Out of the frying pan and into the fire

Disruption is a topic of continual discussion in financial markets these days. Digital disruption works best when a new process is able to effectively provide the same or better service at substantially lower cost. This cost advantage can be the result of efficiencies from technology, or a new model that is able to bypass artificially imposed costs, such as regulatory costs.

New business models are able to thrive under these conditions, while the incumbent operators try desperately to maintain their profitability. As was discussed at the recent Citi Australia and New Zealand Investment Conference, a panel discussed some of the opportunities of FinTech in the banking space. One of the comments made was in regard to the difficulty of incumbents in adopting disruptive technologies. This is due to the inevitable impact the change in business model has on the profitability exiting business.

The margin structures of incumbents is based on sunk cost investments and cost structures. In order to adopt the disruptive business model, the business needs to be willing to go through a period of return and margin dilution as the new business model cannibalises its existing business. Few incumbents can undertake this transformation due to the demand of shareholders for increasing profits and dividends. As a result, incumbent operators tend to go through a drawn out period of earnings decline as they resist the inevitable changes to the market structure. At the same time, the profitability of the new disruptive model increases.

By the time there is a crossover of margins and profits such that adopting the new technology would no longer be dilutive to earnings and returns for the incumbent, it is inevitably too late.

In the banking industry, FinTech has the potential to impact the market in a number of ways, from providing a lower cost alternatives to the traditional intermediary’s role in bring borrowers and lenders together, to significantly reducing the cost and time involved in executing transactions.

Peer2Peer lenders are already operating in the Australian market. The Peer2Peer platform lending models are most attractive in the higher net interest margin markets like personal loans and SME credit. Peer2Peer operators can match borrower returns to the risk weighted returns provided by the borrower. This is in contrast to the banking model in which shareholders take on the credit risk and pass on a low but almost risk free return to those providing funding (ie depositors).

The increasing capital adequacy requirements being imposed on the major banks will act as a further cost and return disadvantage for which the new entrants can use to their advantage.

A recent JP Morgan report notes DFA data indicating that SME awareness of non-traditional unsecured lending options is increasing. SMEs are a high margin customer base for the banks with an aggregate loan book size of around A$200 million across the Australian industry. Growth of alternative models poses a risk of ongoing margin erosion.

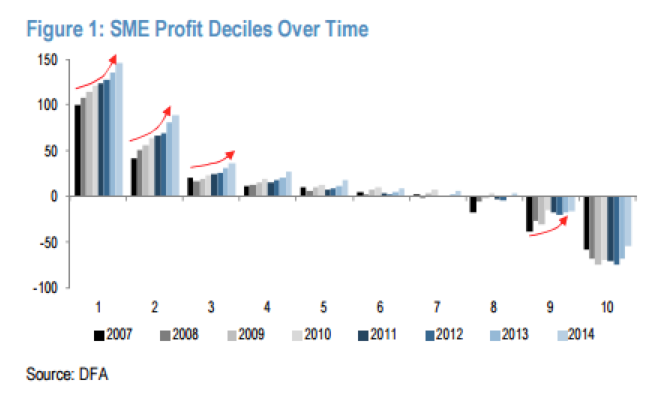

The SME market has become an increasing focus for bank loan book growth given slowing mortgage lending growth. At the same time, SME customers have become increasingly profitable for the banks as shown by the DFA data below on of the level of profitability between 2007 and 2014 for each decile of SME customer. Disruption from FinTech is a risk to bank profit margins in this segment over time. The major banks are partnering with a number of FinTech companies in an attempt to participate in the changes to the market. However, the transition to a lower unit profit model means that the banks need to act quickly to reduce operating costs in order to offset the margin dilution in the revenue base.

The major banks are partnering with a number of FinTech companies in an attempt to participate in the changes to the market. However, the transition to a lower unit profit model means that the banks need to act quickly to reduce operating costs in order to offset the margin dilution in the revenue base.

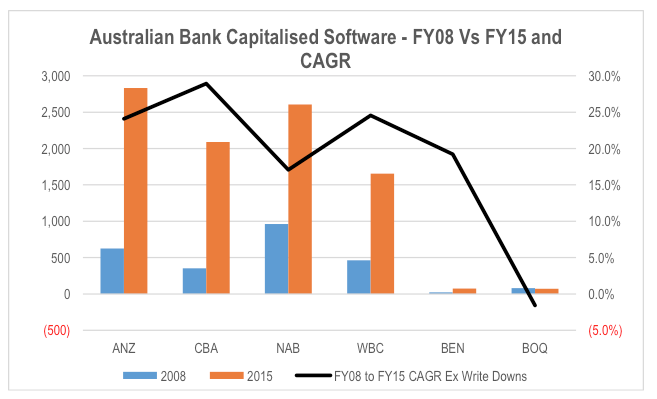

All of the major banks have been investing heavily in technology for a number of years. This is evidenced by the significant increase in the capitalised software balances in their balance sheets. Scale gives the major banks a competitive advantage over the smaller banks in economic funding required technology investments, however there is a risk that this investment does not generate the required benefits due to bureaucracy, waste or accelerating obsolescence. WBC provided an example of this risk in its FY15 results, writing off over A$500 million of capitalised software spend. Thirds implies that the company’s pre-tax earnings were overstated by around A$100 million a year for the last 5 years relative to sustainable levels. NAB took a A$297 million write down to its capitalised software in FY14.

Scale gives the major banks a competitive advantage over the smaller banks in economic funding required technology investments, however there is a risk that this investment does not generate the required benefits due to bureaucracy, waste or accelerating obsolescence. WBC provided an example of this risk in its FY15 results, writing off over A$500 million of capitalised software spend. Thirds implies that the company’s pre-tax earnings were overstated by around A$100 million a year for the last 5 years relative to sustainable levels. NAB took a A$297 million write down to its capitalised software in FY14.

The investment in technology over the last 7 years has acted as a drag on CET1 capital generation for the banks, requiring additional capital raising to meet the increasing regulatory capital requirements being imposed by APRA. Ongoing spend, if not invested wisely, could add to the pressure on sustainable dividend payout ratios going forward.

At the same time, Blockchain technology offers the potential to significantly reduce the cost and speed of executing transactions across the financial system if accepted by regulators. This represents both an opportunity and a threat for the banks that offer the potential for a step change in operating costs for not only the banks themselves but also for new entrants.

Interestingly, CBA will this week demonstrate the technology to regulators, customers and employees in a practical simulation through an internally developed system that validates dummy transactions. It will also host a week long conference on the topic.

While the market has been obsessed by impact of increasing capital requirements on the major banks earnings and return generation, technology poses a longer term and less quantifiable threat to the value of these companies that make up 28 per cent of the ASX300 index.

Effective and efficient investment in technology to significantly lower the operating cost base will become increasingly important over the longer term in allowing a bank to offset the impact of inevitable revenue margin compression from new competition on overall support earnings, returns and dividend payments.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY