Happy hunting

In our domestic funds at Montgomery, one of the reasons we have had a very pleasing year both in absolute and relative terms, is largely due to the fact that we have been able to avoid having our portfolios exposed to businesses facing significant economic headwinds.

Last week we spent some time discussing our thoughts on the theory of mean reversion and how with a dogged focus on the return of capital before the return on it, we noted that we had zero interest in buying up the resource sector despite the large declines in share prices. Something that appears to have accelerated its decent in recent weeks.

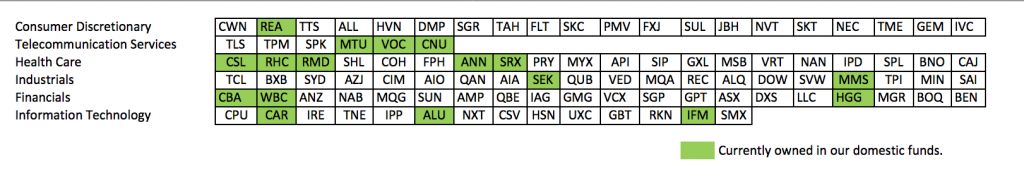

On this note, whilst no year is ever completely void of at least a few businesses providing the investment team with some degree of heightened concern, below you will find the exact same exercise we performed previously for the resource sector. The only difference this time round is that we have covered all ten of the GICS Sectors, tracking their collective 2 Year Forward Consensus Analyst Net Profit After Tax estimates, measured on a monthly basis since the end of 2012. The results are as follows:

As we have repeated many times before, over longer-periods of time, our experience tells us that share prices / business valuations tend to have a high correlation to the earnings power of the business. It therefore goes without saying, that those sectors which have all experienced improving 2 year forward earnings forecasts trends since 2012, should, provide an attractive place to start searching if one was interested in finding investment opportunities more-likely (but not certain) to grow their earnings into the future and therefore offer more chance of providing out-performance, not under-performance.

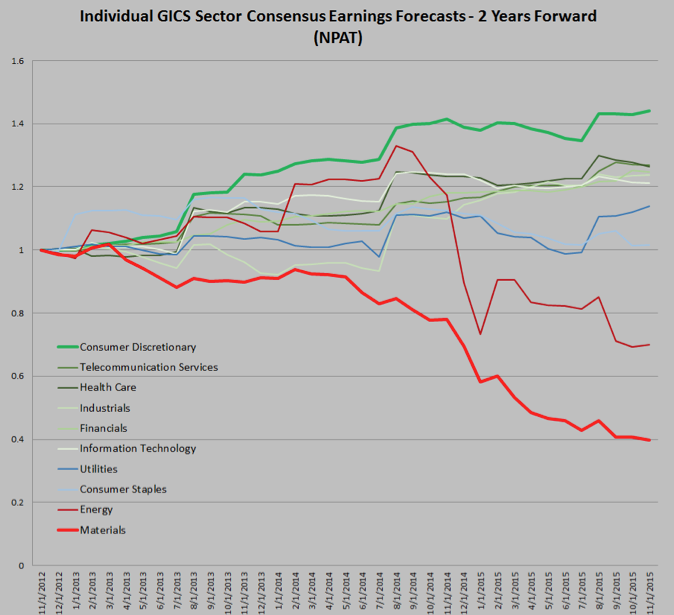

From the above chart, this quantitative analysis throws up the following sectors as candidates worthy of investors’ attention based on this trend – Consumer Discretionary, Telecommunication Services, Health Care, Industrials, Financials and Information Technology. Digging a little further, below and ranked by their respective market capitalisations, we have broken out their individual constituents so you can see who’s driving these respective performances:

Using history as our guide, these sectors have been fertile grounds for us at Montgomery in identifying investment opportunities and we believe they will continue to do so. But please note, a number of these listed companies are current holdings in our funds at Montgomery Investment management (but not exhaustive) which we have colour coded green.

Using history as our guide, these sectors have been fertile grounds for us at Montgomery in identifying investment opportunities and we believe they will continue to do so. But please note, a number of these listed companies are current holdings in our funds at Montgomery Investment management (but not exhaustive) which we have colour coded green.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

I’m curious as to when selected plays in the resource sector will come onto your radar. Cashed up oil/gas producers such as the Beach/Drill Search merger at some point will be a “straw hats in winter” play as they mop up smaller cashed starved E and P’s for bargain prices as the oil price tanks

Thanks team. What about BAL?. You mention the list is not exhaustive. Was there a critia for inclusion in chart. Keep up the good work.

Thanks Russell, I am a long time follower of the blog. I have found you guys very transparent in what you do.

I have been noticing that you guys speak highly of these: MFG, ISD, CGF and MPL. However I don’t see them in the above list. Have you guys changed your mind on them?

Hi Jack, thanks for the feedback. We do our best! This list above is not exhaustive. We still hold all of those, hope that helps.

Hello Russell: There seems to be some confusion about why some companies are not be in list? am I correct that the list is the top market capitalization for each sector. So if a high quality company in any sector is not shown (e.g MFG in Financials) it is because it is too small by M cap?

Hi David, no problem. As mentioned the list is not exhaustive and did have some entry criteria. The main one was that they where covered by analysts late in 2012 and continued to be so over the period under review to make for an easy comparison of earnings revision trends.

Hi David, no problem. As mentioned the list is not exhaustive and did have some entry criteria. The main one was that they where covered by analysts late in 2012.