I’ve been monitoring over the past year, and although there have been some slight drop (in Western Sydney) the desirable inner city suburbs are still high demand and expensive.