Gunns collapse. If only they’d been Skaffold members!

Chalk up another win for Skaffold members.

Substantial capital losses are difficult to make back and irrespective of whether you are still in accumulation mode, retiring or retired it is essential to avoid major losses. One way to do this of course is to diversify and ensure that losses are mitigated through position sizing. Another technique and the one we will discuss here, is to simply avoid the companies most likely to collapse.

This week Gunns (ASX:GNS), was placed into voluntary administration and happily for Skaffold members it is unlikely that anyone owned shares.

Gunn’s was never investment grade. Anyone who purchased the stock from 2003 onwards were taking a massive risk and Skaffold can explain why.

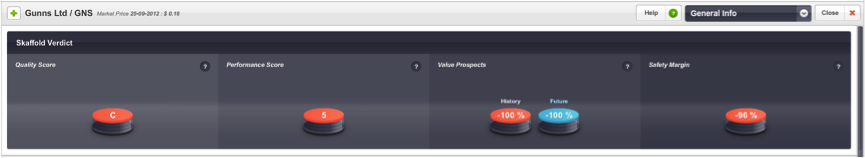

Skaffold’s Verdict (Figure. 1) is a picture of danger.

Figure 1. Skaffold Verdict. Gunns? Not-on-your-life!

The C Quality Score given to Gunns by Skaffold, is the worst possible score and the ‘5’ Performance Score is also the worst. Company’s that receive Skaffold’s C5 rating have the highest risk of permanent capital impairment.

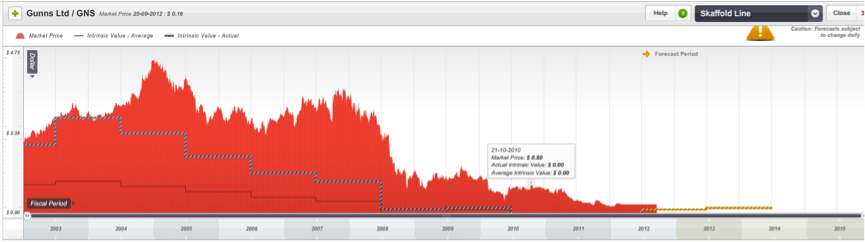

More importantly, Skaffold’s Quality and Performance scores for Gunns have been sub investment-grade since 2005! (See Figure 2). You can instantly see that the Performance Score for Gunns was 4 in 2005.

Figure 2. Skaffold rates Gunns ‘uninvestible’ since 2005

Skaffold removes uncertainty, helping investors steer clear of companies like Gunns. And Skaffold does it more simply. Using the latest at-a-glance technology and the industries most visually rich interface, Skaffold now makes it simple to give a poor company a wide berth.

Drawing on decades of academic research that has now been backtested, Skaffold provides an automated graphical snapshot of every listed company’s ‘investibility’.

“Any time you see a 4 or a 5, or a C in a company’s Skaffold Score zip up your wallet.” Roger Montgomery

Figure 3.

While an investor only investigates the highest quality companies for their portfolio, they should also ensure there is a discount to intrinsic value and that the intrinsic value of the company is rising. As can be seen in Figure 3. This was never the case for Gunns.

Montgomery Investment Management uses Skaffold to help it to the top of Australia’s fund management performance tables and at Montgomery, we think Skaffold is number #1 too.

Compared to the 98 Australian long-only equity funds ranked in the Mercers Survey to June 30, 2012, The Montgomery [Private] Fund ranked above them all and number #1.

Securing your investing future has to be easier if you can reliably avoid the Gunn’s of the investing landscape.

To prevent your portfolio from being shot by the next Gunns join Skaffold today and take advantage of decades of proven academic research and Australia’s favourite online investing research platform.

To learn more about Skaffold and take advantage of its powerful analytics and easy to use visual renderings of every listed Australian company Click Here

Anyone who needs Skaffold to work out not to invest in a company like Gunns should probably steer clear of the stockmarket altogether.

Well its seems there were plenty of non Skaffold owners who did buy Gunns! They should have invested in Skaffold instead.

Hi Roger,

At the other end of the enviromentally friendly scale to Gunns is Carbon Conscious (CCF). I looked at this company in Skaffold about a month ago and it appeared to have good prospects and was well below intrinsic value with a rating of B1. However, I notice now it’s prospects appear heavily downgraded although it remains a B1 company. Any paticular reason? The just released annual report reads ok.

Thanks

Simon

The quality score is a predictor of catastrophe but a high score does not make the company immune to downgrades as part of the normal cycle of business. Too many poor years however would see the score fall below investment grade.