Finding value, the marginal return on capital

In assessing the value of a company, the market tends to focus almost exclusively on the outlook for earnings growth. While obviously important, this ignores other variables that are equally relevant in determining whether a stock represents a good investment from both a quality and a valuation perspective.

As is the case for any investment, the value is of stock is derived from the future cash payments received by shareholders, in other words the dividends received by shareholders. A dividend based valuation uses four variables:

- The level of earnings – technically, the valuation requires an estimate of the earnings generated over the next year.

- Sustainable earnings growth beyond next year’s earnings estimate.

- The sustainable return on additional capital to be reinvested in the business to deliver future growth.

- The cost of capital – this is the annual return required by an investor for a given investment.

In this report I will focus on the third point, the marginal return on capital.

To deliver earnings growth, a company needs to invest. This investment might be new production capacity, or funds for incremental working capital. It might also be capital for acquisitions. As is the case for an individual, the best kind of investment is the type that requires the lowest upfront outlay.

For example, any rational investor would prefer a $10 investment that generates $5 a year of return than a $100 investment that also returns $5 a year. The same applies to a company.

A company has a finite amount of capital. It can either reinvest for growth or it can return surplus capital to shareholder in the form of dividends or share buy backs. The higher the return on capital achieved on growth projects, the lower the amount of capital required to be retained to fund a given rate of earnings growth. A lower amount of capital required to fund growth leaves a greater amount of capital available to be returned to shareholders.

The ability to repeat the reinvestment in growth at a high rate of return is what defines an exceptional company due to the impact of compounding returns.

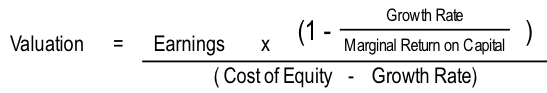

While not wanting to get bogged down in a finance theory lesson, a little mathematics is necessary. Below is the standard formula for valuing a company using the four variables.

The numerator calculates the current sustainable annual dividend payment, while the denominator discounts the value of the growing dividend stream into perpetuity.

If we assume a 10 per cent annual return is required by shareholders, we can calculate combinations of earnings growth and marginal return on capital that generate the same valuation.

For example, the value of 5% a year growth at a 50% marginal return is that same as 6% growth at a 21.4% return and 7% growth at a 15.2% return.

The importance of the marginal return on valuation highlights why it is important to understand the source of a company’s future growth. Historical returns provide a guide, but not an answer. Organic earnings growth is generally higher return than earnings growth from acquisitions. This is because the net investment for acquisitions includes a payment for the value the previous owners generated above the value of the investment they made in the business themselves. This is the payment for goodwill (or other defined intangibles like brands and customer lists), which dilutes the marginal return on capital for the acquirer. Acquisition growth also tends to be higher risk as less is known about the investment as an outsider looking in as opposed to investing in your existing business.

It is important to assess the outlook for return the company will generate on the incremental capital invested to generate growth in determining the value of a company. It is also important to understand how changes in the operating environment will impact the marginal return on capital

An example is the impact of APRA’s decision to increase capital requirements for the major banks. The major banks will be required to hold more equity on loan from January 2020, diluting the return on equity generated relative to previous years.

Therefore, if the banks do not reprice products to increase profits, their stock values should not only fall due to the dilution of EPS from margin pressures, but their PE ratios should also fall due to lower marginal return generation in future periods. If they raise prices to compensation for the increase equity capital, then their competitive position could be negatively impacted relative to other lenders in the market.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY