Has the market run too hard?

Recent research by Montgomery shows that not only are high quality businesses, running ahead of their intrinsic value. So, too, are the largest names on the ASX. Which means long-term investors should approach this market with a degree of caution.

For some time now we have lamented the lack of availability of high quality businesses trading at attractive valuations in Australia. This has lead us to hold a significant cash weighting in our domestic funds, on the basis that long-run equity returns are less attractive when prices are higher.

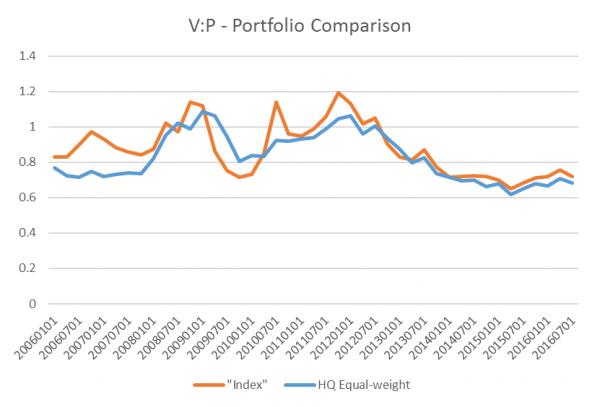

More recently, we asked the question: is this problem more acute in respect of high quality businesses, or is it spread more evenly across the quality spectrum. To try to put some data around this, we did some indicative analysis as follows:

- We took two portfolios – one an equal weight portfolio comprising of the highest quality companies we can see in our investment universe, and the other a capitalisation-weighted portfolio of the largest names in the Index.

- We estimated average intrinsic value for each portfolio using an automated valuation tool, at quarterly intervals going back ten years.

The results of the analysis are set out in the chart below.

Some observations we would make are:

- Valuations for both the “high quality” and the “Index” portfolios appear – unsurprisingly – stretched at the moment. The ratio of value to price is about as low as it has been over the past ten years.

- More interestingly, this problem seems to be affecting high quality businesses in a similar way to other businesses.

In view of this we may need to refine our complaint somewhat, to say that it is hard to find businesses of any quality trading at attractive valuations at the moment.

There is a small element of glass half full here, in that there is no indication that high quality businesses are poised for relative underperformance. However, whichever way you look at it, there seems to be a good case for long-term investors to approach the market with a degree of caution.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To invest with Montgomery domestically and globally, find out more.

MUA look to be good value, but not a lot of history and still on the speculative side. Would be interested to know the MIM team view on this one.

Benjamin Graham’s theory on Margin of safety should be at the forefront of every fundamental investors decision making of whether to sit tight on cash or to wait for the vicissitudes of the market to make investing into good business’s at a good price attractive again.. Knowing when and what to buy and having the discipline to wait and buy at a good price is more important than just comparing rates offered by banks on cash today and what companies quoted are yielding today… Be patient.

Pascal,

I am about to place some of my SMSF with MIM. My reasons are that in the first instance I have now established my SMSF.

Secondly and of more relevance:

1. Since my judgement that the US and to a lesser extent the ASX are “overvalued” the market has gone higher. At that time, I was thinking of placing some funds with MIM and the MIM return was approximately 70% over the past 3 years (or thereabouts). I recall thinking “I’ll just wait for the market to decline and then I’ll give my funds to Roger and Co”.

2. Since then MIM has increased returns by about 10%. This while holding increasing levels of cash. I earned 1.5% in term deposit.

3. If REA or ISD or other quality companies falls, then I am very confident that MIM would be able to take advantage of the price declines and thereby increase the (my) long term returns – it is the long term returns I am interested in because it is my SMSF money. I am not too concerned about the next 12 months. As Roger has stated, they may underperform, but I would rather be wealthier in 10 years time than in the next 12 months.

3. I like to select stocks of my own and while I would like to believe I am the font of all knowledge I am not:) So giving money to MIM in my mind spreads my risk.

4. Looking at MIM historical returns will give you an indication (though not certainty) that your money is with respected financial advisors – the aggregate experience of MIM staff beats my 15 years of experience.

I dont want this to sound like and advert for MIM, but there are several sensible and rational reasons to place money with a view to the long term, rather than focus on the next 12 months.

Regards

Steve

,

Hi Steve,

Appreciate your comments. My comments were not about discrediting RM or his team. In fact, MIM are one of the few that I have confidence in.

I do have some of my SMSF in MIM so obviously I am supportive and have a belief in RM and his team. I am extremely pleased with their approach to investing and how they engage with their ‘investment partners’. Preaching to the converted here.

But it is a time for caution. It’s always a time for caution. If stocks are overvalued, they are overvalued for everybody.

The article published Tim Kelley highlighted that both ‘high quality’ and ‘index’ portfolios appear similarly overvalued. I am in stocks for the long term and made a bucket load from the likes of ALU, BAP, and REA in the last few years, and more recently CCP by simply following the principles outlined by RM.

But I think the overall margin of safety has contracted somewhat in the last 6 months due to world events such as negative / low interest rates, bond prices, US election, Brexit, anemic growth and run up in stocks.

Tim’s article simply added extra caution to my already cautious approach.

Tim – Thanks for your response also.

Regards

Pascal.

Hi,

Given that MIM is only investing in high quality businesses and the article above indicates that both ‘high quality’ and ‘index’ portfolio valuations appear to be stretched, then doesn’t this also imply that Montgomery funds would similarly have a stretched valuation?

I have been considering further investments into Montgomery funds, but the article above makes me feel a whole lot less confident.

Yes, the Montgomery Fund is holding somewhere in the vicinity of 25 – 30% cash, but there is still 70% exposure to assets that could very realistically come off in price. Consider ISD or REA. Any market correction in the next few months, and these stocks could get hammered due to the pressure they are already under despite being quality businesses. And held buy the Fund.

I get the feeling that I would rather hold 100% cash and buy into the fund once the market corrects, if it does. The fact is, no matter how much research we do, there is always an element of gamble because no-one is .

Regards,

Pascal.

That is the dilemma, Pascal. Equities are expensive, but an expensive equity can still provide a better long-term return than cash, and if interest rates stay low then equities may not get any cheaper for quite some time.

We think it makes sense to try to find a pragmatic balance between the extremes of all-cash and all-equities.

Accumulating cash (because there is nothing worth buying) is all very well and good, but it all feels like a holding pattern with no end in sight and no catalyst to move the ASX or any other market either way, because effectively, “we’re all in it together with low interest rates and next to no growth”.

Right now, the S&P500 is very overvalued and has been for a few years now and overall, US corporate earnings are declining, European and Asian growth is stagnant (and again, has been for some years in the former) and quite a number of emerging markets are going to be severely hurt when US interest rates start going up, which eventually, they will have to.

You have the awkward situation where you cannot hold fixed interest or cash for the long term because you are effectively, losing money and if you are forced into shares, A-REITs or property right now, it is overvalued everywhere I look…so if you invest now, your long term return will not be as good.

It may not be a global recession or depression, but it certainly feels like it.

Add to this that we are being told “lower rates for longer” and it makes me wonder (as someone who has been doing this for over 10 years), why bother investing anyway if there’s seemingly no point to it. I originally got into this because I wanted to set myself up for retirement (at least 25-30 years away from now). It never used to be this hard to find value for such a long period of time; there was always something to buy (or sell – and get a better return on your money elsewhere), but even if you did sell – resulting in a tax bill anyway – where would you put the money ? There isn’t anywhere.

Hi Chris, This comment of your is profound: “we are being told “lower rates for longer” and it makes me wonder, why bother investing anyway if there’s seemingly no point to it.” Perhaps you have the makings of a catalyst right there.

agree with your observation and I think what you observed translates into lower return expectation and slowly get used to this environment. To my mind, waiting patiently on the sideline and perhaps taking advantage of short-term cyclical correction (10%-15%) before deploy more money into the market to strengthen the relative risk-return reward balance.

Unfortunately, this low yield environment is here to stay for a while IMO

Hi Tim,

Interesting article and, as concluded, the “ave intrinsic value” of the 2 portfolios is the same over a 6 month period. Should it not also follow that regardless of whether prices go up / down the proportion should stay the same? i.e. regardless of whether you buy index fund or highest quality companies they will both follow the trend?

Regards

Joe

On average you would think it would, Joe. Our concern was that a ‘flight to quality’ may have pushed one portfolio further into expensive territory than the other, but the evidence doesn’t support that.